Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

New Downtrend or Just Downward Correction?

October 8, 2018, 7:24 AM

Stocks continued their short-term downtrend on Friday following the monthly jobs data release. The S&P 500 index fell to its late January local high of around 2,873, before a quick intraday upward reversal. So will the downtrend continue? Or is this just some profit-taking action before another medium-term leg up?

-

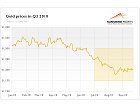

Gold Disappoints in Q3 2018

October 5, 2018, 8:07 AM

“Mr. Gold, you have disappointed us! But, really, you dropped almost four percent in the third quarter of this year.” This is what many analysts could say. But we warned our Readers against being bullish in the current macroeconomic environment. We invite you to read our today’s article about the gold market in Q3 2018 and find out what happened – and what are the implications for the end of the year.

-

Does Gold Speak Italian?

October 4, 2018, 11:20 AM -

Topping Pattern or Just Consolidation Before Another Leg Up?

October 4, 2018, 7:26 AM

Wednesday's trading session passed with no significant changes, as stocks extended their short-term fluctuations following the recent advance. The S&P 500 index continues to trade relatively close to its late September record high. Is this a topping pattern or just a consolidation before another leg up?

-

Inverse H&S in the Miners? Really?

October 3, 2018, 10:56 AM

Gold rallied, silver rallied, and mining stocks rallied. That’s how one can summarize yesterday’s session. The volume was huge, so it appears that a major upswing has just begun. But is this really the case? As always, just because things look encouraging and the emotions are high, it doesn’t mean that anything changed. One needs to step back from the day-to-day price and volume changes and look at the factors that are in place right now without any biases. No hopes, no “feelings toward the market”, and no worries about missing the boat. Just facts and logic.

-

Time for More Action?

October 2, 2018, 10:59 AM -

Gold & Silver Trading Alerts - Trading Performance

October 2, 2018, 10:52 AM

The intent of this page is to show you the simulated (hypothetical) returns of precious metals portfolios for the past decade,* in order to check how all of them performed individually, and how a portfolio consisting of them would have fared. We will then check how changing the positions according to our signals (as described in Gold & Silver Trading Alerts and Premium Updates – which is how the former used to be called in the past) for the long-term investment capital would have impacted the results.

-

Two Press Conferences That Could Affect Gold Prices

October 2, 2018, 5:03 AM -

The Silver Exclamation Mark

October 1, 2018, 8:21 AM

Rallying mining stocks? Forget about them. Silver is the new cool kid in the neighborhood. Having rallied by almost 50 cents in just one day, silver stole the spotlight and seems to be ready to move much higher… Or much lower. Does anyone still fall for silver’s fake rallies? Based on the size of the rally and the corresponding volume, it certainly seems to be the case. But you don’t have to fall for it – that is if you prefer to analyze the market’s emotionality instead of acting on it. It’s not an easy thing to do, because each silver rally seems to be “it”. But what’s easy and what’s profitable is rarely the same thing.

-

Uptrend to Continue?

October 1, 2018, 7:17 AM -

Fed Tightening Cycles: Broader View and Implications for Gold

September 28, 2018, 5:44 AM

It should be clear that the Fed’s tightening is bearish for gold, shouldn’t it? Our today’s about the history of the Fed’s tightening and its impact on the macroeconomic variables and the gold prices undermines that popular belief. We invite you to read it and draw precious metals investment conclusions from it.

-

Fed Turns More Hawkish in September. Is the Gold Case Lost?

September 27, 2018, 7:53 AM -

Fed Hikes, Stocks Fall, Just Correction?

September 27, 2018, 7:23 AM -

The Final Silver Sign

September 26, 2018, 9:13 AM

We’ve seen myriads of signs pointing to lower precious metals prices in the past months, weeks, and days. We even discussed how ridiculously similar the current situation is to what happened in 2013, right before the $200+ decline in gold. But the final bearish confirmation usually comes from the silver market and this time is no different.

-

Will Gold Prices Soar after March 2019?

September 25, 2018, 9:42 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts