Based on the January 25th, 2013 Premium Update. Visit our archives for more gold & silver articles.

In our updates we regularly reply to that we receive from our subscribers. The question that we received this week along with our reply provides a good introduction to more detailed analysis of the precious metals mining stock charts.

Q: Back in early November of last year, with gold at 1685 and the Dow at 13,100, GDX was at 50. Compared to today, GDX has to gain $5 just to return to that status, where miners were already beaten down.

With long-term investments, I am now just about where I was in late 2009. If gold returns to the lower 1600's, miners could take years to recover, assuming the bull market is not over. Worse, stocks are pushing historic highs. A correction now, and any decline in gold will decimate miners. And that could come any day. Please comment.

A: Generally, if you look at miners' performance in another timeframe, they don't look that bad, they look average. A lot happened in 2009, especially in terms of mining stocks and depending on which month you take into account, your portfolio might be up, down or unchanged from 2009 given that you focused on mining stocks.

In general, we're with you regarding how it feels. We think that there are very few people who are happy with their performance - maybe JP Morgan and others shorting the metals. We'll see. The corrections are supposed to make people discouraged. If they have managed to do that, they might just be over. About 30 years ago gold had to correct much more than it has so far before it really rallied. Perhaps this time the time factor was enough to cool everything down. And the fact that we haven't seen a decline similar to the pre-79-80 spike is because the fundamentals (especially the money supply) are much better this time. This would imply that the real high of 1980 will very likely be exceeded. Generally, the more we think about how big the correction is (combined with positive fundamental situation), the more confident we become that the precious metals market is the place to be.

There are over 20 detailed charts in the Update on which this article is based on and in this essay we would like to feature 2 of them â as the title of this essay suggested, they are indeed encouraging (charts courtesy of http://stockcharts.com.)

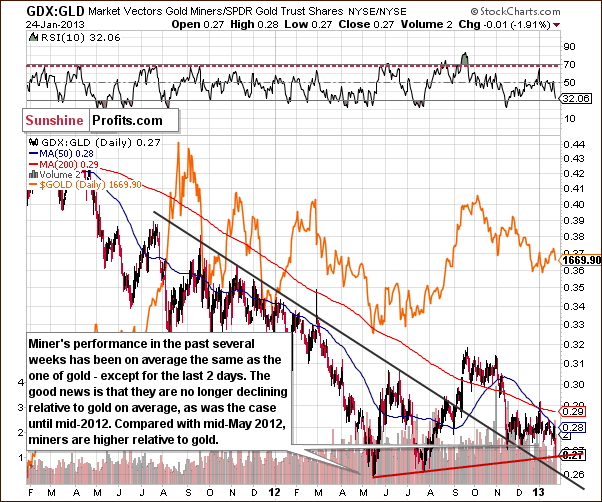

The first one features the miners to gold ratio chart. On this chart we see that the ratio hit the support line after declining significantly (actually, it moved to the lower, declining support line on Friday). The RSI level was close to 30 on Thursday and moved decisively below this level on Friday - thus flashing a buy signal.

The mining stocks have been underperforming recently on a daily and weekly basis but for the past half year or so not so badly. They performed strongly last fall and all-in-all, the situation is not as bad as at first sight. It's not good, but it's not extremely bad either.

The above chart features the miners to other stocks ratio. The volume seen is not the volume of the ratio - there is no such thing - but it's ratio of volumes (GDX ETF : SPY ETF). Here, the RSI level also flashed a buy signal based on Thursday's decline. In other words, miners underperformed other equities so badly that the situation has become extreme.

We saw a significant decline in the ratio and a high ratio of volumes between the miners and other stocks. It's possible that a local bottom has been reached on Friday.

Summing up, the situation in the gold and silver stocks sector is truly not as bad as it appears at first glance especially when combined with the bullish outlook for stocks and the bearish situation in the USD Index.

The short-term analysis, individually tailored gold stocks ranking, silver stock ranking and direct buy and sell signals are available via Premium Updates and daily Market Alerts. Become our subscriber today - we just saw a signal from one of our unique SP Indicators - you can track them with a weekly delay but with this kind of volatility, you will likely miss a large part of the move if you wait that long with taking action. That's why we encourage you to sign up today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA