Earlier today, the U.S. dollar moved lower against the yen, which took USD/JPY to the lower border of the rising trend channel. Will this support withstand the selling pressure in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1505; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

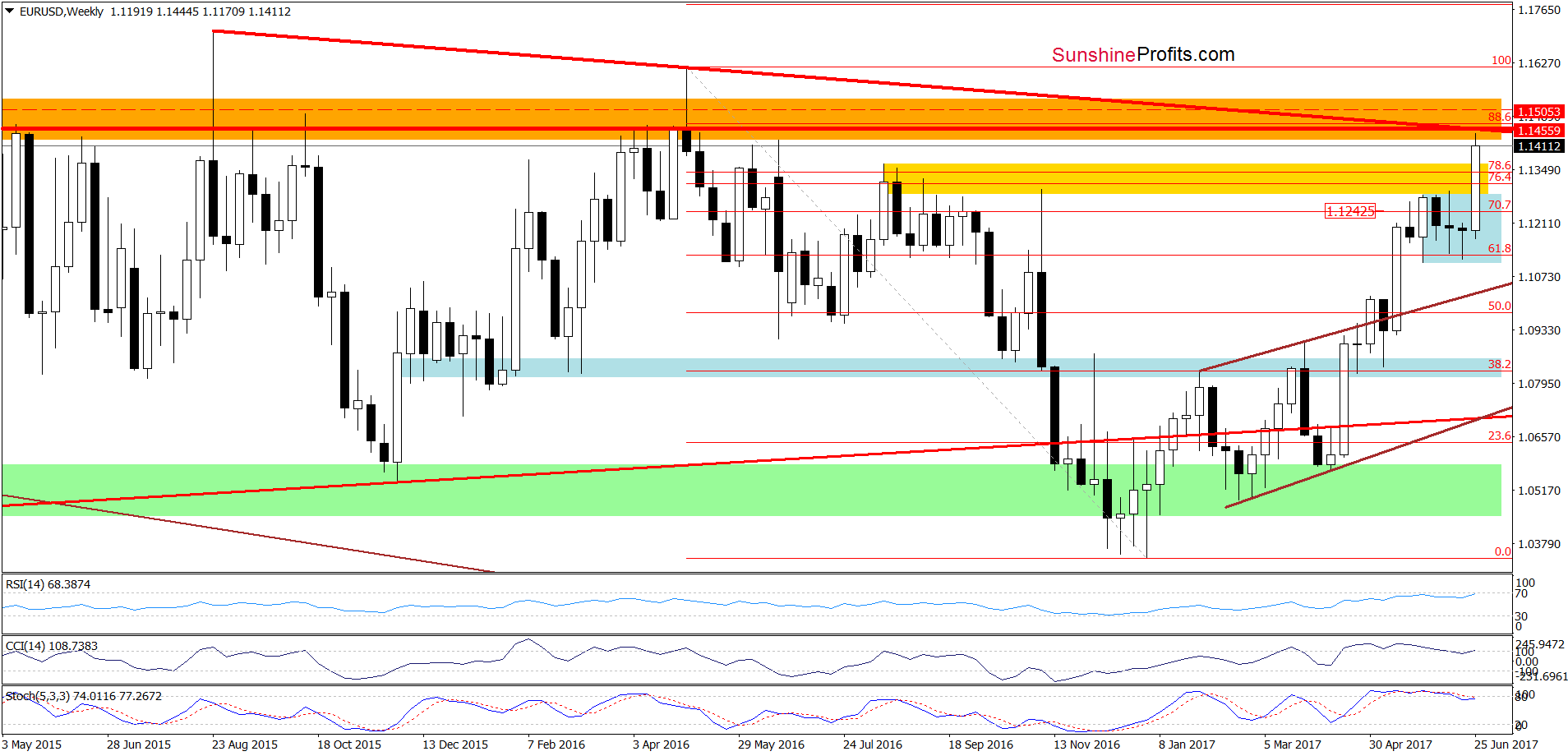

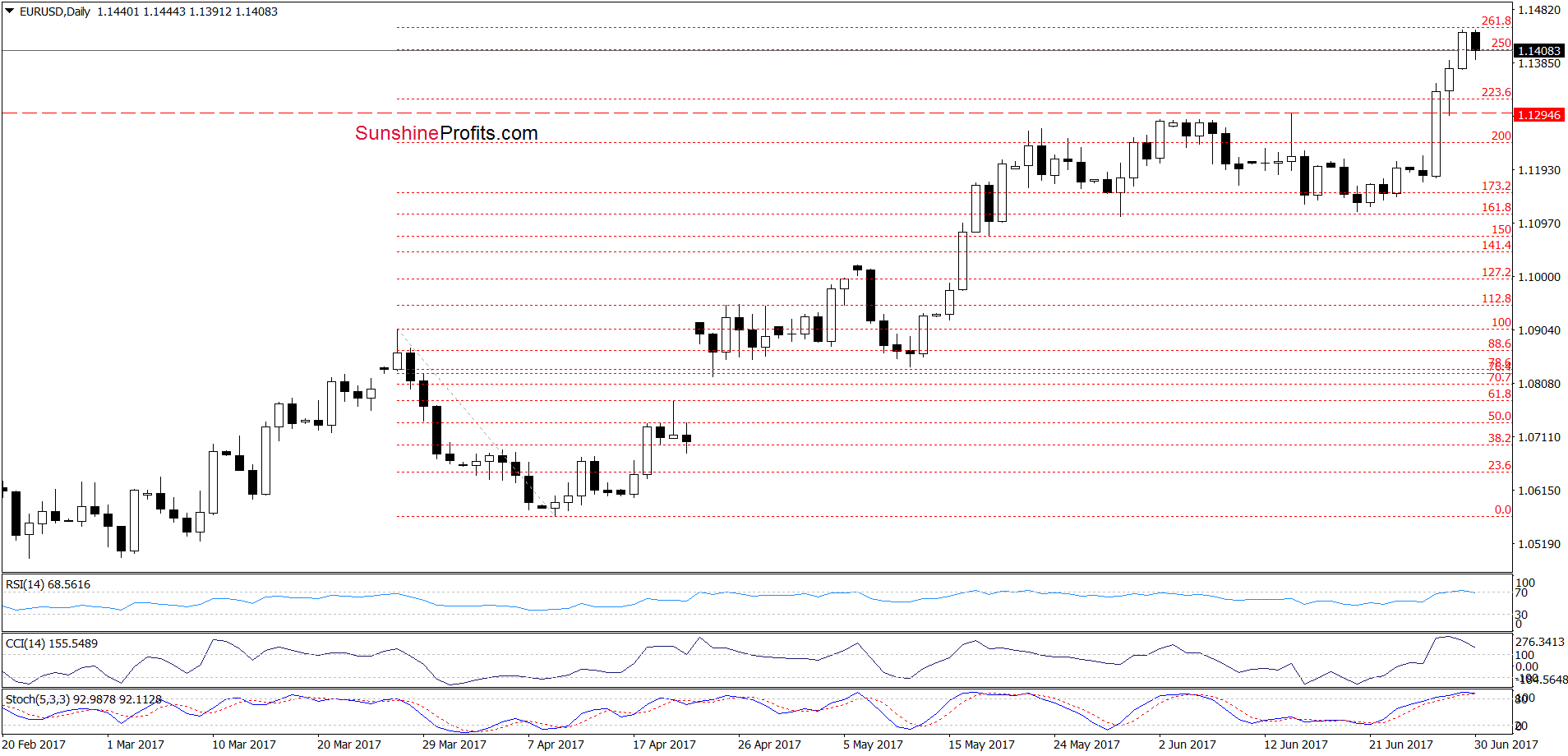

Looking at the charts, we see that the proximity to the long-term red declining resistance line (the key resistance at the moment) and the 261.8% Fibonacci extension encouraged currency bears to act, which resulted in a pullback earlier today. Additionally, the current position of the weekly and daily indicators suggests that reversal and lower values of the exchange rate are just around the corner.

This scenario is also reinforced by the fact that EUR/USD almost touched the red horizontal resistance line (marked on the weekly chart) based on the highest weekly closes of the previous years. The weekly closing prices are the key closes to keep in mind in case of bigger trends and the level that was just reached stopped the rally twice. There was a move above it in May 2016, but was very temporary. Since the week is ending today, it appears that the top is in or that we will see only a temporary upswing and a weekly close back at/below the resistance line.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1402 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

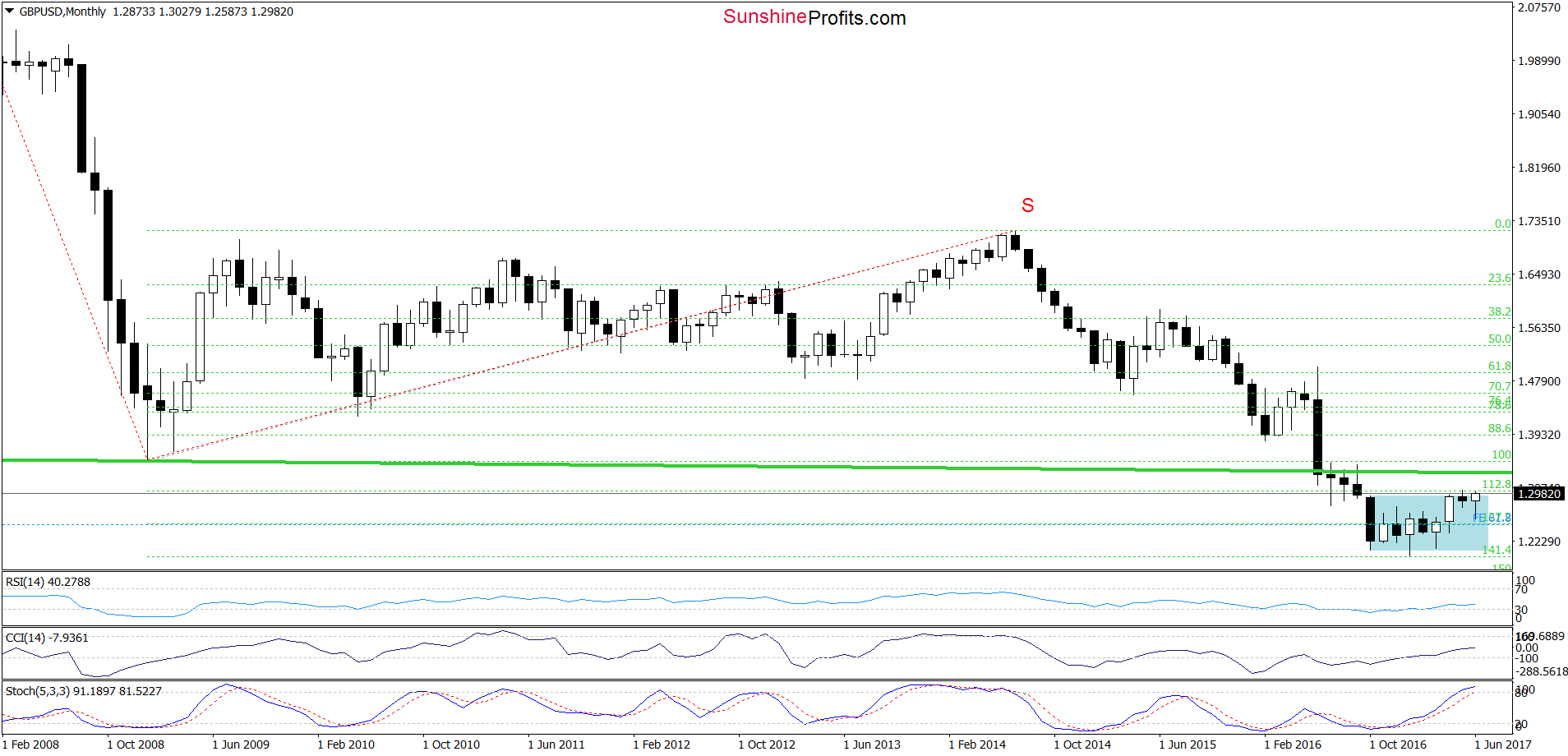

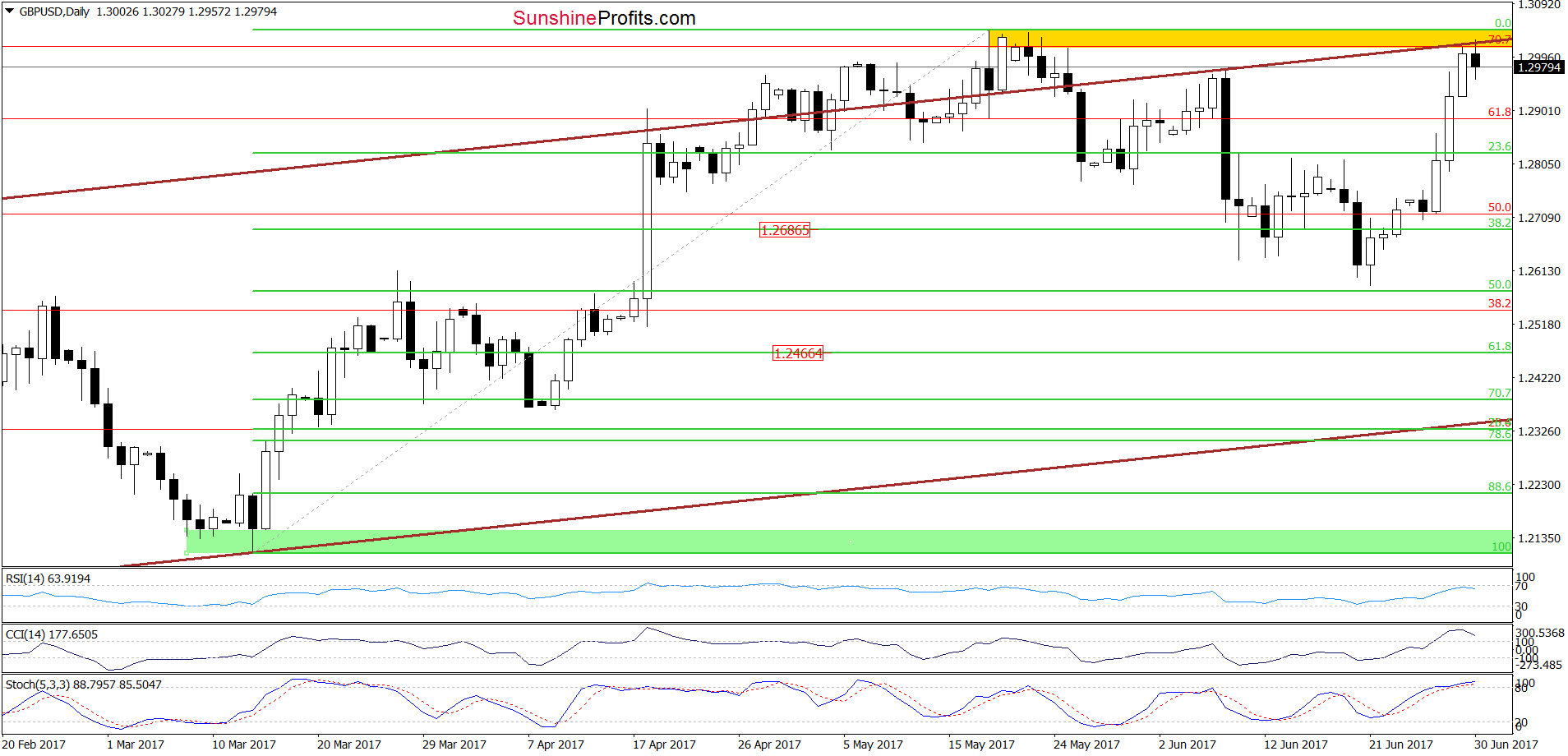

GBP/USD

Looking at the daily chart, we see that GBP/USD extended gains and climbed to the upper border of the brown rising trend channel yesterday. Earlier today, this important resistance line together with the yellow resistance zone encouraged currency bears to act, which resulted in a pullback. Additionally, the CCI and the Stochastic Oscillator remain in their overbought areas, suggesting that sell signals and lower values of GBP/USD are ahead us. If this is the case and GBP/USD declines from current levels, we’ll see a test of the recent lows in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.3232 and the initial downside target at 1.2375) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

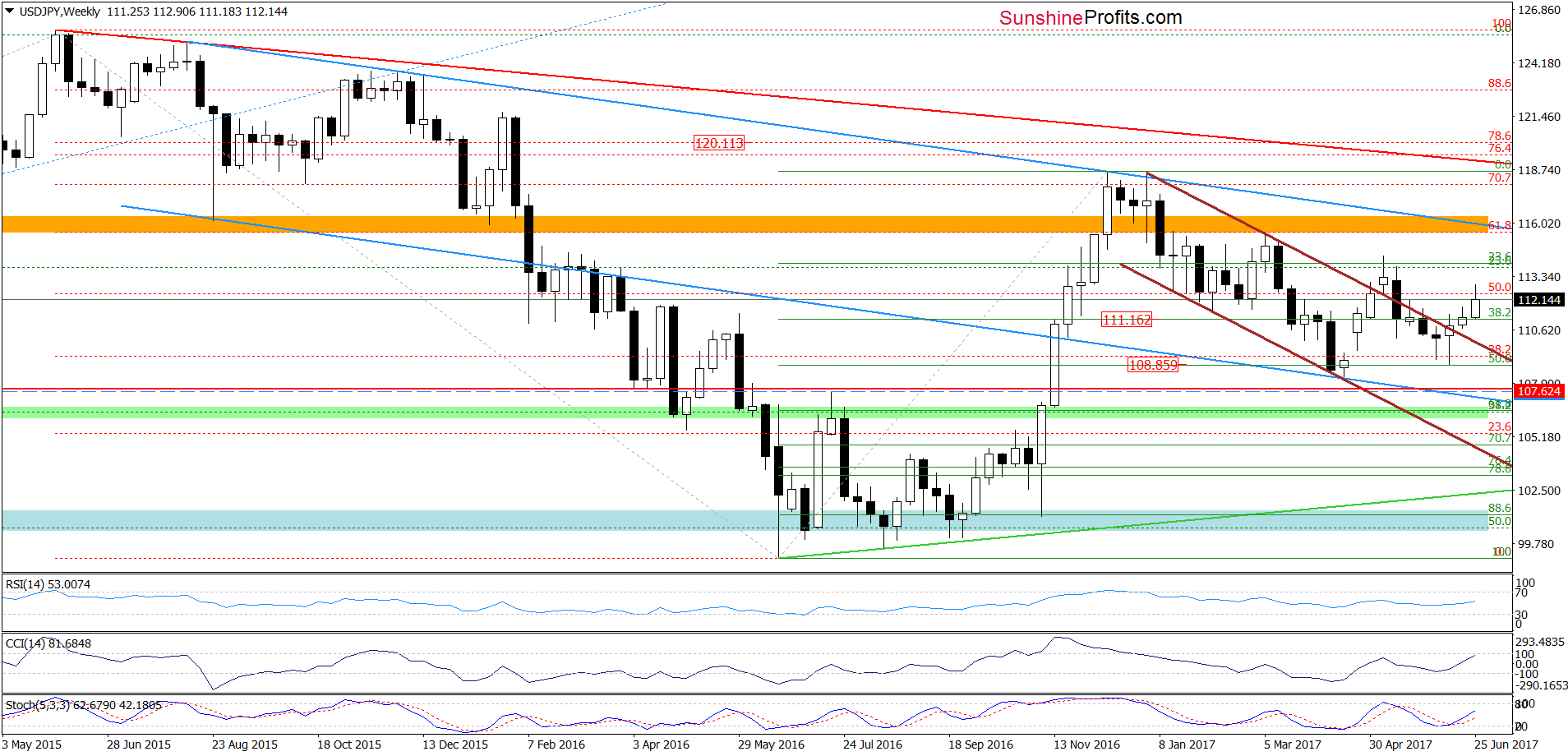

On the weekly chart, we see that USD/JPY is still trading above the previously-broken upper border of the brown declining trend channel, which together with the buy signals generated by the indicator suggests further improvement in the coming weeks.

Nevertheless, there are some bearish factors on the very short-term chart, which could trigger a bigger pullback. Let’s take a closer look at them.

At the beginning, let’s focus on the quote from our Wednesday’s alert:

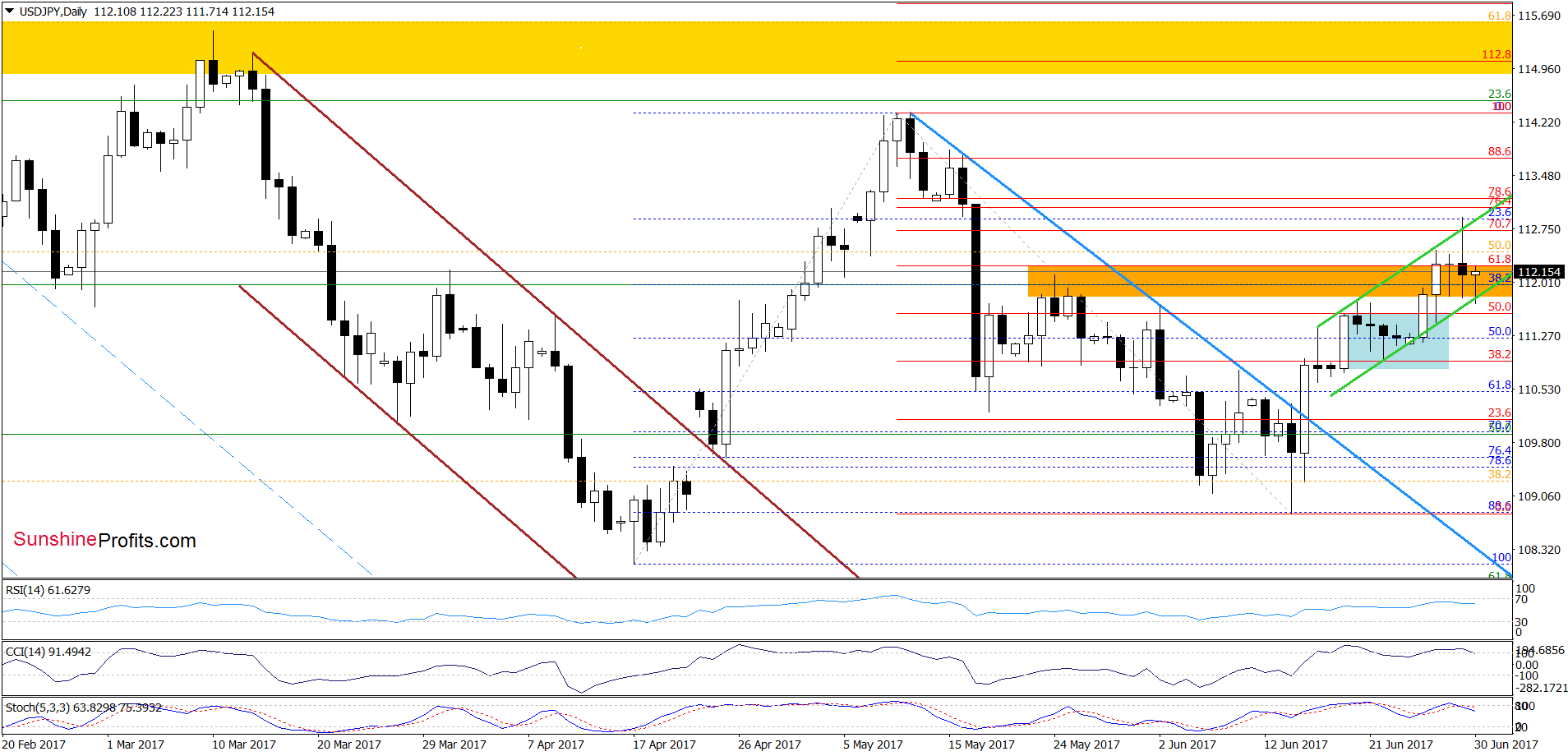

(…) USD/JPY broke above the upper border of the blue consolidation and increased above the 61.8% Fibonacci retracement and the orange resistance zone yesterday. Thanks to this move, the pair approached the upper line of the green rising trend channel, which triggered a pullback earlier today. Nevertheless, the Stochastic Oscillator re-generated the buy signal, which together with the medium-term picture suggests that we’ll likely see a test of the upper border of the green channel in the coming day(s).

From today’s point of view, we see that the situation developed in line with our assumptions and USD/JPY extended gains. Despite this improvement, currency bulls didn’t manage to hold gained levels, which resulted in a pullback and a closure inside the green rising trend channel. In this way, the exchange rate invalidated the tiny breakout above the upper border of the formation, which together with the sell signals generated by the indicators suggests further deterioration in the coming days.

If this is the case, currency bears will try to push the pair under the lower green line. If they succeed, we’ll see a drop to (at least) 110.06, where the upper border of the long-term brown declining trend channel (marked on the weekly chart) currently is. Taking all these facts into account, we think that closing long positions (as a reminder, we opened them when USD/JPY was trading around 109) and taking profits off the table is the best decision at the moment.

Finishing today’s commentary on this currency pair, please note that if we see a daily closure above the upper border of the green rising trend channel we’ll consider re-opening long positions. Nevertheless, if USD/JPY closes today’s session below the lower line of the formation, we’ll consider opening short positions. As always, we’ll keep you - our subscribers - informed should anything change.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, there will be no regular Forex Trading Alert on Monday, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts