Based on the March 23rd, 2012 Premium Update. Visit our archives for more gold & silver articles.

Its tough being a lone voice saying that gold prices will go up when they have tumbled and the financial press is writing obituaries for the gold bull market. Its also encouraging being a lone voice saying that gold prices will go up precisely because it means that the general sentiment is very bearish and this is what we see at major bottoms. Gold has gotten clobbered and silver has taken a beating as Treasury yields surged and markets are moved by optimism that a recovery has gained traction. Fears over an implosion in the Eurozone seem to have receded.Februarys jobs report signaled a strengthening recovery. Greeces widely expected default has momentarily taken Europes sovereign debt crisis off the radar screen. UBSs Edel Tully has lowered the one-year price target of gold to $1,550 an ounce, a 12.7% downgrade.

Yet, it was the case that many analysts were quite bullish in February 2012, when we suggested waiting on the sidelines Since then we have gotten a long-term buy signal from the SP Gold Bottom Indicator along with many other signalsand suggested that now is the time to go long with a portion of ones speculative money. In our previous essay on the possible rally in precious metals (March 20th, 2012), we wrote that the bullish outlook was still in place. To quote:

( ) the situation in gold remains very bullish for both the short term and long term based on this weeks charts.

We are of the view that the declines in gold prices last week and this week do not invalidate it in any way.

Another one of our indicators, the SP Gold Stock Extreme Indicator, also shows a bullish signal. This indicator has been very good at spotting short term and medium term bottoms since 2008. It has, in fact, been 100% accurate since that time as far as short-term bottoms are concerned. This serves to further reassure us that being on the long side of the precious metals market is a good place to be right now, despite the clamor and noise all around us.

There is no denying that it is emotionally difficult to be long gold right now but thats also bullish in a way. Please note that the hardest investment decision that you have to make will often be the best one. The metal has now fallen almost $150 an ounce from a Feb. 29 high.

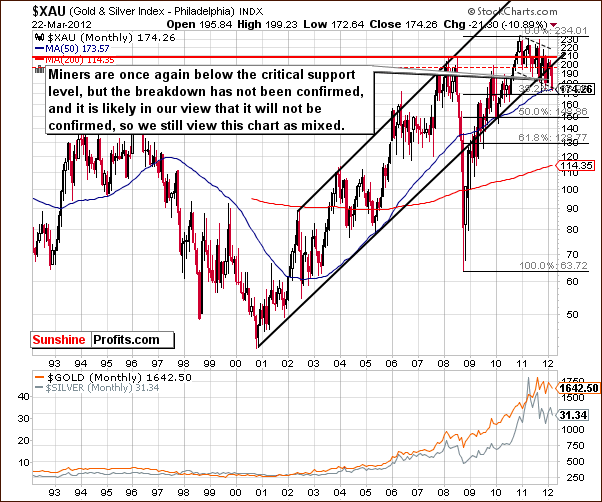

While we are bullish on gold and silver, lets take a look at the possible developments in the related mining stocks sector. Well begin the technical part with the analysis of the XAU Index. We will start with the very long-term chart (charts courtesy byhttp://stockcharts.com.)

In the very long-term XAU Index chart, the breakdown is still not confirmed. The miners remain above the medium-term support line but below the very long-term resistance line. Many more days below this line are needed before the breakdown is confirmed in this very long-term chart. Overall, the situation here remains mixed.

In the medium-term HUI Index chart, we also have a breakdown, which has not been confirmed. The first attempt was immediately invalidated and it appears that a second attempt is likely to be unsuccessful as well. This is based on RSI levels and the situation in gold, the latter being discussed in full detail in our premium analysis.

In the GDX SPY ratio chart, we see further evidence that the breakdown has not been confirmed. Prices moved below the previous low temporarily and are now there once again but this is not viewed as a confirmation. The breakdown is simply not in and the situation is still bullish right now. The RSI level remains oversold and below 30 as well.

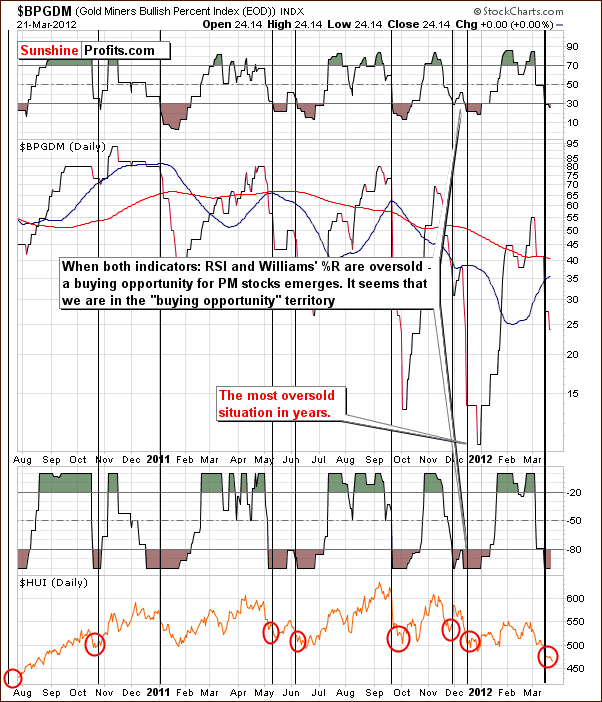

In the Gold Miners Bullish Percent Index chart, we see that the two important indicators, the RSI and Williams %R are both below oversold levels. This has been a very reliable indicator pointing to a bottom being seen very soon situation. These signs have been in place for several days now, so the suggestion is that the bottom is in or very, very close.

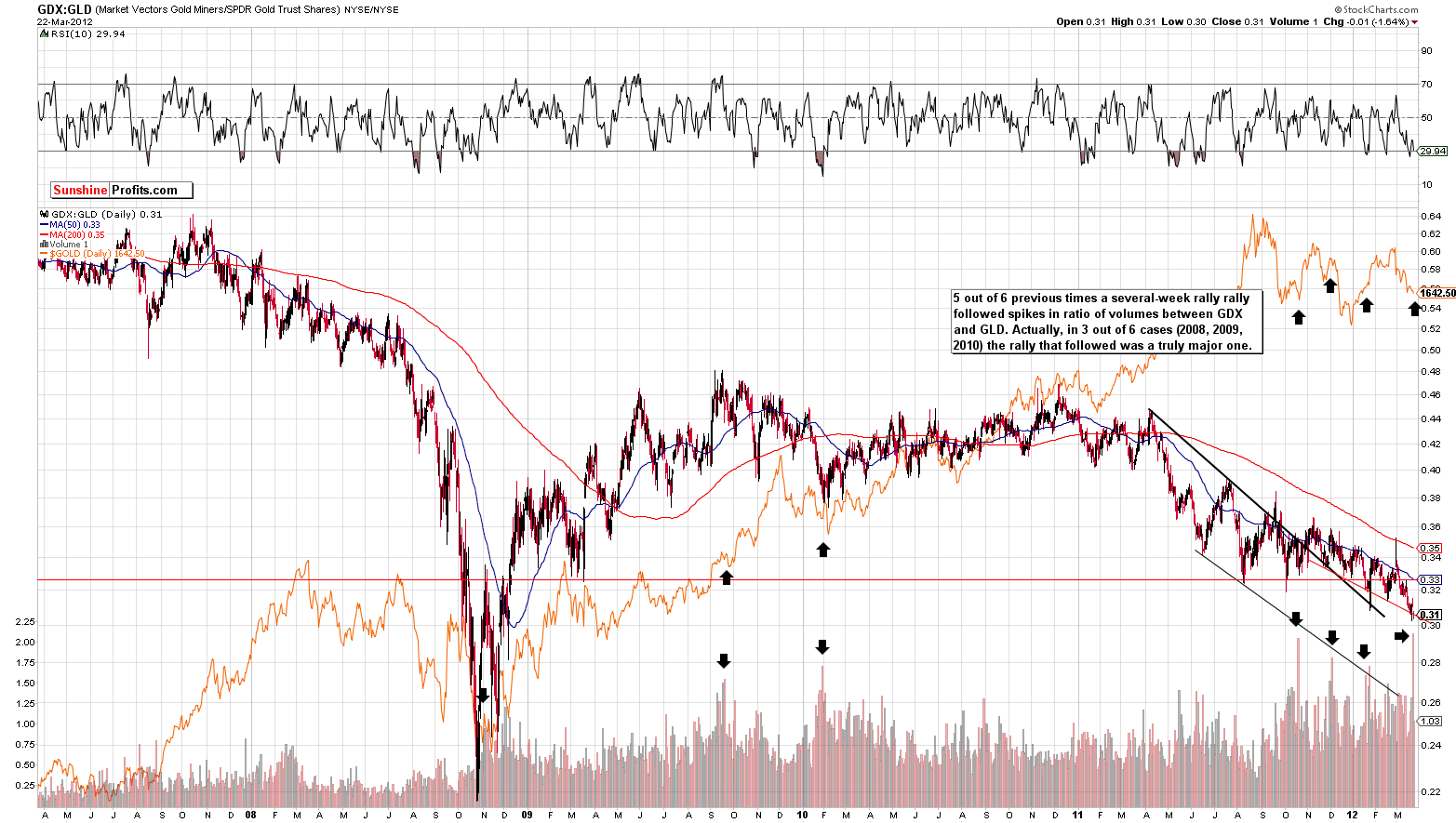

In the gold miners to gold ratio chart (you can click the chart to enlarge it if youre reading this essay at sunshineprofits.com), we are going to take a slightly different approach. Instead of focusing on the poor performance of mining stocks relative to gold, we will analysis their volume levels with respect to those of the GLD ETF. Here we see an extraordinary event in this ratio. The gold mining stock volume has been exceptionally high as compared to that of the GLD ETF.

This type of situation has only been seen a few times in the past and in five of the six previous times, a rally of at least a few weeks duration followed. The one exception was in December 2011. At that time, a rally had just been seen and the RSI level was well above 50, so the situation was overall quite different from other cases.

In the other five instances, rallies of at least a few weeks duration followed, including three major rallies. These were the rallies, which followed the 2008 bottom, the September-October 2009 bottom, and the post correction rally in early 2010.

Summing up, the situation doesnt look too encouraging for gold and silver mining stock investors at first glance. However, taking into account volume spikes and the Gold Miners Bullish Percent Index, a fairly bullish picture emerges. The situation is even more bullish for the underlying metals: gold and silver.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Gold declined early on Thursday, but immediately corrected about 80% of the decline. At the same time, silver declined more significantly and miners moved below their important support level. In today's Premium Update we comment on all of these important events and put them into proper perspective.

Areas covered in today's report include: USD Index, S&P 500, SPY ETF, crude oil, Correlation Matrix, gold (including details regarding the self-similar pattern), GLD ETF, gold from non-USD perspective, silver, SLV ETF, XAU, HUI, GDX ETF, Gold Miners Bullish Percent Index, and GDX:GLD ratio. Naturally, we provide price targets for gold, silver and miners.

Additionally, we comment on our in-house developed "extreme" indicator, miners' (lack of) performance relative to gold, disconnection between prices of gold and gold ETFs, the expected length of the bull market in the precious metals, inflation expectations, log scale on charts, comparison of today and 2008, and more.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.