Day after day the price of gold and silver gets lower and lower as the US Dollar rallies. Many precious metals investors fear that there’s more to come and stay out of the market or even sell their long-term holdings – sometimes at a loss. The existence of the long term bull market is often questioned. There are very few eager buyers at this time. We’re among them and this essay will include some of the reasons of why we remain optimistic.

First of all – did the fundamentals change during the last several months? We don’t think so. And if it is not the fundamentals that drive the price lower then it means that the reasons are probably emotional. From time to time every market gets ahead of itself during upswings (greed) and during downswings (fear). We believe that previous several weeks are a good example of the latter type of behavior. If so, then we should look for clues that will convince us that the ‘weak hands’ have already sold precious metals and related equities. When all of those who wished to sell, have already done so, they can do only one thing - get back to the market. Naturally this is a very simplified version of the way bottoms are made, as not all of the momentum players get out of the market and not all of those who got out, get back in. Not being absolutely precise here does not change the fact that this can be seen in the price and what is more important can be successfully traded.

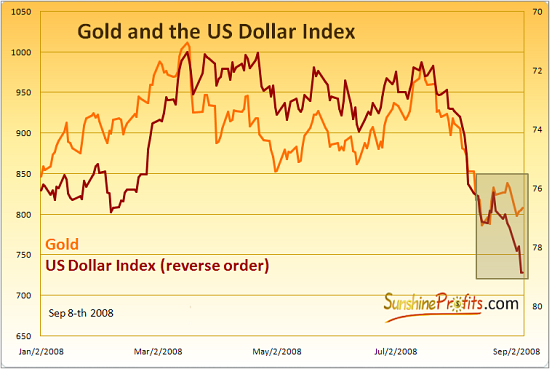

In this case, we have higher highs in the US Dollar without lower lows in the price of gold. Such a disparity usually means changes – this time in favor of gold. We wrote about this technique in one of our previous commentaries. Please take a look at the chart below:

The order on the right axis is reversed, so that you can better see how gold’s reaction toward changes of the USD decreased. Please note that these are closing prices. The marked rectangle shows you how gold simply stopped reacting to dollar’s fall – this is a very bullish sign.

The rally in the USD has been very rapid but it does not change the

overall trend in our view – which is down. The severity and speed of

this rally suggests that at least small decline is imminent, and since

gold managed not to fall along with rising USD, its reaction to even a

small downswing in the dollar might be sizeable.

The dollar

itself is also reaching a very strong multi-year resistance around the

80 level. The chart (courtesy of stockcharts.com) below illustrates this

situation.

Usually rallies that are so rapid are vulnerable to strong resistance

levels, as short-term oriented speculators (which usually drive such

upswings) rush to secure gains as the resistance level approaches. As a

counter-trend rally, the current rise in the value of the US Dollar is

particularly exposed to this mechanism.

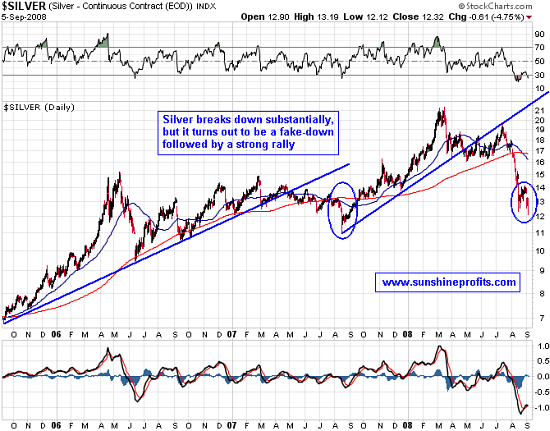

As far as silver and gold

are concerned from a long-term point of view, some investors might be

cautious because silver fell very far from its previous trend line and

now, unlike gold, it has fallen below its previous low.

We have marked the two situations when silver fell, as gold refused to

follow it: over a year ago and right now. The interesting fact is that

in the past, such an event was followed by very strong short- and

medium-term rally. It’s not out of the question that it will happen

again.

On the silver chart one can see that much technical damage

has been done to the white metal. This is NOT a key issue in our view.

From time to time silver tends to break the technical rules in a sense

that after a technical formation materializes or silver breaks below a

critical support level, its reaction is the opposite of what one would

normally expect.

Silver is a relatively small market where large

amount of capital can move the price up or down more easily than it

would be the case with a bigger market. The price could also be more

easily kept down or pumped up artificially by only a few entities, which

would aim to profit on the stop loss orders of other market

participants. We will not go into details of this mechanism in this

essay, but we would like to point your attention to the fact that the

smaller the market is, the less precise the technical analysis gets.

What

makes the situation on the precious metals market even more interesting

is the fact that the precious metals stocks have been beaten so

severely, also compared to the underlying metals.

This suggests that fear has reached extreme levels. Additionally we are getting close to very strong support levels. Gold stocks followed the general stock market in the last few days, which only exacerbated the levels of fear we are currently witnessing. However given the aforementioned reasons we seriously doubt the price will get below the lows marked with the dashed lines.

Summing up, we have the underlying security – gold, which refuses to go lower despite the rise in the currency it is priced in – the US Dollar and very negative sentiment among most precious metals investors. At the same time the very rapid rally in the USD reaches a multi-year resistance level. The fundamentals of gold and especially silver, which will ultimately drive the market in the long term, are still very favorable. We view this situation as very bullish in the short, medium and long term.

Of course the market might prove us wrong, as nobody can be right 100% of the time. Should our view on the market situation change substantially, we will send an update to our registered Users along with suggestions on how to take advantage of it. Register today to make sure you won’t miss this free, but valuable information. You’ll also gain access to our Tools section. Registration is free and you may unregister anytime.

P. Radomski