Based on the October 14th, 2011 Premium Update. Visit our archives for more gold & silver articles.

No good news to deliver so far this year on the eurozone. Just this week Slovakias government became the first in the eurozone to fall over opposition of bailing out indebted economies after the countrys parliament voted down approval for enhancing the zones rescue fund. Also this week, Jean Claude Trichet, European Central Bank President, warned that Europes financial crisis has reached a systemic dimension. Greece has continued to dominate the headlines and is facing a fifth successive year of recession and a possible sovereign default. Italy, Spain, Portugal, Ireland and even France have seen their share of headlines. Over the course of the year we have seen several instances where bad news about the euro boosted gold prices. Sovereign balance sheets resemble an overweight diabetic on the verge of a heart attack, wrote Pimcos Bill Gross in his recent letter to investors.

At the beginning of the year many investors were of the point of view that after years of delivering gains, bonds might not be such a great investment idea for 2011 since there is a distinct risk that long-term interest rates might rise, which would spell trouble for bondholders. They were wrong, but they were in good company. The person who took the biggest hit for making the wrong call on bonds is the worlds greatest bond trader, Pimcos Bill Gross, who advocated dumping government debt because of low yields. Instead, investors have been pouring their money into U.S. Treasuries all year as a safe haven. Due to Pimco's wrong-way bet, the once leading bond fund is up just 1% this year, trailing the returns of a whopping 84% of its peers. Recently Bill Gross has made a U-turn and has placed a big bet on lower long-term interest rates.

Housing is a key driver of expansion during economic recovery but in January we thought that it looked like home building will remain in a depression with a huge backlog of unsold and vacant homes. Foreclosures will continue with yet more houses dumped into a weak market. That has proved to be the case so far this year. The Standard & Poors/Case-Shiller 20-city index of prices has fallen back to where it was in 2003. Housing prices in Phoenix are at 2000 levels, and Las Vegas at 1999 levels. Lower prices have made homes more affordable than theyve been in a generation. But mostly its still a vicious cycle of foreclosures and falling prices. There are still many people who have negative equity they owe more on their mortgages than their homes are worth-- so that millions of more foreclosures are still in the pipelines.

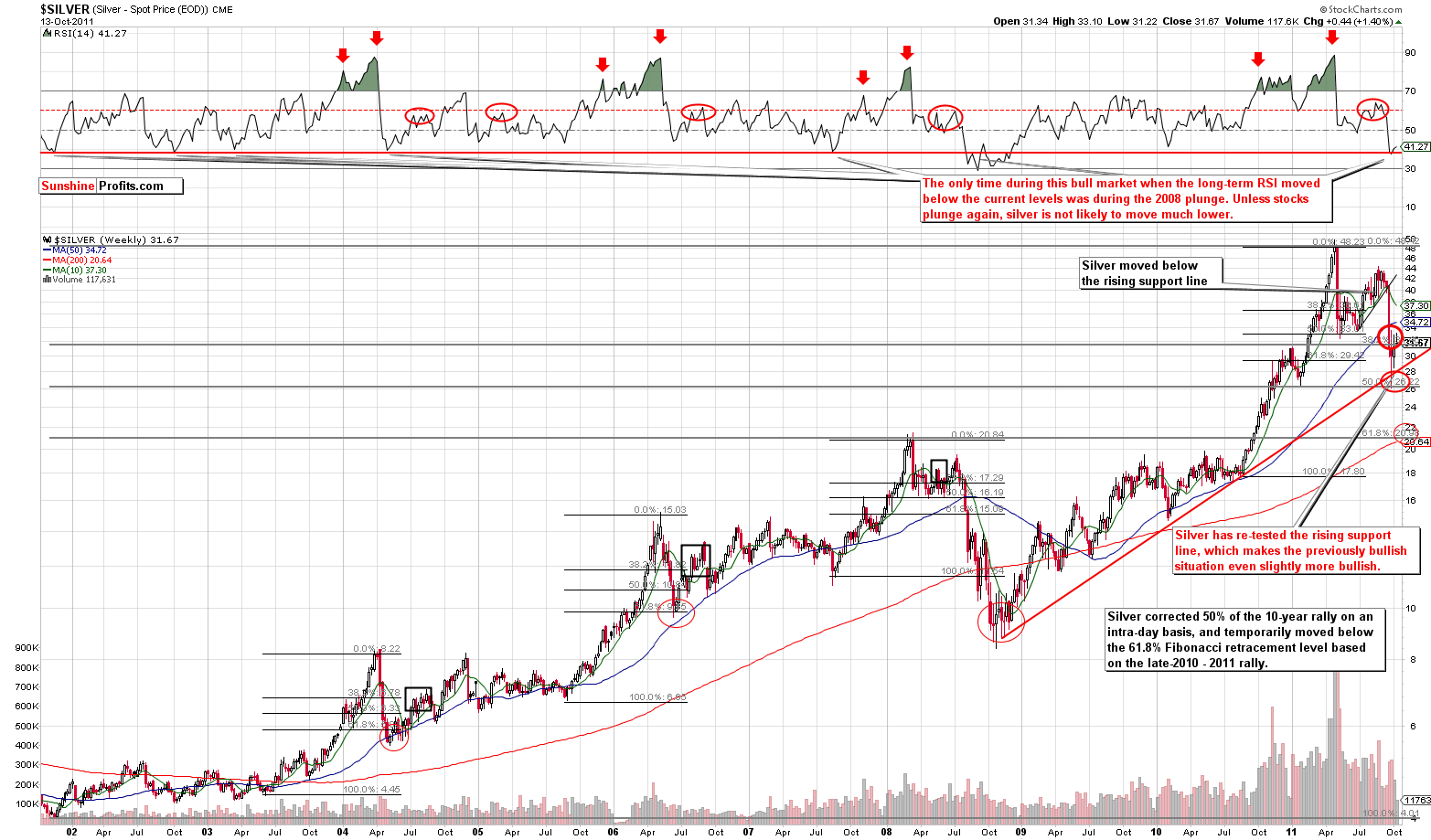

Recently, there has been much talk about where gold is going now. This have pushed silver a little bit to the side, which we dont think is quite fair. Because of that, we devote our today analysis solely to the white metal. We will start the technical part of this essay with the analysis of the silver long-term chart (charts courtesy by http://stockcharts.com.)

In the chart (if youre reading this essay on SunhineProfits.com, you can click the above silver chart to enlarge), very little change was seen this week. Silvers price moved to the 38.2% Fibonacci retracement level based on the 20022011 rally. Silvers price pulled back after moving above this level. This is likely insignificant and nothing more than a verification of a move back above the 38.2% level. Such price action is not unusual.

In the short-term SLV ETF chart this week, we see a move of interest as silvers price declined on low volume indicating a period of consolidation. The price level is now close to the 20-day moving average and in the past, such moves following an early part of the rally have typically been meant a reversal to the upside after the bottom was (shortly) reached.

Thursdays price decline is not really of concern, and the situation is not bearish at this time.

In the silver to gold ratio this week, we see a bottom developed after the rising support line was reached. Thursdays close was just under .02 and it appears that a rally from here is likely. The target level is around .022. If golds price moves sharply higher, silver is likely to increase to a greater extent on a percentage basis.

Summing up, the situation remains positive for silver and the same can be said about gold.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

The precious metals market rallied this week, but with the dollar pausing/ending its decline, will the rally continue? Will stocks plunge once again and drag gold, silver and mining stocks with them? What one should pay attention to in volatile markets?

In today's issue we deal with the above questions. In particular, we cover the following:

- Long-term interest rates

- USD long-term trends,

- USD vs. gold

- Self-similar pattern on the general stock market,

- Financial sector

- Precious metals correlations (and changes in them)

- Big gold chart with an important long-term pattern being currently in play

- Gold from the non-USD and yen perspective

- Short-term pattern present on the gold market

- Silver's cyclical tendencies

- Platinum

- Thursday's decline in the precious metals sector

- Discussion on the volatility in the markets

- Targets for gold, silver and mining stocks

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.