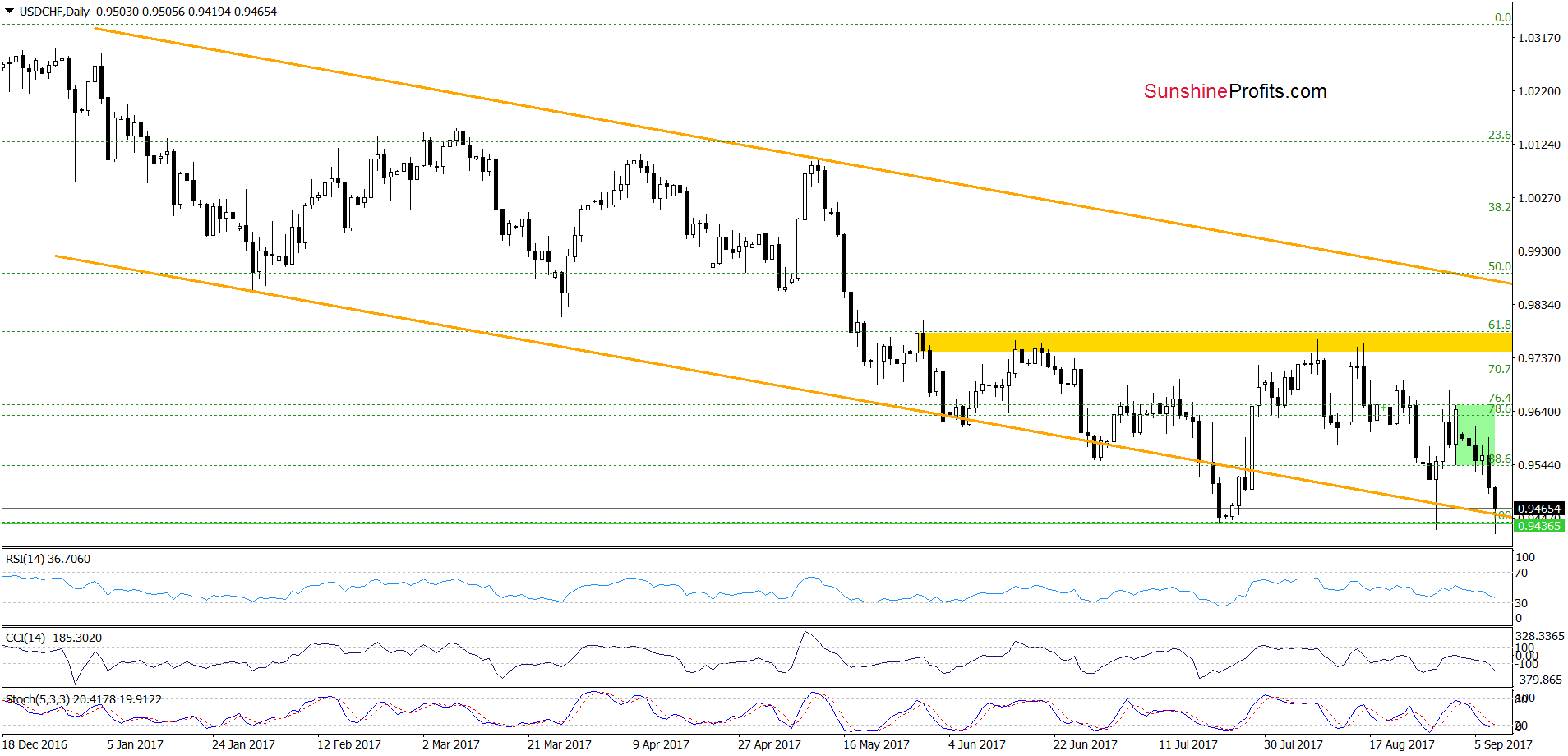

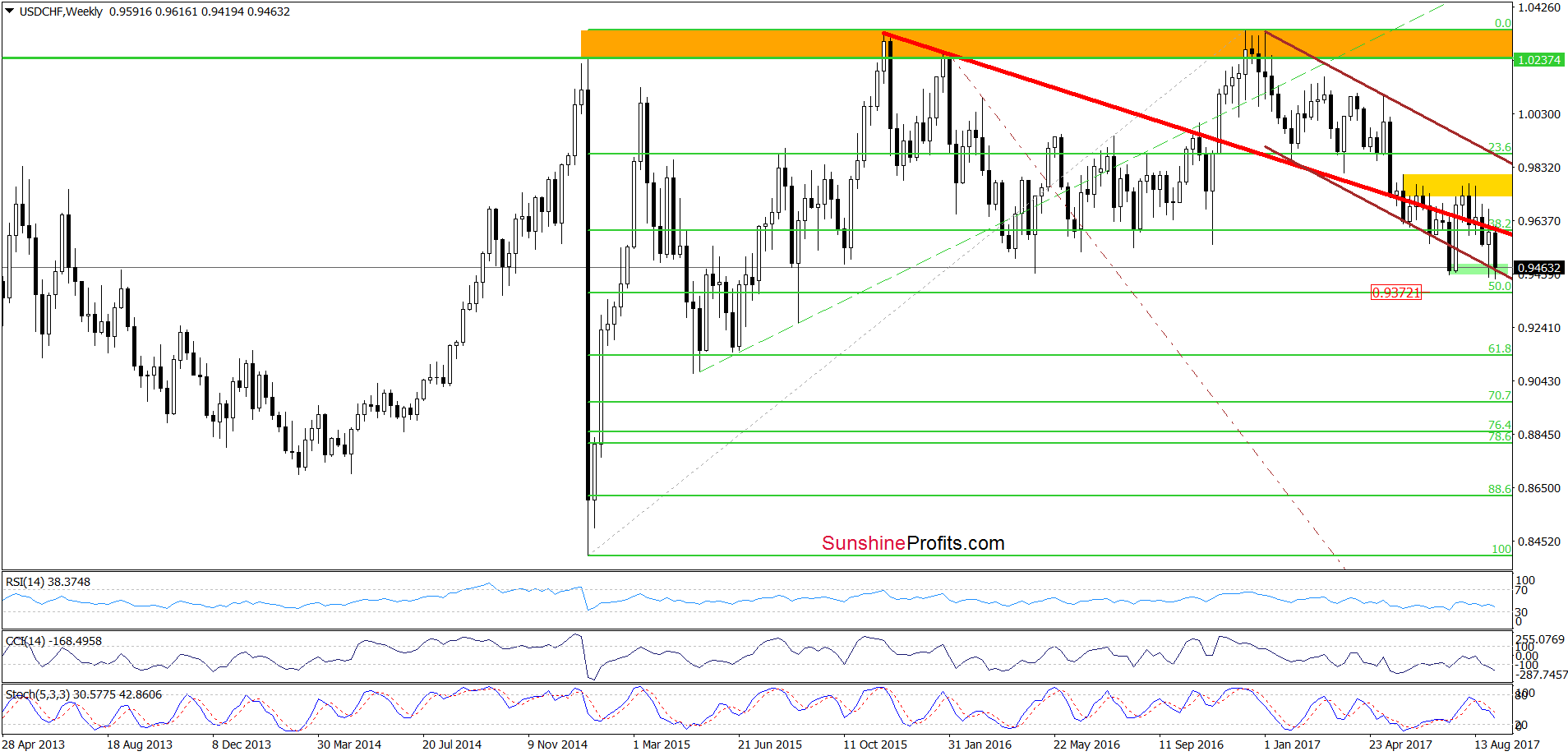

Earlier today, the greenback extended losses against the Swiss franc, which pushed USD/CHF slightly below the August low. In this way, the exchange rate re-tested the long-term support line based on the 2011 and 2015 lows. Will it be strong enough to stop currency bears in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1466)

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

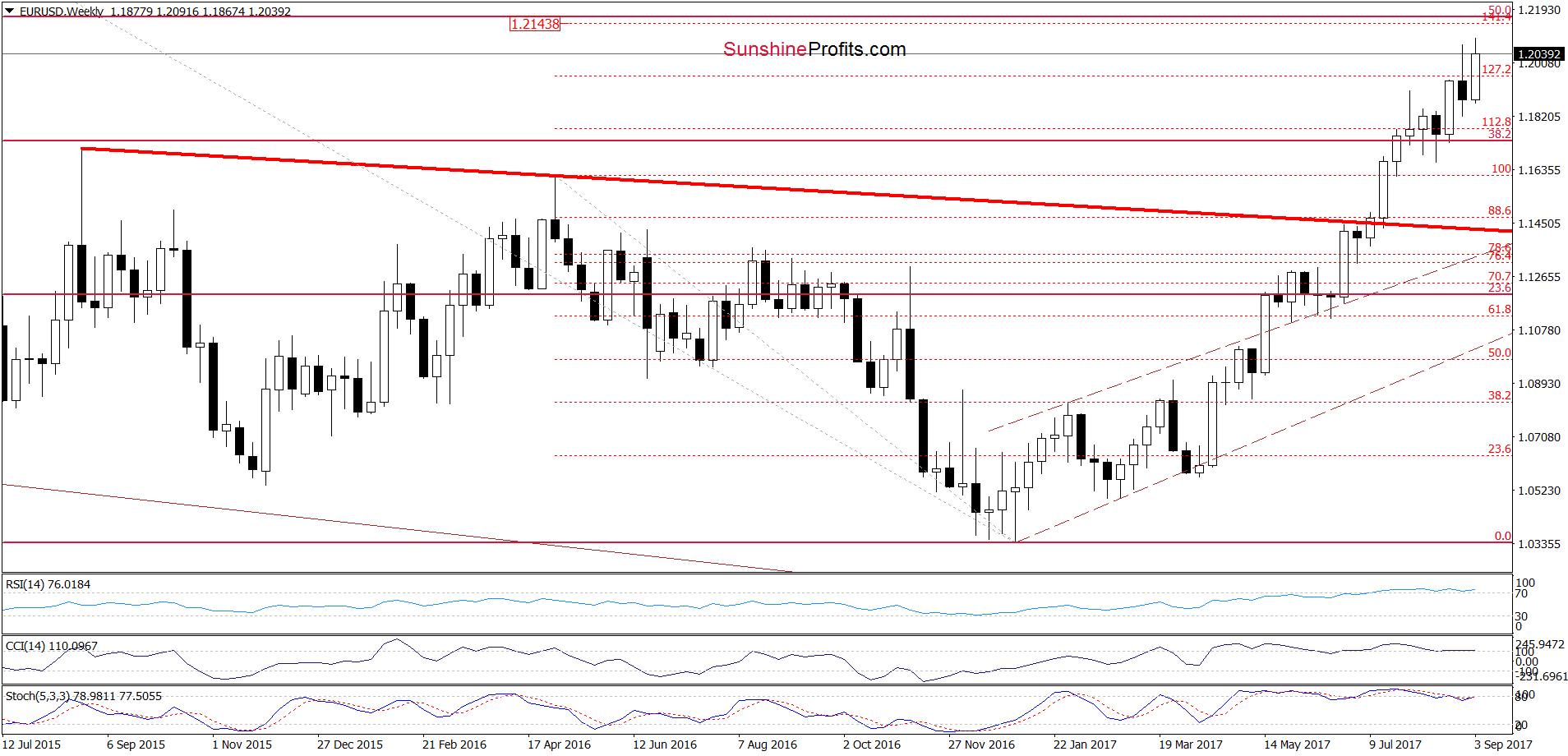

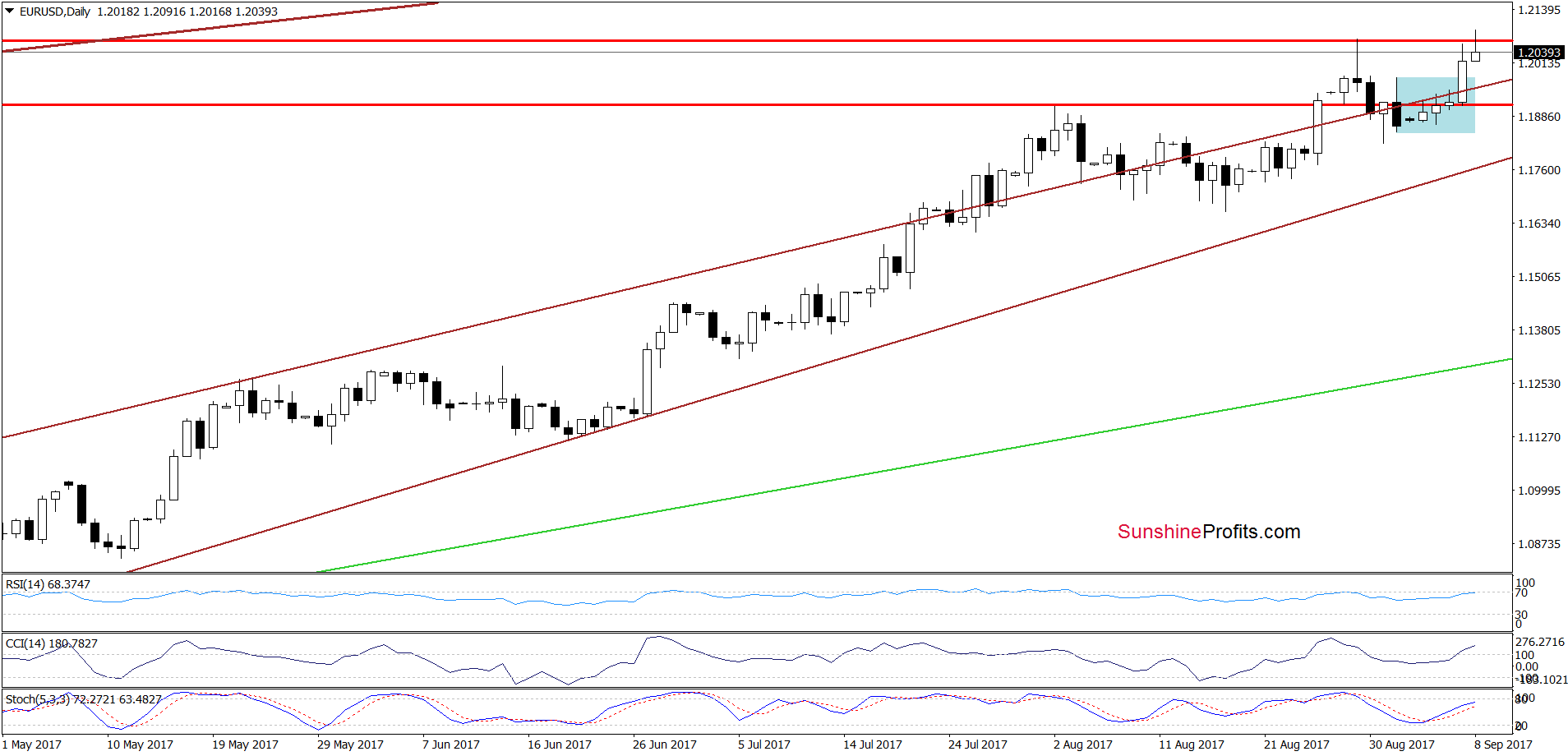

From today’s point of view, we see that EUR/USD moved higher once again, but then reversed and declined, which suggests that another attempt to move lower may be just around the corner – especially if indicators generate sell signals.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1466) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

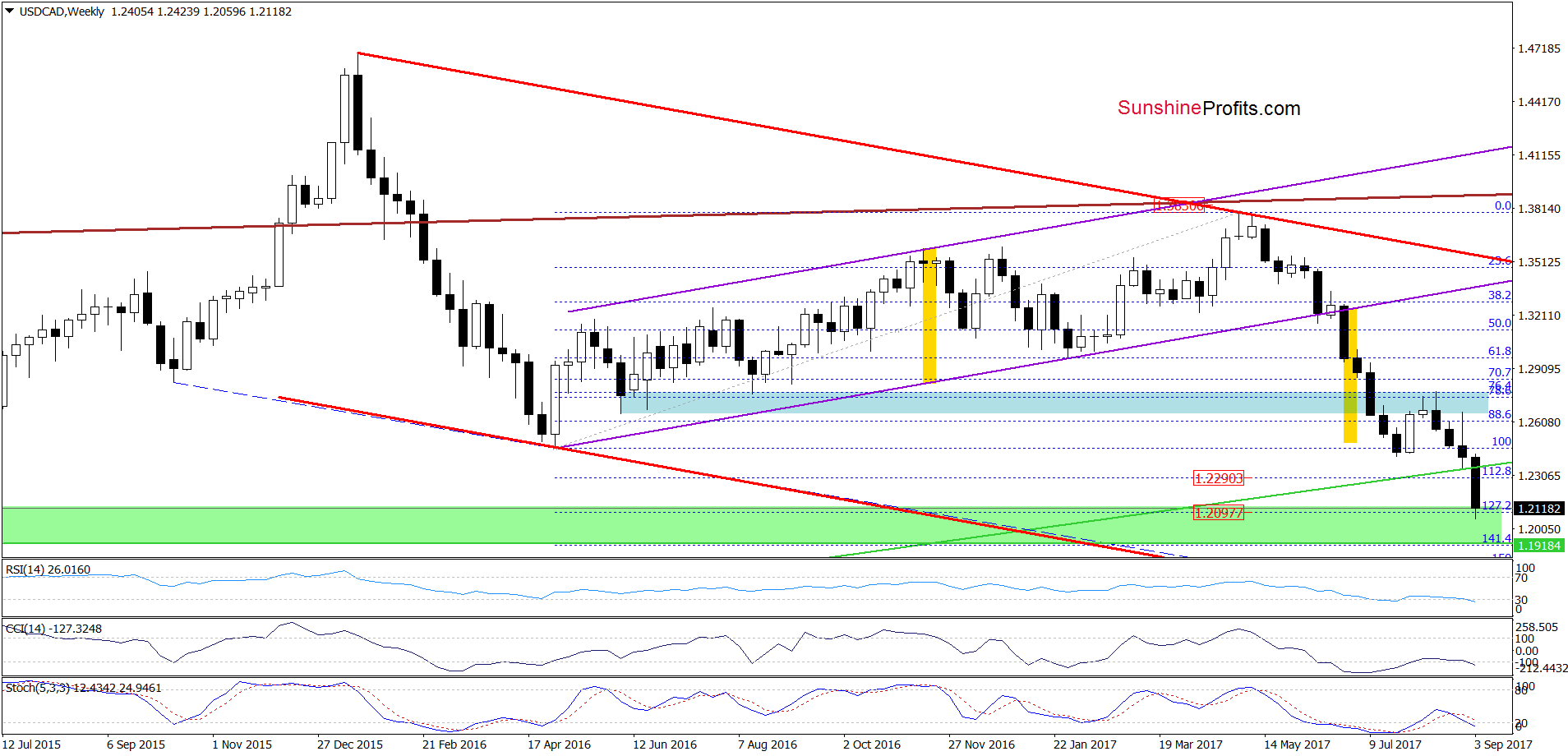

USD/CAD

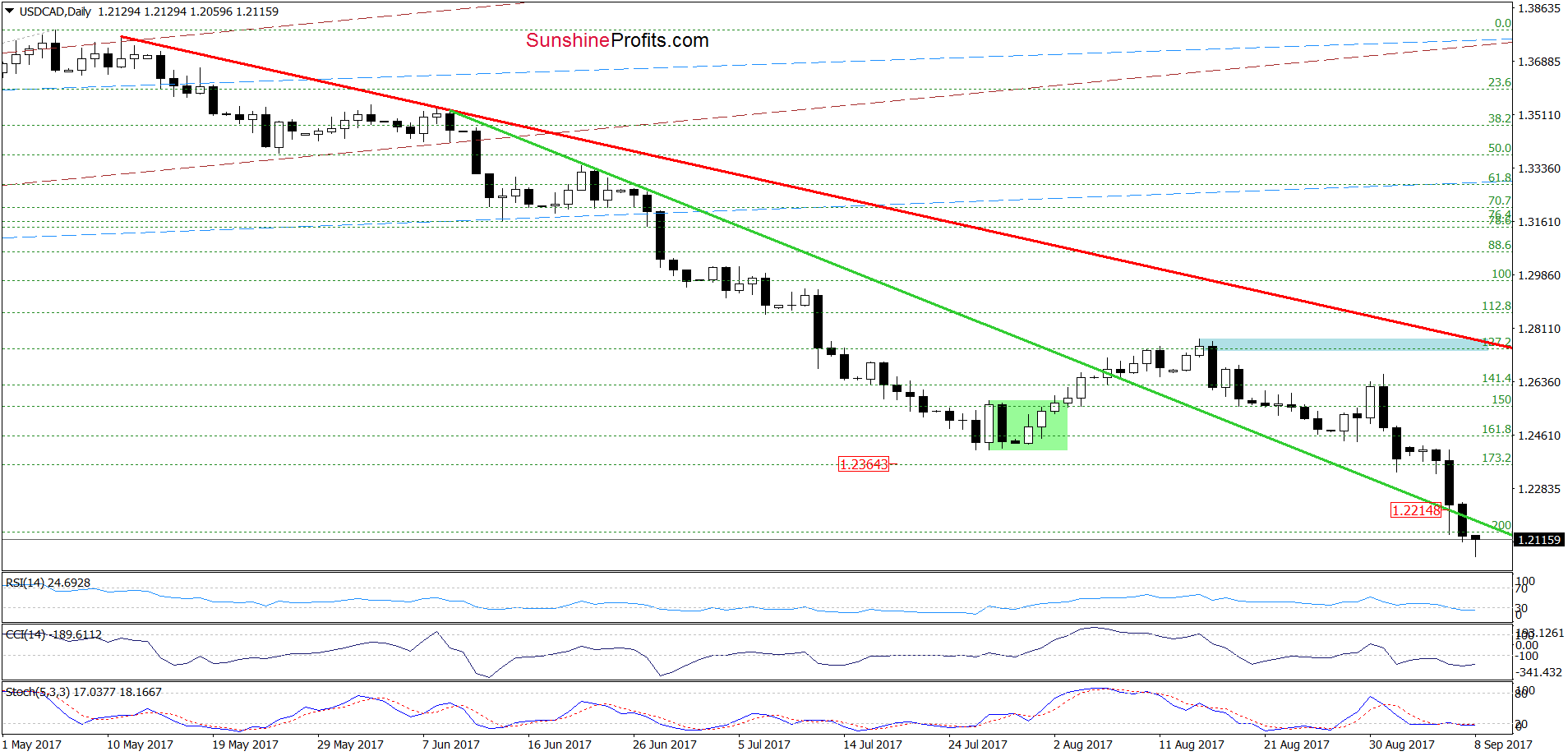

Looking at the daily chart, we see that USD/CAD extended losses and broke below the green support line and the 200% Fibonacci extension.

What’s next for the exchange rate? Let’s take a closer look at the weekly chart and try to find out.

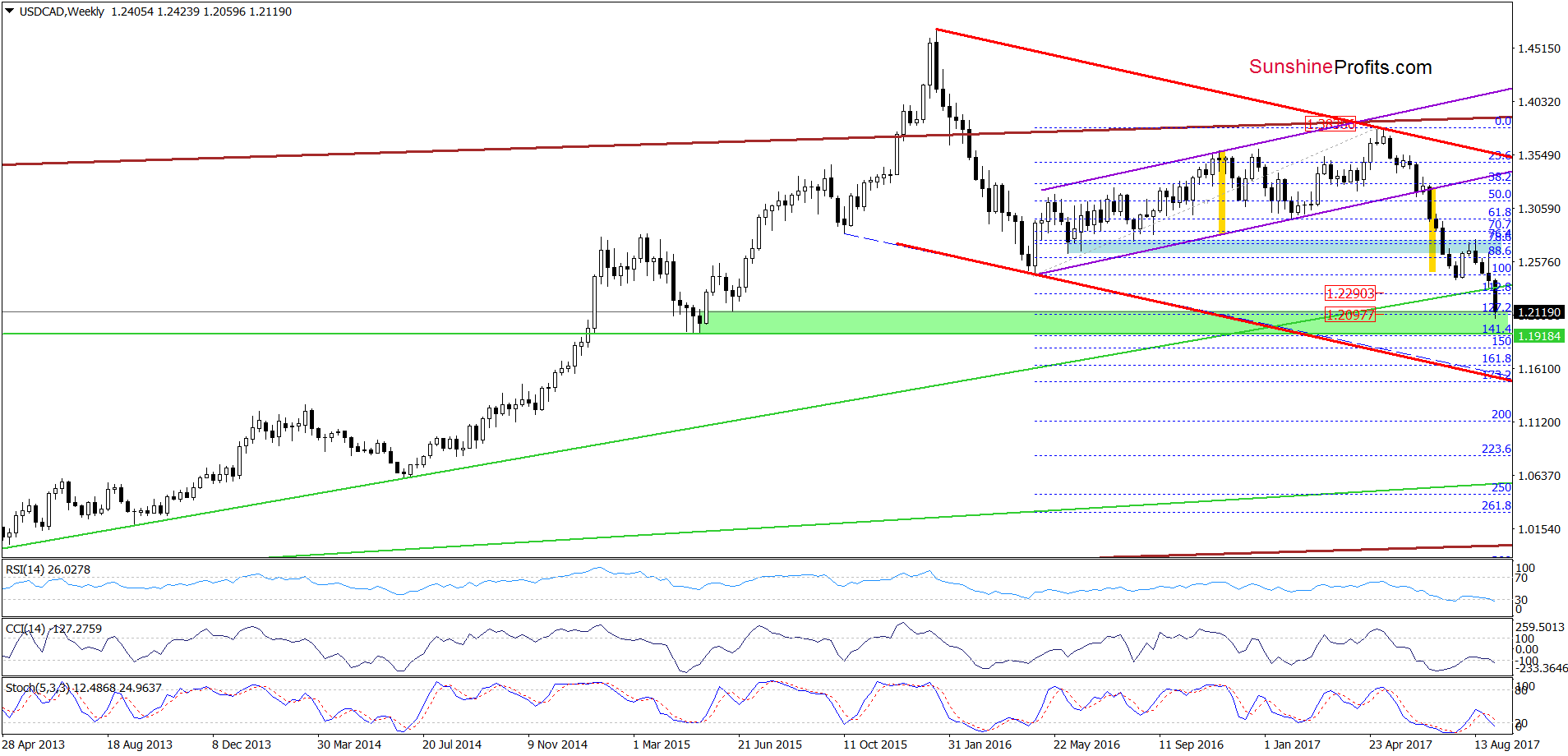

The first thing that catches the eye on the weekly chart is a breakdown under the long-term green support line. As you see, this bearish development triggered further deterioration, which resulted in a drop to the upper border of the green support zone (created by the 127.2% Fibonacci extension), which could stop currency bears in the coming week. Nevertheless, even if it doesn’t and the pair extends losses, the next downside target will be quite close – around 1.1918, where the lower line of the green zone (created by the 141.4% Fibonacci extension and the May 2015 lows) currently is.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

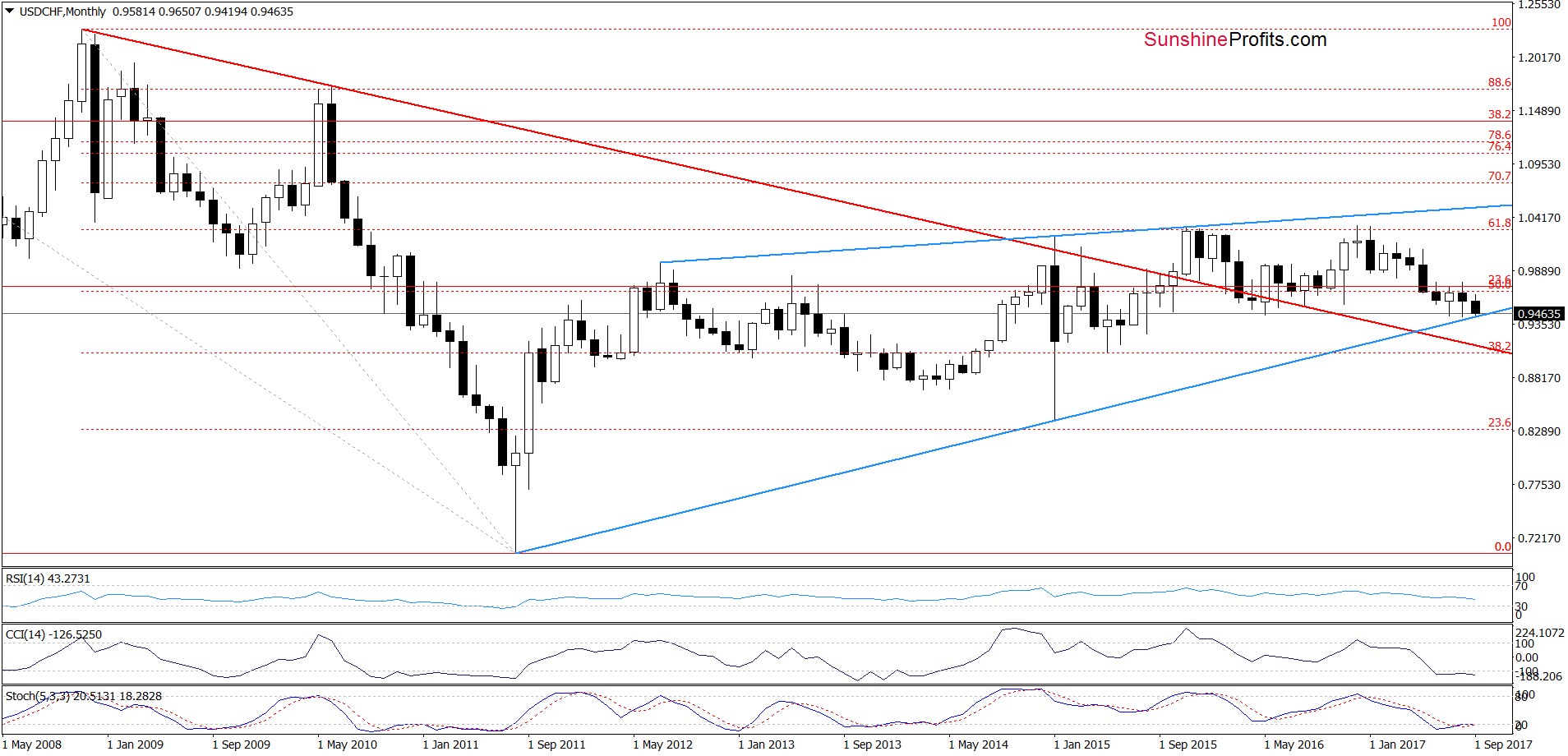

USD/CHF

On Wednesday, we wrote the following:

(…) the exchange rate pulled back and stuck in the green consolidation. Earlier today, currency bears pushed USD/CHF under the lower border of the formation, which is a negative development. Nevertheless, in our opinion, it will be more bearish and reliable if the pair closes today’s session under 0.9544. In this case, we’ll likely see further deterioration and a test of the support area (around 0.9440-0.9455) created by the lower border of the orange declining trend channel and the long-term blue rising support line (…)

On the daily charts, we see that the situation developed in line with the above scenario and USD/CAD slipped to our downside targets. What’s next? Taking into account the fact that the above-mentioned levels stopped currency bears two times in the previous weeks, it seems that history will repeat itself once again and we’ll see another reversal from current prices in the coming week. Nevertheless, even if USD/CHF moves lower once again, it seems to us that the 50% Fibonacci retracement (seen on the chart below) will stop declines and trigger another rebound in the following days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts