Based on the December 2nd, 2011 Premium Update. Visit our archives for more gold & silver articles.

There is palpable fear in the world and the urgency could be felt in the new strategy unveiled Wednesday morning by the worlds major central banks to bolster the financial system by increasing liquidity in the financial markets. In response, stock markets surged with joy with the S&P up 4.3 per cent. The move dragged down the dollar, bolstered the euro and pushed gold prices 2 per cent higher to finish November with a 1.9 per cent rise.

In effect, the Fed will be handing money to other global central banks at a lower rate than in the past and those central banks, in turn, will be able to lend the dollars to banks in their own countries. The hope behind this move is that it will prevent Europes financial woes from undermining the stability of the global banking system.

The Federal Reserve, European Central Bank and central banks in Canada, Britain, Switzerland and Japan said in a joint announcement that they will lower the interest rate paid on swaps, used to funnel dollars to the banking systems of countries where there is need. The Fed will lend dollars to the other central banks, the European Central Bank, for example, in exchange for euros. The ECB will pay interest, and in turn will lend out the dollars to banks in the eurozone that have obligations in dollars but are temporarily unable to borrow dollars to meet them. Normally banks can borrow the dollars they need from other banks, but in crisis mode, banks tend to hoard their cash and are fearful to loan it out.

The purpose of these actions is to ease strains in financial markets and thereby mitigate the effects of such strains on the supply of credit to households and businesses and so help foster economic activity, the banks said in a statement.

Earlier on Wednesday, China had its own declaration that it is dropping its reserve requirement ratio for banks by 0.5% for the first time in nearly three years. The move reduces the amounts that banks must keep in reserve and frees up funds for lending, in effect easing monetary policy, a signal from China that it wants its economy to grow and it will accept more commodity imports. Both the coordinated central bank move and the Chinese move are bullish fundamental factors for stocks and commodity markets, including precious metals. Lets take a look at the general stock market chart below (charts courtesy by http://stockcharts.com.)

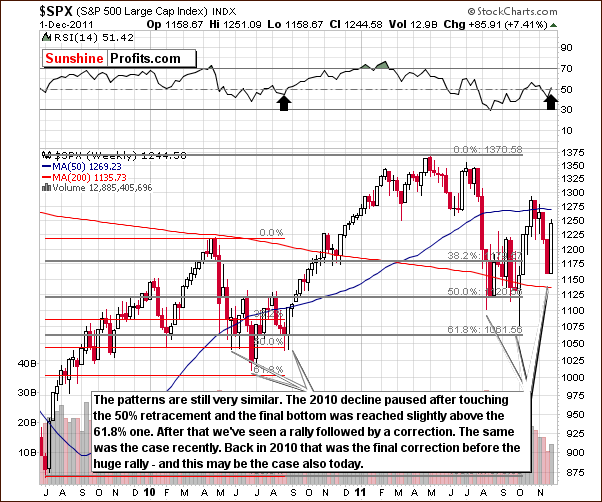

In the long-term S&P 500 Index chart, we see quite a different picture. The situation is very bullish and similar to what was seen in the middle of 2010. Two local bottoms at that time were followed by a rally and we now see a similar pattern developing.

Back in 2010 we saw another move lower before prices rallied. We cannot rule out a similar pattern this time. Even if this materializes, it will not invalidate the bullish case. This is precisely what seems to have taken place though probably invalidated by this weeks sharp rally.

The trend now is to the upside and this is confirmed by both: analysis of trading patterns and RSI levels. There is a strong analogy with stocks mid-2010 price action and if this continues, the S&P could move above 2011 highs and possibly to new all-time nominal highs. In either case, stock prices appear to be poised to move to the upside.

In the short-term SPY ETF, the next target level appears close to the 2011 high and even though this may not be the final top for this rally. It could in fact be an intermediate top with a period of consolidation possible once reached.

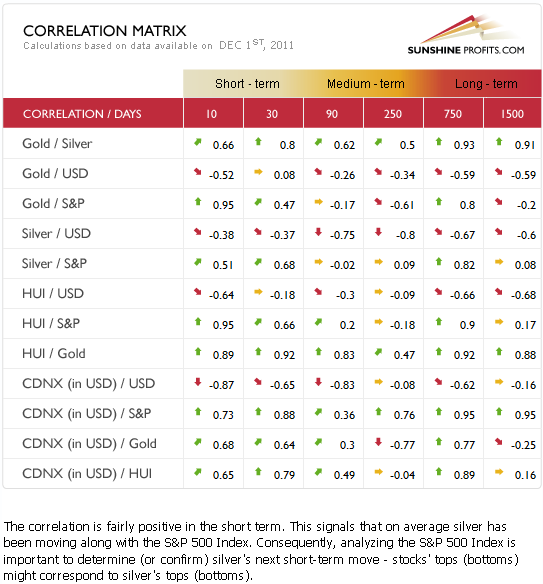

In the Correlation Matrix - a tool which allows us to see the impact of the currency and stock markets upon the precious metals - the implications overall are positive for precious metals. Stocks are positively correlated in the short term with the precious metals and the bullish outlook for stocks is therefore positive news for gold, silver and gold and silver mining stocks.

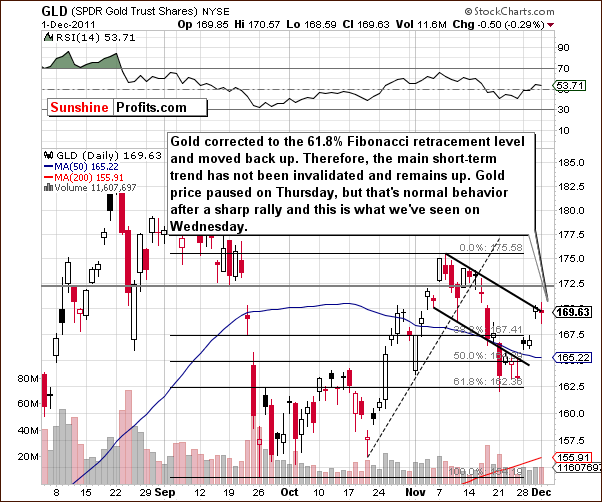

Meanwhile, in the short-term GLD ETF chart, we see that gold has corrected about 61.8% of its September to November rally. This appears to be a classic consolidation within an uptrend. Consolidations are necessary to cool emotions and to build a base to for a bigger move to the upside. Thursdays pause after Wednesdays huge rally is not a bearish sign but rather quite normal after a sharp upswing.

Summing up, numerous signals from analysis of charts this week indicate that the outlook is bullish for stocks. This could further support the bullish situation for gold in the short, medium and long term.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Precious metals are moving higher amid euro-related worries. The USD Index stopped its rally, but is this just a pause, or is it likely to move lower from here? Given the fact that the correlation coefficients for gold and USD are close to 0, would such a move have indeed a negative impact on precious metals? These are just one of the few things that we cover in today's Premium Update.

If you've been following our Premium Updates, then the sharp rally in the general stock market is not something that caught you by surprise. In today's issue we examine the structure of the move and see a self-similar pattern that provides us with exciting implications for gold, silver and mining stocks. In addition to the above analysis, we provide you with long- and short-term targets for gold and silver. We also provide you with the odds that the next target will be reached, analysis of the long-term silver cycles, miners' performance relative to gold and more.

Moreover, this week's Premium Update includes our up-to-date rankings of top junior mining companies. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.