Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Little Changes and Many Signals in the PMs

October 22, 2018, 9:01 AM

There were not many changes in gold, silver and mining stocks on Friday, and not much has changed in terms of the weekly closing prices either. Gold and gold stocks closed modestly higher, and silver was up by $0.01 last week (after declining $0.01 in the previous week). Some data sources point to $0.02 movement in both weeks, but the overall implication is the same – nothing really happened since gold soared most likely due to Trump’s comments. What can we infer from this silence? Much more than it seems at the first sight.

-

More Fluctuations - Bottom or Just Pause Before Another Sell-off?

October 22, 2018, 7:25 AM -

Why Is the Weakness In GBP/USD Likely?

October 19, 2018, 10:03 AM -

One Year after QT Started, Gold Still Unmoved

October 19, 2018, 4:44 AM -

Uncertainty Following the Rebound, New Uptrend or Just Correction?

October 18, 2018, 7:38 AM

Stocks went sideways on Wednesday, as investors hesitated following the recent volatile fluctuations. The S&P 500 index retraced some of its last week's sell-off on Tuesday, following bouncing off the long-term upward trend line. Is this a new uptrend or just upward correction before another leg down?

-

Gold Would Not Enjoy That FOMC Is Going More Restrictive

October 18, 2018, 6:53 AM -

Determining the Outlook for Mining Stocks? Look Deeper Than Others.

October 17, 2018, 11:12 AM

Gold miners completed the inverse head-and-shoulders pattern – it’s now a fact. And many analysts would have one believe that it’s the only fact that matters right now or that it’s of major importance. But just like focusing on one tree can make one miss the entire forest behind it, the above could make the entire precious metals outlook appear different than it really is. There are multiple factors in place and we will not cover all of them in this essay, but even in case of the mining stocks, there are many factors that gold promoters and those who put a lot of weight in the inverse H&S pattern in mining stocks, are usually not mentioning in their analyses. We’ll discuss some of those factors below.

-

Does Gold Like Acronyms? The Golden Story of SPX, CPI, and IMF

October 16, 2018, 7:01 AM -

Friday's Bounce, Trend Change?

October 15, 2018, 7:33 AM

Stocks were retracing some of their recent sell-off on Friday, as investors' sentiment slightly improved following the quarterly corporate earnings releases, among other factors. The S&P 500 index bounced off its long-term upward trend line. But is this an upward reversal or just quick a dead-cat-bounce correction before another leg down?

-

Next Points for Oil Bears

October 12, 2018, 10:57 AM -

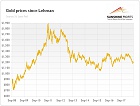

Gold Ten Years after Lehman Brothers

October 12, 2018, 5:25 AM

We know, it’s just a symbol. But it’s a powerful symbol of the most severe recession since the Great Depression. Yup, it’s another article about the Lehman Brothers’ collapse. But we really invite you to read it, as we thoroughly analyze the impact on that bankruptcy on the price of the yellow metal. You will also find out what can we learn from the 2008 banking crisis for the gold market.

-

Will October Stock Market Sell-Off Boost Gold?

October 11, 2018, 8:05 AM -

Sell-off in October, Just Seasonality?

October 11, 2018, 7:29 AM -

Strong Labor Market, Weak China, and Gold

October 9, 2018, 7:49 AM -

Gold: Ready, Set, Go! Were You Really Ready?

October 8, 2018, 9:08 AM

The previous week is over and even though we haven’t seen any significant volatility in its final part, it doesn’t mean that we haven’t seen any meaningful signals. We did and one of them has important implications for the short term and a few others have much more important implications of the medium-term nature. Based on today’s sizable decline in gold and silver, it seems that the short-term signal has already worked.

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts