The beginning of the week was quite difficult for the bulls, because USD/JPY dived once again and closed the day below 112. Nevertheless, thanks to the yesterday's decline the currency pair reached some important supports. Can they change the fate of currency bulls in the coming days?

- EUR/USD: short (a stop-loss order at 1.1878; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3377; the initial downside target at 1.2923)

- USD/JPY: long (a stop-loss order at 111.11; the initial upside target at 113.40)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Looking at the daily chart, we see that although EUR/USD broke above the upper line of the consolidation during yesterday’s session, this improvement was quite temporary and very similar to what we already saw during recent days.

Why? Because despite this improvement currency bulls didn’t manage to hold gained levels, which resulted in another invalidation of the breakout and a comeback into consolidation.

Earlier today, the buyers tried to go higher once again, but despite these efforts the exchange rate is still trading inside the consolidation and below the 23.6% Fibonacci retracement (at the moment of writing this alert).

Additionally, the sell signal generated by the Stochastic Oscillator remains in the cads, while the CCI increased to the level of 100, suggesting that the space for gains may be limited and another reversal from this area should not surprise us in the very near future.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1878 and the initial downside target at 1.1343 are justified from the risk/reward perspective.

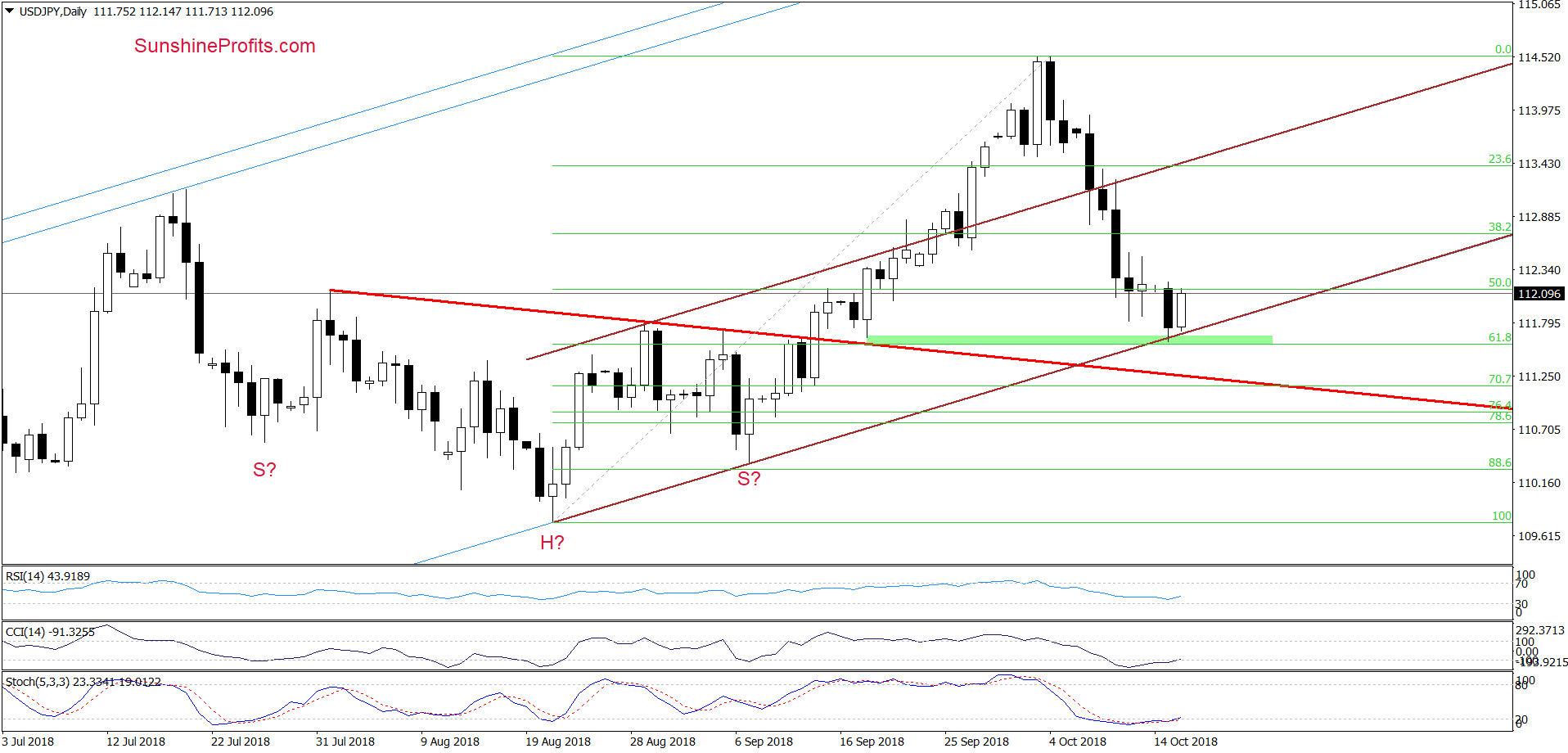

USD/JPY

From today’s point of view, we see that currency bears showed their claws once again during yesterday’s session and pushed USD/JPY below the 50% Fibonacci retracement, which resulted in further deterioration and a test of the lower border of the brown rising trend channel and the 61.8% Fibonacci retracement.

What’s interesting, thanks to yesterday’s downswing, the exchange rate tested the durability of one more support line. Let’s take a look below.

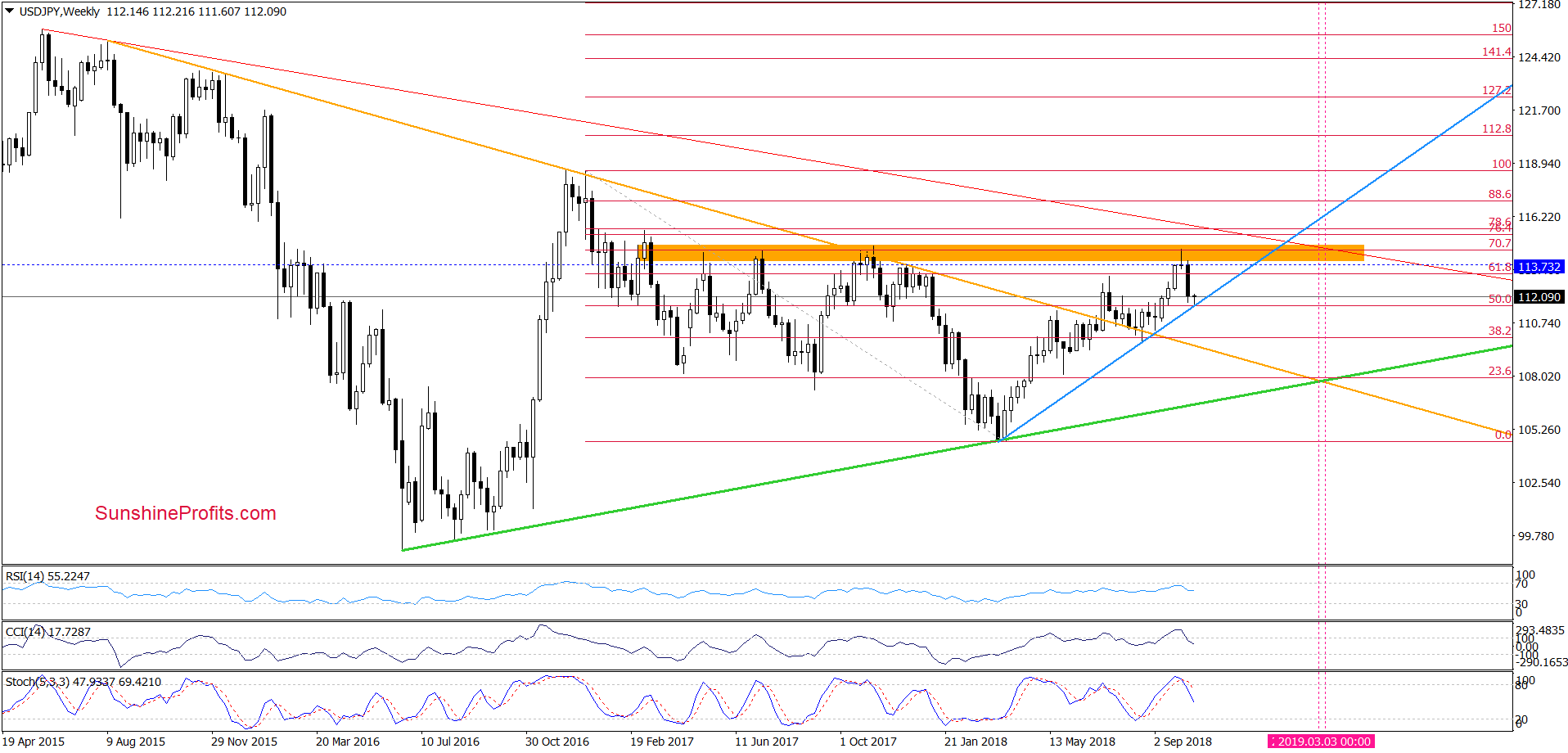

From the weekly perspective, we see that the pair dropped to the medium-term blue support line based on the March and August lows, which suggests that as long as it servs as a support another bigger move to the downside is not likely to be seen.

Additionally, the CCI and the Stochastic Oscillator generated buy signals, increasing the probability of (at least) the very short-term improvement in the following days. If this is the case and USD/JPY moves higher from current levels, we’ll likely see a test of the previously-broken upper line of the brown rising trend channel (or even the orange resistance zone marked on the weekly chart) in the very near future.

Taking all the above into account, we think that opening long positions is justified from the risk/reward perspective. All needed details you will find below.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 111.11 and the initial upside target at 113.40 are justified from the risk/reward perspective.

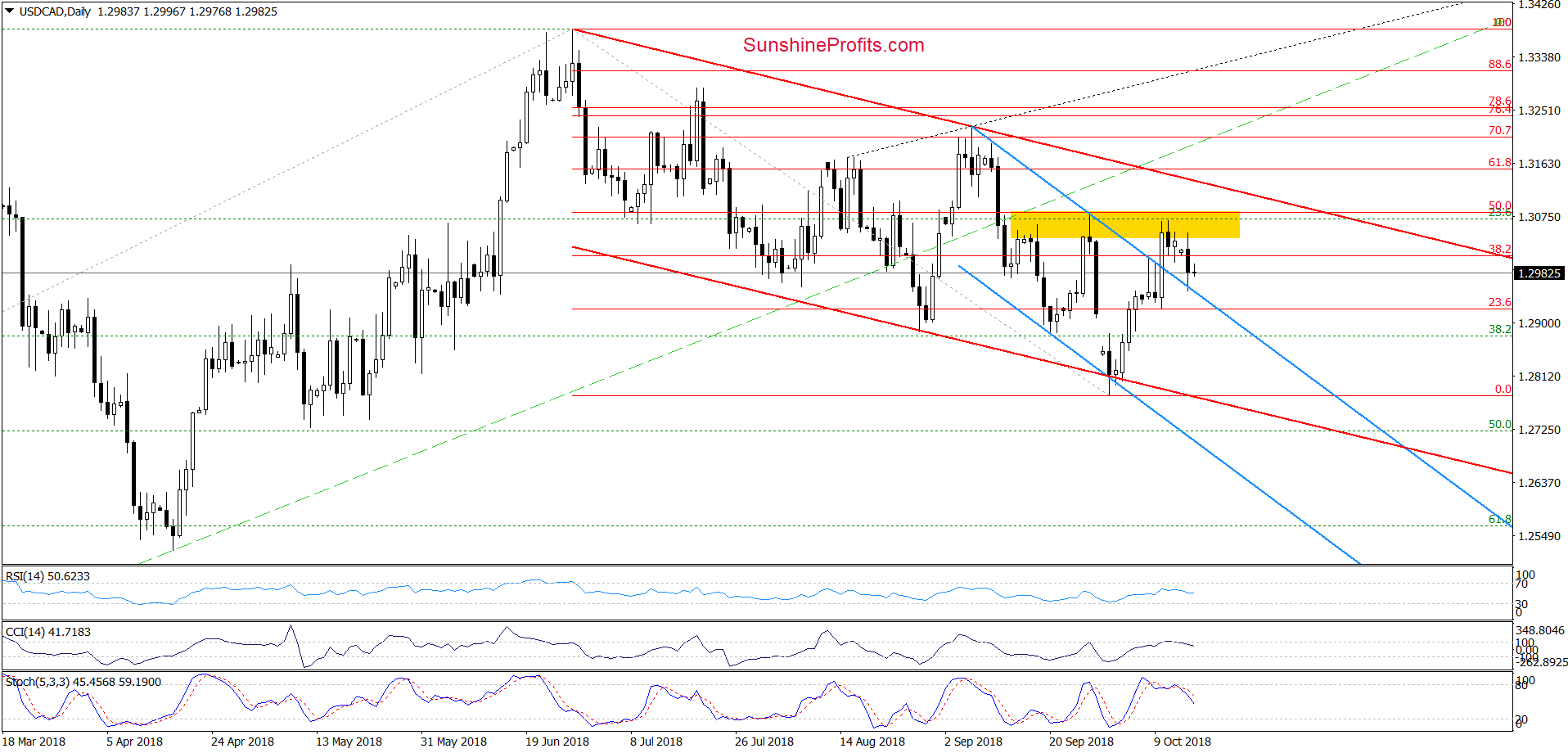

USD/CAD

In our last commentary on this currency pair, we wrote the following:

(…) the yellow resistance zone created by the peaks formed in the second half of September and the 50% Fibonacci retracement (based on the entire June-October decline)(…) stopped further improvement and the exchange rate pulled back, which in combination with the sell signals generated by the daily indicators suggests that we’ll likely see (at least) a test of the previously-broken upper line of the blue rising trend channel in the coming day(s).

As you see on the chart, the situation developed in line with the above scenario and USD/CAD slipped to the above-mentioned downside target during yesterday’s session.

Although the upper line of the blue trend channel triggered a rebound before the session closure, the sell signals generated by the indicators remain in the cards, suggesting that lower values of USD/CAD are still ahead of us.

Therefore, we believe that another test of the strength of the above-mentioned blue line is very likely later in the day. If the exchange rate closes the day below it, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts