Although USD/JPY invalidated the earlier breakdown in the previous week, currency bulls didn’t manage to trigger a significant upward move, which raises some doubts about their strength. Will their opponents push the exchange rate lower in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

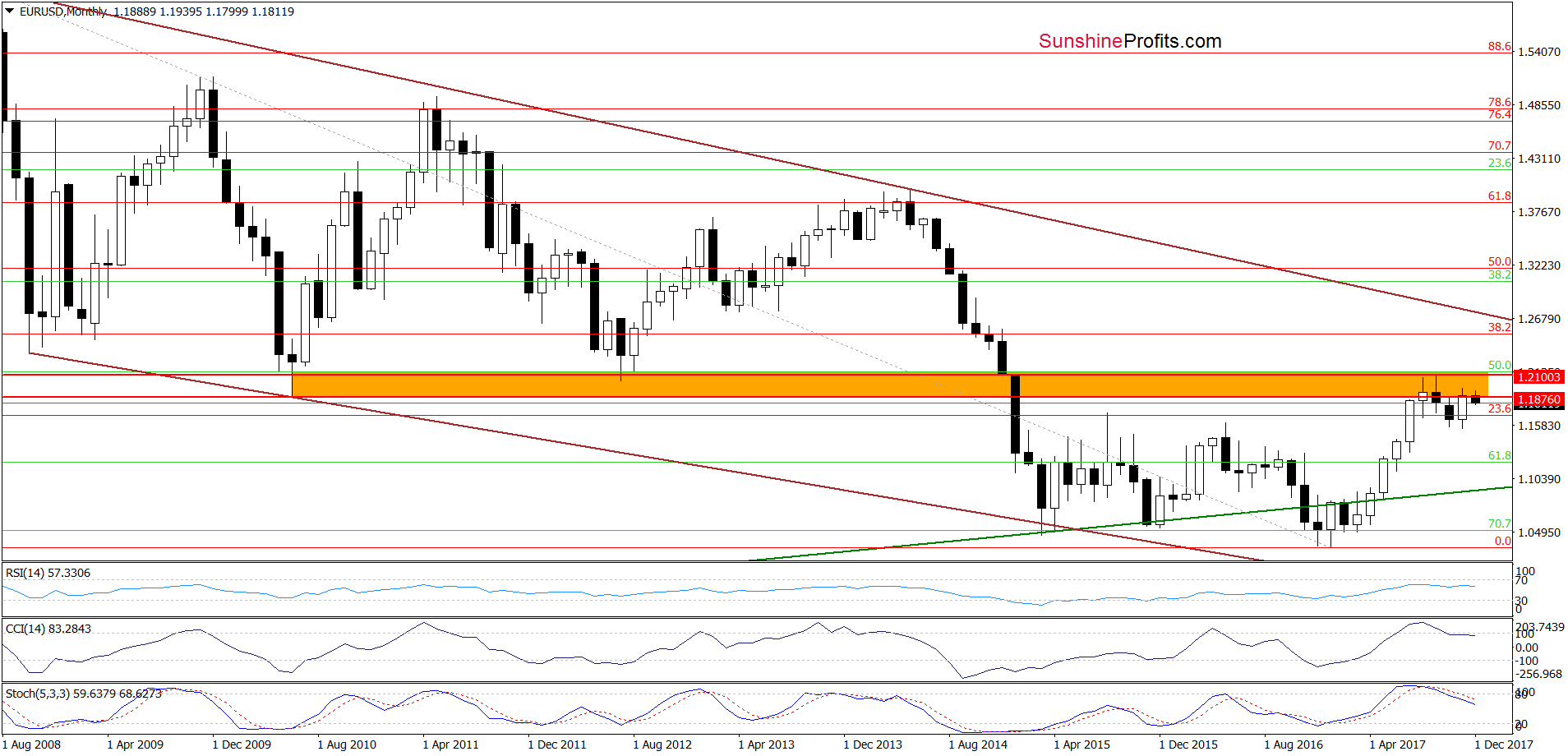

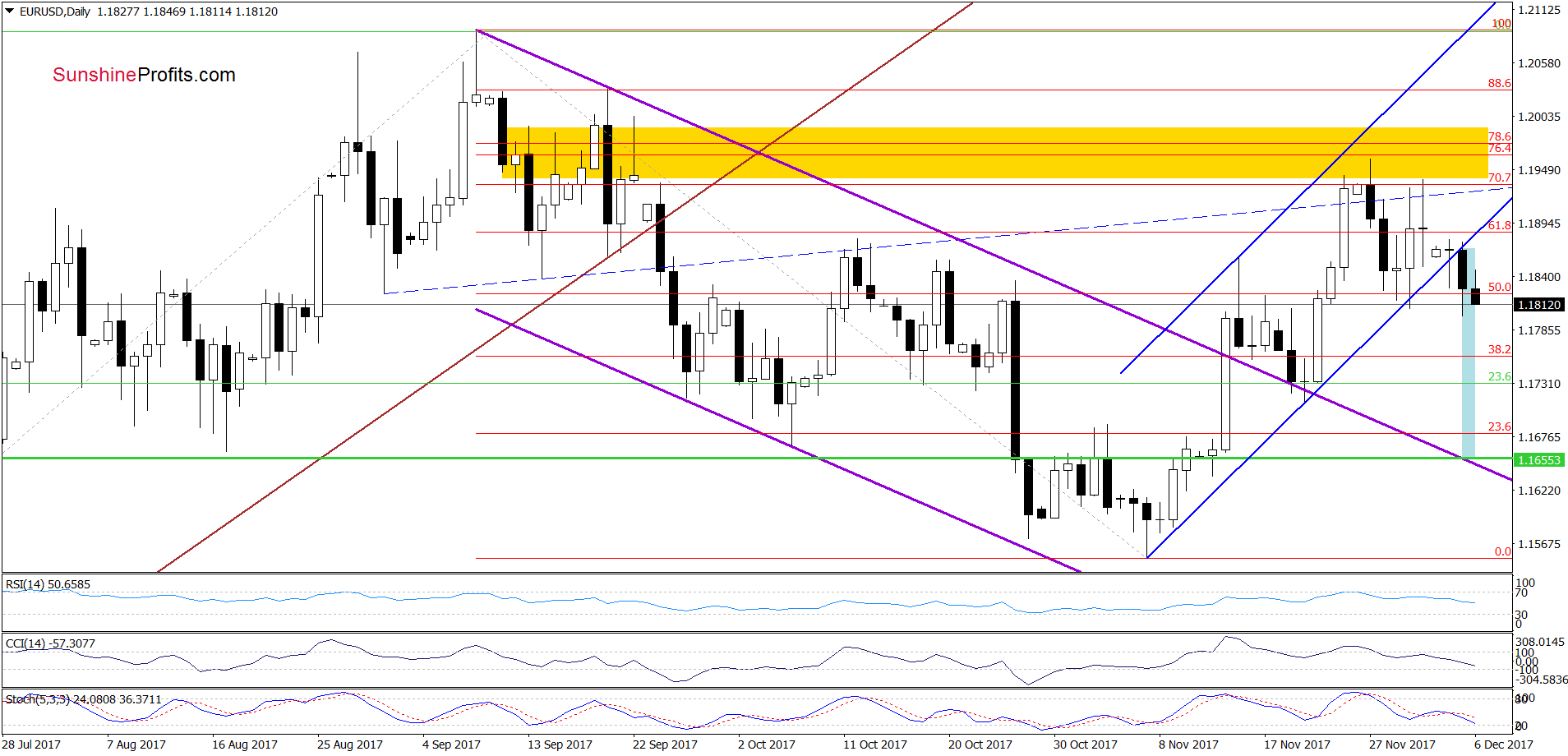

EUR/USD

Earlier today, EUR/USD moved lower once again, approaching the yesterday’s low, which together with the sell signals generated by the indicators suggests that what we wrote in our previous alert remains up-to-date:

(…) In our opinion, if EUR/USD drops under the lower border of the blue rising trend channel, the first downside target will be around 1.1732, where the November 22 low is. If this area is broken, the next target will be the previously-broken upper line of the purple declining trend channel seen on the daily chart (currently around 1.1660).

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

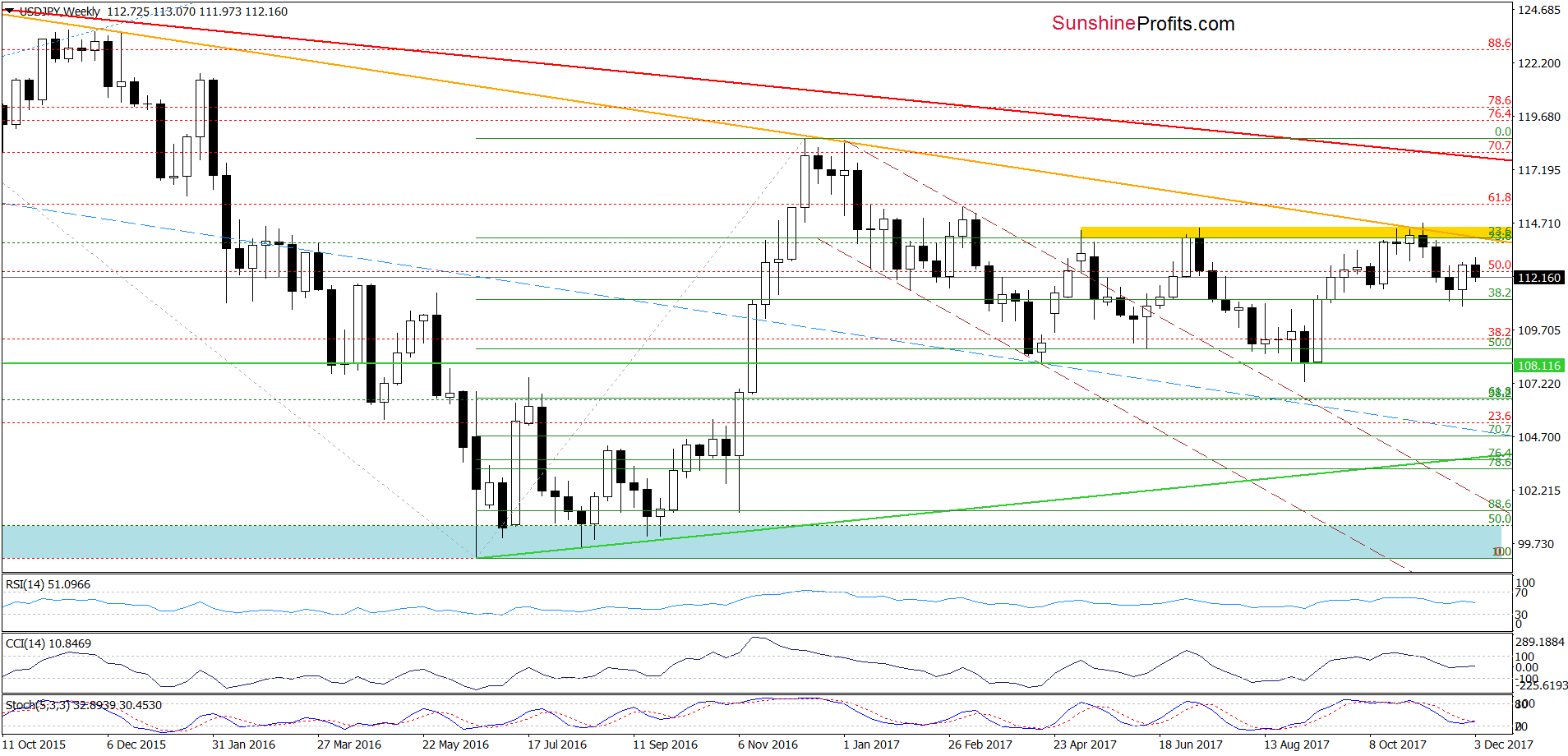

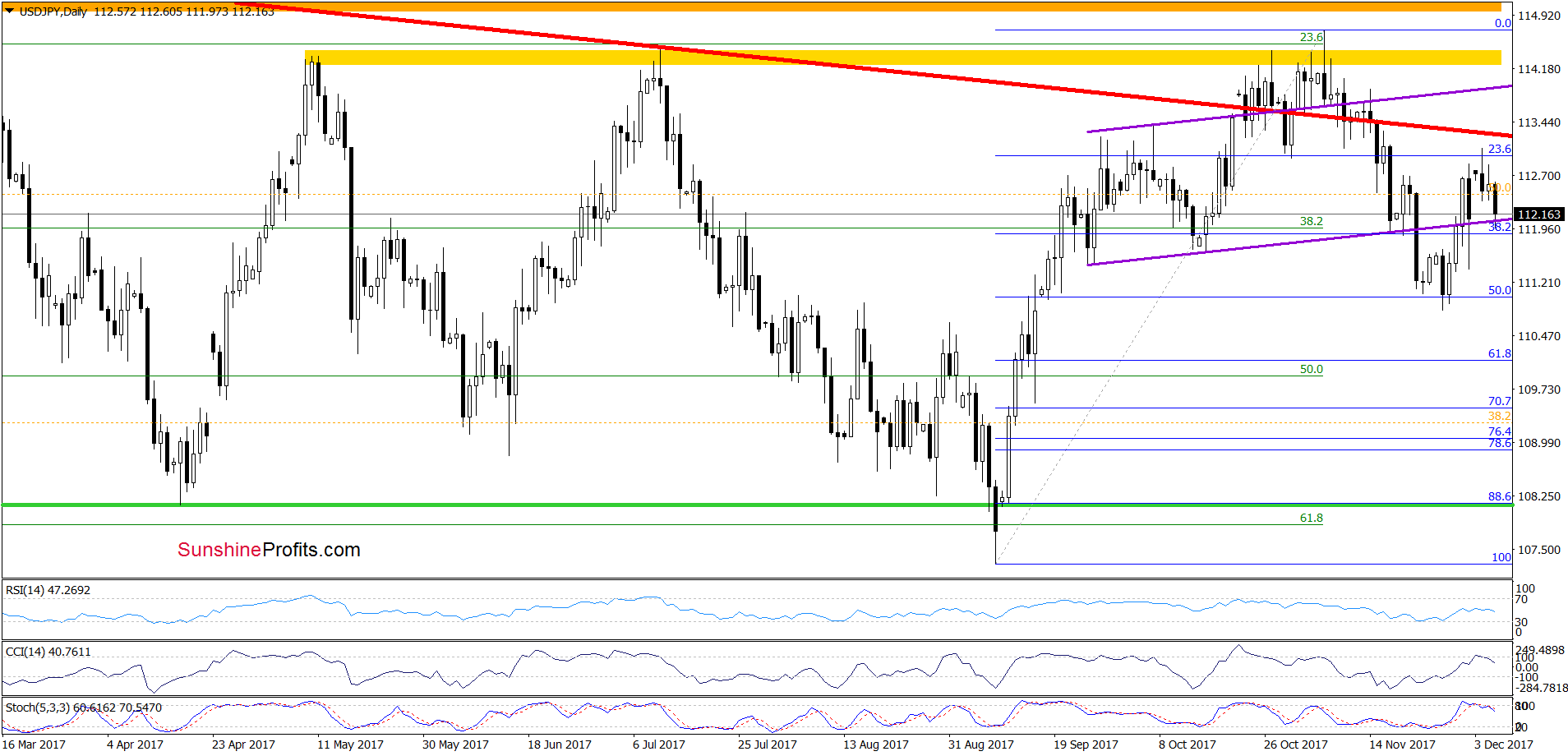

USD/JPY

Quoting our last commentary on this currency pair:

(…) we should keep in mind that the exchange rate remains under several important resistances, which block the way to higher levels. This fact is even more significant when we consider the current position of the daily indicators.(…)

Taking all the above into account, we think that even if the exchange rate moves higher from here (…), we won’t see a significant rally in the coming days. Why? In our opinion, as long as there is no breakout above the yellow resistance zone (created by the May, July and November peaks and currently reinforced by the long-term orange declining resistance line) seen on the weekly chart the way to higher values of USD/JPY is closed and another reversal in this area is very likely.

From today’s point of view, we see that the situation developed in line with the above scenario and USD/JPY moved lower in recent days. Thanks to today’s drop, the exchange rate reversed and came back to the lower border of the purple rising trend channel earlier today.

What’s next? Taking into account the weakness, which currency bulls showed this week and the sell signals generated by the indicators, we think that further deterioration and a test of the late November lows is very likely. Nevertheless, this scenario will be even more reliable if the pair closes today’s session (or one of the following sessions) under the lower line of the above-mentioned trend channel.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

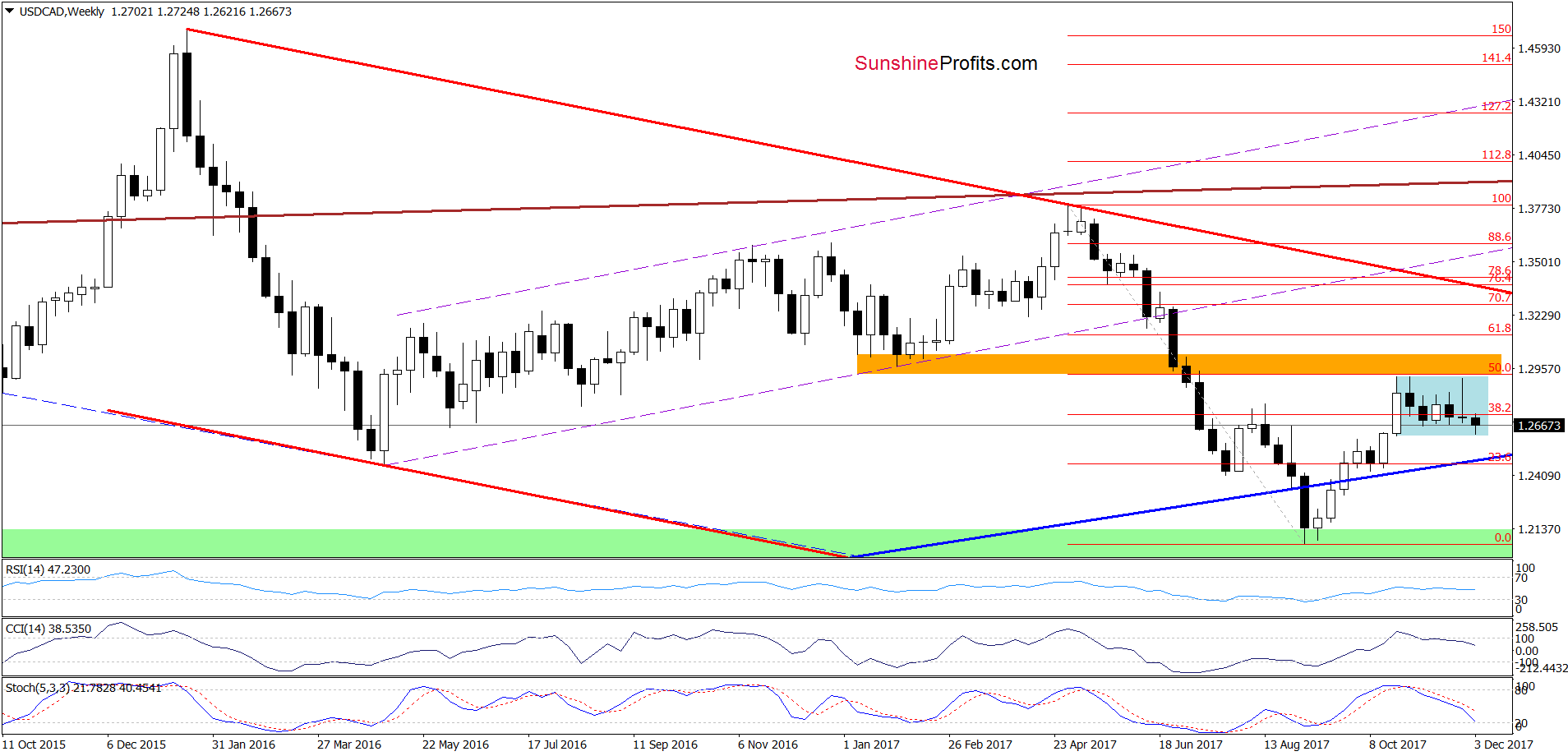

From the medium-term perspective, we see that although USD/CAD moved lower earlier this week, the lower border of the blue consoidation stopper further declines and triggered a small rebound.

How did this price action affect the very short-term picture of the exchange rate? Let’s check, examining the daily chart.

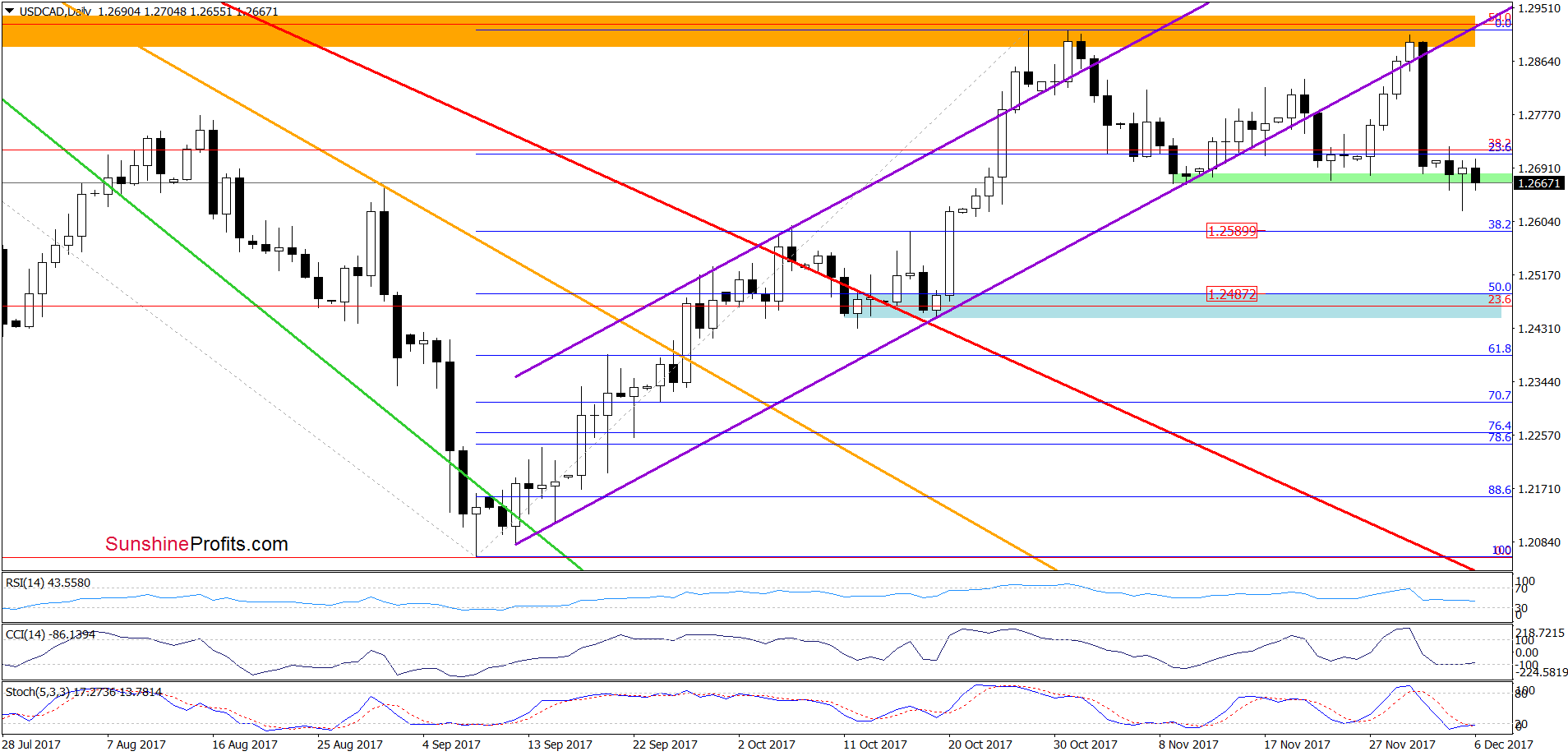

Looking at the above chart, we see that although USD/CAD extended losses yesterday, currency bulls stopped their opponents, which resulted in a comeback above the green support zone. Despite this move, the pair reversed and moved lower once again earlier today, which makes the very short-term a bit unclear.

On one hand, we see an invalidation of the breakdown and very low readings of the indicator (the CCI generated a buy signal, while the Stochastic Oscillator is very close to doing the same), but on the other hand the size of rebound is tiny compared to the Friday back candlestick created by currency bears. Therefore, in our opinion, waiting at the sidelines for more reliable clues is justified from the risk/reward perspective at the moment.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts