Based on the November 4th, 2011 Premium Update. Visit our archives for more gold & silver articles.

Is Greece the canary in the coal mine? Less than a week after European leaders crossed the Ts and dotted the Is on the debt-restructuring plan for Greece, the prime minister's ruling party called for a surprise referendum on the E.U. debt deal. Then on Thursday he called it off. Sovereign debt and fiat currencies are all paper.

All that is happening only heightens talk about gold as money. But first, lets have a definition of money, it being a subject that interests almost everyone on the planet. Like Voltaire said: When its a question of money everyone is of the same religion.

Wikipedia defines money as: Anything that is generally accepted in payment for goods and services and in repayment of debts. The main uses of money are as a medium of exchange, a unit of account, and a store of value.

No other commodity has been as universally valued over time and across as many societies as gold and silver. There is an emotional and cultural attachment to it handed down to us through the generations. It is undoubtedly a store of value, it is a unit of account, but is it used as a medium of exchange?

Not really, other than in Utah which took steps recently toward making gold legal tender. Other states have proposed similar measures. But people today are completely unfamiliar with the use of gold as money since everyone uses paper money or bank credit money, such as checks and credit cards.

According to the Austrian economist Carl Menger, its acceptability in trade is the defining property for money and gold does not fit that criteria. According to Menger, while money undoubtedly does serve as a store of value and a unit of account, these properties are derivative, not definitional properties. The reason that a medium of exchange (money) necessarily is also a store of value is the anticipation of its exchange value in the future. The question of whether any particular good is money, can be articulated thus: Is it accepted as the final means of payment for transactions?

At present almost all the nations have their own fiat money or else they belong to a currency union such as the European Union. Some nations use the US dollar. Hardly anywhere do we see gold accepted as a means of payment. So gold must fail the definitional test of being money.

So gold is not really money anymore (not yet?), but keep in mind that it does have most of the desirable properties of money. It is durable, portable and easily divisible into bars and coins that share uniform properties. It is easily recognizable. Gold's value and purchasing power are stable over time, as its supply grows slowly and it cannot be created ad infinitum as fiat paper currency can be.

For nearly three thousand years since the first gold coins were struck in Lydia in 700 BC, Gold's primary use has been recognized as a medium of exchange. The history of gold as money in coin form spans 2630 years, from 700 BC to about 1930 AD. In comparison, the history of paper and base metal and silver coin in circulation spans only about 40 years, from 1930 to 1970. And the history of paper and base metal coin with no connection to Gold or silver, also spans a period now approaching 40 years - from 1970 until today.

So its 2, 630 years of history for gold as money versus about 40 years for fiat currencies not tethered to gold.

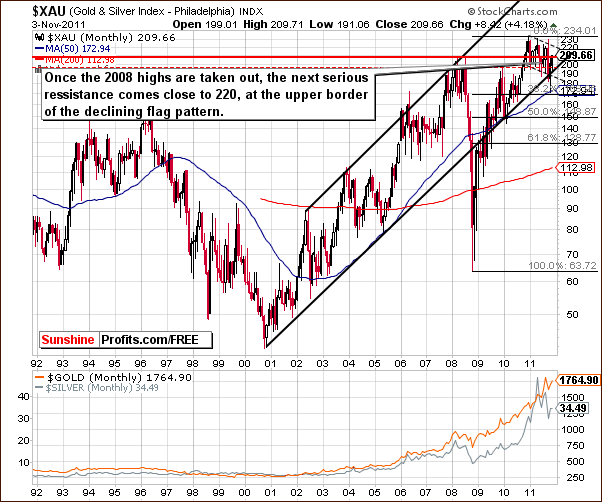

Leaving history alone, lets see how the situation looks in the precious metals market this week. Well begin the technical part of this essay with the analysis of mining stocks. We will start with the very long-term XAU chart (charts courtesy by http://stockcharts.com.)

In the very long-term XAU gold and silver miners index chart, we see that index levels are once again trying to move above their 2008 highs. Once this is accomplished, the next stop appears to be considerably higher, and an upside target levels of 220 and 230 (previous highs) seems reasonable. We have a bullish situation at hand.

In the long-term HUI Index chart, the outlook is also bullish. Its important to note that the RSI level here is still not yet in the overbought range. In the past, tops have previously formed when the RSI level was close to 70. This is not the case today, and although price corrections along the way have been significant, the time that it took was pretty insignificant.

Gold stocks are now close to the 600 level and once this is taken out will likely approach 640. This is the trading range of the September highs and could very well be reached again. The situation here remains bullish at this time.

In the short-term GDX ETF chart, we have seen a breakout which has not yet been confirmed. Based on this factor alone, the situation is only slightly bullish. However, other factors mentioned earlier (XAU and HUI charts) suggest that a move higher is more likely than not. The next target is at the $67 level - at the previous highs.

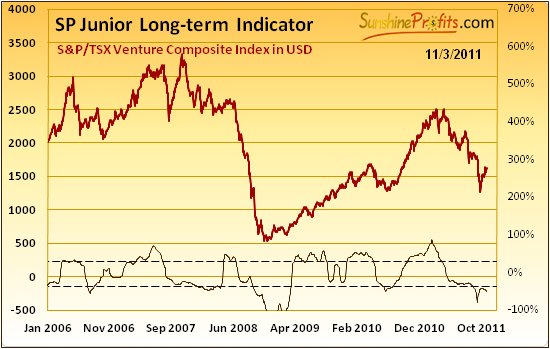

As far as analysis of the junior mining stocks is concerned, we take the long-term approach, so in most cases we review it on a monthly basis. While we will leave our stock picks to our subscribers, we would like to provide you with a quick overview of the whole sector. We will use the TSX Venture index as a proxy for the junior sector.

Over a month ago, our SP Long-term Junior Indicator had flashed a buy signal which suggested moving back to the junior sector, and so far it appears to have been a profitable move.

The above indicator flashes a buy signal when it moves below the lower dashed line and starts to rise and it flashes a sell signal when the indicator is above the upper dashed line and starts to decline. In this case, weve seen the former and it the outlook for juniors is bullish.

As you see, the outlook for juniors reinforces the outlook for senior mining stocks. This is also in line with our outlook on precious metals themselves. The latter was reflected in our latest essay on precious metals and the stock market. In that essay, we wrote the following:

As of now, we are still inclined to think that in the very-short term a move up in gold is more possible than not. This obviously doesnt alter our long-term bullish outlook in any way.

(...) the analysis of long-term interest rates and of the general stock market suggests possible higher prices across the PM sector in the immediate (!) term.

The situation was bullish last week and continues to be so today. At present, this is also backed up by the developments in miners.

Summing up, the gold and silver mining stocks appear poised to move higher across the board. This is additionally confirmed by the information coming from the junior market.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

While the previous Premium Update could have been called the Target Update, today's name should be Golden Update as it includes so many (8) gold charts. Plus, it's loaded with targets anyway. In addition to providing "how high could gold and silver go" details, we arm you with targets for XAU, HUI, GDX, S&P 500 and the USD Index.

In addition to the in-depth discussion of the situation on the above-mentioned markets, today's big (over 5000 words) issue includes the analysis of the financial sector, gold as money, precious metals correlations, miners' performance relative to gold, SP Junior Long-term Indicator, the situation in Greece, the diamond market and more.

Moreover, this week's Premium Update includes our up-to-date top gold & silver junior rankings. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.