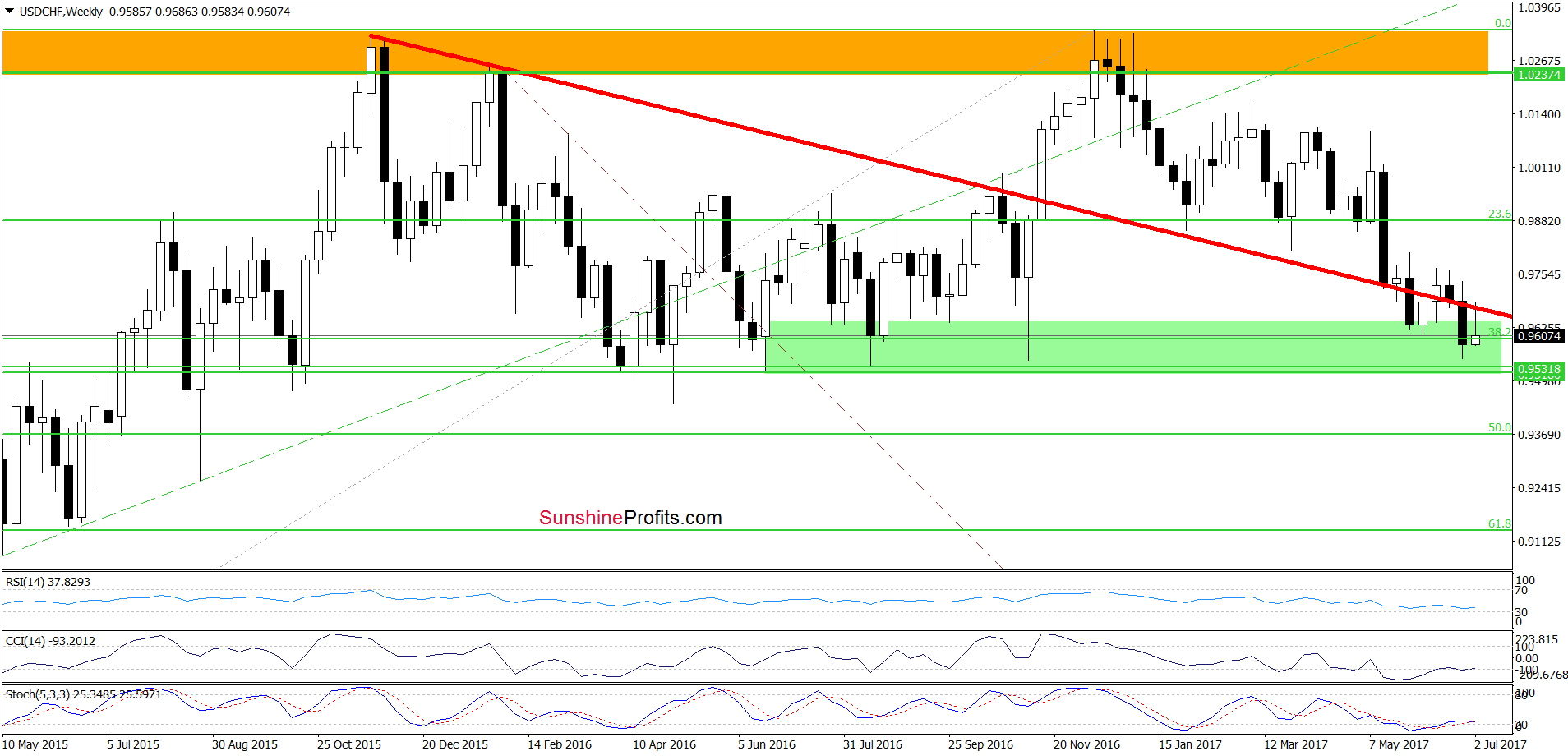

Yesterday, the U.S. dollar extended losses against the Swiss franc after the ADP report showed that private sector payrolls increased less than economists' expectations, disappointing market participants. As a result, USD/CHF re-tested the 38.2% Fibonacci retracement, but will it withstand the selling pressure in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1505; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 111.67; the initial upside target at 114.87)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7724; the initial downside target at 0.7473)

EUR/USD

Looking at the medium-term chart, we see that although EUR/USD bounced off the yellow zone (which serves as the nearest support at the moment), the exchange rate is still trading under two key resistance lines: the long-term red resistance line based on the August 2015 and May 2016 peaks and the red horizontal resistance line cased on the highest weekly closures. This means that our Wednesday’s commentary remains up-to-date also today:

(…) it strongly appears that the euro has either reached its top or is about to do so shortly (perhaps today). The horizontal resistance line that you can see on the above chart is based on the highest weekly closes of the previous years. The weekly closing prices are the key closes to keep in mind in the case of bigger trends and the level that was just reached stopped the rally twice. There were temporary moves above it, but they all were very temporary. Since the week is ending today, it appears that the top is in or that we will see only a temporary upswing and a weekly close back at/below the resistance line.

A strong bearish confirmation comes from the RSI indicator – practically in all recent cases (the last 9 years), the readings of the RSI that were as high as the current ones meant that the euro was going to reverse shortly.

So, despite the bullish action [last] week, the outlook for the euro is actually very bearish and the chart is quite clear about that.

Monday’s session seems to have confirmed the above – the Euro Index declined, just like it did previously when it approached similar price levels in terms of the weekly closing prices. The outlook remains strongly bearish – it seems that another sizable decline has already started.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1505 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

Quoting our last commentary on this currency pair:

(…) the breakdown under the lower border of the purple rising trend channel and below the blue support line encouraged currency bears to act, which resulted in a sharp decline. As a result, USD/CAD declined under the 88.6% Fibonacci retracement (based on the entire January-May upward move), which suggests a test of the 2017 lows in the coming day(s). Nevertheless, in this area is also the 61.8% Fibonacci retracement based on the May 2016-May 2017 increase, which could encourage currency bulls to act in the very near future.

From today’s point of view, we see that currency bears pushed USD/CAD lower (as we had expected) and the exchange rate slipped slightly below our downside target. Despite this deterioration, the short-term green support line based on the previous lows stopped further declines, triggering a pullback. Additionally, all daily indicators generated the buy signals, which encouraged currency bulls to act and resulted in an invalidation of the breakdown below the January low and the 61.8% Fibonacci retracement seen on the weekly chart. What’s next? Taking all the above into account, we think that USD/CAD will extend gains in the coming week. How high could the pair go? If the exchange rate breaks above the upper border of the blue consolidation (at 1.3012), we’ll likely see an increase to around 1.3119 (23.6% Fibonacci retracement based on the entire May-July downward move) or even to the previously-broken lower border of the blue rising trend channel marked on the daily chart (around 1.3200).

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

On the weekly chart, we see that although USD/CHF increased earlier this week, the long-term red declining line stopped currency bulls, triggering a pullback. Such price action looks like a verification of the breakdown, which is a negative sign, but will we see further deterioration in the coming week?

Let’s examine the very short-term picture and try to find out.

From this perspective, we see that the recent upward move took USD/CHF above the lower border of the orange declining trend channel, which resulted in an invalidation of the earlier breakdown. Despite this positive event, currency bears pushed the pair lower in previous days, which together with the medium-term picture and the sell signal generated by the Stochastic Oscillator suggests a test of the orange support line and the green support zone in very near future.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts