Visit our archives for more gold & silver articles.

The reasons for the gold’s decline given in the press were a case of “round up the usual suspects.”

There were concerns that China’s economy is slowing and that European leaders may fail to stem the debt crisis. As expected, the new French President Francois Hollande challenged Germany’s deficit-cutting stance. The euro hit a near two-year low against the dollar on Thursday after dismal German economic data suggested that no country in Europe is immune from crisis. The German data for May suggested the growth in Europe's economic engine that has so far helped the currency bloc dodge recession, may be starting to slow. Last week euro dropped sharply to $1.2515, its lowest level almost two years. All that boosted the dollar driving the greenback to the highest since Sept. 13, 2010, against a six-currency basket.

It is likely that the confidence in the U.S. dollar will turn out to be medium-term-lived. It won’t be too long before the people will turn to the tried and true source of true wealth preservation—gold. Global economic turmoil is likely to continue over the next few years as we lurch from one economic crisis to the next and gold will be the beneficiary of this. We have no doubt for the long term. Those who invest in gold for long-term wealth preservation don’t feel the bumps as much along the way.

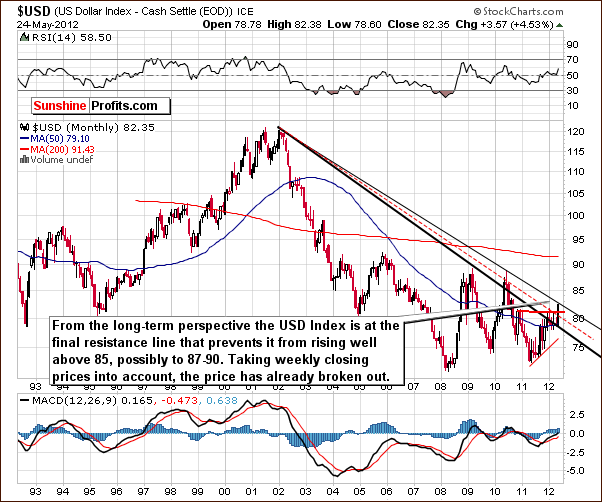

However, things may turn out differently in the medium term (several weeks to several months). Let's begin today’s technical part with the analysis of the US Dollar Index’s very long-term chart (charts courtesy by http://stockcharts.com.)

The index has rallied in spectacular fashion for the past few weeks and the move is clearly visible even from the very long-term perspective. Three resistance lines have been surpassed and the index is currently at its last one based on intra-day highs. Once broken, if the breakout above the 82.5 level is confirmed, much higher values will likely be in the cards. A move to 87-90 would not be surprising in this case.

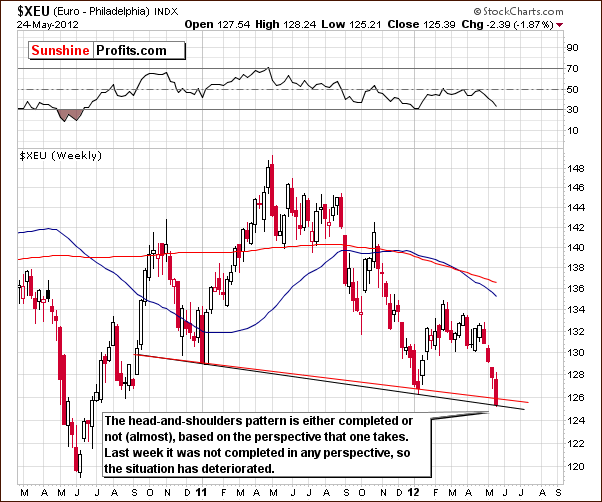

Now, let’s see how Euro did last week.

The euro decline is quite likely responsible for most of the positive upswing seen in the USD Index. If the breakdown is seen here - below the black neck line of the head-and-shoulders formation - if we see the index close below this line for three consecutive days, the Euro Index will likely move much lower and the dollar much higher.

In fact, we have already seen a breakdown in the euro based on weekly closing prices (red line) and this is being verified right now. Whether or not the breakdown is in is a bit unclear, but the situation in the Euro Index has surely deteriorated last week.

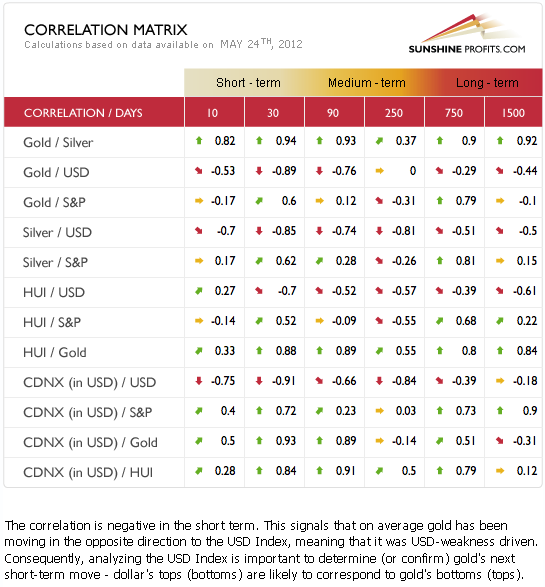

To finish off today’s essay let’s have a glance at our in-house developed tool that traces the intermarket dependencies.

The Correlation Matrix is a tool which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector. Last week, the coefficients were classic as gold and stocks were positively correlated and gold was negatively correlated with the dollar.

A key factor this last week was how moves in the USD Index were immediately reflected in gold’s price. It appears to be very important at this time to watch any move in the dollar and act accordingly. Based on the short-term trend, the USD Index seems likely to be headed above 82.5 even if it has to temporarily correct first (please note that there can be no such correction before the breakout). Lower precious metal prices will probably be seen following such a move.

Summing up, all-in-all, the medium-term picture appears quite bullish for the dollar and bearish for the euro. If the breakout above 82.5 in USD Index is confirmed, a more powerful rally in it and a decline in gold will likely follow. The latest Premium Update includes our detailed analysis of gold, silver and mining stocks along with price targets and suggested actions for investors and traders. We encourage you to read the full version of this essay.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading.

P. Radomski

Back