This essay is based on the Premium Update posted on May 23rd 2009. Visit our archives for more gold articles.

This week we saw the precious yellow metal go from "Gold" to "Golder" in contrast to the USD, which this week verified its breakdown. In the previous free commentary I mentioned one of the ways, in which a breakout can be verified, and that is by declining to the previous trend line are turning up again. However, there are also additional ways to verify a breakout, and I wrote about it in one of the previous Premium Updates. This week the USD Index did not go back to its previous trend line and neither did the precious metals. I consider the breakout to have been verified by the fact that these sectors closed above (gold) and below (USD) their respective trend lines for at least 3 consecutive trading days. We may, and probably will have some kind of consolidation here, but that does not change the overall bullish picture in the long term.

Gold and silver have been on a tear, moving higher without looking back, and have now reached the levels of their previous local tops. Our subscribers are glad to be well positioned with most of their holdings in precious metals since the end of April. The USD Index has been very weak in the last few days, but is now looking oversold. Since breakouts have been verified, the next directional trade for gold will most likely be up. However, since the recent rally has been sizable, especially in the mining stocks, you may want to wait for a brief correction before opening new long positions. A correction would also serve as an opportunity to close any remaining short positions you may have in precious metals.

The General Stock Market

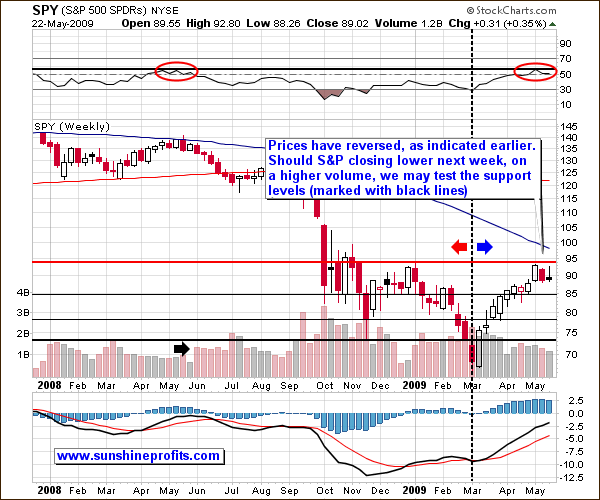

This week I would like to comment on the general stock market and implications the situation on this particular market has for the precious metals investors and speculators. Today, I am taking a look at the general stock market through the weekly chart of the SPY ETF. Charts are courtesy of stockcharts.com.

Clearly, the move in the U.S. dollar has not been the only important news this week. What looked like simple side-ways trading from a daily perspective becomes more important once we zoom out to get a larger picture. As you see in the above chart, the broad market has declined since we wrote about this being the likely scenario, but the decline has not been as dramatic as our support lines might suggest. So far, the situation is similar to the one a year ago. Please take a look at the way the RSI indicator shaped almost exactly a year ago, and compare it to how it is shaped now--almost identical.

The similarity does not end there. In 2008, we had a local low at the beginning of March and reached a top in May. This year the current rally also began in the beginning of March 2009 and it seems that a high was reached two weeks ago. Please note that both rallies took place on declining volume. The final confirmation that I've marked with a black arrow was a week during which the SPY fell on a much higher volume. Should this take place this week, we may indeed move lower from this point. It's a tough call to make whether or not this is the beginning of a new, powerful downturn, but at the moment, we cannot rule this possibility out completely.

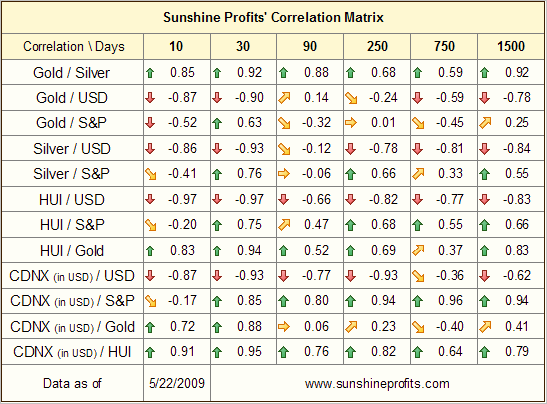

For us, precious metals investors and speculators, the important thing to consider is how such a plunge would affect prices of precious metals and their corresponding equities. For more details we will need to analyze the appropriate rows in the correlations table.

As you can see, gold (and also silver) have had a high correlation with the S&P over the previous 30 trading days moving in the same direction, but this has changed over the past two weeks. The column with the very recent data (meaning the previous 10 trading days) has been unusual and we find the two assets moving in opposite directions. This is especially unusual for silver.

What is really remarkable is that the gold stocks, as measured on the HUI Index, have been negatively correlated with the general stock market. This has definitely not been the prevailing trend over the past several years. Should this phenomenon hold for several more days (so that it significantly influences the 30-day column), we can assume that this phenomenon is not just "noise", but is indeed a significant development in the precious metals market. It will serve as a strong sign that mining stocks will be moving higher.

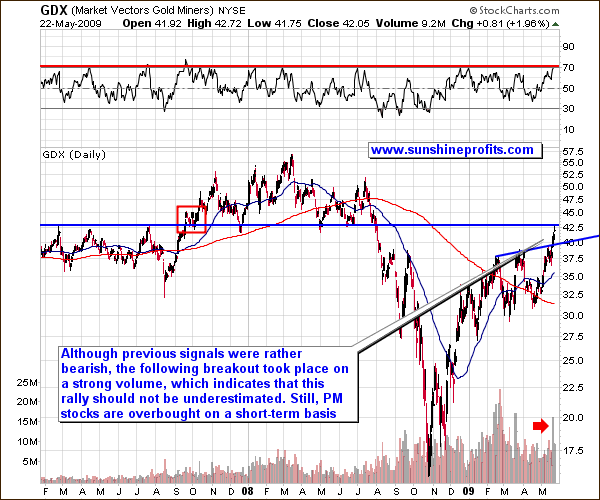

Mining Stocks

The RSI indicator also suggests that a breather is needed in the mining stock sector. A correction, possibly not a very deep one, is the most probable outcome in the next several days or weeks. If the previous support level serves as a resistance (in other words the GDX does not fall below $40), we will have a very good opportunity to enter speculative long positions. This would correspond to a similar breakout/testing situation in 2007 that I marked for your benefit with a red rectangle.

Summary

From a long-term perspective the situation on the whole in the precious metals sector still looks favorable. We have rallied substantially during the past few weeks (to the delight of our subscribers, who completed purchasing long-term holdings at the end of April) and although a brief correction is possible, this possibility does not justify moving large capital out of this sector. A week or two of a correction are insignificant when you look at things from a multi-year perspective.

To make sure that you get immediate access to my thoughts on the market (including information available only to Members of the Premium Service) I suggest you sign up for my free e-mail list. Sign up today and you'll also get free, 24-hours access to the Premium Sections on my website, including tools and charts dedicated to PM Investors and Speculators. It's free and you may unsubscribe anytime.

P. Radomski

--

This week we have seen important moves in both the precious metals and the USD markets which could be of great consequence to serious investors. With gold and silver on a tear and the USD in the dumps, I present my views on what may be waiting around the corner from a long- and short-term perspective.