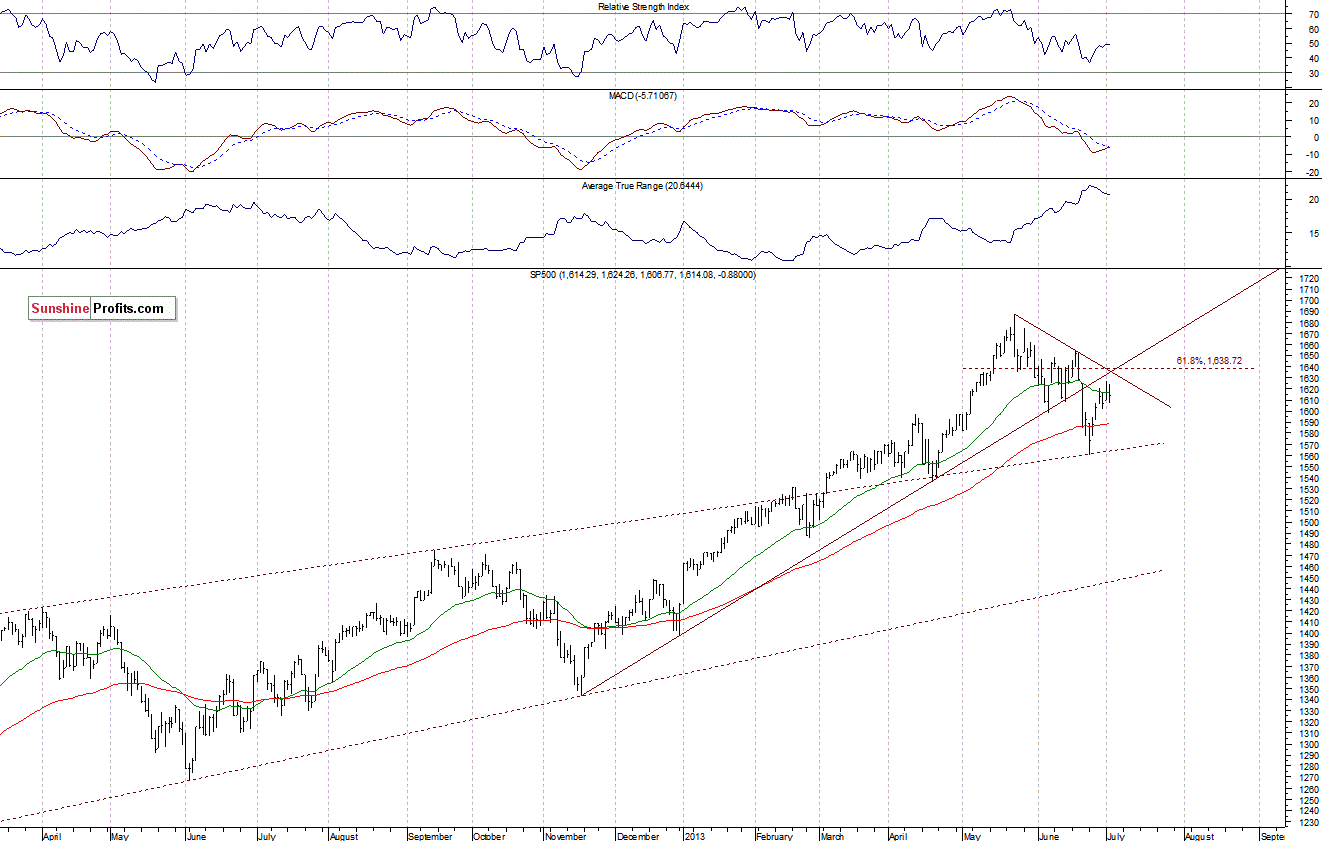

The main U.S. stock market indexes closed virtually flat yesterday, remaining in the short-term consolidation. The market practically did not change its position for a few days, as the beginning of the third quarter is marked by fluctuations in the area of the recent local peaks. The S&P500 index rebounded after a decline caused by the Fed Chairman’s comments last month on possible monetary policy changes. The rebound reached slightly above the 50% retracement level of the May-June sell-off (Monday’s session’s high at 1,626.61 vs. the retracement level at 1,623.76) and stopped at the previously broken November-May upward trend-line, as we can see on the daily chart:

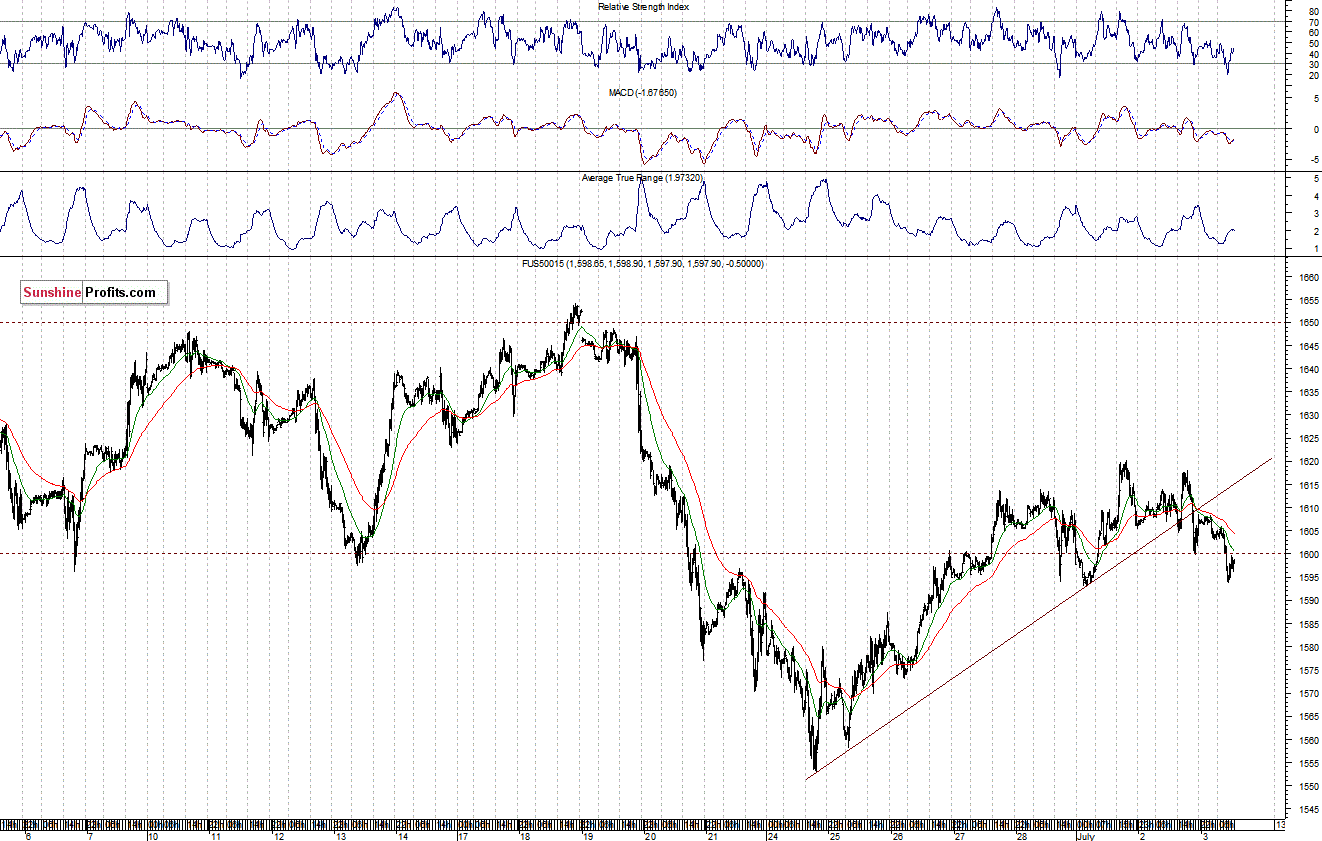

The U.S. stock market is expected to open lower this morning due to the sell-off on the European markets, caused by the fears of a political crisis in Portugal and turmoil in Egypt. It is worth mentioning that the stock market will close at 1 p.m. today, because of the July 4 holiday. In the short-term the S&P500 futures contract (CFD) extends the consolidation around the 1,600 level. It is testing the support at 1,595-1,600, after falling below the recent upward trend line. The resistance remains at around 1,620 (the consolidation’s upper limit). The 15-minute chart shows further uncertainty:

Thank you.

Paul Rejczak

Back