Earlier today, the U.S. dollar extended yesterday’s gains against the yen, which resulted in another climb to the major medium-term resistance line. Will currency bulls finally manage to push USD/JPY higher?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3272; the initial downside target at 1.2375)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

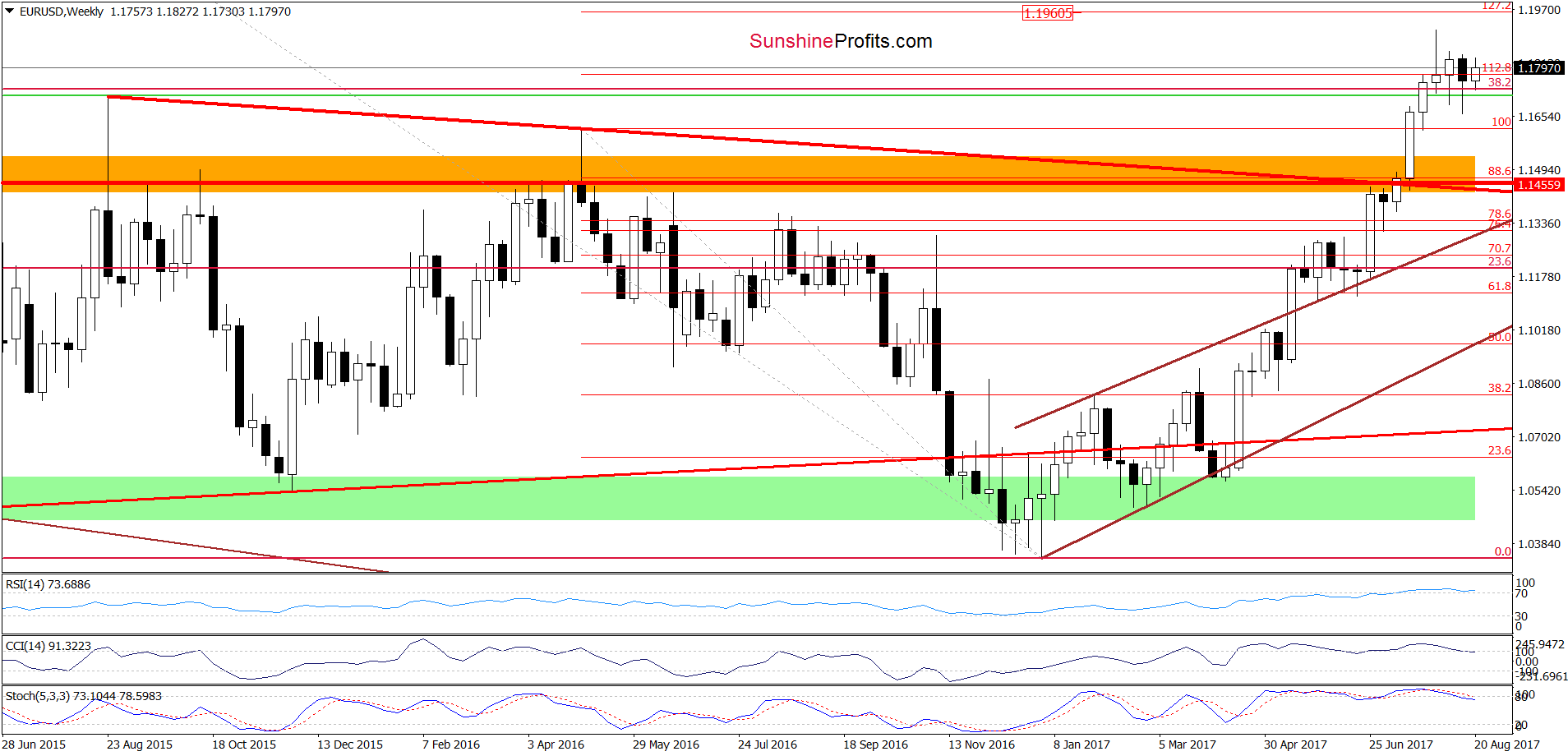

EUR/USD

On the daily chart, we see that the overall situation in the very short term hasn’t changed much since yesterday, which means that our previous commentaryon this currency pair is up-to-date also today:

(…) EUR/USD is still trading in the blue consolidation under the upper border of the brown rising trend channel, which makes the very short-term situation unclear. Nevertheless, the pair climbed above the 38.2% Fibonacci retracement and the 112.8% Fibonacci extension (marked on the weekly chart), which suggests an invalidation of the earlier tiny breakdowns under these lines and another attempt to move higher. However, we saw such sideway moves recently, which means, in our opinion, that as long as there is no breakout above the August high or a breakdown below the lower border of the brown trend channel another bigger move to the upside/downside is not likely to be seen and short-lived moves in both directions should not surprise us. Therefore, we think that waiting at the sidelines for a profitable opportunity is the best decision at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

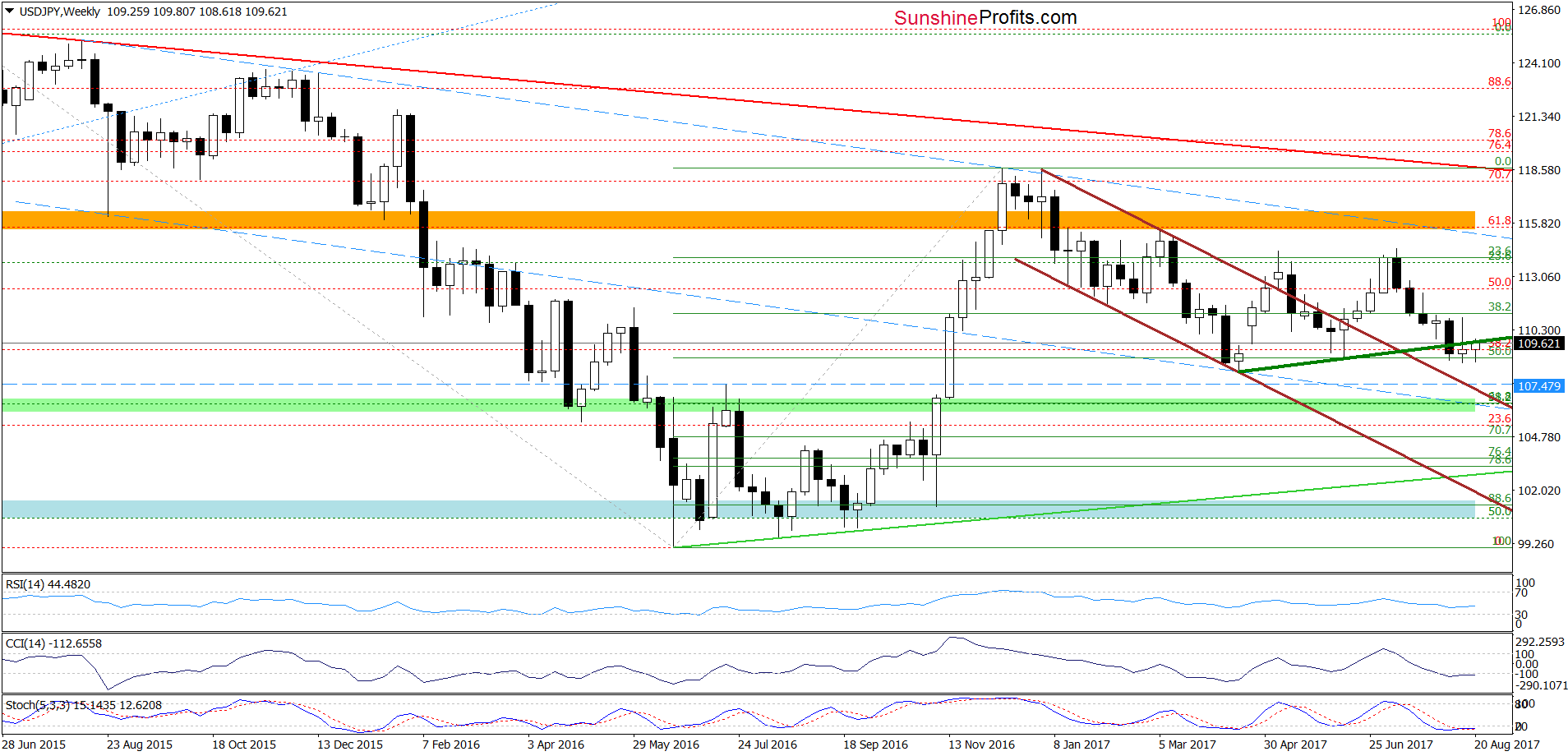

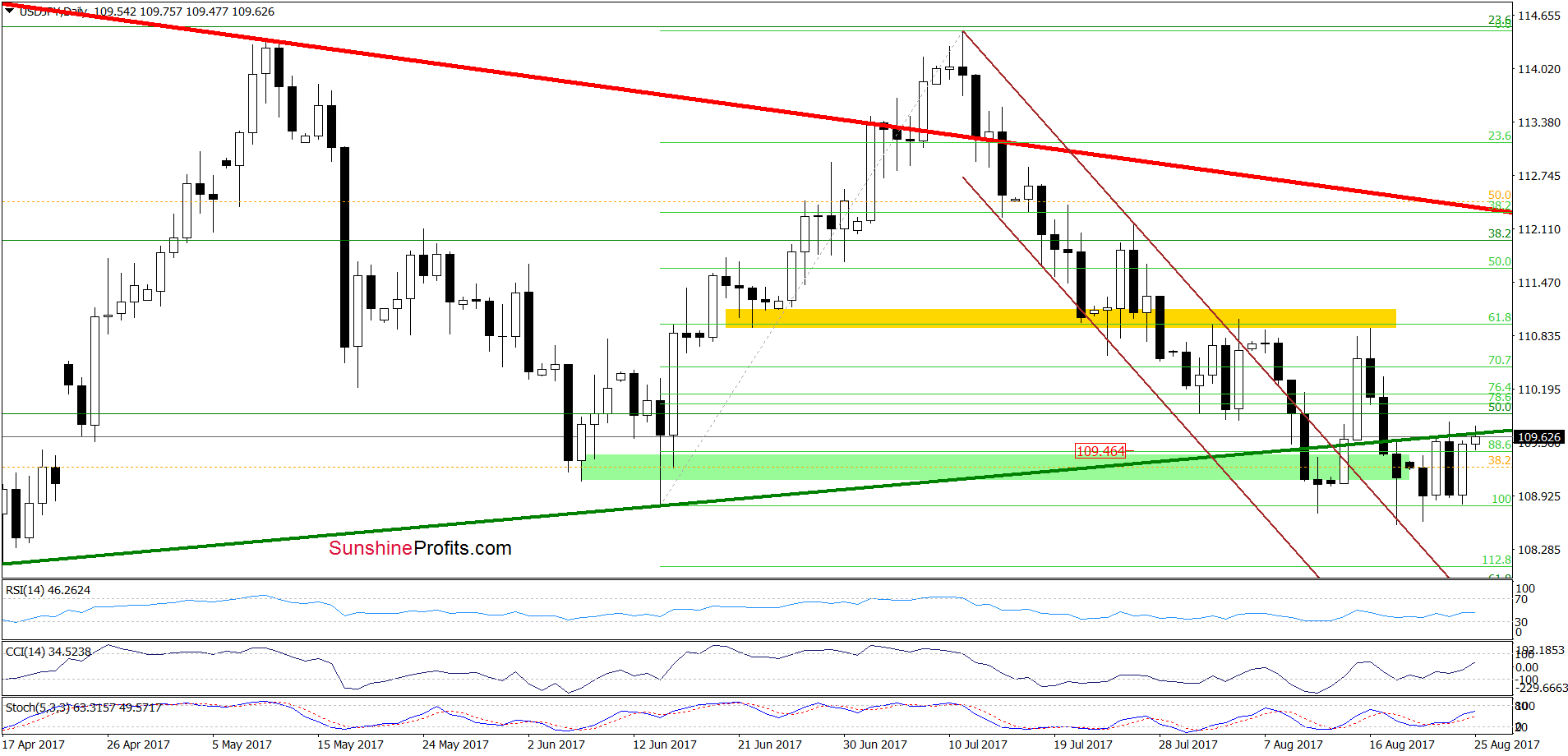

USD/JPY

From today’s point of view, we see that currency bulls pushed USD/JPY higher once again, which resulted in a re-test of the previously-broken medium-term green line based on the mid-April and mid-June lows. Although this is a positive event, we saw similar price action in recent days. Back then, both attempts to move higher failed, which suggests that as long as there is no invalidation of the breakdown under this resistance line all upswings could be nothing more than a verification of the earlier breakdown and a bigger move to the upside is not likely to be seen.

If this is the case, we think that the pair will reverse and move lower once again and (at least) test the recent lows. Nevertheless, if this support is broken, we may see a decline even to the mid-April low of 108.11 in the coming week.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

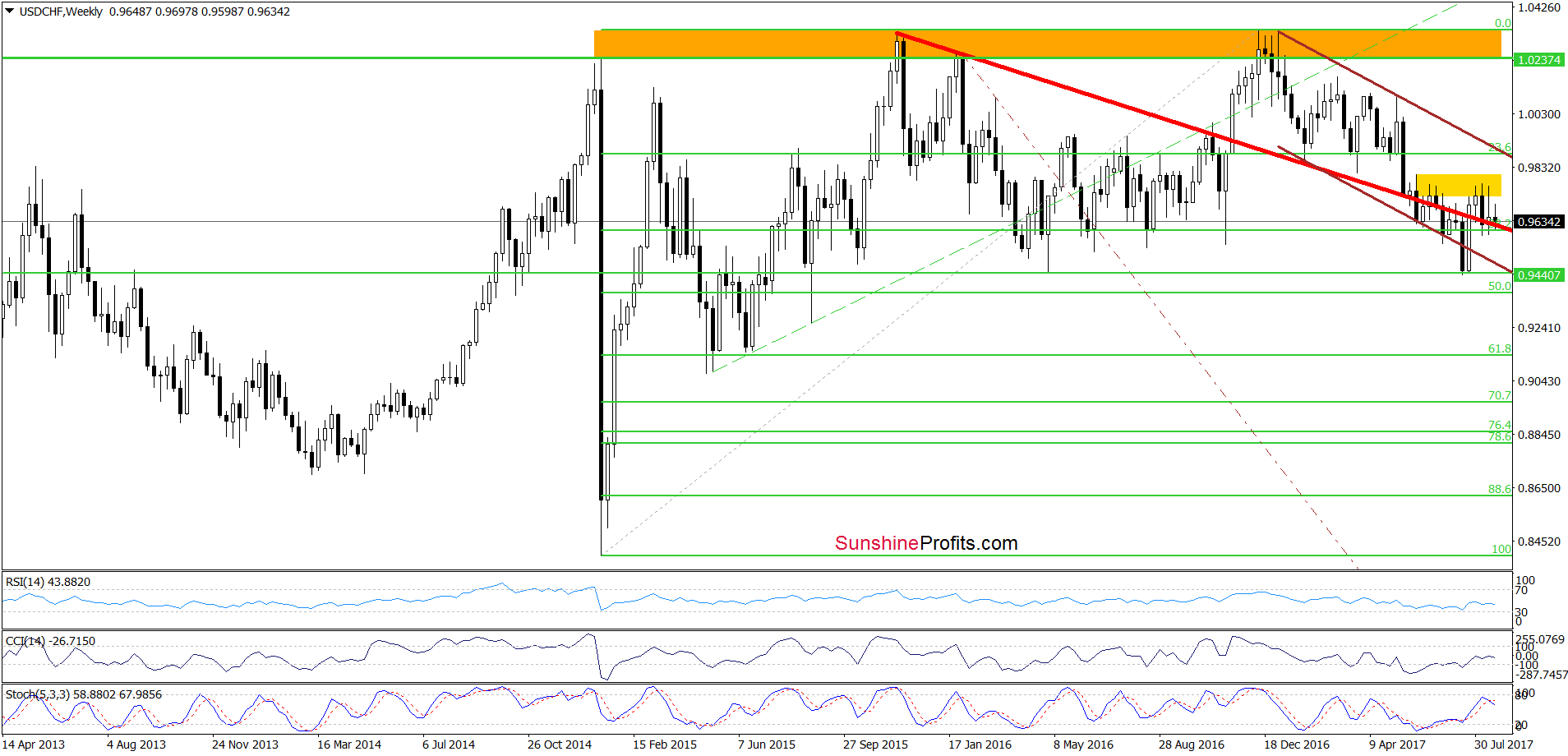

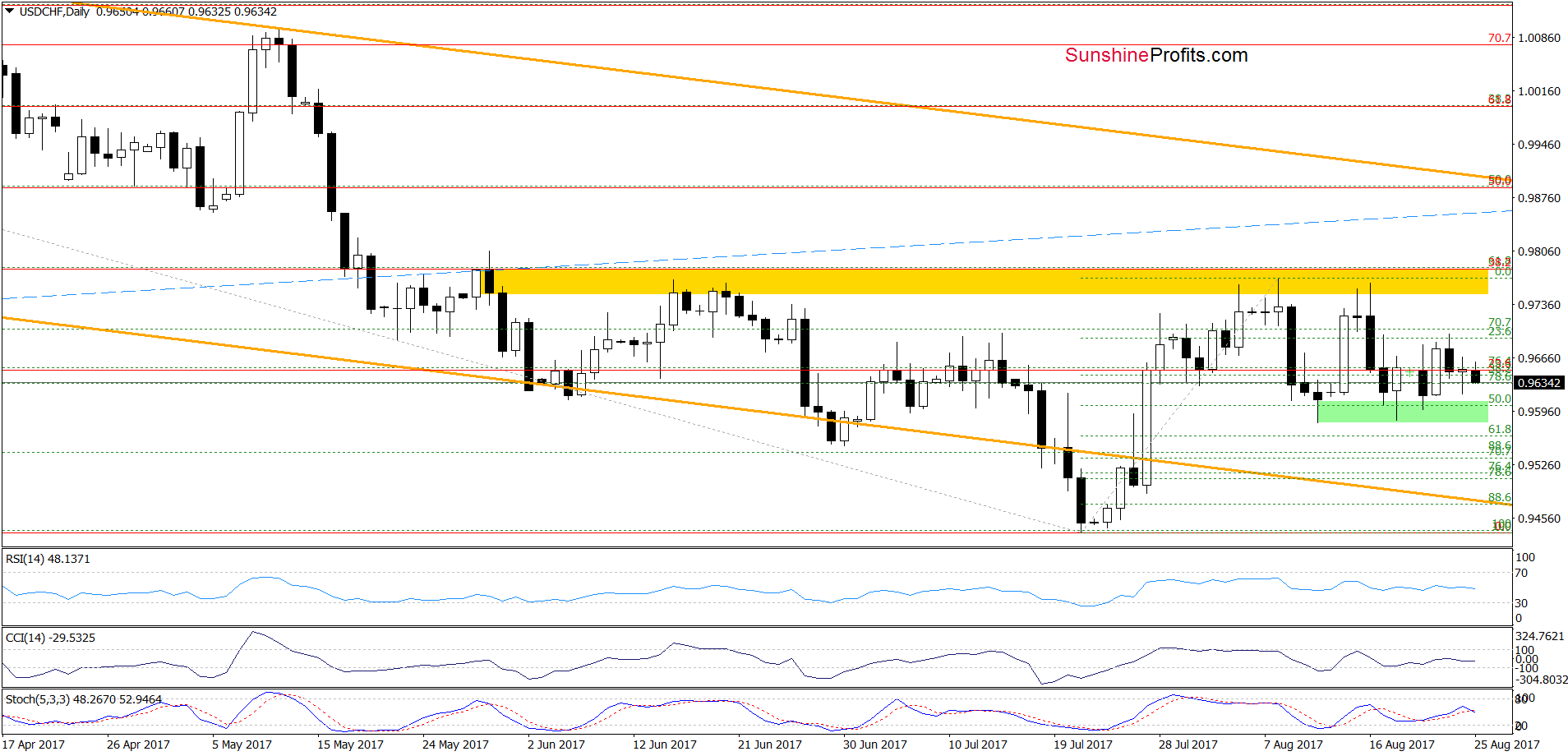

USD/CHF

Looking at the daily chart, we see that although the green support zone triggered a rebound on Tuesday, currency bulls didn’t manage to hold gained levels, which resulted in a reversal on the following day. Earlier today, the pair extended losses, which suggests that we’ll see a re-test of the recent lows in the coming week (please note that this scenario is currently reinforced by the sell signal generated by the daily Stochastic Oscillator).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts