On Friday, the greenback extended losses after disappointing data showed a slowdown in inflation and retail sales, raising worries over the strength of the U.S. economy. As a result, USD/CAD hit a fresh multi-month low. Where are currency bulls?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1563; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 111.67; the initial upside target at 114.87)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

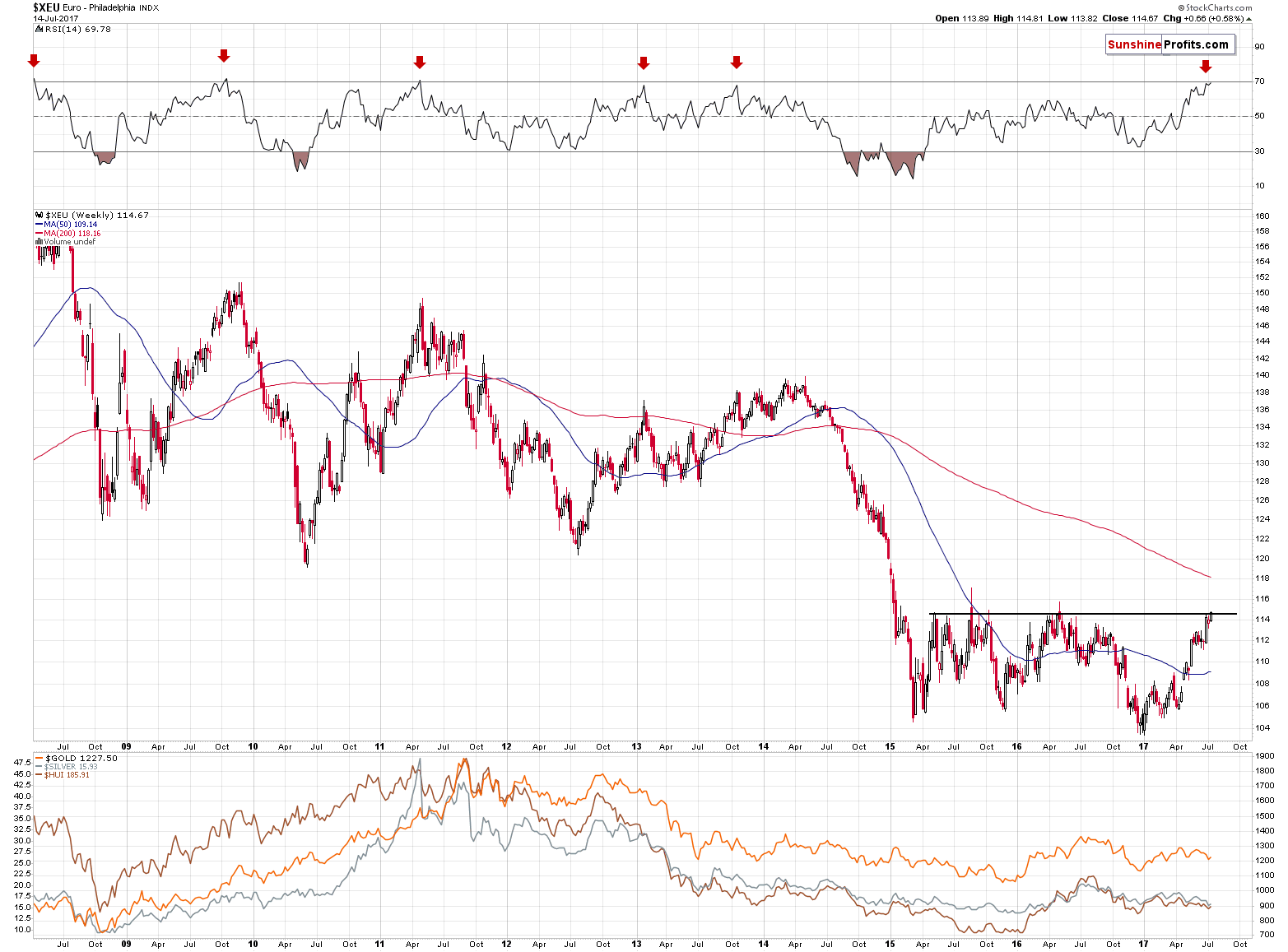

We discussed the big picture of the Euro Index in today‘s Gold & Silver Trading Alerts and we wrote the following:

The Euro Index closed the week very close to the previous highs and consequently a turnaround and major decline appear to be just around the corner. This is confirmed by the RSI indicator – practically in each case that it was at the current levels, a major top formed and the Euro Index declined for months (late 2013 was the only exception, however, please note that the top that the Euro Index had reached at that time was very close to the final 2014 top that was followed by a huge, multi-month slide). The implications are bearish for the Euro Index.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1563 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

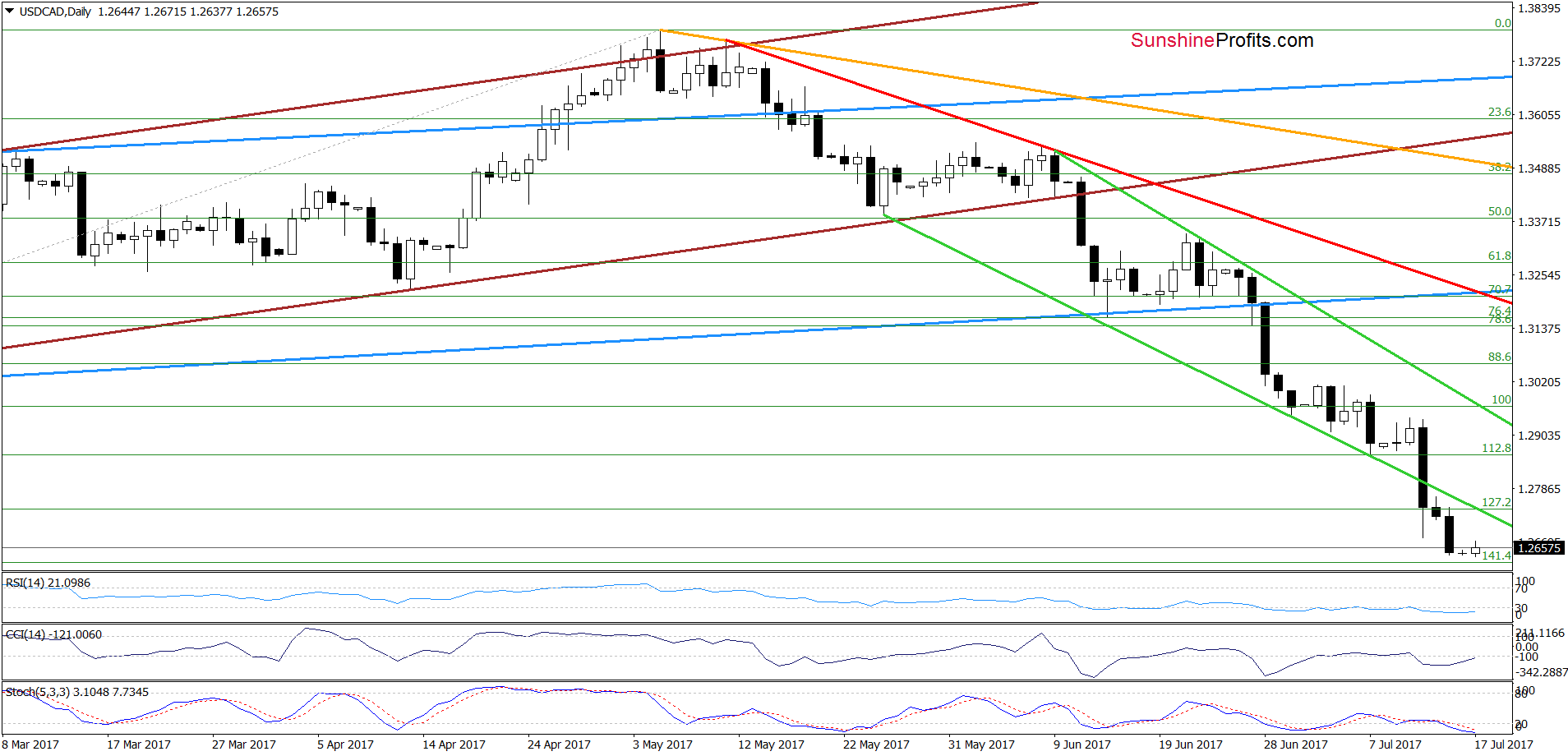

Looking at the daily chart, we see that USD/CAD extended losses on, which resulted in a fresh multi-month low and a drop to the 141.4% Fibonacci extension, but will this support manage to stop currency bears?

Let’s take a look at the weekly chart and try to find the answer to this question.

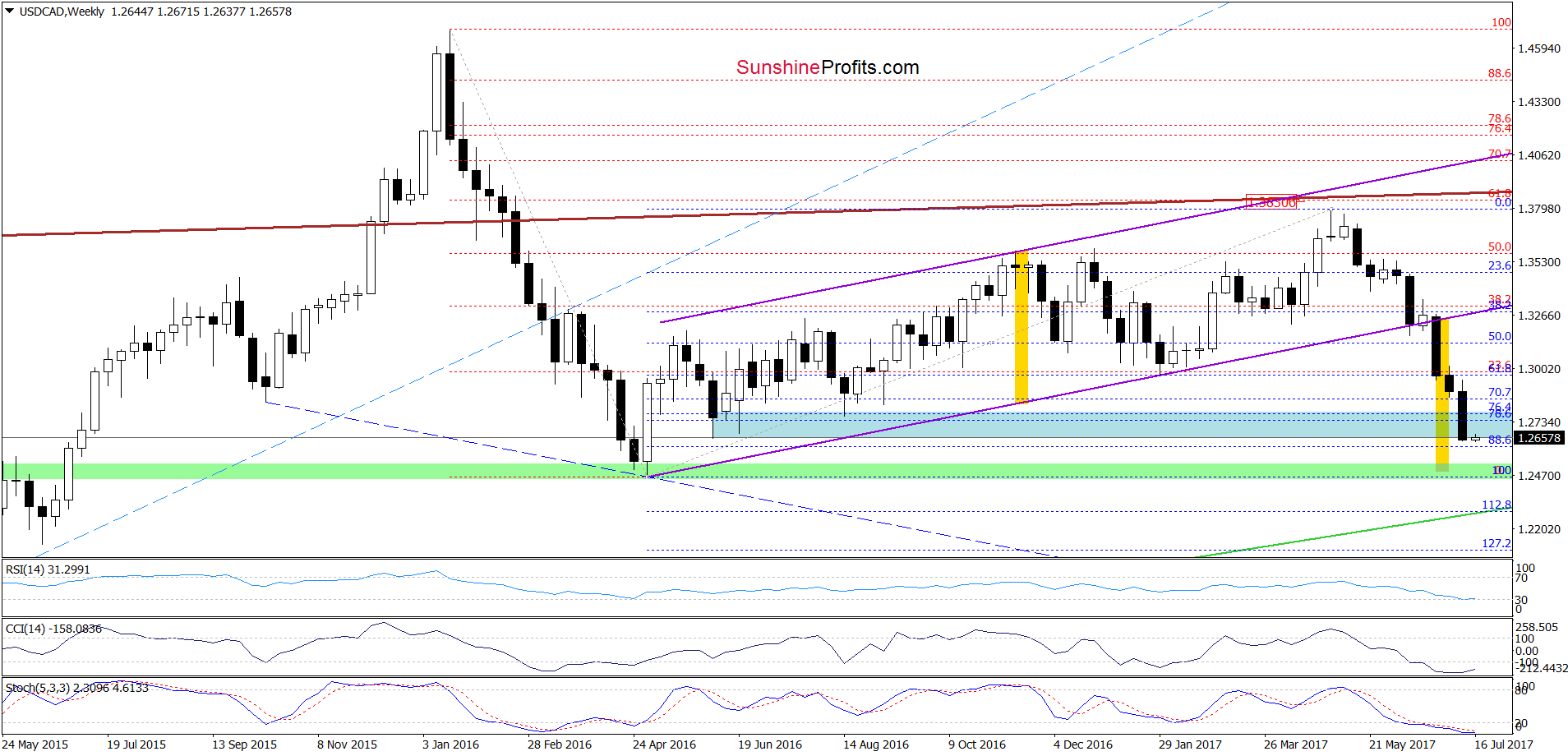

From this perspective, we see that the last week’s decline took USD/CAD under the blue support zone, which means that what we wrote on July 13 remains up-to-date also today:

(…) What’s next? (…) taking into account the height of the trend channel (marked with yellow), we should (…) consider further deterioration and a drop to the green support zone (based on the late April and May 2016 lows) in the coming week(s) (in this area the size of the move will correspond to the height of the trend channel).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

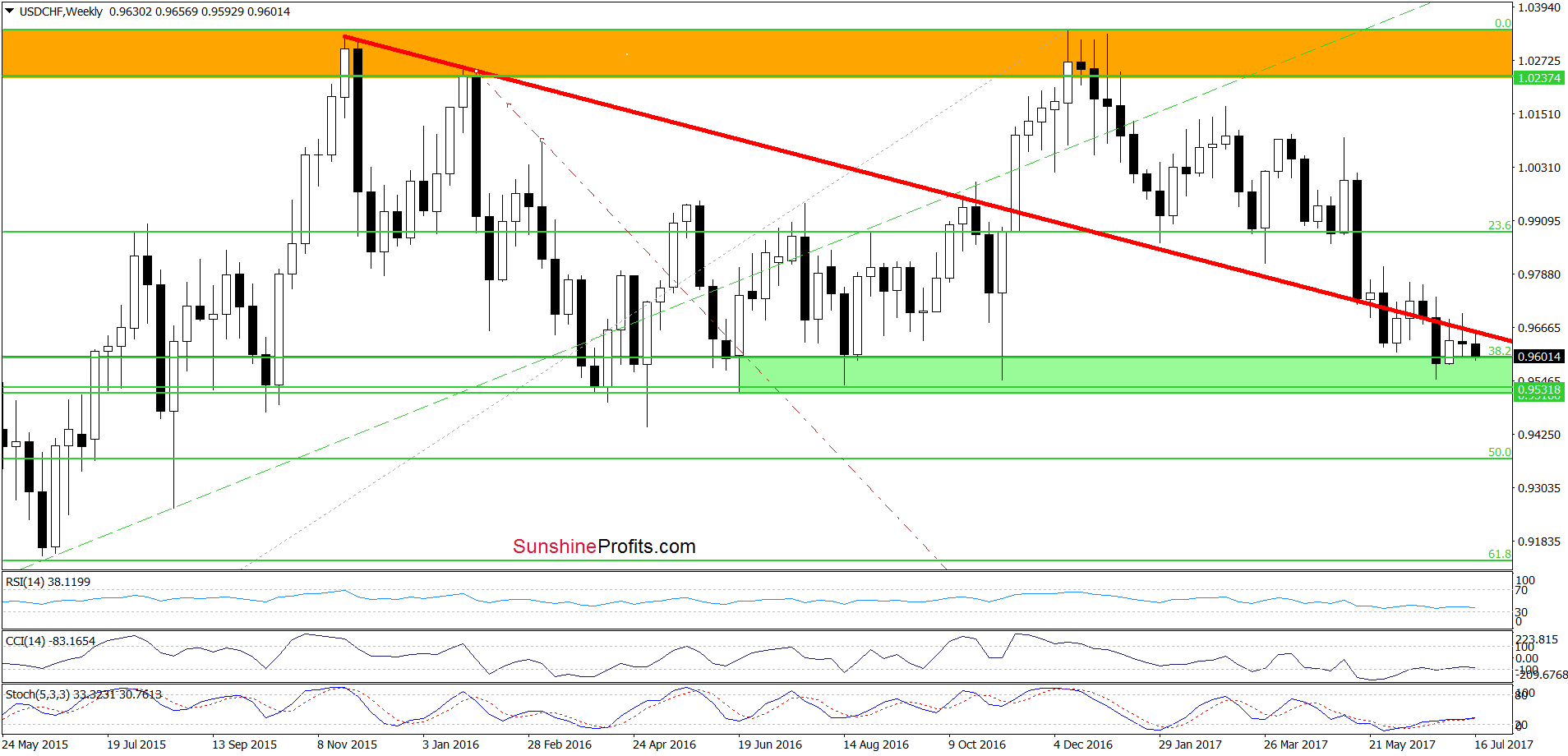

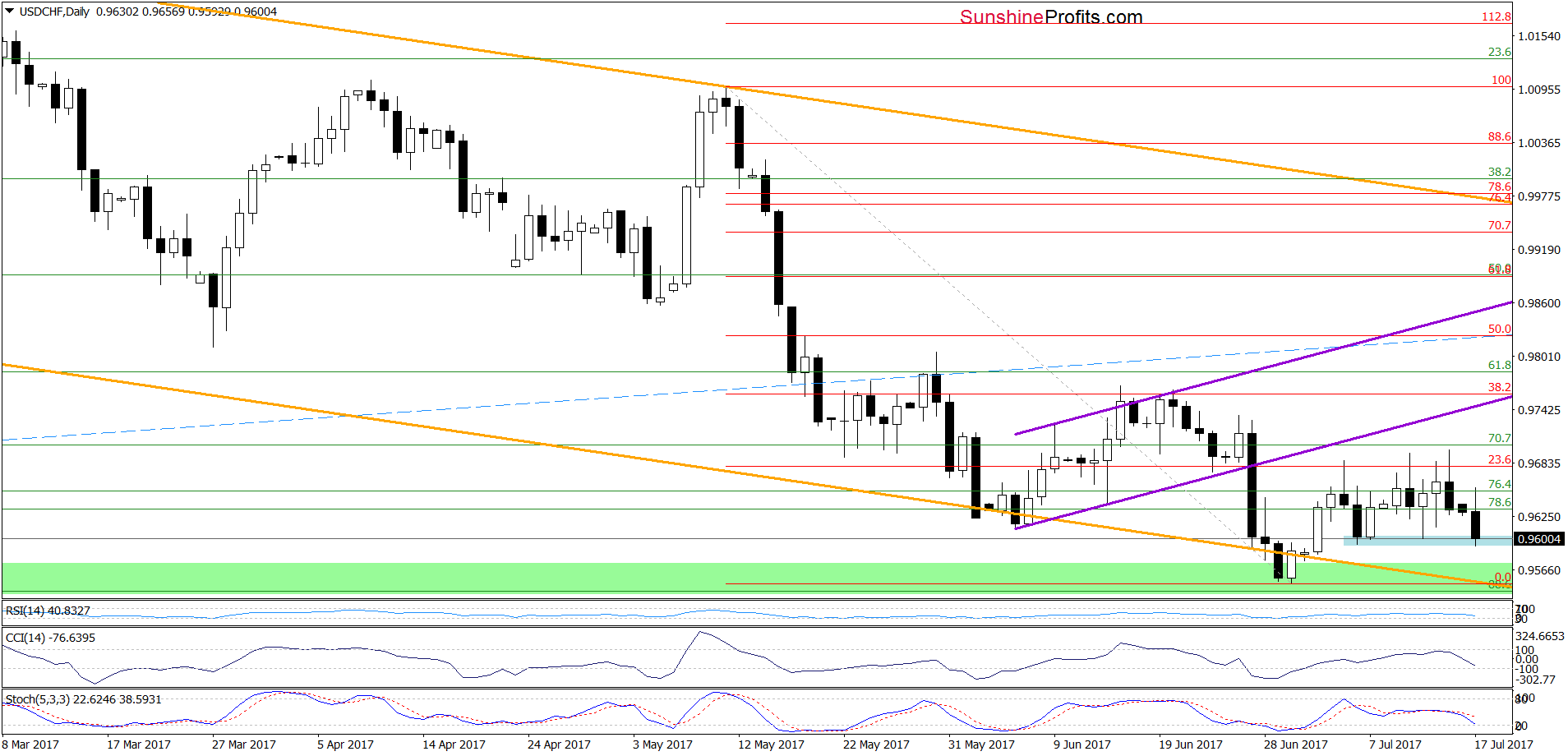

From the medium-term perspective, we see that although USD/CHF increased above the red declining resistance line in the previous weeks, these improvements were temporary and the exchange rate pulled back in both cases, closing the whole week under this line. Such price action triggered further deterioration earlier this week, which suggests that we may see a test of the June low before the next move to the upside.

This scenario is also reinforced by the very short-term picture of USD/CHF.

Why? Because looking at the daily chart, we see that although the exchange rate slipped to the blue support zone, the sell signals generated by the indicators are still in play, supporting currency bears and another attempt to move lower. Therefore, if we see a drop from here, the nearest downside target will be the lower border of the orange declining trend channel, which intersects the green support zone at the moment of writing these words.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts