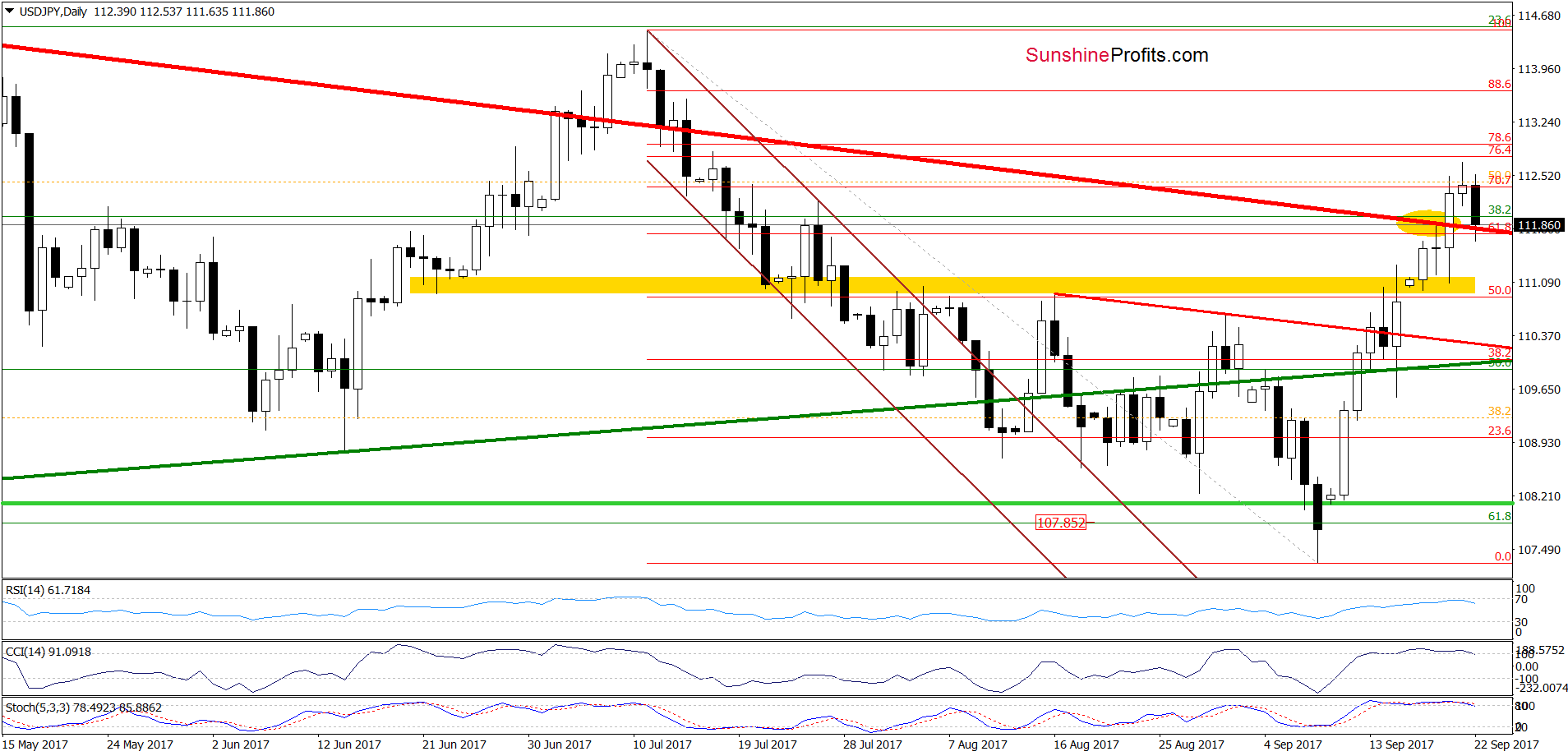

Earlier today, USD/JPY pulled back and slipped to the previously-broken support/resistance line. Will we see a verification of the earlier breakout or rather further declines in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1466)

- GBP/USD: short (a stop-loss order at 1.3773; the initial downside target at 1.3317)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

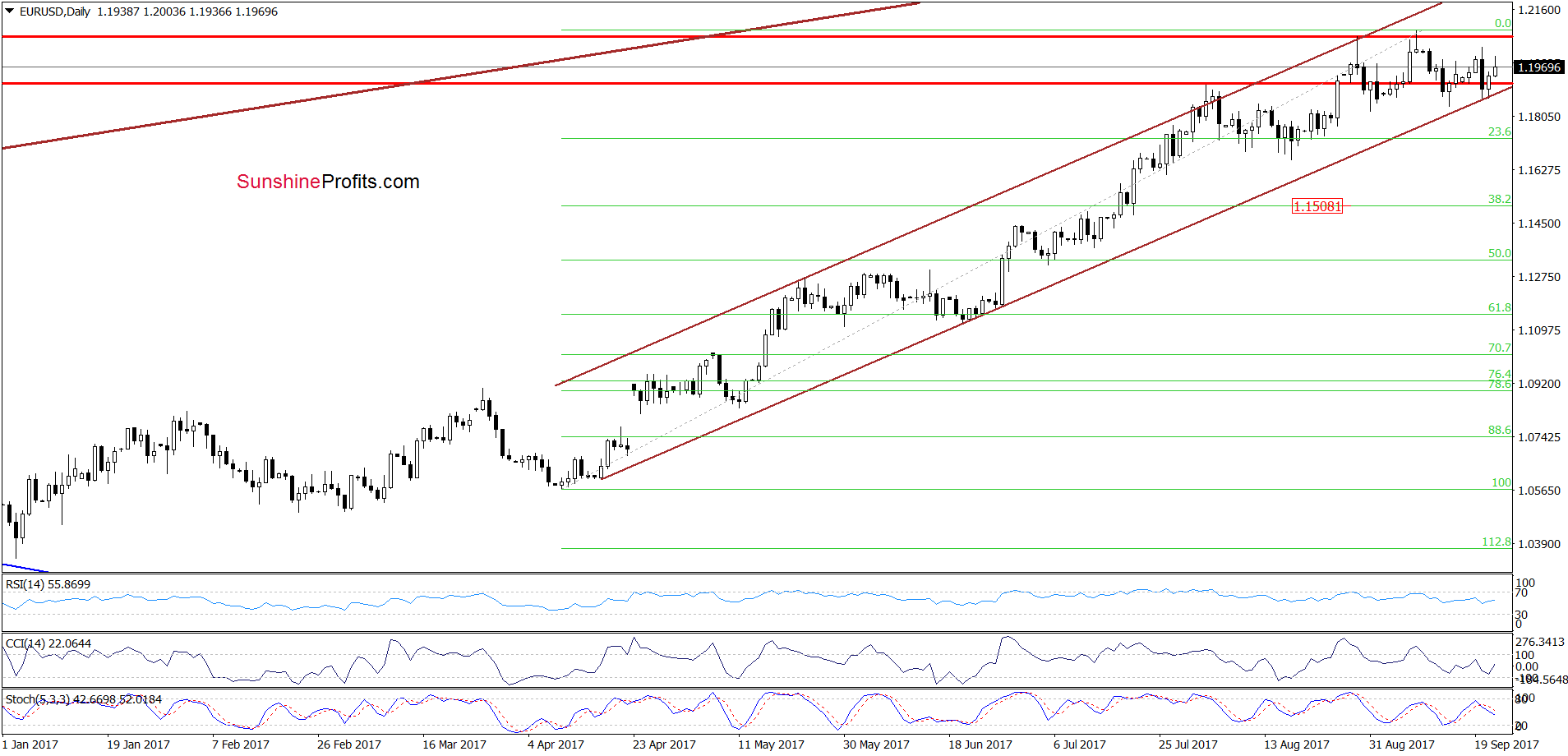

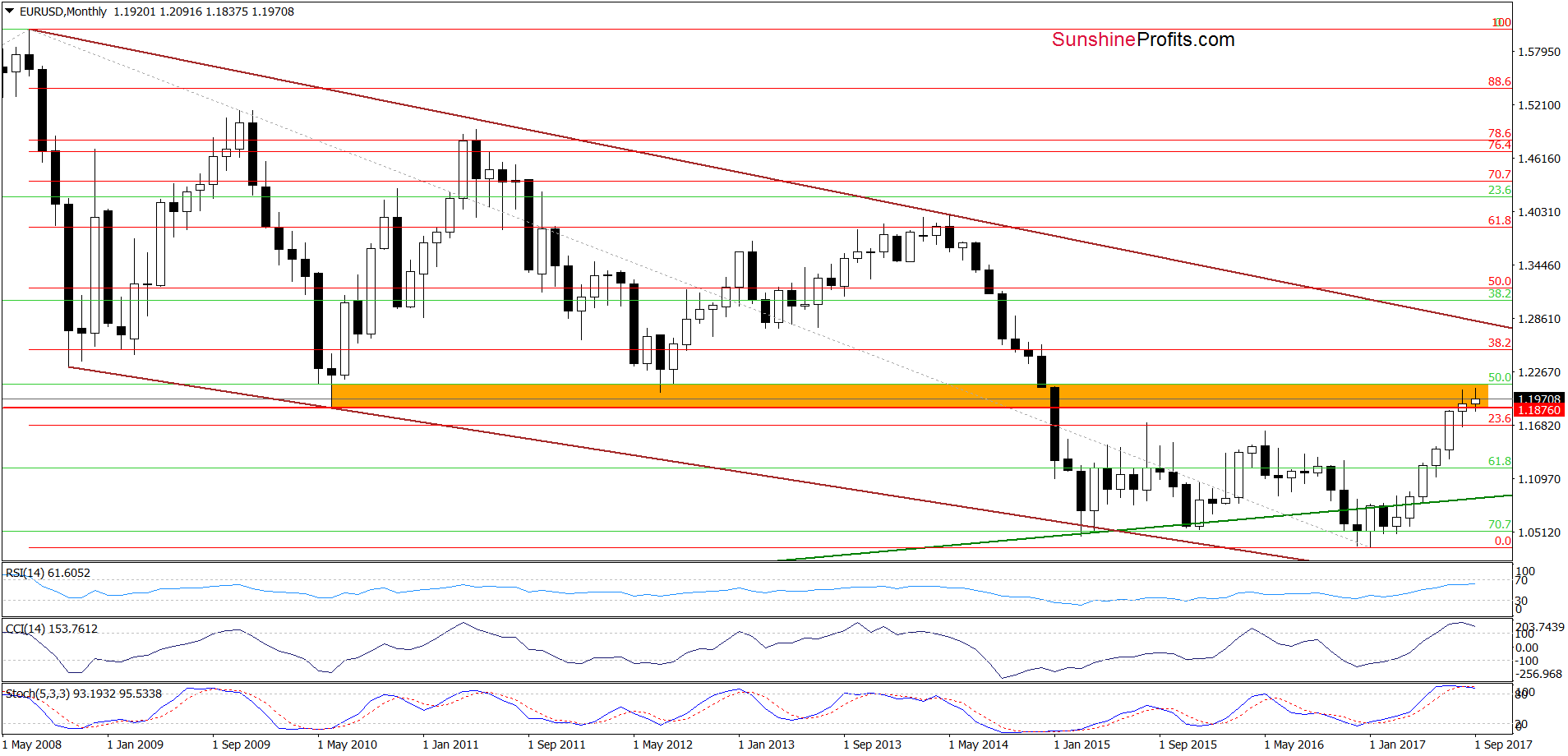

EUR/USD

Yesterday, the lower border of the brown rising trend channel triggered a rebound. Earlier today, the exchange rate extended that move, but despite this improvement, EUR/USD remains below recent peaks. Additionally, the sell signal generated by the Stochastic Oscillator is still in cards, supporting currency bulls and another attempt to move lower in the coming week.

On top of that, we should keep in mind what we wrote about broader perspective on Wednesday:

(…) EUR/USD remains in the orange resistance zone – below the 2010 and July 2012 lows (in terms of monthly closing prices), which suggests that the 2017 upward move could be a verification of the earlier breakdown below these levels. This scenario is also reinforced by the current position of the long-term indicators – they increased to the highest levels since April 2014. Back then, such high readings of the CCI and Stochastic Oscillator preceded bigger move to the downside, which suggests that we may see a similar price action in the coming week(s). Therefore, even if EUR/USD moves a bit higher in the very short term, we believe that another significant move will be to the downside.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1466) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

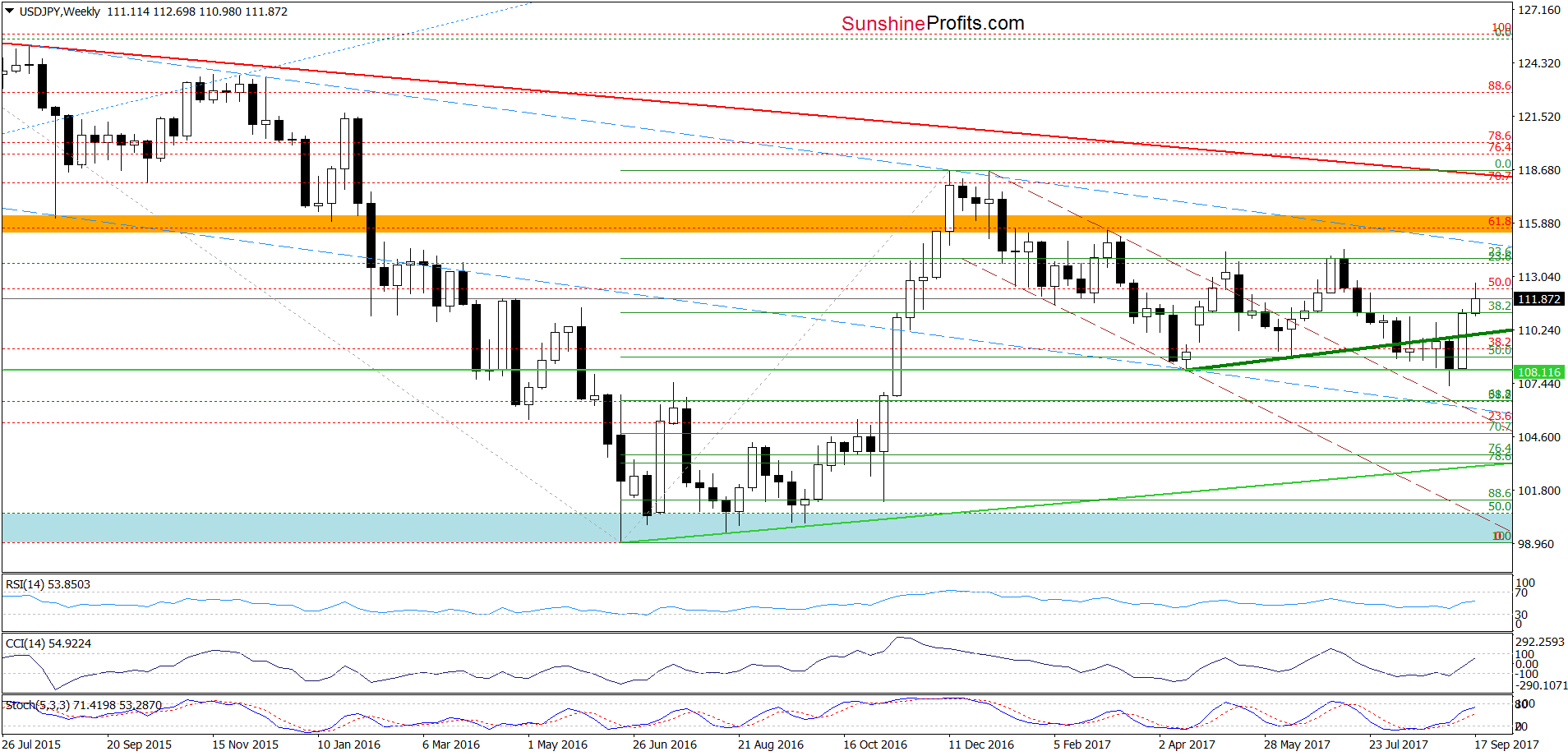

USD/JPY

Looking at the daily chart, we see that although USD/JPY broke above the red declining resistance line and the 61.8% Fibonacci retracement, currency bulls didn’t manage to hold gained levels, which resulted in a pullback earlier today.

Additionally, the CCI and the Stochastic Oscillator generated sell signals, suggesting that further deterioration is just around the corner. Nevertheless, in our opinion, this scenario will be more likely and reliable if the exchange rate closes today’s session under the previously-broken red support/resistance line and the 61.8% Fibonacci retracement. If we see such price action and the pair invalidates the earlier breakout, it will be a bearish development, which will likely trigger further deterioration n the coming week. If this is the case and the pair moves lower, the initial downside target will be the previously-broken yellow zone, which serves as the nearest support at the moment.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

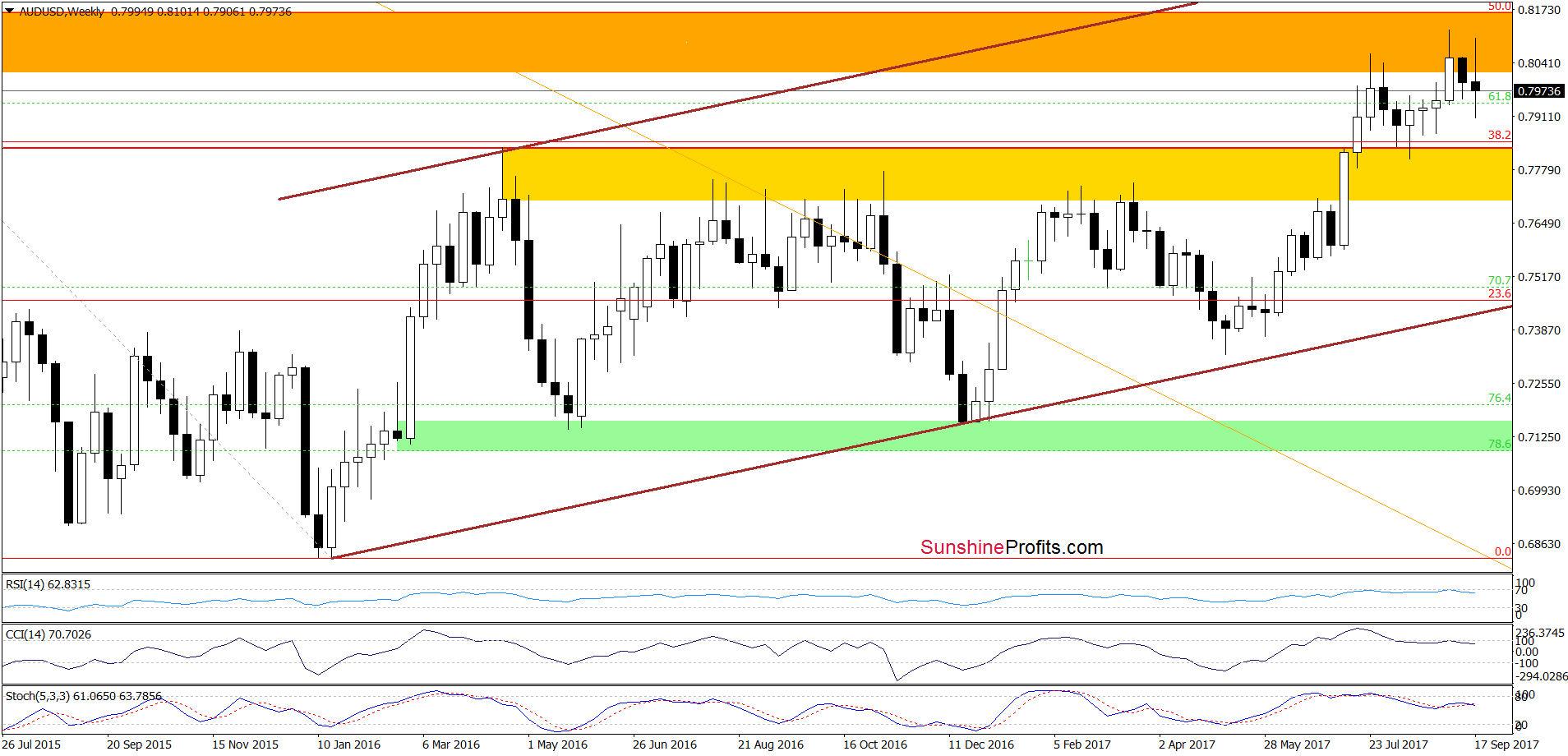

On the medium-term chart, we see that the orange resistance zone stopped currency bulls, triggering a pullback in the previous week. In recent days, AUD/USD re-tested this major resistance, but we didn’t see any improvement, which suggests that another move could be to the downside.

Will the very short-term chart confirm this scenario? Let’s check.

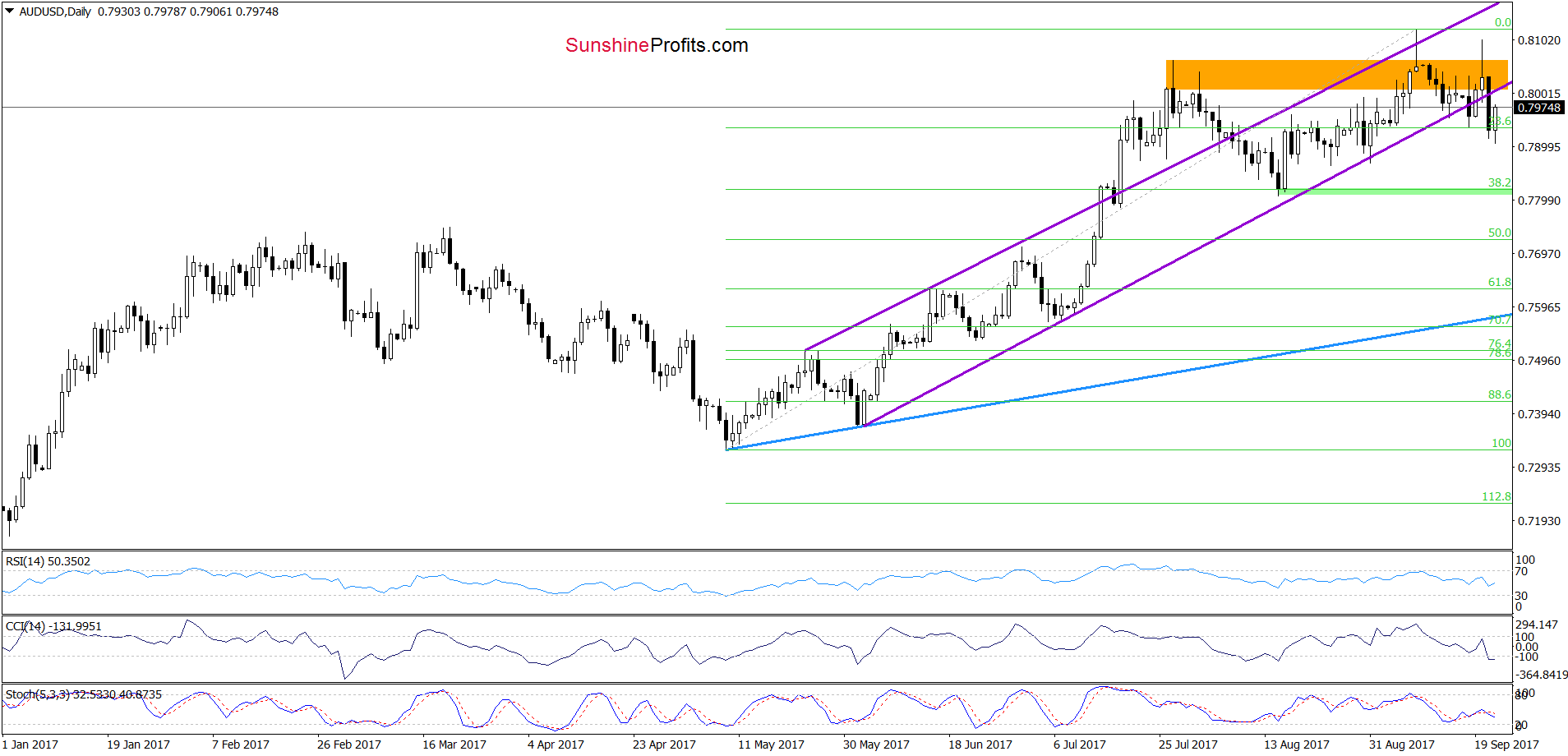

The first thing that catches the eye on the daily chart is another breakdown under the lower border of the purple rising trend channel. Although currency bulls pushed the pair higher earlier today, it is still trading under the purple line, which means that the current upswing could be nothing more than a verification of yesterday breakdown.

If this is the case and we see a reversal later in the day (or on Monday), lower values of the exchange rate will be more likely in the following days.

How low could the pair go? In our opinion, if AUD/USD declines from current levels, the initial downside target will be around 0.7805-0.7820, where the green support zone (created by the mid-August lows and the 38.2% Fibonacci retracement) is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts