Earlier today, the euro moved a bit higher against the greenback, but will we see further rally in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1505; the initial downside target at 1.1009)

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 113.08)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7683; the initial downside target at 0.7444)

EUR/USD

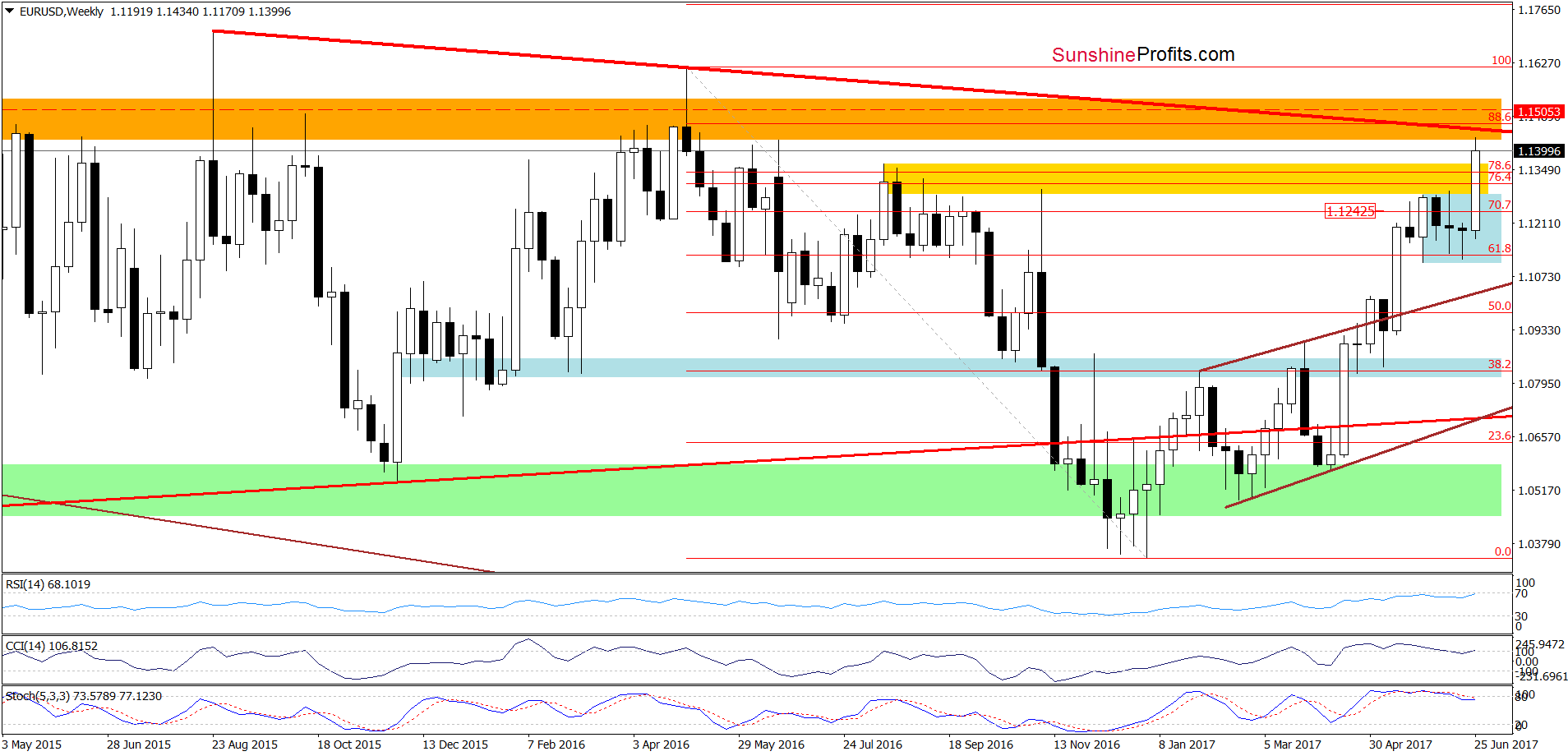

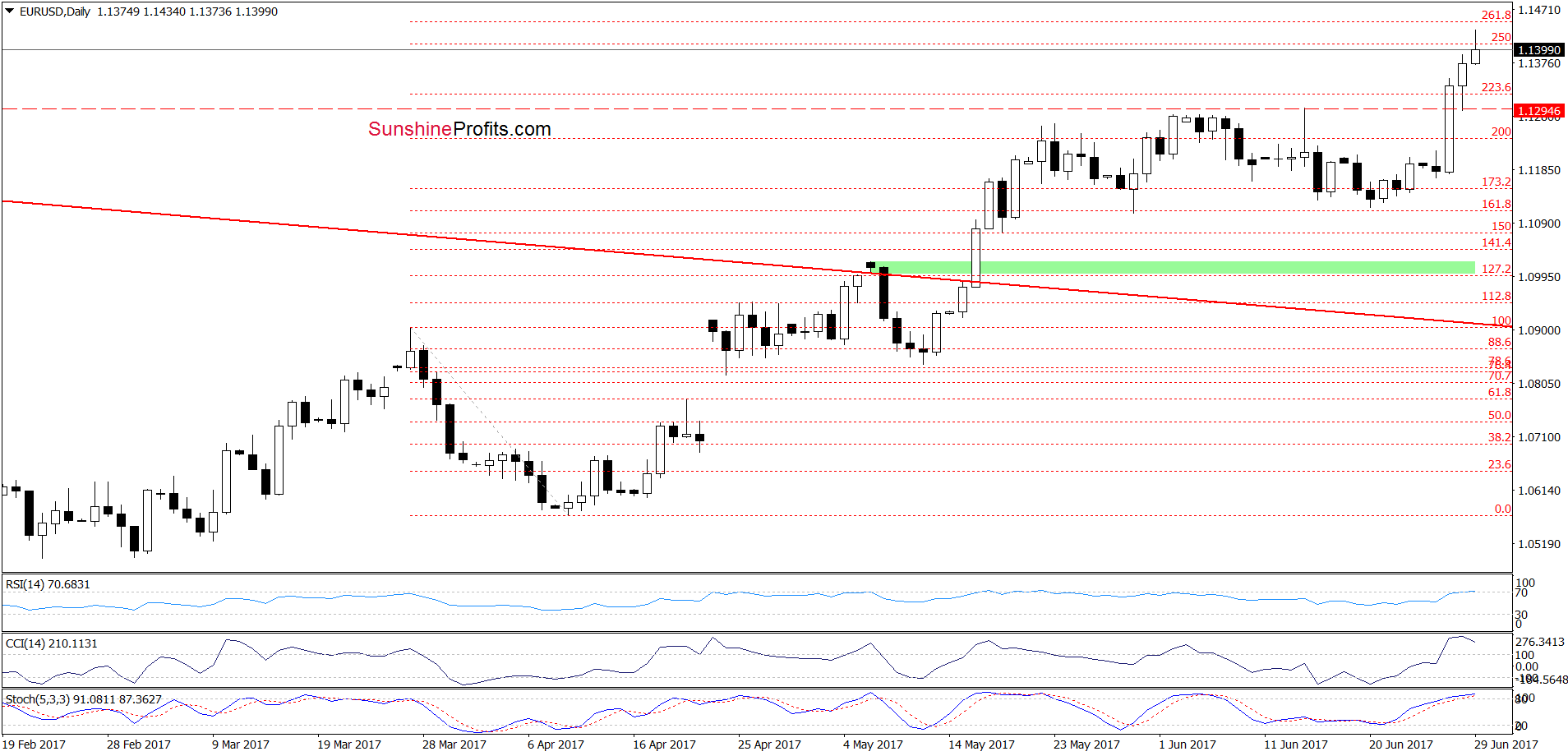

From today’s point of view, we see that EUR/USD extended gains and climbed above the yellow resistance zone. Despite this move, the long-term red declining resistance line (the key resistance at the moment) continues to keep gains in check. Additionally, the current position of the weekly and daily indicators suggests that reversal is just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1402 and the initial downside target at 1.1009) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

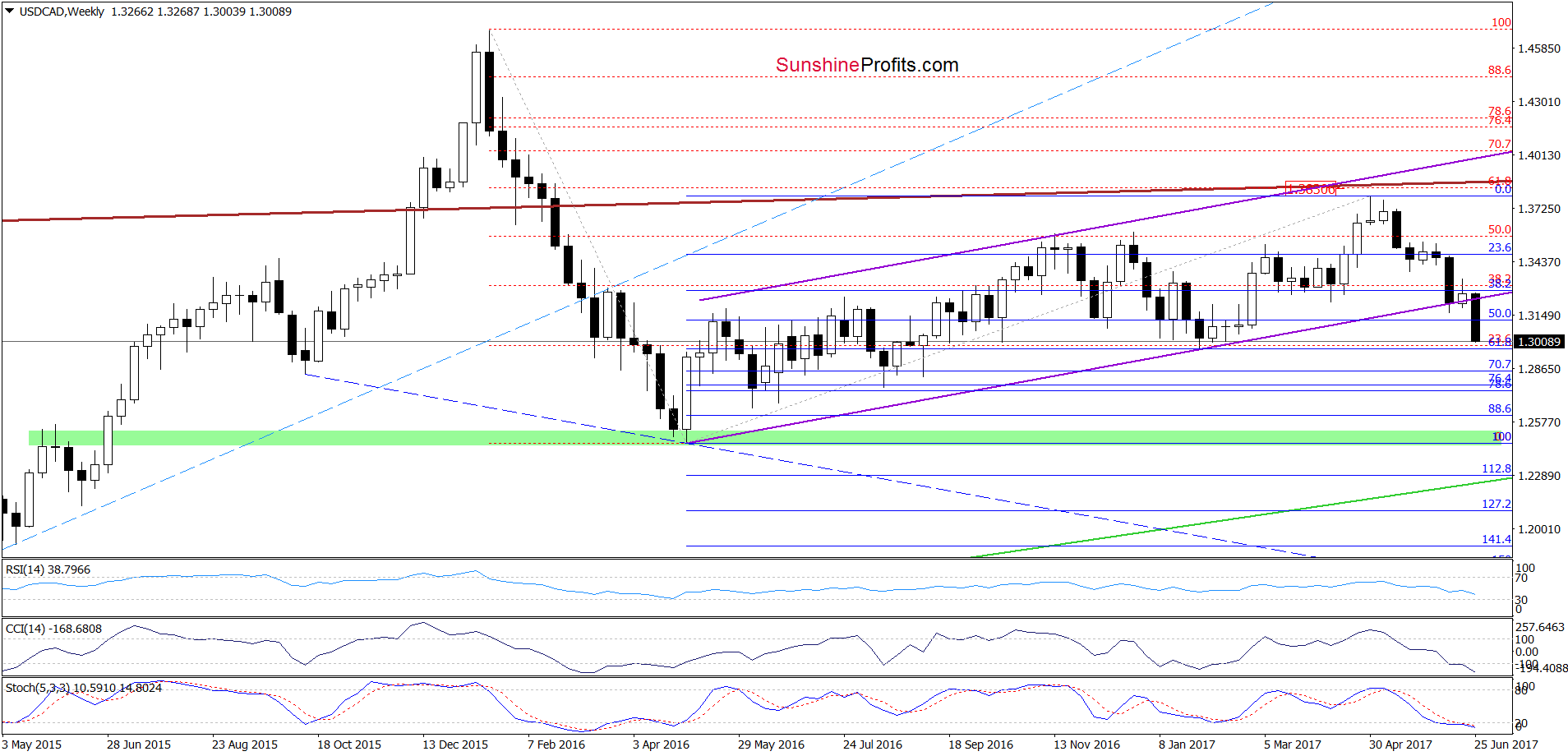

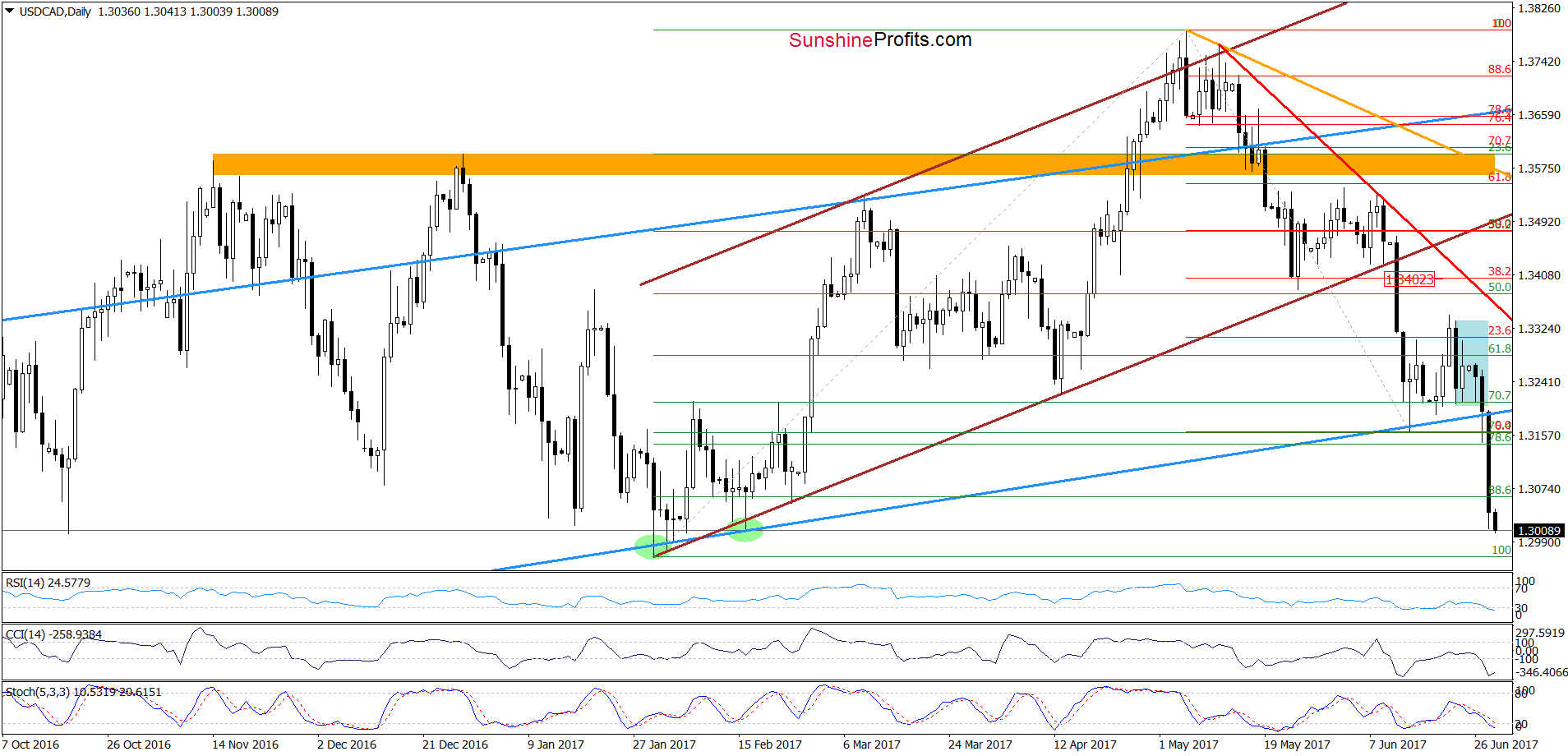

Looking at the charts, we see that the breakdown under the lower border of the purple rising trend channel below the blue support line encouraged currency bears to act, which resulted in a sharp decline. As a result, USD/CAD declined under the 88.6% Fibonacci retracement (based on the entire January-May upward move), which suggests a test of the 2017 lows in the coming day(s). Nevertheless, in this area is also the 61.8% Fibonacci retracement based on the May 2016-May 2017 increase, which could encourage currency bulls to act in the very near future.

Very short-term outlook: bearish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

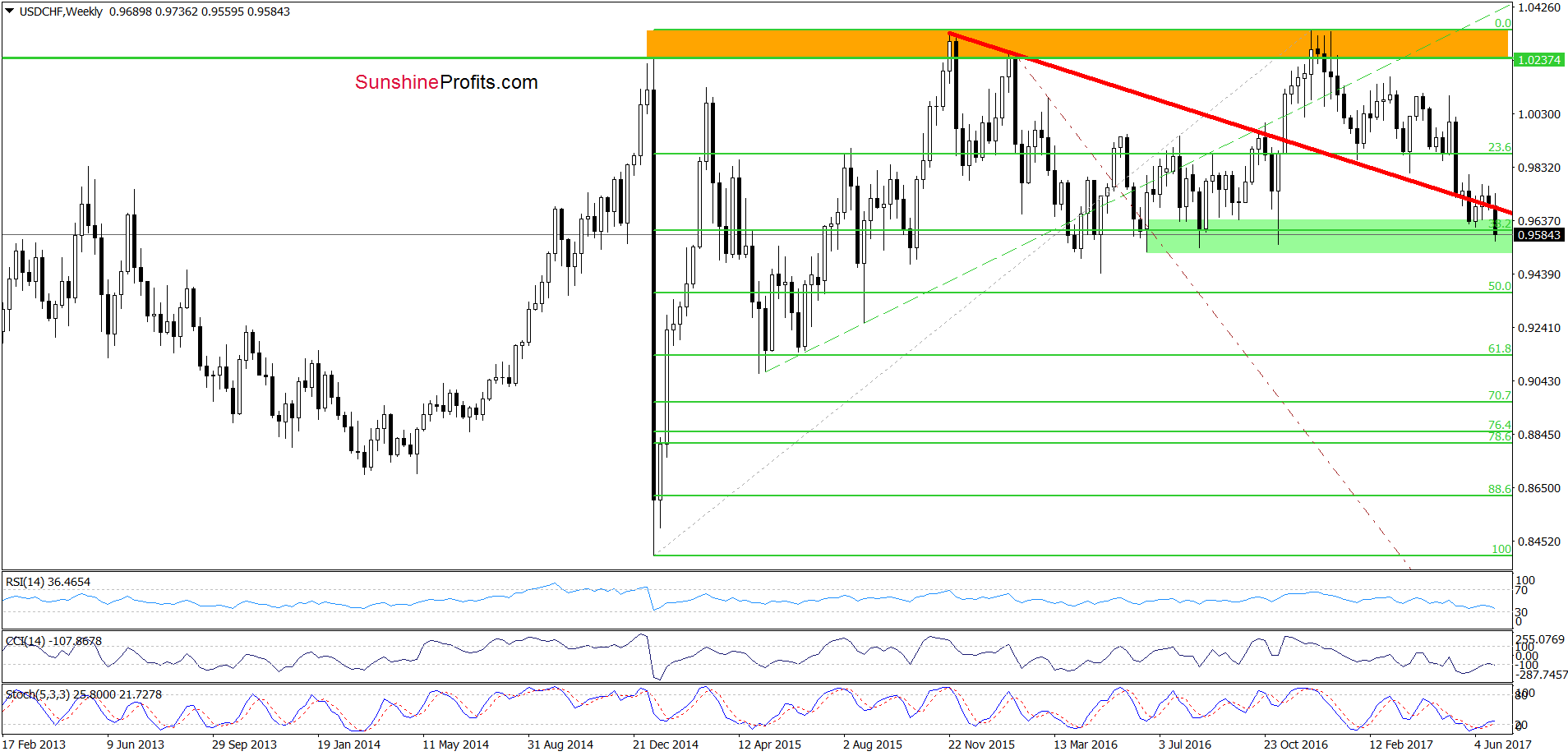

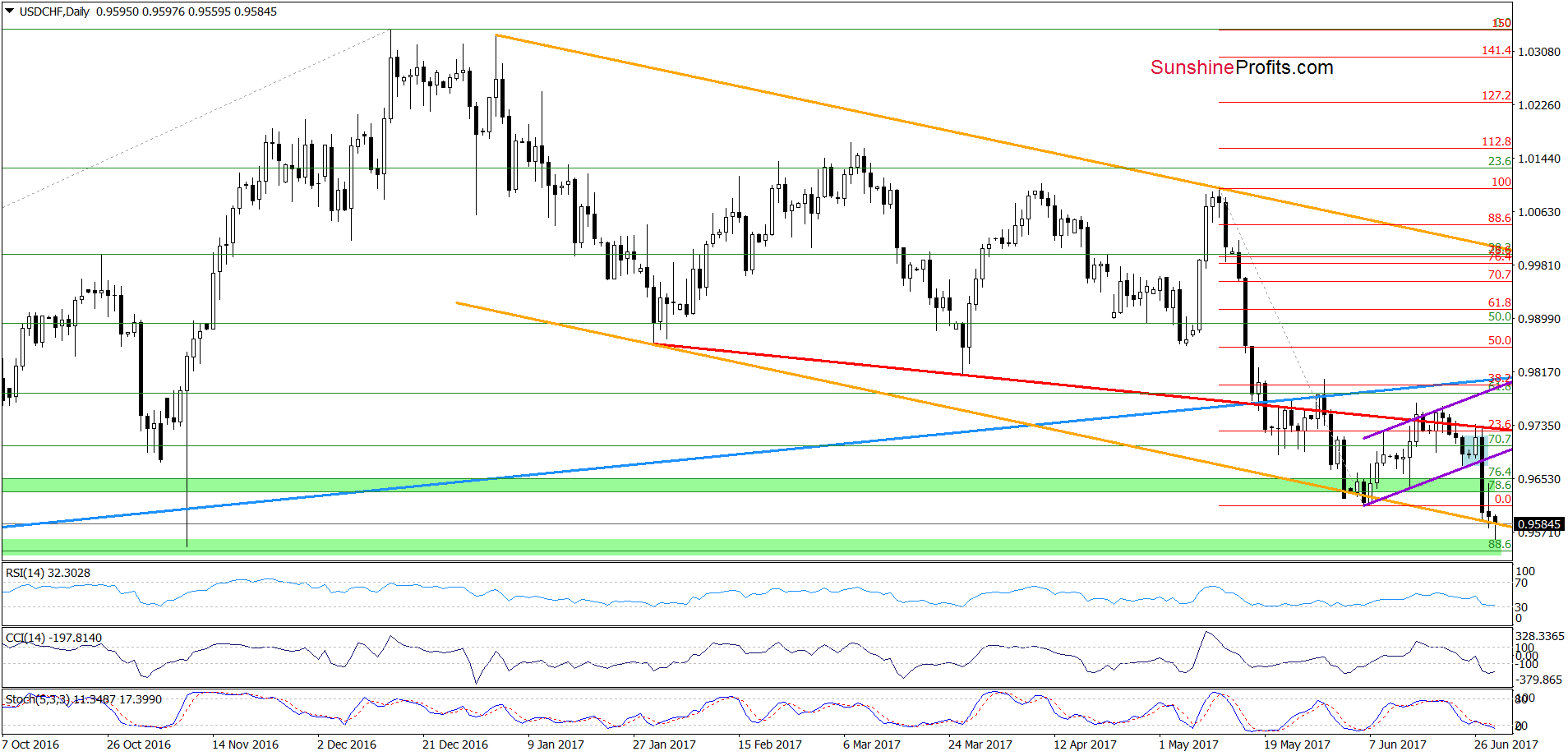

USD/CHF

The first thing that catches the eye on the medium-term chart is the breakdown under the long-term red declining line.

How did this drop affect the very short-term picture? Let’s examine the daily chart and find out.

From this perspective, we see that USD/CHF declined sharply, which resulted in a breakdown under the lower border of the purple rising trend channel. This deterioration encouraged currency bears to act and triggered a drop to the lower border of the medium-term orange declining trend channel marked on the daily chart. Thanks to this move, the exchange rate slipped also to the green support zone created by the previous lows, which together with the current position of the daily and weekly indicators suggests that reversal and rebound in the coming days should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts