Although the beginning of the month was cruel for currency bulls as USD/JPY extended losses and slipped to a fresh 2018 low, the buyers didn’t lose their cold blood and managed to trigger rebounds. Looking closely at them, we noticed something that could reverse their sad fate in the coming days.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3221; the initial downside target at 1.2918

- USD/CHF: none

- AUD/USD: none

EUR/USD

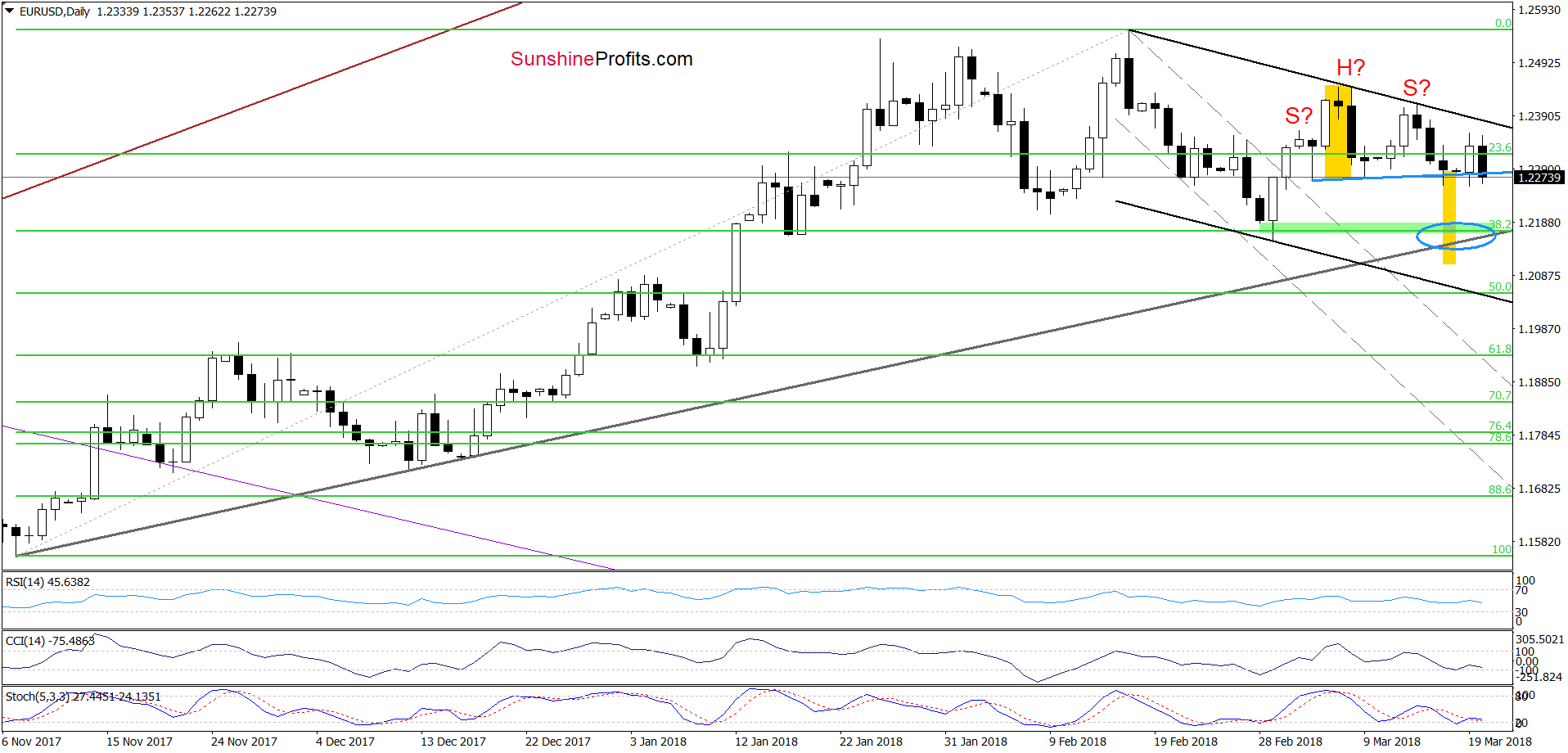

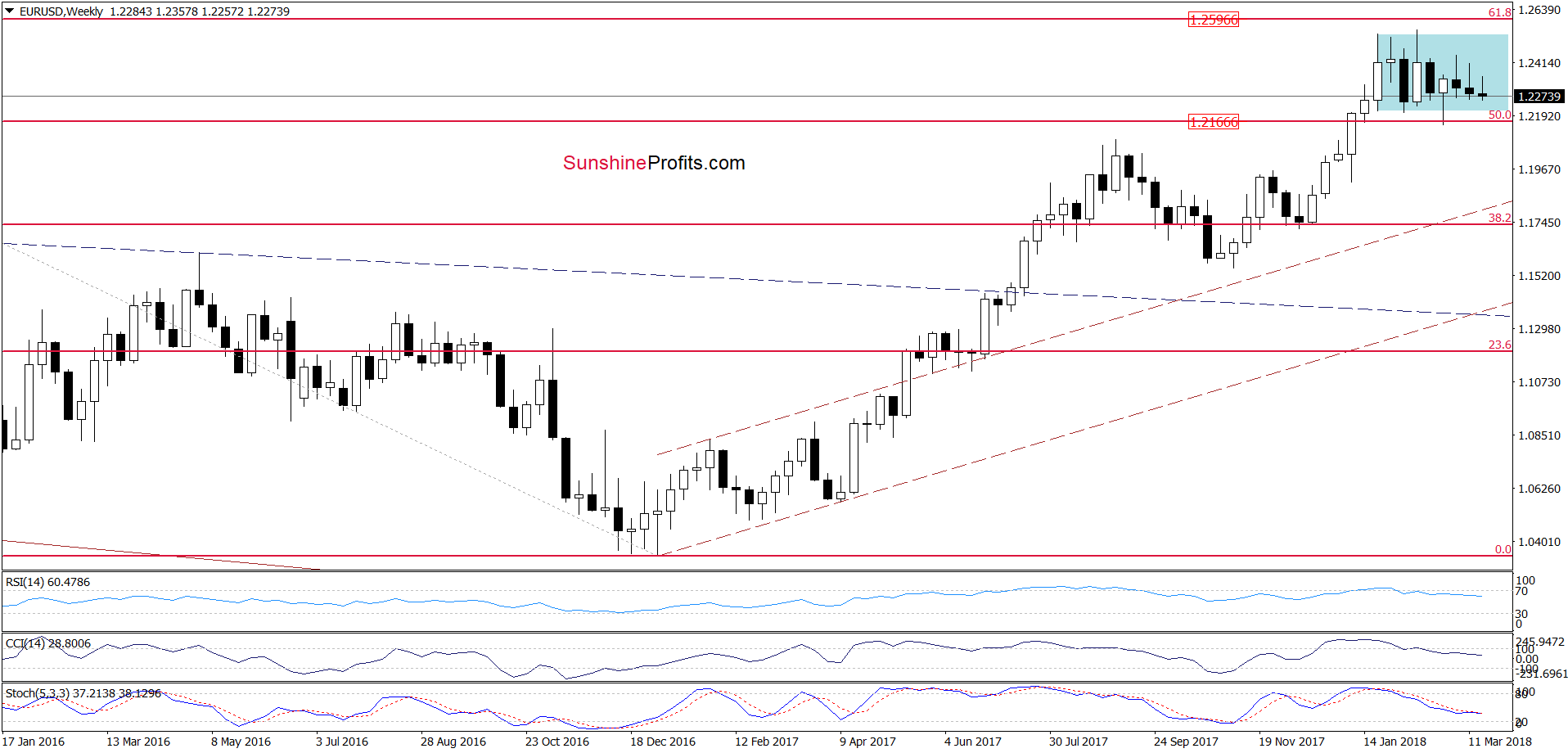

Looking at the daily chart we see that although EUR/USD bounced off the blue support line based on the previous lows (the neck line of the potential head and shoulders formation) yesterday, currency bears didn’t give up and pushed the exchange rate lower earlier today.

As a result, the pair erased Monday’s increase and slipped slightly under the blue line, but can we trust this decrease? In our opinion, not really, because this is nothing more than the repeat of what we already saw in previous days.

Therefore, as long as there is no daily closure under this line there are no enough bearish implications of that move to justify the opening of short positions – especially when we factor in the medium-term consolidation seen on the chart below.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

Yesterday, GBP/USD bounced off the previously-broken upper border of the purple declining trend channel (marked with dashed lines) and the lower black support line, which resulted in a climb to the yellow resistance area.

Despite this move, the pair pulled back and slipped under the black line, invalidating Monday’s breakout earlier today. On top of that, the Stochastic Oscillator generated the sell signal, suggesting further deterioration. Nevertheless, we think that today’s price action will be more pro-bearish if we see a daily closure under the black line and the level of 1.4000.

What could happen if the pair extends losses?

In our opinion, if the exchange rate declines under the previously-broken upper border of the purple declining trend channel and the lower black support line, we’ll see a test of the March low or even the blue support line based on the previous lows in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

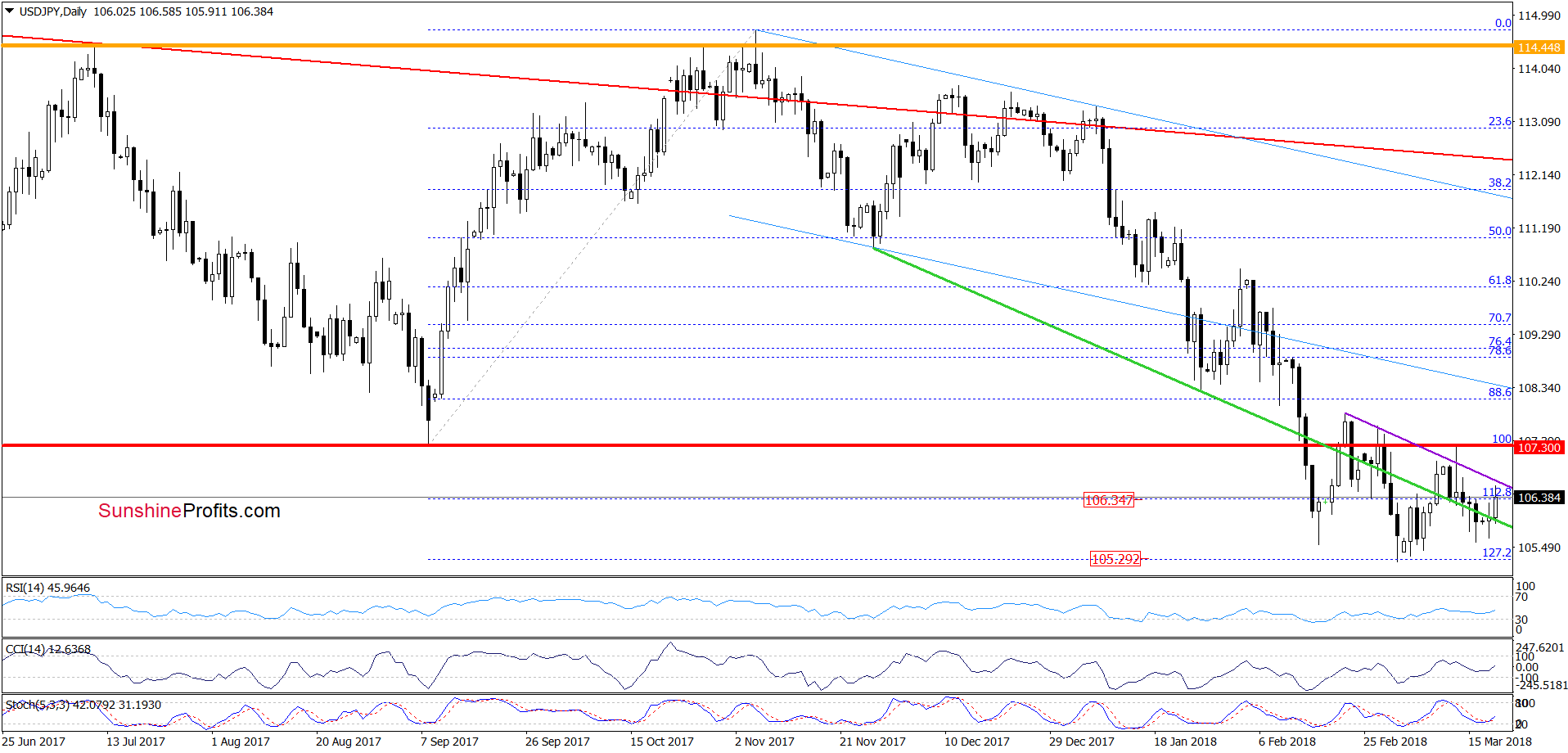

On Friday, we wrote:

(…) if we see a daily closure above the previously-broken green line, the exchange rate will likely test the recent highs at the beginning of the coming week.

From today’s point of view, we see that USD/JPY came back above the green resistance line earlier today, which together with the buy signal generated by the Stochastic Oscillator suggests further improvement and the realization of our Friday’s scenario.

So, why we didn’t open long positions? We believe that the best answer to this question will be the quote from our last commentary on this currency pair:

(…) we do not open long positions as long as the exchange rate remains under the red resistance horizontal line and the February 21 peak of 107.88. If we see a breakout above these resistances, we’ll consider going long. Until this time, waiting at the sidelines seems to be the best decision – especially when we factor in the fact that potentially profitable positions on other currency pairs are just around the corner.

Finishing today’s alert, it is worth noting that we noticed a potential pro-bullish technical formation (the reverse head and shoulders pattern) on the daily chart of USD/JPY, however, as long as the exchange rate is trading under the above-mentioned resistances we just look very closely at it and monitor the behavior of both bulls and bears in the area of the neck line.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts