The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold & silver articles.

The gold prices have been soaring up dramatically and the upsurge is on an all time high. The reasons behind it can be documented in the size of an encyclopedia, but what's important to consider at this stage is that investors, speculators or anyone with money in once hand and wanting to make profits with the other is now shifting all the resources towards the yellow metal. And as a consequence everyone is trying to learn, understand, apply and cash upon anything related to yellow metal. Being the less volatile and still the safest hedge, Yellow metal is dominating the entire precious metal range big time.

Yellow Fever:

This growing interest of all sectors i.e. general public, corporations and with economies have brought gold into limelight and its performance has since improved consequently. Through the 90s when the economic bubble was building up to be busted later, Gold was considered a slow yet steady mover. But it is the same stable movement that has brought gold the reputation which remains unharmed against the market threats- the verifiable inherent intrinsic worth. That means the current prices of gold are not a bubble and therefore it cannot be busted overnight or over the years. In fact if we look at it closely and study, then it is practically impossible now to bring gold down in the long term equilibrium. The contrary is only possible if all the great economies of the world such as BRIC collapse simultaneously, stop trading; population stop working which is practically impossible except if in case the World War 3 is triggered. Only in that condition it would be possible to suffocate the system beyond measure and subsequently the GDP of the world gets affected. Still, in that scenario, gold is likely to move much higher in the short run because of the safe-haven effect.

Ulterior Motive:

Economists claim that the manipulation of dollar and abolishment of Bretton Woods System was all part of a political movement to accumulate gold while diverting the attention of general investment markets. The promotion of dollar as a tool for trading and reserve was part of the bigger plan to control the gold reserves all over the world. The policy was simple calling gold ‘timid' and stocking it instead.

John Embry- Chief Investment Strategist at Spot Asset Management says,

I think there are some very smart people who say one thing and are doing another, because these are the people who have manipulated gold prices and they are very smart people.

He further adds,

We are speculating on how much gold the Americans actually do own today, I mean officially the reserve today is 8134 tonnes; if they got half of that I'd be surprised, I think it might be considerably less than that it has been swapped over 15 year period.

Inflation-proof Metal:

But what is that something special about this yellow metal that has kept it evergreen. Any artificially manipulated economic move on mass scale reflects as the increase in gold prices.

During the first stage of the current bull market, it was the case that gold's rise was visible only in the US dollar. In fact many economists still understand when we say that it's not gold that's "up", it's actually in reality the dollar going "down". The situation is rooted back in 1971 when Nixon tried to manufacture a new economic order under the power of Dollar. Ever since then, everything is under tremendous stress and pressure, which finally boiled down to the meltdown of 2008. It is actually the politicians continuously debasing the US currency that is working towards the benefits of those who had invested in gold. It's like offering someone the ninth slice out of the 8 slices in the pizza; the US dollar is left with no cushion to uplift the economy. As a consequence against the pledges they had made, there was only deficit that they could post on annual budgets. On the other hand they keep other spending off-budget so that they can use a little global inflation as an escape goat to make up for their created loopholes.

At this point not only US politicians work in favor of gold investors - it's been the case with many government-related authorities all over the world try to help their citizens by debasing their own currency.

Barren Purchasing Power:

The power of purchase has been severely tarnished from both ends of the economic policy i.e. the fiscal as well as monetary end. On one hand the treasury issues- bills, notes and bonds and on the other end of the spectrum Federal Reserve continuously prints money to make up for the deficits. It's like a double trouble printed on the both sides of the coins. The bond issued by treasury is exactly equal to $1000 printed by Fed (not taking time value into account here), but the most interesting thing is both instruments are bidding for the non-existent ninth slice of pizza.

Political Face of Economics:

There is a higher hierarchy of personal gains dominating the international politics, even on the domestic domain the political aims and agenda crosses over in such an undignified pattern that it is useless to tame or temper with it.

You seem like a good guy why do you want to enter politics?

That was the most frequently asked question, when Barack Obama was promoting his presidential campaign. This is the widespread perception of people in America, and don't forget perception is always manifolds bigger than reality. Bottom line remains politicians can't change, it's their habit to promise and not deliver. It's their world wide track record not just confined to USA. Therefore the only way out is to secure yourself The Ron Paul Way through the world wide reach of Yellow metal or its stocks.

Control Your Finances:

As your custodian, consultants or analysts we believe it is in our best interest to inform you and keep you updated and abreast with the latest economic information whether in any speculative or investment category. Knowing the above-mentioned political hotch- potch is only fruitful when you use and apply it for your own advantage, benefit and well-being. That's our job to inform you in a timely manner so that you get prepared in advance and use it for your profits in gold.

You must invest in "hard assets" to protect yourself from the tarnished power of purchase in US dollar or any other currency. Rest-assured one thing we know and is a recognized fact that the supply of these hard assets are far too limited as compared to the outrageously in-print T-bills or Dollars. And so does the law of demand and supply, at low supply, price is bound to soar.

One thing's for sure that all hard assets are safely profitable in long-term equilibrium whereas gold in comparison to all such assets (such as real estate, collectibles, rare art or other mode of investment) is extremely liquid and easily penetrable worldwide.

After you're sold on the idea of gold, gold and only gold; we must now equip you with the valuable insight of the gold stock and its potential.

Gold Coins-Bullion & Numismatic:

Some people like to begin with the gold coins. Gold coins are easy and solid investment, but one has to understand that there are two categories in it. The bullion coins are the more famous and easily available of the two, are priced based on their gold content. Whereas the other normally known as the numismatic coins, are based on their rarity and therefore are priced slightly higher; both the categories have their corresponding pros and cons. The bullion coins though have bigger market based on its buy/sell ability. The one ounce coins are high in demand and turnover because of its low premium and discount features and as a starter these categories like the American Gold Eagle, the Canadian Gold Maple Leaf, and the South African Krugerrand, suit most of those who like to enter the world of gold investments with minimum risk.

Cost Effectiveness:

We must not ignore the fact that this actual physical possession and exchange add a lot of terminal cost that can decrease your profit ratio. So in order to avoid the dealer markup, shipping, and possible sales tax and moreover dealing with coin storage and insurance makes it really hectic - still, one definitely worth enduring because of the safety that physical possession ensures, if you are thinking of buying gold for the long run (for over a year.) Buying shares of one of several Gold ETFs is a good alternative in this scenario, but only if you are willing to trade the metals market, the main reason behind it being low commission.

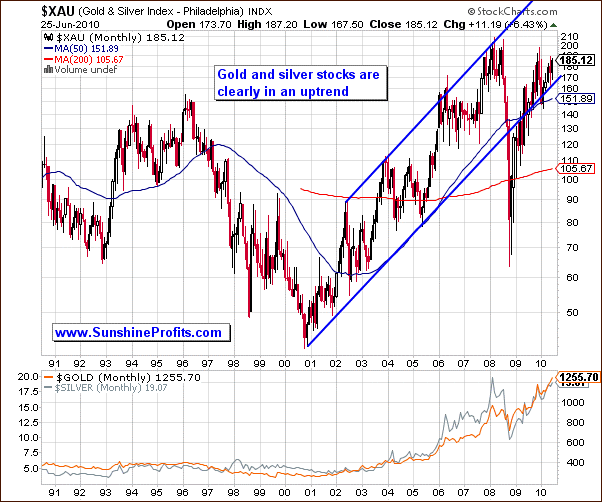

Gold mining stocks is one of the highly sought after gold instrument. The most vital fact is that the current production automatically acquires profits with upsurge of the Gold price, in other words justifying a higher stock price. Secondly, the reserves that are yet to be mined and still in ground automatically gain worth as a counter effect of gold price increase. Most miners often have reserves ten times of the annual production rate; so likewise it becomes more stable, steady and easier to continue posting profits based on its consistent maneuvering when gold prices are increasing.

This might be a sound a bit too mouth watering based on the mechanics we discussed, but dependent on various features, you need to have a successful combination of various gold stocks in your portfolio so that you can balance damage control, in case there are corrections happening at haphazard patterns. This needs lot of case studies, implicative improvisation, and of course market intuition, which can be played upon but cannot be proven through vital indicators and economic dynamics.

The gold stocks generally perform better than gold in a bull market - during its first two stages. But the big question remains which gold stocks to choose from? There are fundamentally two stock groups, which are categorized on the basis of their mining dynamics. The first is known as the Explorers of which there are almost 1000 publicly owned companies. The second are the Producers, of which around 50 companies trade in the North American Stock Markets.

Mining is a highly specialized and scientific task, it needs proper evaluation and assimilation by a third party who can attest the value of reserves or resources under the ground. Producers or Near-Producers are often a safe investment for you because they are backed by a third party authentication of engineering firms. Just like auditor reports bear a strong importance in eyes of the stockholders so does these engineers authentication and feedback is highly regarded to evaluate their gold stock prices.

These near-Producers have taken a deposit through bank feasibility stage. An independent engineering firm's analysis sheds light on two aspects. Drill holes (in the mine) are close-enough spaced to justify the surety about the ore grades in-between the holes and thus qualifies for Proven and Probable called P+P classification. The capital investment required to initiate mining procedures to begin on site production will yield a profit or strategic monetary return. After that as we mentioned earlier the independent engineering will guarantee the deposit's economics, which is also a pre-requisite that the US SEC needs for a miner to be able to call its ounces in the ground, P+P Reserves.

Another cited reason to promote US dollar after abolishment of Bretton Woods System and promotion of stock markets was to drift a common man's interest from gold. For centuries chemists were conducting research to create chemical gold. The quest for treasures and mining all over the world was hindering the path of those who pushed to substitute gold and gold stocks mining with Dollar and general stocks. But the intrinsic inherent value pattern of gold is such that it is still the true exhibit of value until today and since thousands of years. Ironically the supply being limited and people hoarding it up from all over the globe it is geared to gain its worth manifolds. Peter Schiff's forecast of $5000 per ounce may sound like a far-fetched reality but the economic stability and strength gold draws from the setbacks of other commodities and various trade deficits coupled up with its limited supply ensures that it may hit anywhere close to $5000 as soon as the next chaos of hyperinflation sets in.

Gold stocks and its brands: Gold stocks although are all gold but they still provide you wonderful flexibility to encash the variant speculative features, happening as a result of their diversifications. Content wise it's all the same but it is the geo-political position, production costs and national economy of the country (where the mine is located) dictates the price. But like most stock markets, the valuation is never accurate and that's where the investor and speculator churn their profits. For example Agnico-Eagles's just under 16 million ounces of P+P Reserves, each be valued ten times higher than those of Crystallex? With both having new mines in Mexico, why are Gammon's 5 million ounces valued at $100/oz above those of Minefinders?

This is where the inefficiency (of stock markets evaluation) can help in making profits, infact a combination of various gold stocks is always good to cross hedge and make-up for losses in the shorter as well as longer run.

Compiling the entire argument, we must encourage investors to probe more into gold, whether for gold or gold stock. Gold stock evaluations are filled with inconsistencies and that's where the profits have always belonged. Inaccuracy of valuations leads to precision of profits. One man's loss is the other man's gain. Keep a keen eye on the various gold stocks and just as we suggested try to profit from the diversified natures of various precious metals. We advise a combination of various gold stocks can really be beneficial for your consistent profitability. Of course, not everyone should own the same combination of gold stocks, as every Investor has different risk preferences and different investment horizons. This is why we provide our Subscribers with the Leverage Calculators (in the Tools section on the website) that create a ranking of gold or silver stocks with particular Investor's needs in mind.

Wishing you a profitable week.

Thank you for reading.

Atif Khan, Ph.D.

Sunshine Profits Contributing Author

--

In this week's Premium Update we continue to provide you with details regarding the most probable short-term scenario for gold, silver, and mining stocks' prices, as well as provide our thoughts on what we expect in the next several months. In today's globalized economy no market moves on its own, so taking this into account we analyze markets that currently influence the precious metals sector, and explain which might become more important in the future.

This week's commentary includes 15 charts, including: Euro- and USD Indices, main stock indices, the financial sector, gold from various perspectives, silver (including white metal's cyclical turning points), HUI Index (what's a pre-spike and what does it mean to your portfolio?), GDX ETF. Additionally, we analyze the Gold Miners Bullish Percent Index.

Moreover, we comment on China, and gold's popularity and its short-, and long-term implications on the price of the yellow metal. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.