Based on the March 11th, 2011 Premium Update. Visit our archives for more gold & silver articles.

Its been only a few days since weve posted our latest timing-related essay on gold and silver prices, and since that time the situation has changed dramatically. Before providing you with the main point of this essay, we would like to comment on one of the questions that weve received recently.

Weve been asked about the influence that the general stock market can have on the prices of precious metals in the following weeks.

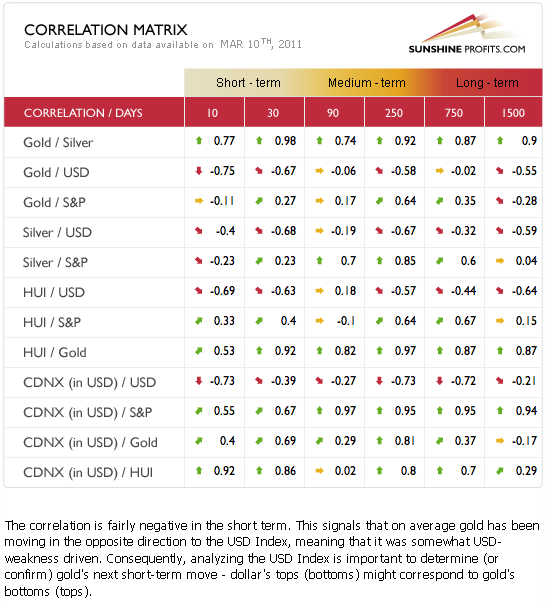

In order to address this question, we believe it would be particularly useful to provide you with the basis for this type of analysis the correlation numbers. This is where our Correlation Matrix comes in please take a look a look below for details regarding gold, silver and mining stocks correlations.

In Correlation Matrix, very little has changed since the previous week but we can draw some conclusions from the correlations seen with stocks. Looking at the 90-day column especially, we see that the value of the correlation coefficient between stocks and silver is quite high and amounts to 0.7.

Consequently, it seems that bigger declines in the general stock market could result in the same across the precious metals sector and especially for silver.

The bad news is that the situation on the general stock market is not bullish at all. Please take a look at the chart below (charts courtesy by http://stockcharts.com.)

In the Broker / Dealer Index which reflects the action within the financial sector, we can see that index levels have broken below the rising trend channel. Normally this index leads the trends of other stocks and therefore the downturn seen here implies that declines will be seen in the general stock market as well.

Therefore, caution is required at this time based on the correlation coefficients, the Broker / Dealer Index Chart, and also (not featured in this essay) the price-volume actions in the general stock market.

The USD Index in the short term has moved mostly in the opposite direction of gold, silver and gold and silver mining stocks. These markets appear, however, to move independently in the medium term. If the situation turns bullish in the USD Index, this could be slightly bearish for the precious metals sector. In the short term, the precious metals appear to move on their own, however if large declines are seen in the general stock market, it would put a negative pressure on precious metals, especially on silver and juniors.

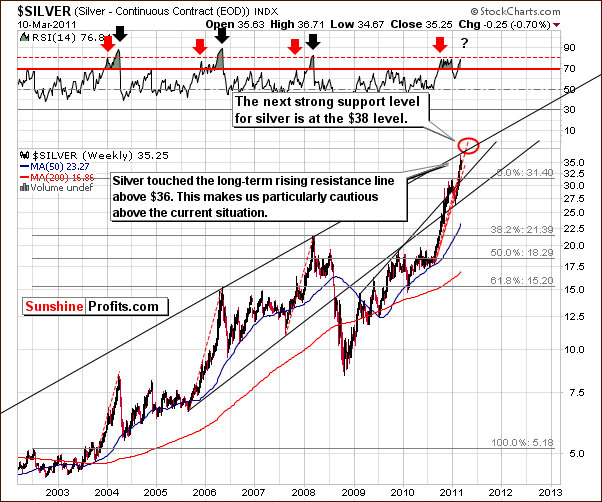

Speaking of silver, lets take a look at the very long-term chart featuring the white metal.

In the very long-term chart for silver, we have quite a bearish development. When silvers price surpassed the $36 level, it touched the very long-term rising resistance line. This level may have been touched somewhat ahead of schedule and the $38 target level may not be seen now for some time.

Actually, it is possible that we have seen a local top already, and extreme caution is warranted from here. In fact, on March 11th, 2011 we have suggested that our Subscribers close their speculative long positions in gold, silver and mining stocks, as we believed that the risk/reward ratio was no longer favorable.

Before summarizing, we would like to move our analysis of the movements of the price of gold beyond the usual factors. We would like to make you familiar with the idea of the Brownian motion. Brownian motion is a mathematical way of describing phenomena which are perceived as random. If we assume that the price changes of gold have a certain amount of randomness to them, then we may use Brownian motion to describe these price changes.

Lets take a look at the chart above. It presents both actual prices of gold since 2002 (the red line) and the Brownian motion based on those actual prices (the green line). This particular Brownian motion fluctuates around an exponential relationship. However, it doesnt seem that prices of gold can be directly approximated by this Brownian motion the actual prices of gold deviate from this motion and gold trades most of the time significantly below the green pattern.

So, why would we be actually interested in Brownian motion if it doesnt tell us what the level of the price will be? The answer is right on the chart. If you look at the local tops in gold, you will surely notice that most of these tops had been preceded by a moment in which prices of gold reached the level suggested by Brownian motion. This means that the analysis of Brownian motion might be able to point to possible tops in gold. Knowing that lets move to the proper analysis.

At the moment, the price of gold is around $1,400. The above-mentioned chart shows that this level is still far from the level suggested by Brownian motion. This might imply that gold still has a potential to move higher and that we wont see a major (!) top in the nearest future. Another thing is that the actual price of gold has been closing the distance to the Brownian motion and that much of that process took part in the second half of 2010 and in the first months this year.

These two points suggest that the major top in gold is yet to come and that it wont materialize until the price of gold reaches the level of $1,600 possibly moving temporarily above this level. At this moment it seems that long-term investments are more than justified as gold is still likely go move higher, even if it doesn't happen right away.

Summing up, the long-term situation for the precious metals market remains favorable, but metals could decline from where they are on a short-term basis if the stock market decline continues. At this point, we view the latter as likely.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Today's - almost 30-pages-long - Premium Update includes detailed analysis of the latest events in gold, silver and mining stocks. Is the $38 target for silver still valid? Along with discussing the situation on the silver market, we let you know what we think about the current seasonal tendencies (for gold) and cyclical turning points for silver and USD Index.

The Correlation Matrix provides us with guidelines as far as influences from the general stock market and the USD Index are concerned. The dollar bounced recently, but is that a beginning of a new rally, and if so, what does it currently mean to Gold and Silver Investors? Main stock indices declined on significant volume - does the traditional way of analyzing volume apply to stocks today? These are just a few out of many things covered in today's report.

We've also explained what influence is the April contract liquidation likely to have on the price of the yellow metal. Additionally, we've dedicated entire section to crude oil and its relationship with precious metals. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.