Although currency bulls bounced off the major long-term support and broke above the upper border of the short-term declining trend channel, we didn’t notice a rally in recent days. Does it mean that the buyers have already lost their strength and another move to the downside awaits us?

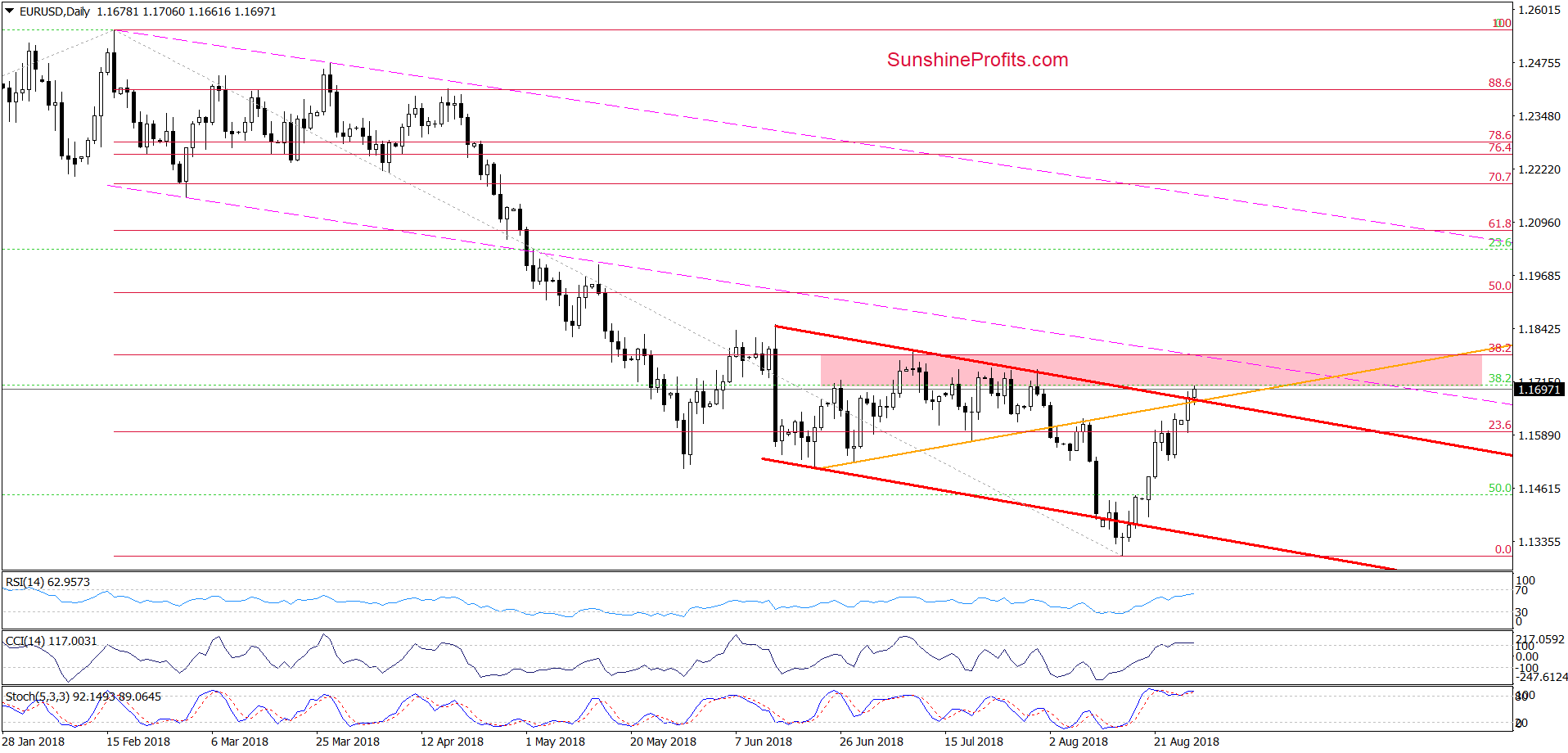

EUR/USD

The highlight of today’s session is a breakout above the upper border of the red declining trend channel and the previously-broken orange resistance line. Although this is a bullish development, the day is not over yet and reversal from this area can’t be ruled out.

Why? Because, the exchange rate reached the lower border of the pink resistance zone created by the recent peaks, the lower border of the pink declining tend channel (marked with dashed lines) and the 38.2% Fibonacci retracement based on the entire February-August downward move.

This suggests that even if the pair moves a bit higher from current levels, the space for gains seems limited and reversal in the very near future is very likely – especially when we factor in the intersection of the upper and lower arms of the triangle and based on in technique about which you could read more here).

Trading position (short-term; our opinion): Connecting the dots, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

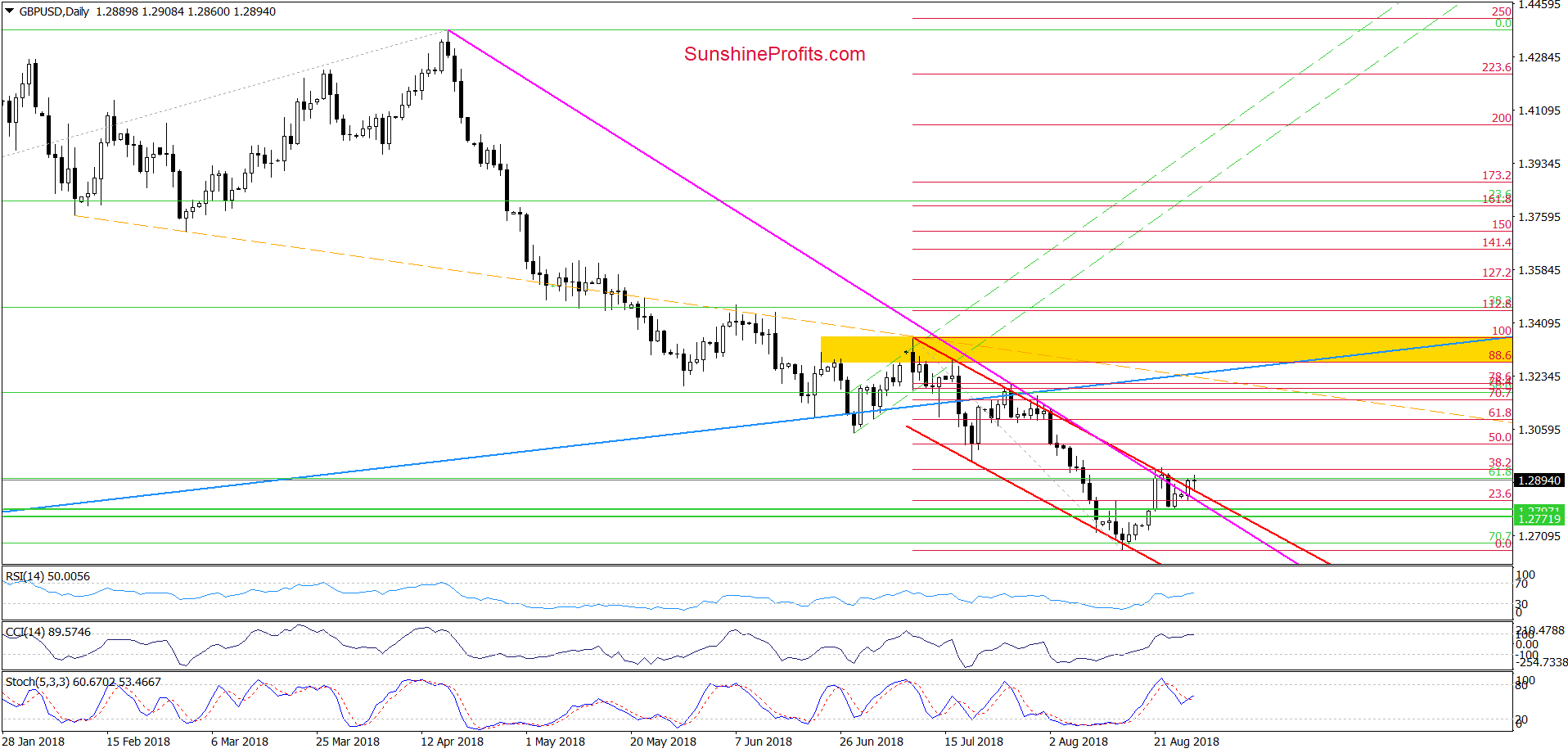

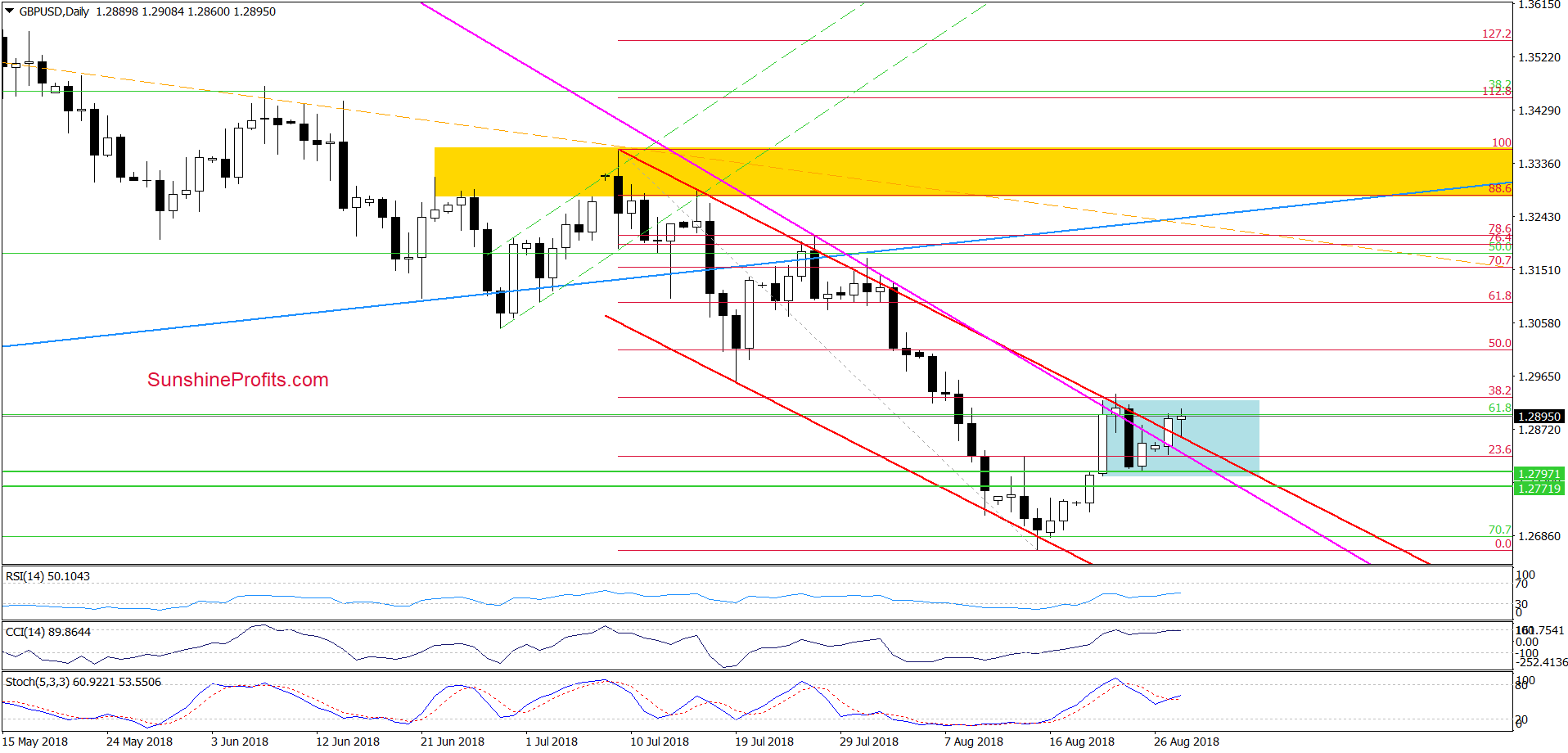

GBP/USD

Looking at the daily chart, we see that although GBP/USD broke above the upper line of the red declining trend channel and the medium-term pink declining line, the overall situation in the very short term hasn’t changed much as the exchange rate is still trading inside the blue consolidation.

Therefore, we think that a bigger move to the upside will be more likely and reliable only if we see a breakout above the upper line of the formation and the 38.2% Fibonacci retracement, which is slightly above it. Until this time, short-lived moves in both directions should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

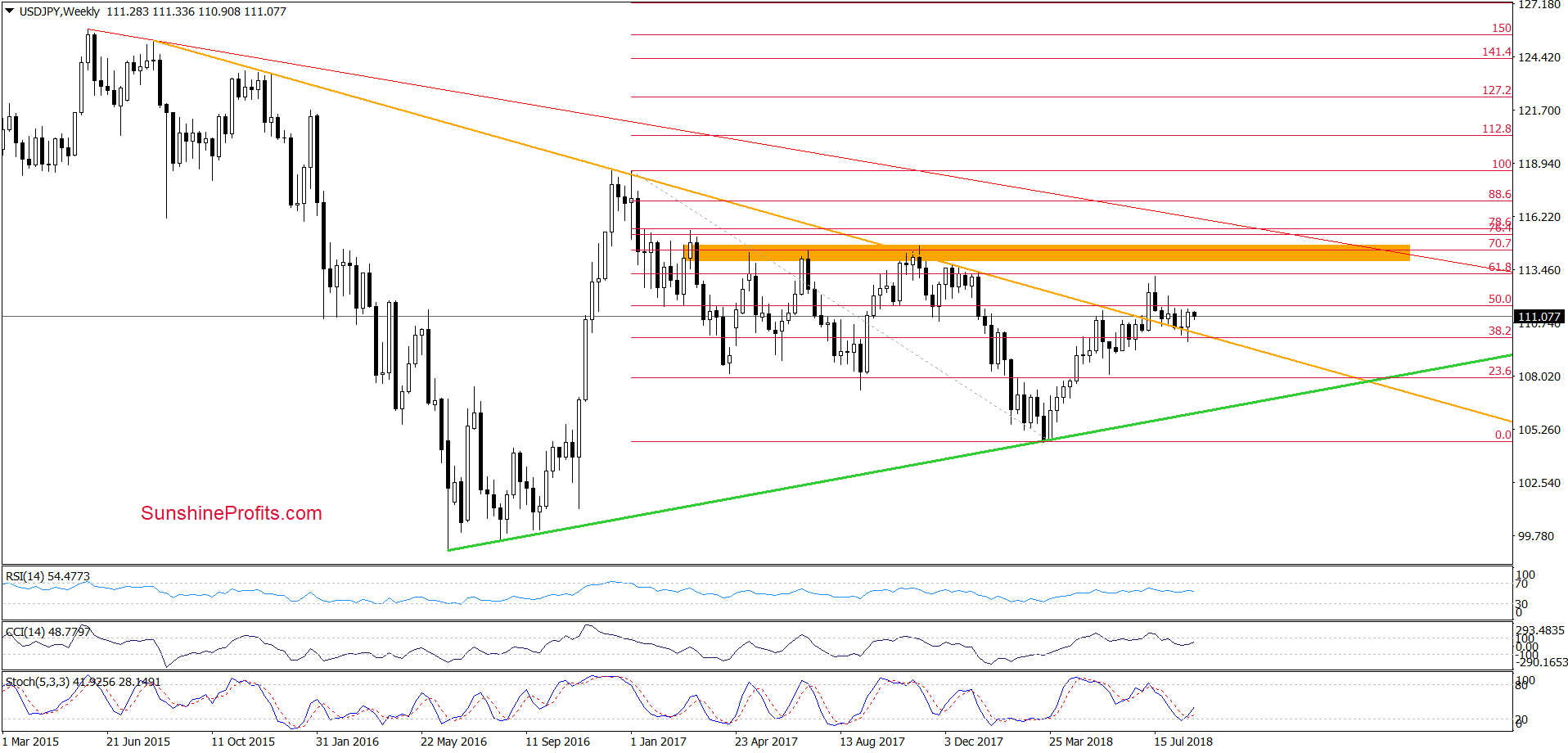

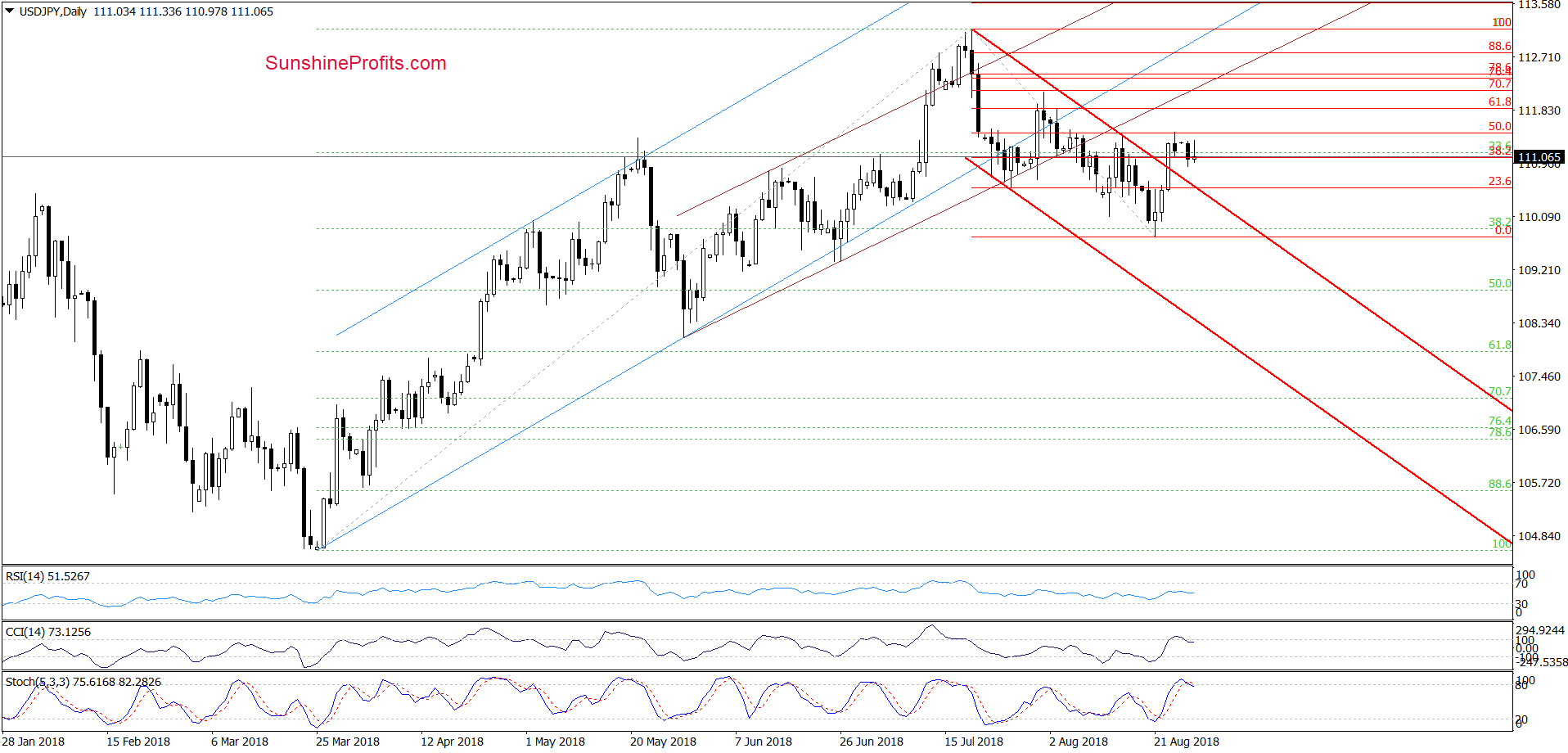

USD/JPY

Looking at the above chart, we see that although the exchange rate pulled back a bit, the overall situation in the medium term remains almost unchanged, because USD/JPY is trading above the previously-broken long-term orange declining line (which serves as the major support).

Having said the above, let’s check what can we infer from the short-term chart.

From this perspective, we see that although the pair climbed above the upper border of the red declining trend channel, currency bulls didn’t trigger a rally in the following days. Instead, USD/JPY started a consolidation under the 50% Fibonacci retracement (based on the entire July-August decline), which suggests that the buyers may not be as strong as it seemed at the first glance.

Additionally, the CCI and the Stochastic Oscillator generated the sell signals, suggesting that another downswing may be just around the corner. If this is the case and the exchange rate declines from here, we’ll likely see a test of the strength of the upper border of the red declining trend channel (the nearest support at the moment of writing this alert) in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts