On Friday, the greenback extended gains against the yen, which resulted in a breakout above the upper border of the short-term rising rend channel. What impact could this event have on USD/JPY future moves?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1505; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 111.67; the initial upside target at 114.87)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7724; the initial downside target at 0.7473)

EUR/USD

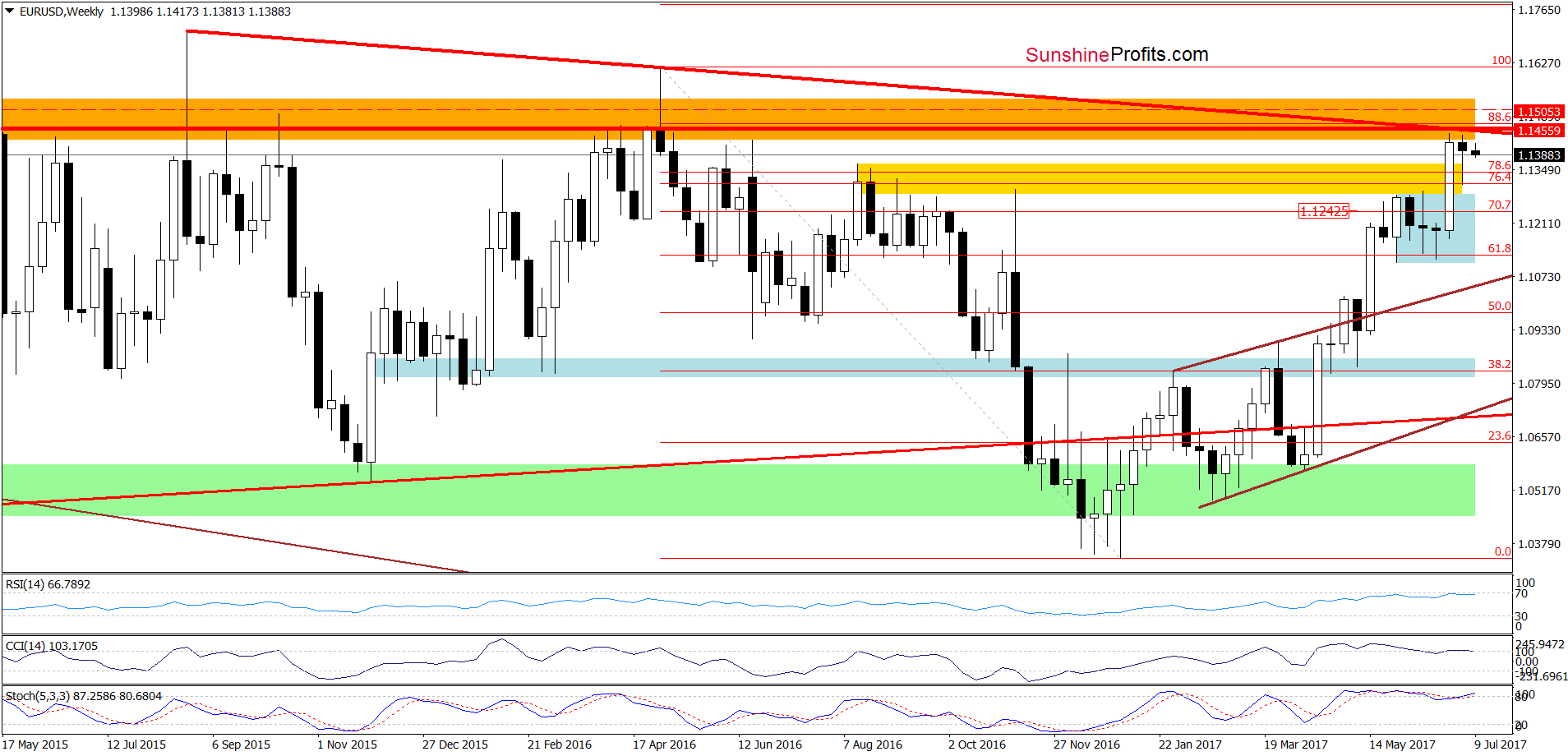

From the medium-term perspective, we see that the exchange rate is still trading under two key resistance lines: the long-term red resistance line based on the August 2015 and May 2016 peaks and the red horizontal resistance line cased on the highest weekly closures. This means that our Wednesday’s commentary remains up-to-date also today:

(…) it strongly appears that the euro has either reached its top or is about to do so shortly (perhaps today). The horizontal resistance line that you can see on the above chart is based on the highest weekly closes of the previous years. The weekly closing prices are the key closes to keep in mind in the case of bigger trends and the level that was just reached stopped the rally twice. There were temporary moves above it, but they all were very temporary. Since the week is ending today, it appears that the top is in or that we will see only a temporary upswing and a weekly close back at/below the resistance line.

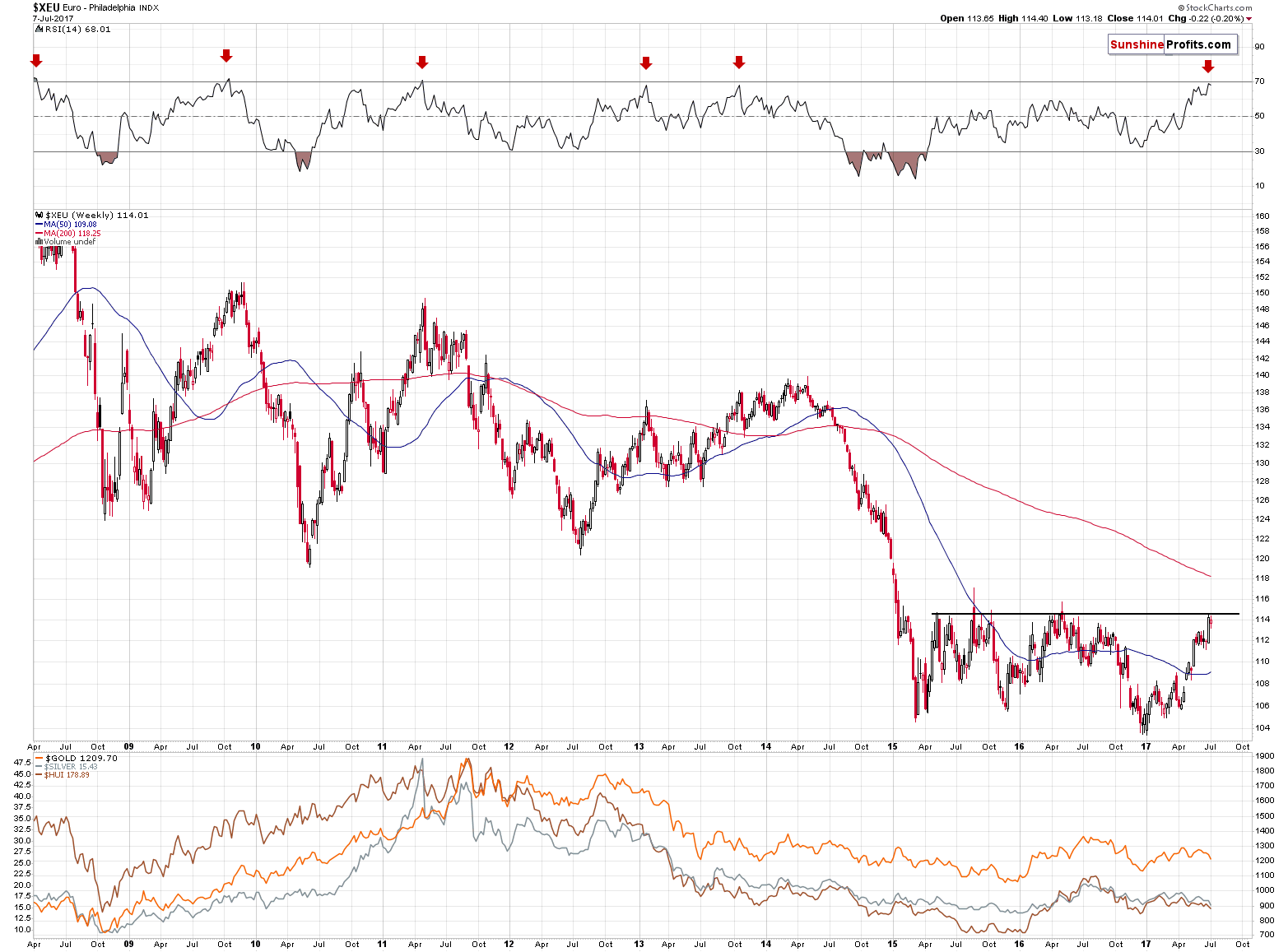

A strong bearish confirmation comes from the RSI indicator – practically in all recent cases (the last 9 years), the readings of the RSI that were as high as the current ones meant that the euro was going to reverse shortly.

So, despite the bullish action [last] week, the outlook for the euro is actually very bearish and the chart is quite clear about that.

Monday’s session seems to have confirmed the above – the Euro Index declined, just like it did previously when it approached similar price levels in terms of the weekly closing prices. The outlook remains strongly bearish – it seems that another sizable decline has already started.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1505 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

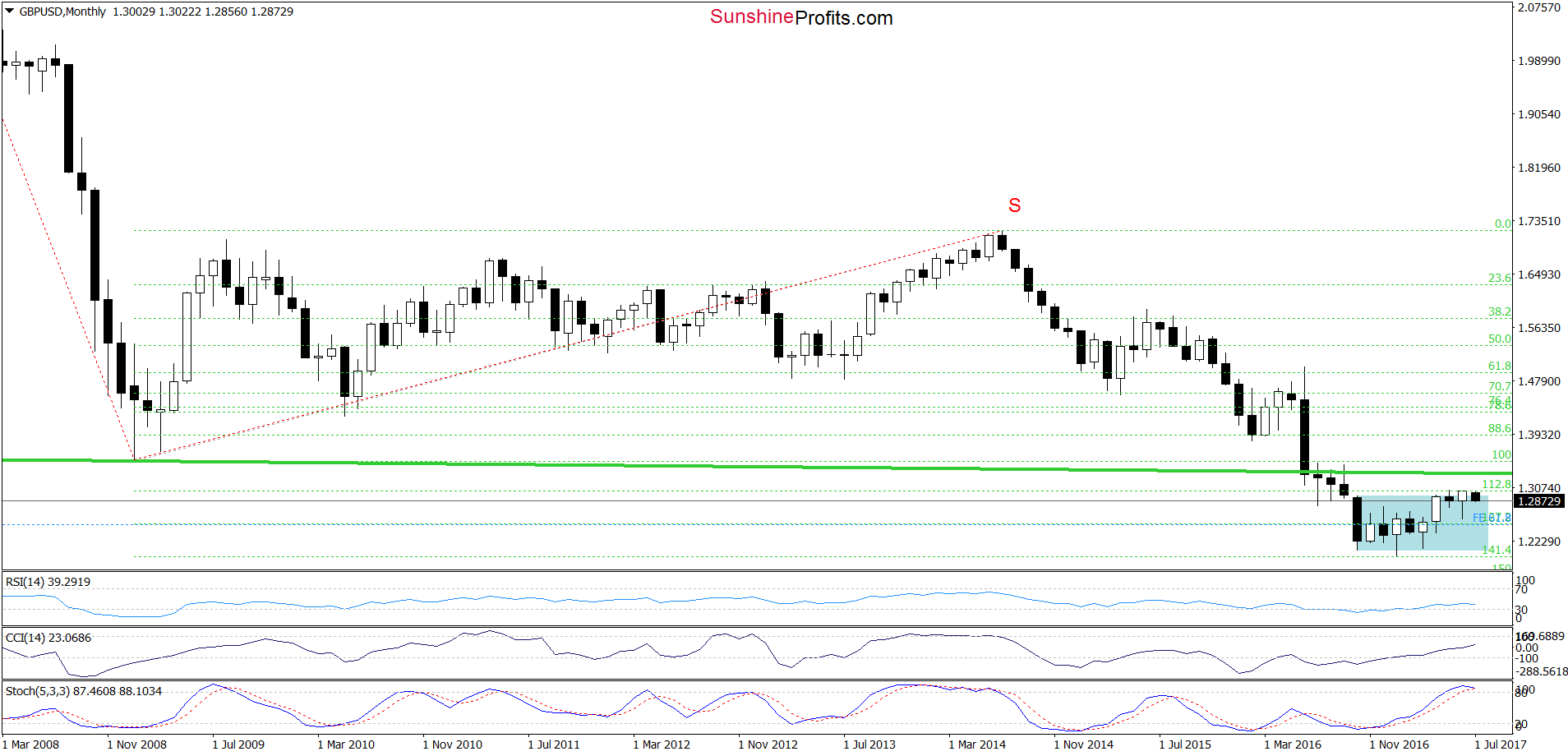

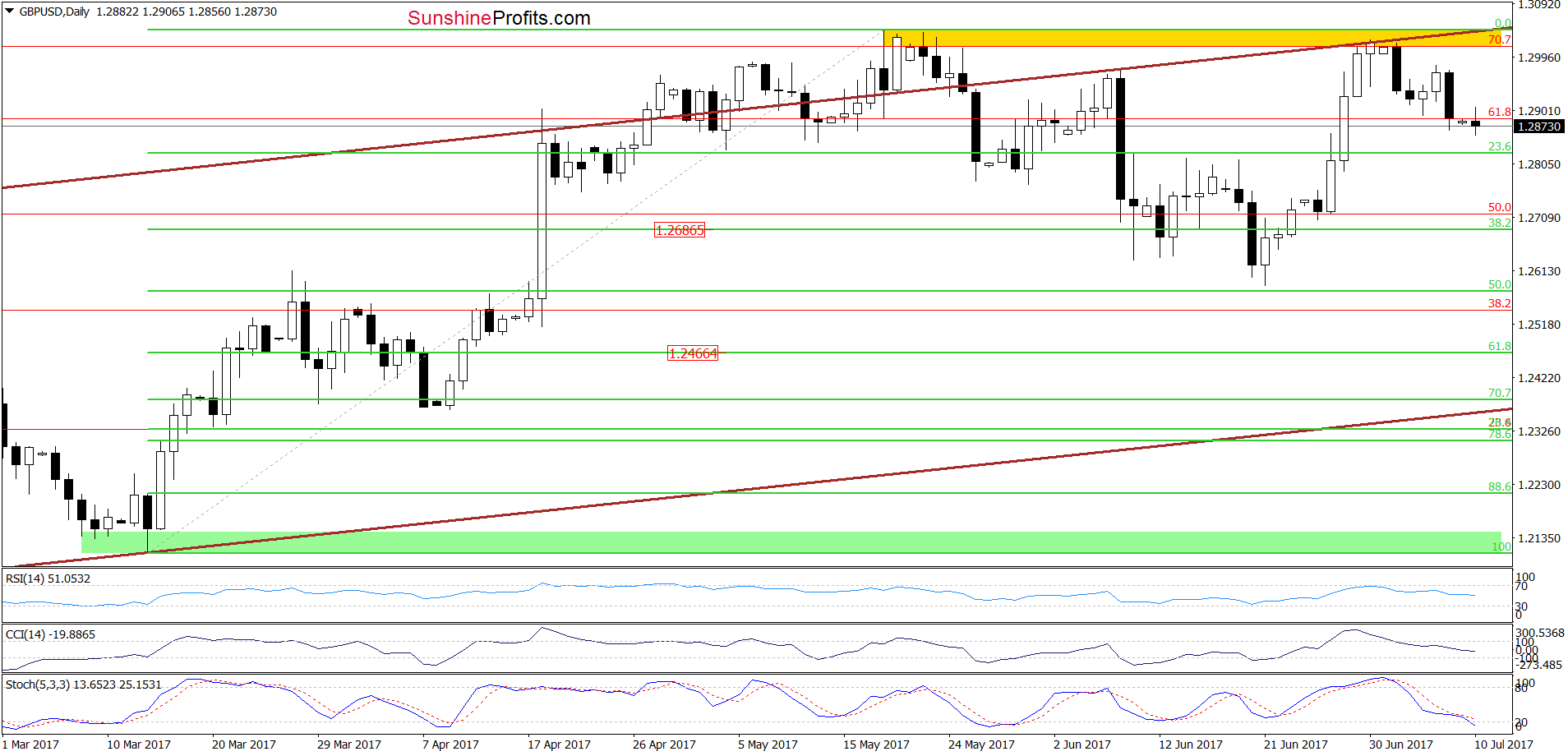

GBP/USD

Looking at the daily chart, we see that the combination of the upper border of the brown rising trend channel and the yellow resistance zone encouraged currency bears to act, which resulted in a pullback. Additionally, the sell signals generated by the CCI and the Stochastic Oscillator remain in play, supporting currency bears and suggesting lower values of GBP/USD. If this is the case and GBP/USD declines from current levels, we’ll see a drop to around 1.2686 (the 38.2% Fibonacci retracement) in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.3232 and the initial downside target at 1.2375) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

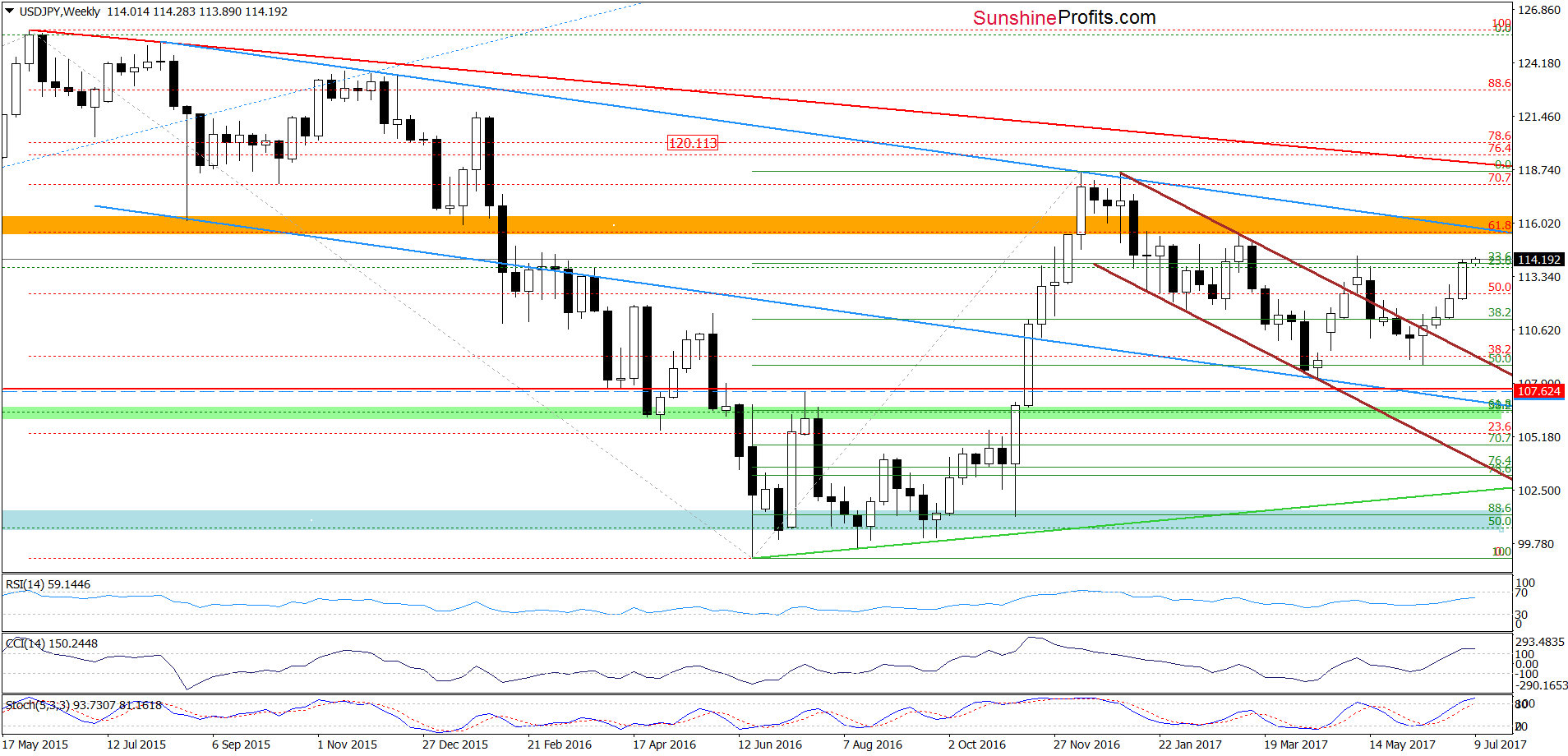

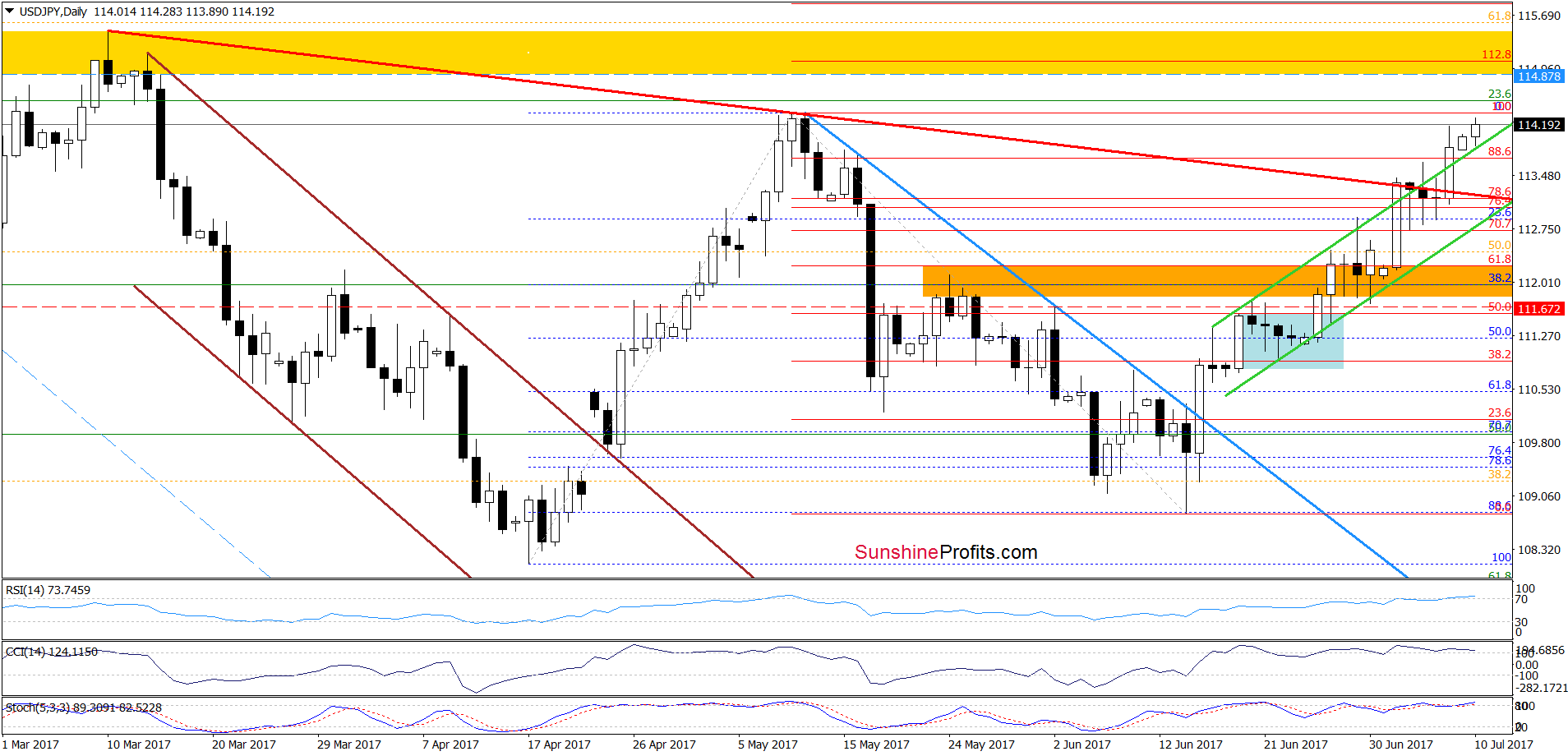

The first thing that catches the eye on the daily chart is the breakout above the upper border of the green rising trend channel, which together with the medium-term picture suggests a test of the yellow resistance zone (seen on the daily chart) in the coming days.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (a stop-loss order at 111.67 and the initial upside target at 114.87)) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts