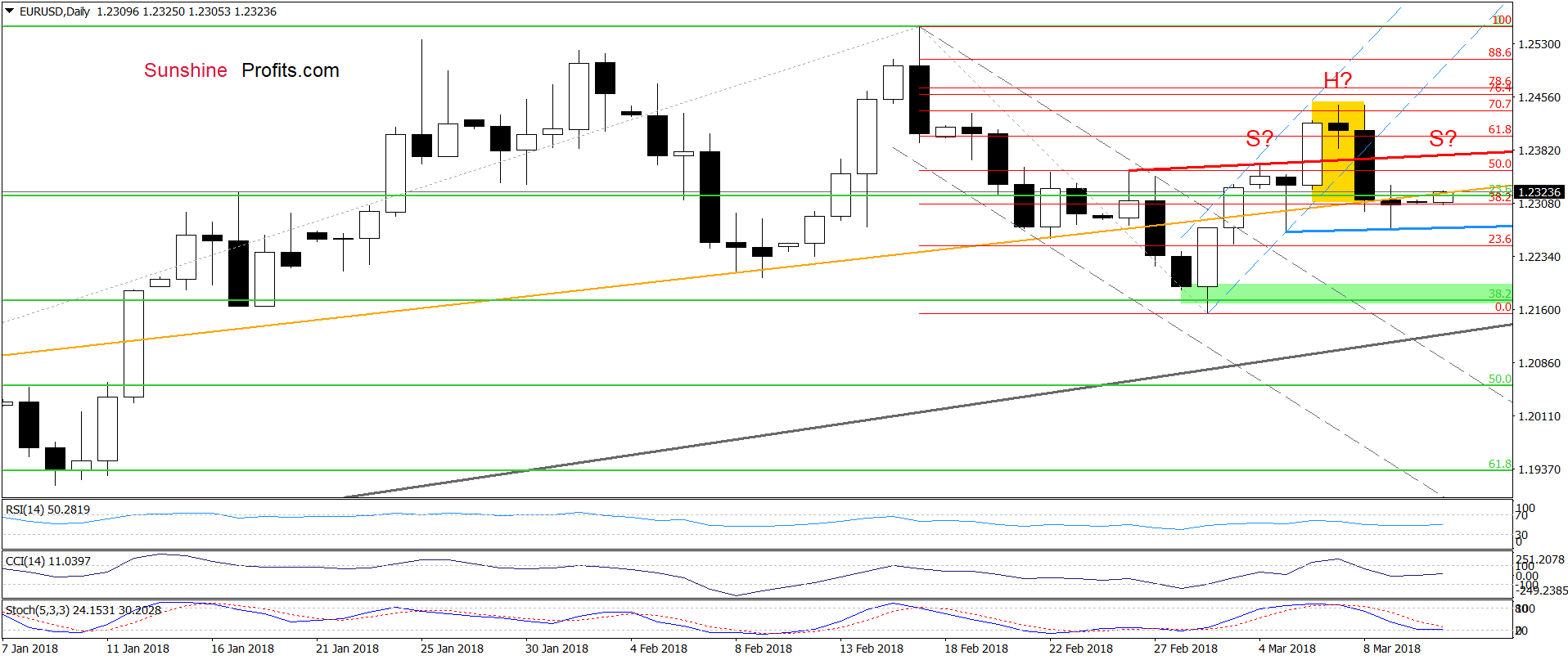

From today’s point of view, the daily chart of EUR/USD we can summarize in one sentence: from extremes to extremes. Last week, the pro-growth pattern appeared, which awakened currency bulls’ imagination, but quite soon it turned out that the buyers didn’t have enough strength to implement it. Now, we are observing how the complete opposite of the above-mentioned formation is shaped. Will the bears also run out of steam?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

On the daily chart, we see that the overall situation in the very short term hasn’t changed much as EUR/USD is trading around Friday’s high and the orange line, which means that what we wrote in our last commentary on this currency pair remains up-to-date:

(…) the euro’s reaction to today's positive U.S. data is surprisingly weak, which raises some doubts about the legitimacy of opening short positions. Therefore, we decided to wait at the sidelines for today’s closing price, because it seems to us that we could see (…) move to the upside first and an attempt to create the right shoulder of the pro-bearish formation.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

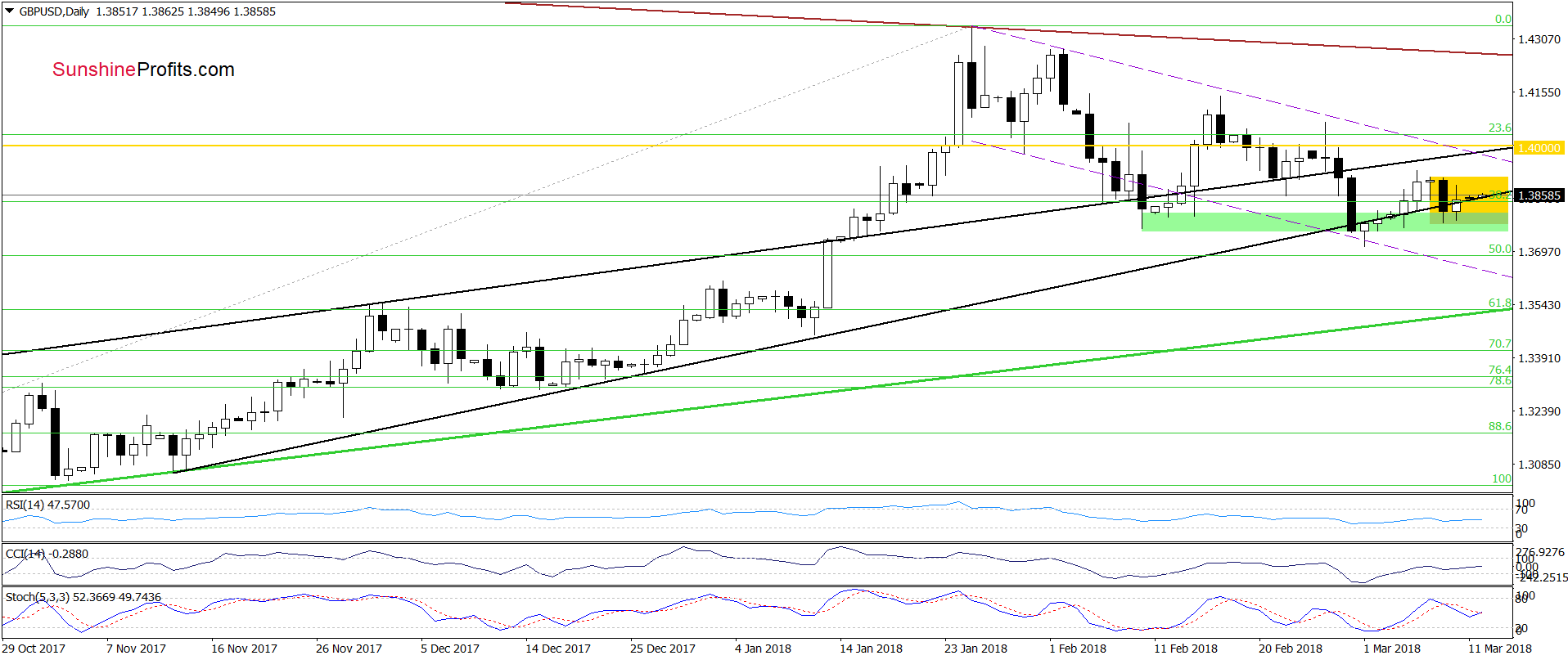

Looking at the daily chart, we see that the overall situation in the very short term hasn’t changed much as GBP/USD is consolidating inside the black rising wedge. The Stochastic Oscillator re-generated the buy signal, suggesting that further improvement and a test of the resistance area created by the upper border of the purple declining trend channel (marked with dashed lines), the upper line of the black rising wedge and the barrier of 1.4000 is still likely.Nevertheless, if we see a reliable bulls’ weakness, we’ll consider re-opening short positions in the coming day(s).

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

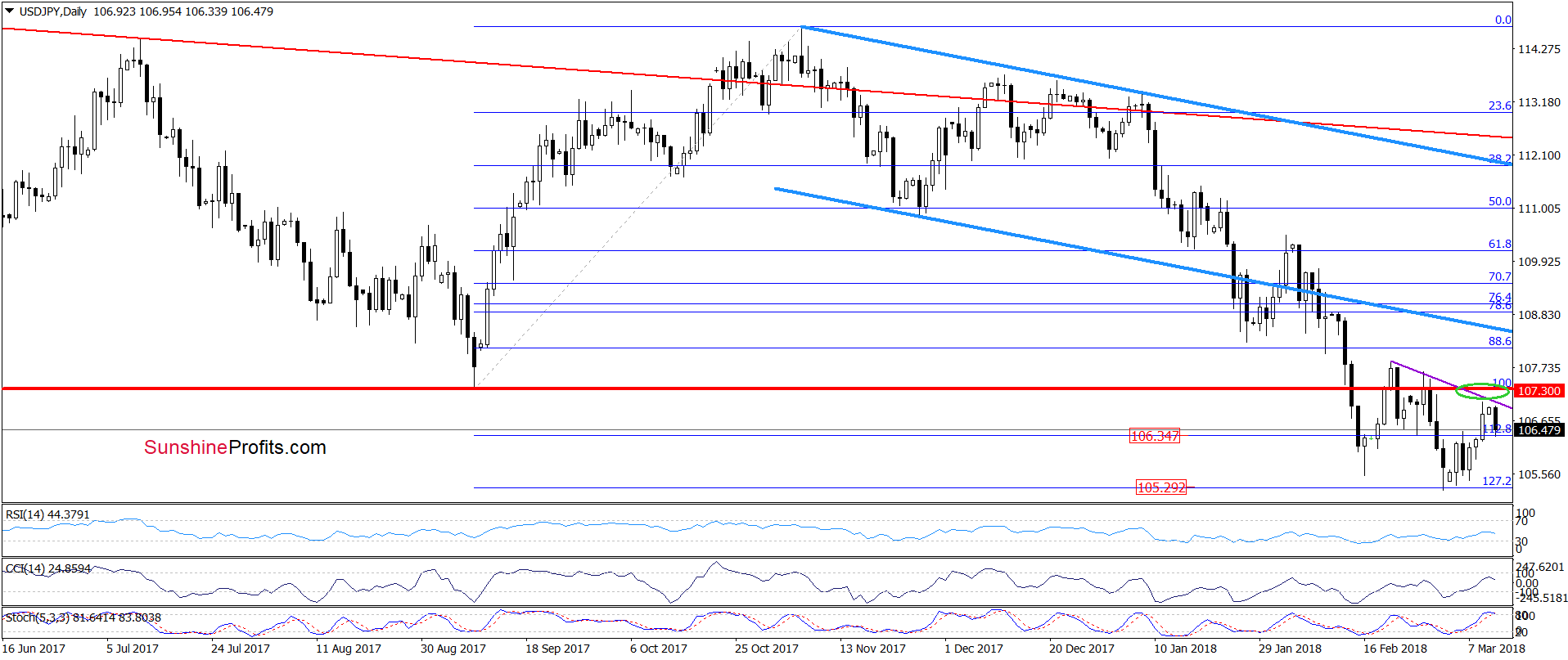

From today’s point of view, we see that USD/JPY extended gains on Friday, but the proximity to the resistance area created by the September low (the red horizontal resistance line) and the purple declining resistance line based on the previous peaks was enough to encourage currency bears to act.

As a result, the pair reversed and declined earlier today, which together with the current position of the indicators (the Stochastic Oscillator is very close to generating a sell signal), suggests that we’ll likely see further deterioration in the coming days. Nevertheless, this scenario will be more reliable if the exchange rate closes today’s (or one of the following) session under 106.24 (the Friday’s low). If we see such price action, the initial downside target will be around 105.92, where the 61.8% retracement (based on the recent rebound) is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts