Based on the August 26th, 2011 Premium Update. Visit our archives for more gold & silver articles.

To quote Charles Dickens, this week was the best of times, it was the worst of times.

This week Quaddafi was finally cast out, Dominique Strauss Kahn was cleared, Japans credit rating was cut, Washington quaked and everyone waited with bated breath for the words from Jackson Hole, WY.

Oh, and we forgot to mention, gold skyrocketed to $1900 at the beginning of the week and then plunged in one of its worst days Wednesday when gold prices tumbled a whopping $95.80, or 5.1%, to settle at $1,765.50 an ounce -- the lowest level in a week. To keep things in proportion-- gold started the year just above $1,400 an ounce.

Also this week SPDR Gold Trust's total assets surpassed that of the SPDR S&P 500 ETF, making GLD the largest exchange-traded fund in the world for the first time. But also to keep things in proportion, the assets of the Gold Trust ETF are still trivial compared to the trillions held in equities and bonds. Four times as much money is held in Apple (AAPL) stock alone. Naturally, there are many other ways to own gold, but in general, this means that not that many people own gold despite all the hoopla.

The Federal Reserve is holding its annual symposium in Jackson Hole, WY, this weekend and all eyes are on Federal Reserve Chairman Ben Bernanke when he addresses the group today. It was at last years meeting that Bernanke hinted the Fed would start another round of asset purchases to stimulate the economy and about three months later the Fed announced the $600 billion bonds purchases, later dubbed QEII. And that, folks, was one of the contributing factors for gold hitting $1900 this week.

But it doesnt really matter to gold what Ben Bernanke will say. If there's QE3, gold should go up in the long term. And if there's no QE3, gold still will go up. The higher inflation and weaker dollar that QE3 would likely cause would be positive for gold, which is known as an inflation hedge. No QE3 would mean a zero-rate policy may continue for more than a while (even longer than they already pledged), which is an ideal environment for gold to grow. A new round of quantitative easing is not likely to be met with approval from the emerging world, particularly China, or other large holders of U.S. Treasuries and U.S. dollar-denominated assets.

No matter what is said in Jackson Hole, there is no doubt that the US economy is in a deep hole. The uncertainty surrounding the U.S. deficit-reduction debate has fueled concern about a U.S. default, potential destruction of the U.S. dollar along with fears of a global recession or depression.

Those that argue that gold is overvalued from a long-term perspective are not looking at the right numbers. They ought to be looking at Europe's banks and at the amount of short-term obligations that are sitting on the U.S. Treasury's books.

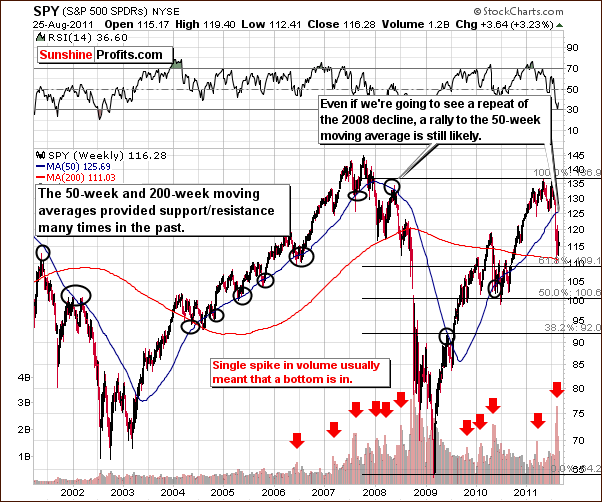

Having considered the points made above, its no wonder that the mood among stock investors is pretty grim. This is precisely why we will begin this week's technical part with the analysis of the stock market. We will start with the very long-term SPY chart (charts courtesy by http://stockcharts.com.)

In the chart, we see a local top signal from analysis of both volume and Fibonacci retracement levels. In addition, there are two reliable (with proven track record as seen above) support and resistance factors in play: the 50-week and 200-week moving averages.

The SPY ETF just touched the 200-week moving average and a rally from here is likely. At this point we do not expect the 2008 plunge to repeat. However, even if that is going to be the case, then we would still likely see prices move higher - perhaps towards the 50-week moving average before the decline continues.

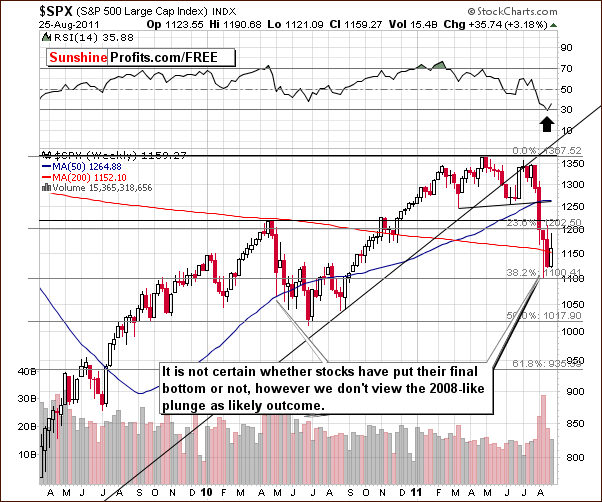

In the S&P 500 Index chart this week, we have seen a decline to and a possible bottom at the 38.2% Fibonacci retracement level. This has been confirmed by the RSI indicator. Although we could still see a sideways trading pattern, the size and rapidness of the recent decline leads us to believe a bigger rally from here is more likely than not in the coming weeks.

You would probably also want to notice that the current situation is very much in line with our previous remarks on gold and the stock market, made on August 19th in our Free Commentary:

As far as the general stock market is concerned, ( ) the decline in stocks was quite volatile but did not necessarily change the overall outlook. It still seems that the weeks ahead could very well be bullish for stocks although this upturn may not be seen immediately. At this point it seems extremely important to keep track of the general stock market as its significantly correlated with precious metals. Any rally in stocks ( ) would most likely result in lower prices for gold, silver and mining stocks.

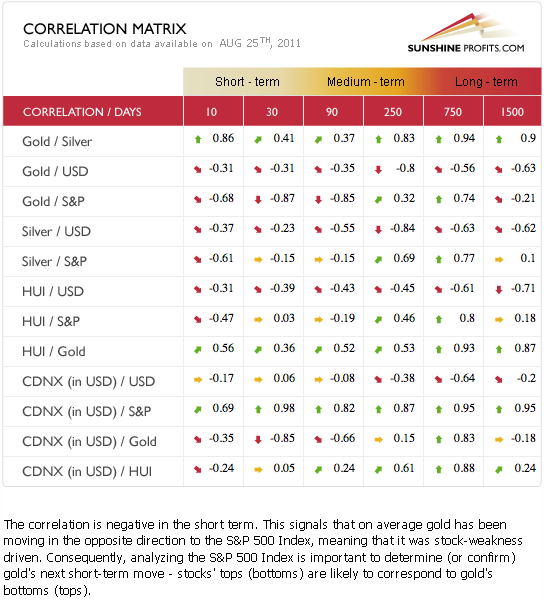

To check whether the correlation between precious metals and the stock market actually remains stable, lets have a glance at this weeks Correlation Matrix.

We see that a move higher for the general stock market would likely have a negative effect upon the precious metals sector and especially upon gold. Lower gold prices would likely be followed by lower silver prices, not because of the general stock market rally, but because of golds price decline. This would likely impact gold and silver mining stocks as well. Overall, the precious metals stocks link has changed very little recently from a correlation perspective.

Summing up, although stocks could move either way from here, it is more likely that higher prices will be seen in the short term. The direction of the market beyond this timeframe is uncertain. Based on the persistent negative correlation between the stock market and precious metals the expected short-term rally in stocks would likely have a negative impact on gold and silver.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

This week's extreme volatility made us send a smaller update on Monday and a Market Alert on Wednesday. Today's Premium Update includes not only much more in-depth analysis of gold's decline (detailed discussion of downside targets), but also a follow-up on our Monday update that was dedicated to silver.

Speaking of silver, today's report features two very long-term silver charts and one of them illustrates our next long-term targets for the white metal. There's a relationship that allowed estimating (with a significant precision) all previous major tops in silver and in today's issue we use the same method to project the following ones.

Additionally, we comment on the particularly interesting price pattern in gold stocks that appears to be in play right now and we provide targets for silver and gold stocks.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.