Based on the March 16th, 2012 Premium Update. Visit our archives for more gold articles.

According to a Bloomberg survey at a precious metals conference this week, gold is poised for a 21 percent gain in 2012, extending its bull market to 12 consecutive years. Bullion may rise to $1,897 an ounce in New York by Dec. 31 from $1,566.80 at the end of 2011.

They have plenty of reasons for optimism, despite the recent drops in price. Demand for gold has strengthened as Europe seeks to contain its debt crisis and China has displayed a growing appetite for gold. Governments have kept interest rates at all-time lows to shore up growth. Central banks have been net buyers for three straight years, the longest stretch since 1973, according to World Gold Council data.

They are not the only ones optimistic about gold. The specter of inflation is making some turn to the yellow metal.

By the time inflation becomes evident,says Paul Johnson of the $14 billion Paulson & Co. hedge funds, gold will probably have moved, which implies that now is the time to build a position.

And just recently the Islamic Republic News Agency reported that Iran would begin accepting payments from its trading partners in gold. This move further reinforces the universal currency and store of value aspects of the metal. Iran already allows its trade partners to pay in their native currencies. It has also accepted payment in the form of goods from both India and China. It will now take payment in gold. Fundamental situation is clearly bullish for the yellow metal.

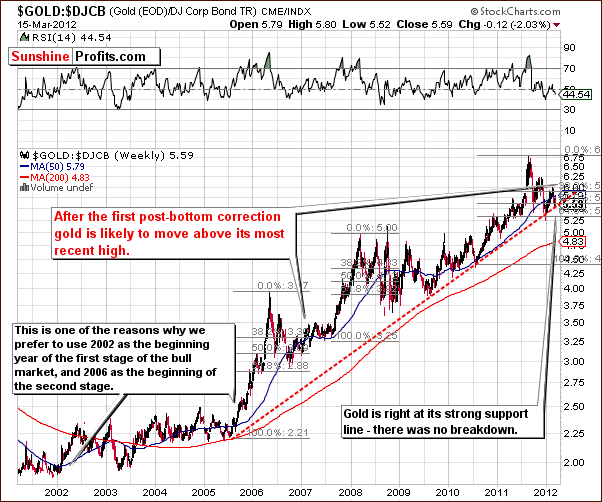

Lets turn to the technical portion with analysis of the gold to bond ratio. We will start with the long-term chart (charts courtesy by http://stockcharts.com.)

A look at the gold to bond ratio provides us with the proper long-term perspective in viewing golds decline last week. Analysis of this chart suggests that the bullish trend definitely remains in place, as no breakdown has been seen below the long-term support line.

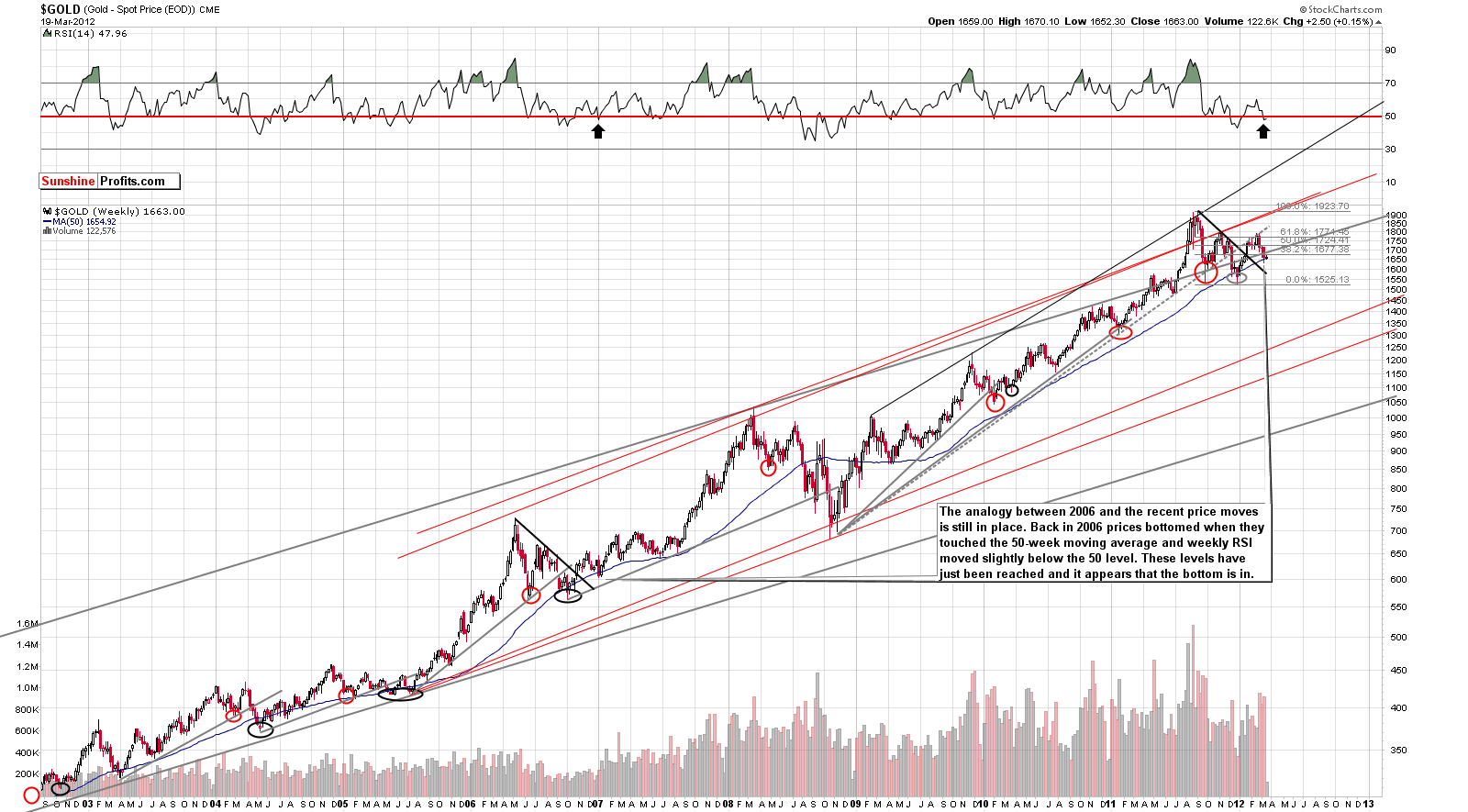

In the long-term chart for gold (you can click the chart to enlarge it if youre reading this essay at sunshineprofits.com), we see that the important support level mentioned in our essay on the possible rally in gold (March 14th, 2012) has been reached. Quoting from the abovementioned essay:

Last week saw several important developments as golds price decline approached the 50-week moving average while the RSI level remained slightly above the 50 level. This is a bit ambiguous with respect to what likely seemed to be needed for the final bottom to form.

In the past few days golds price moved slightly below the 50-week moving average and afterwards moved back above this level. In addition, the RSI moved below 50.

These two signs defined the bottom seen in early 2007 and it appears that the current bottom is already in at this time. Also, the possible correction appears to have happened already.

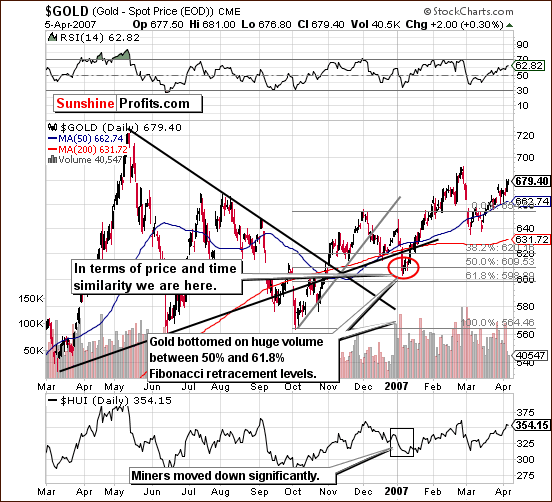

Taking a look at the chart from 2006-07, we see that the major bottom seen early in 2007 saw gold bottom half way between the 50% and 61.8% Fibonacci retracement levels. Huge volume levels also accompanied this local bottom. Furthermore, golds stock prices visibly declined at the same time and the RSI level moved close to but did not reach 30. Now lets take a look at where we are today.

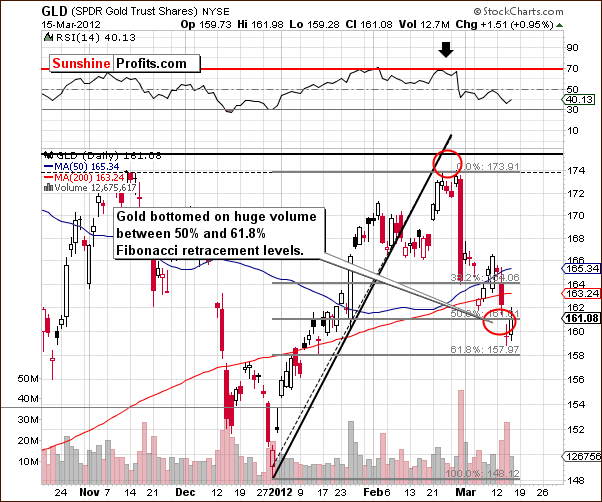

We now turn to the current short-term GLD ETF chart. Golds price has declined past the 50% Fibonacci retracement level but is still above the 61.8% level. In fact, on Wednesday, golds closing price was between the two and the bottom formed on significant volume. Also, the RSI level declined close to 30 and then moved back up. The situation is nearly identical to early 2007.

In our opinion, the striking similarities make our analysis this week quite reliable. Many factors are very much in tune and it is likely that this pattern will hold for the next couple of months. Keep in mind that it may take a week or so for the rally to really get underway.

Some might say that the bearish head-and-shoulders pattern is visible to some extent but a closer look reveals that this is not really the case. The shoulders are not really symmetrical. In early 2007, the pattern was even more visible and the target level based upon it was lower than the actual bottom that was formed. With the pattern less visible this time, and so many other factors aligned perfectly, it is likely that the bullish implications here will prevail.

In this weeks chart of gold from a non-USD perspective, we have a confirmation of the bullish outlook we have seen in the previous charts. Another move to the downside target area, which was reached last week, has been seen and its likely that a double bottom will form and the ratio will then move higher. The breakout above the declining resistance line (based on 2011 tops) has been well verified and it seems that now is the time for the rally to begin.

Summing up, the situation in gold remains very bullish for both the short term and long term based on this weeks charts.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

The precious metals market moved lower recently, and we received a lot of question this week. Consequently, we're providing you with detailed analysis of the precious metals market. Once again, gold appears to be the key to the whole sector. The questions that we replied to include ones about: manipulation in the gold and silver markets, our proprietary indicators, how to bet on the coming move in gold, AAPL:GLD ratio, candlestick patterns, and other important issues.

Meanwhile, platinum is once again more expensive than gold - we explain if it's still safe to enter the platinum market and which ETF one could use. Additionally, we analyze the current seasonal patterns in gold (is March-April period bearish for gold?) and we comment on the possibility of gold confiscation. Naturally, we provide our targets for gold, silver and mining stocks and our opinion on the probability of moving higher. Plus, we comment on one of our most important indicators that has just flashed a signal once again.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.