Visit our archives for more gold & silver articles.

All eyes are on Greece which is heading toward national elections six weeks after the last vote. Many feel that a Greek euro exit would be a chance to cauterize a festering wound and move on. There are also those that feel that Greece could be the first of several dominoes to fall, much larger economies such as Spain, Italy, for example.

Meanwhile, Spain’s 10-year borrowing costs had hit as much as 6.5 per cent on Wednesday with the risk of the country paying astronomical prices to borrow in the future. Spain has now issued more than half of its total debt needed for this year, yet concerns that Madrid will struggle to meet its deficit reduction targets for this year and next have pushed therisk premium between German and Spanish 10-year bondsto the highest in the history of the single currency.

What is the most likely scenario if Greece exits the Eurozone? It isn’t pretty for Greece.

The Greek government (if one is formed soon) could legislate that all corporate and personal savings in Greek banks will be denominated in Drachma. The Drachma would swoon so that almost immediately Greek consumers will need more Drachmas to buy one Euro.

A run on the banks would be most likely followed by a run on the Drachma, with Greeks constantly converting their drachmas into Euros, or other currency. The drachma constantly plunging against foreign currencies could cause a new crisis of hyperinflation.

Of course, there are examples of other countries that have left what's effectively a common currency zone without suffering hyperinflation. A Greek exit could stimulate the same growth dynamic that's recharged Iceland and Argentina. Greece will once again become a cheap country, attracting tourism and with attractive exports.

Having briefly discussed the political and economic events, let’s move on to today's essay technical part. Before analyzing the recent developments in the mining stocks, let’s see what’s happening in the general stock market (charts courtesy by http://stockcharts.com.).

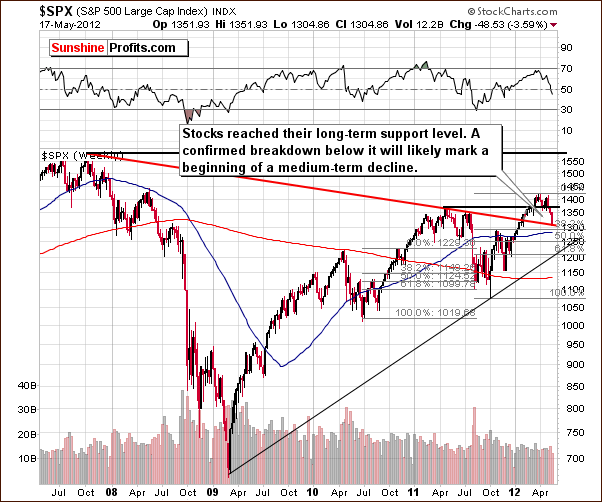

In the long-term S&P 500 Index chart, we see that prices moved lower this week and are at the long-term support line. Last week we wrote the following:

Taking a relative comparison to the similar rally that we saw in the second half of 2010 with the current price patterns, it seems quite possible that we could have simply seen a correction with a rally now to follow.

This is the long-term support line based on previous highs and if it holds the decline, higher prices could be seen for the short term.

If the support line is broken, however, significantly lower prices are likely. In other words, stocks would be expected to begin a medium-term decline. Since the support line was not broken so far, the above picture is bullish. However, the financial sector provides us with a very different signal.

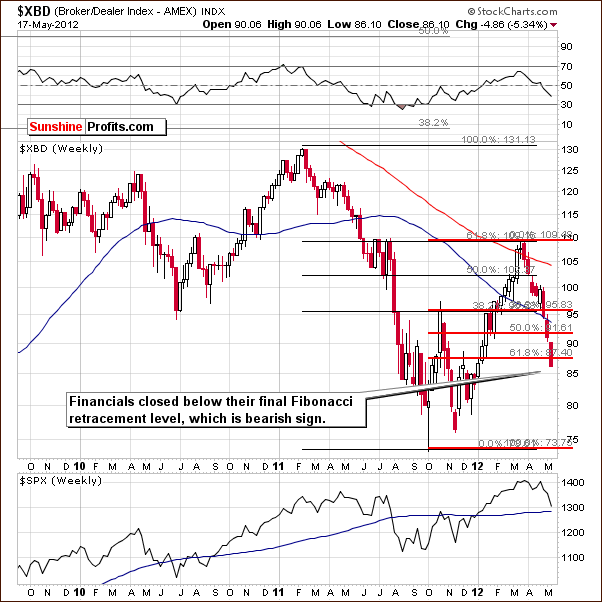

In the Broker Dealer Index chart (a proxy for the financial sector), we see that the financials are below the lowest Fibonacci retracement level based on the previous rally. Since they have broken below it, further weakness and additional moves to the downside appear likely.

So, all in all, the situation in the general stock market is rather mixed – a bounce or breakdown will tell us what type of medium-term move we should expect: a rally or a decline.

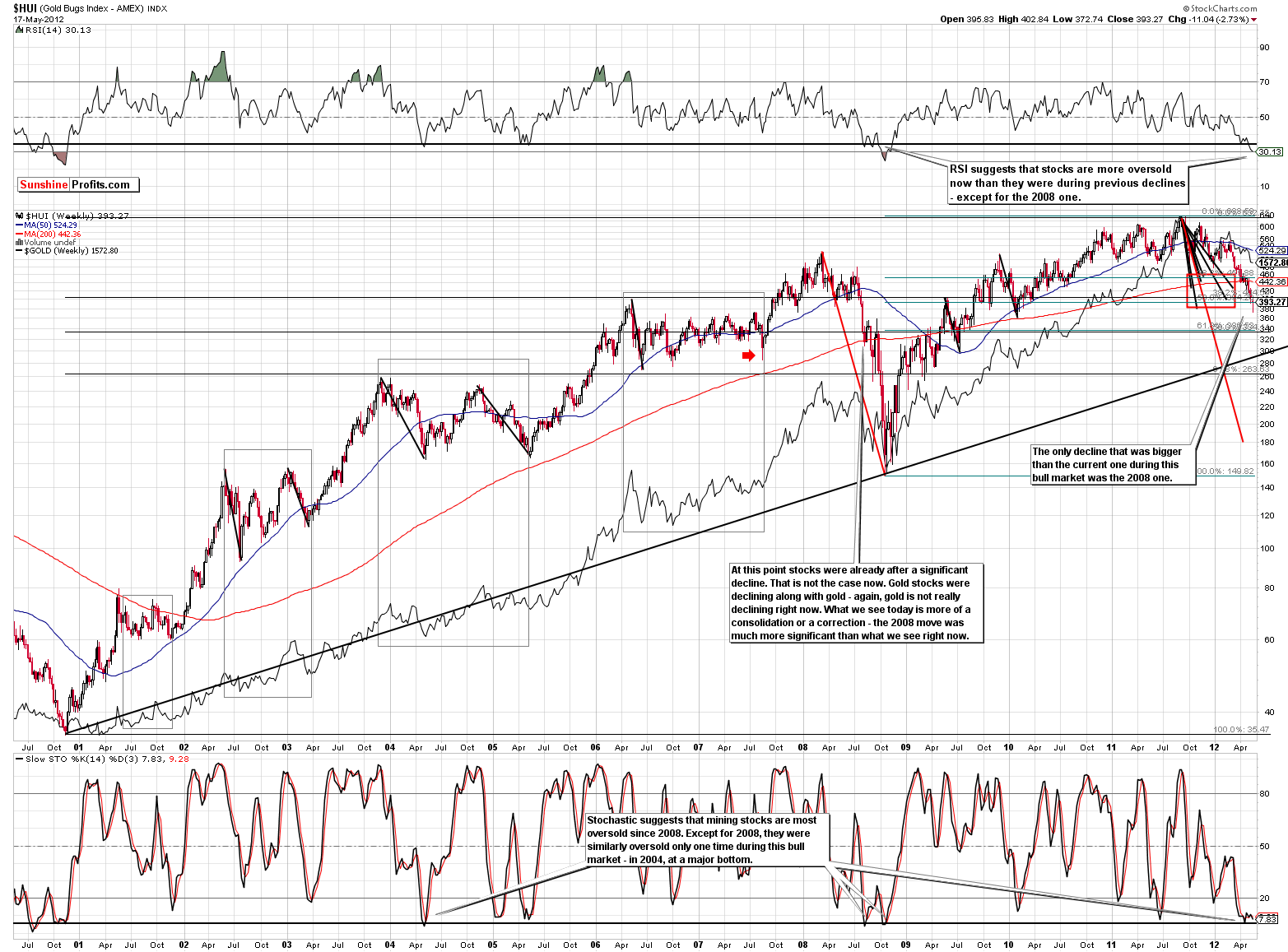

This is what makes the situation similar to what is seen in the HUI Index (proxy for gold stocks).

In this week’s long-term HUI Index chart (if you are reading this essay on sunshineprofits.com, you may click the above chart to enlarge), we see that the current decline has been more significant than previous ones. Only the decline of 2008 was greater. At this point we can no longer say that the current decline is very similar to other declines and that it’s not similar to the 2008 one. This is a bearish development and the RSI levels also suggest that a major decline might be underway. This is concerning, because once the RSI level moved below the thick horizontal line in the chart, downside momentum has increased in the past.

It now seems that after a sharp consolidation, further similarities to the 2008 decline may be seen. This is something which has become apparent only in the past few days. Based on the RSI level and the HUI confirmed move below the 395 level, the outlook here has changed considerably this week.

Summing up, the continuation of the decline in the general stock market appears unlikely based on the long-term support line. However, since we have bearish signals from the financial sector, the situation is mixed for stocks and there are no specific implications for the precious metals sector at this time. The situation in mining stocks is mixed as well (even though miners bounced on Thursday and Friday) as the recent decline make a repeat of 2008 more probable than was the case previously. More details (and comments on this week's breakdowns) are available to our subscribers.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

This is definitely one of the more important weeks of 2012 - at least for precious metals investors and traders. Today's large Premium Update includes our latest comments on the recent breakdown in gold, silver and mining stocks and the subsequent move higher. We tell you what we view as the best approach to this critical situation from both: investment and speculative points of view. We have once again received a lot of questions and today's issue includes a near-record number of replies. Among other things it includes the analysis of following issues:

- The political situation in Greece

- Long- and medium-term USD picture

- The Euro Index

- S&P 500 Index

- DIA ETF

- The financial sector

- Crude oil price

- Precious metals correlations

- Long-term silver chart (RSI)

- Silver:gold ratio (breakdown?)

- Long-term gold price chart (RSI)

- Short-term GLD ETF price chart

- Gold:bonds ratio

- Non-USD gold price

- Gold priced in the Japanese yen

- Long-term HUI Index chart (is the repeat of 2008 still unlikely?)

- TSX Venture Index

- Fundamental vs. technical aspects of mining stock investments

- Technical indicators' efficiency

- Sep-Dec 2011 and today similarity

- Position sizing

- 400-day moving average

- Contrarian sentiment analysis

- Black Swans

- Technical and fundamental valuations

- Hedging details

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.