-

Gold Investment Update: Precious Metals Still Hungover After New Year’s Eve

January 4, 2022, 10:04 AMGold, silver, and mining stocks started 2022 with a bang. However, this wasn’t the kind of fireworks investors were hoping for.

While gold, silver, and mining stocks partied hard into year-end, the trio woke up to massive hangovers on Jan. 3. Although I’ve been warning for some time that mining stocks would stumble in 2021, the New Year is still filled with old problems.

For example, the GDX ETF has been making lower lows and lower highs for months, and when its RSI (Relative Strength Index) approaches 70, the senior miners often run out of gas. For context, I highlighted the events with the blue vertical dashed lines below.

Moreover, with the senior miners’ current price action following the ominous paths of 2000, 2008, and 2013, and their stochastic indicator still signaling overbought conditions, Monday’s weakness may be a sign of things to come.

Please see below:

Please also consider the implications of year-end tax-loss harvesting. With the general stock market rallying to start the New Year, losing positions that were sold to offset capital gains near the end of 2021 were likely repurchased on Jan. 3. However, gold, silver, and mining stocks didn’t benefit from the phenomenon. As a result, while the GDX ETF may have outperformed gold, the relative strength was immaterial within the overall picture.

Turning to the HUI Index’s long-term chart, the same bearish forecast is present. For example, I marked the specific tops with red and black arrows. In the current situation, we saw yet another small move up, but that’s most likely because price moves are now less volatile. The areas marked with red ellipses remain similar and show back-and-forth movement before the big decline.

As a result, we’ve entered a consolidation phase, and the implications are not bullish, but bearish.

Making three of a kind, the GDXJ ETF’s corrective upswing has likely run its course. Interestingly, the junior miners’ current rally mirrors the small correction that materialized in mid-2021. Back then, the GDXJ ETF rallied on low volume and didn’t recapture its 50-day moving average. With the same tepid strength present today, the drawdown that followed in mid-2021 will likely commence once again.

On top of that, the behavior of the GDXJ ETF’s RSI is also similar – with the indicator moving from roughly 30 to 50. For context, I highlighted the similarities with green and purple ellipses below. Also noteworthy, similar developments occurred in February/March 2020, before the profound plunge unfolded. As a result, the GDXJ ETF looks set for another sharp drawdown over the medium term and predicting higher prices might be misleading.

Finally, while my short position in the GDXJ ETF proved quite prescient in 2021, the junior miners continue to underperform the senior miners. With the GDX/GDXJ ratio likely to confront new lows in the coming months, the GDXJ ETF should remain a material laggard in 2022.

In conclusion, gold, silver, and mining stocks started off 2022 with a bang. However, it wasn’t the kind of fireworks that investors were hoping for. With each new celebration shorter in magnitude, it’s likely only a matter of time before their parties are canceled. As a result, the precious metals still confront the same bearish technical outlooks that plagued them in 2021. While mean reversion remains undefeated over the long term, the wait may prove longer than many expect.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Will Santa Give Us Interest Rate Hikes for 2022?

December 23, 2021, 11:13 AMIf the Fed normalizes its balance sheet and markets freak-out, it will be a bridge too far. But interest rate hikes won’t crash a strong US economy.

With Fed officials increasingly hawked up, the narrative shifted from a tapering of asset purchases to potential interest rate hikes. And now, with whispers of the Fed plotting to normalize its balance sheet, questions have arisen over the potential impact on the PMs.

To explain, I wrote on Dec. 20:

After admitting that inflation “is alarmingly high, persistent, and has broadened to affect more categories of goods and services,” Waller implored the Fed to sell some of its bond holdings.

For context, tapering means that bonds are purchased at a slower pace or not at all. However, even zero purchases result in the Fed’s nearly $8.76 trillion in bond holdings remaining constant. Conversely, if the Fed reduces its balance sheet by selling bonds to private investors, it’s akin to a taper on steroids. Waller said:

“If we start doing some balance sheet runoff by summer, that’ll take some pressure off, you don’t have to raise rates quite as much. My view is we should start doing that by summer.”

However, is this a plausible path for the Fed over the medium term? In a word: no. While the prospect is profoundly bullish for the USD Index and profoundly bearish for the PMs, Chairman Jerome Powell will likely avoid quantitative tightening.

For one, if the Fed tries to reduce its balance sheet from 35% to 20% of GDP, the financial markets will freak out. Currently, the Fed has such a large stockpile of bonds that private investors can’t absorb that kind of supply. Thus, another taper tantrum will likely unfold if the Fed tries to ‘normalize’ its balance sheet through the open market.

Second, the Fed’s only hawkish goal is to calm inflation. To explain, when inflation was running hot and most Americans bought into the “transitory” narrative, Fed officials exuded confidence. However, when consumer confidence sunk to a 10-year low and inflation became political, the Fed changed its tune. As a result, Powell wants to reduce inflation while tightening as little as possible (3% to 4% inflation may be considered acceptable in 2022). Thus, normalizing the balance sheet is likely a bridge too far.

However, please remember that if quantitative tightening is a ten on the hawkish scale, hitting a seven or an eight is still profoundly bearish for the PMs. To explain, I highlighted on Dec. 20 how San Francisco Fed President Mary Daly had a come-to-Jesus moment. I wrote:

Daly – a major dove that urged patience in November – admitted on Dec. 17 that “I have adjusted my stance.”

And conducting another interview with The New York Times on Dec. 21, Daly said:

“My community members are telling me they’re worried about inflation. What influenced me quite a lot was recognizing that the very communities we’re trying to serve when we talk about people sidelined” from the labor market “are the very communities that are paying the largest toll of rising food prices, transportation prices and housing prices….

“I’m comfortable with saying that I expect us to need to raise rates next year. But exactly how many will it be – two or three – and when will that be – March, June, or in the fall? For me it’s just too early to know, and I don’t see the advantage of a declaration.”

However, with her slip of “two or three” rate hikes offering a window into her thought process, it’s clear that more hawkish policy will materialize over the medium term.

Please see below:

To that point, many short and medium-term gold bulls support the narrative that “the Fed is trapped.” For context, we’re bullish on the PMs over the long term. However, we expect sharp medium-term corrections before their uptrends resume.

Moreover, the narrative implies that the Fed can’t tighten monetary policy without crashing the U.S. economy. Thus, Fed officials are “trapped,” and the PMs should soar as inflation runs wild. However, this hyper-inflationist theory is much more semblance than substance.

To explain, adopters assumed that the Fed couldn’t taper its asset purchases without crashing the U.S. economy. However, the Fed tapered, then accelerated the taper, and the U.S. economy remained resilient. Now, the new narrative is that the Fed can’t raise interest rates without crashing the U.S. economy. However, it’s simply misleading.

As evidence, anxiety has increased with U.S. monetary and fiscal spending stuck in reverse/neutral. For example, the Fed is tightening monetary policy and Americans are no longer receiving stimulus checks and enhanced unemployment benefits. Moreover, U.S. President Joe Biden’s $1.75 trillion stimulus package was torpedoed by Senator Joe Manchin. As a result, who knows if it will pass in 2022?

However, while “the Fed is trapped” crew cites these issues as reasons for an economic calamity, they often miss the forest through the trees. For example, while the fiscal spending spree may end, U.S. households are still flush with cash.

Please see below:

To explain, the green line above tracks U.S. households’ checkable deposits (data released on Dec. 9). In a nutshell: it’s the amount of money that U.S. households have in their checking accounts and/or demand deposit accounts.

If you analyze the vertical ascent on the right side of the chart, you can see that U.S. households have nearly $3.54 trillion in their checking accounts. For context, this is 253% more than Q4 2019 (pre-COVID-19).

Likewise, even though U.S. stimulus has disproportionately flowed to the top, the bottom 50% of American households (based on wealth percentiles) still have plenty of money to spend.

Please see below:

To explain, the green line above tracks the checkable deposits held by the bottom 50% of U.S. households (again, data released on Dec. 9). And with these individuals sitting on nearly $243 billion in cash, it's 142% more than Q4 2019.

Finally, it's important to remember that more than 75% of Canada's exports are sent to the United States. And with the former's exports to the latter hitting an all-time high in October (data released on Dec. 7), it's another indicator that U.S. consumer demand remains resilient.

The bottom line? While some investors expect a dovish 180 from the Fed, they shouldn’t hold their breath. With U.S. economic growth still resilient and the U.S. consumer in much better shape than some portray, the Fed can raise interest rates without crashing the U.S. economy. As a result, Powell will likely stick to his hawkish script and forge ahead with rate hikes in 2022.

Conversely, the only wild card is the Omicron variant. If the latest strain severely disrupts economic activity, the Fed could slow its roll. However, this is extremely unlikely. For one, the strain’s spread has been violent, but so far, the data shows it’s much milder than Delta. Second, the Fed needs to solve its inflation problem. And with the FOMC’s dot plot and officials’ rhetoric nodding in agreement, they likely realize that a continuation of 6%+ inflation will do more harm to the U.S. economy than raising interest rates.

Also, please note that when the Fed called inflation “transitory,” I wrote for months that officials were misreading the data. As a result, I don’t have a horse in this race. However, now they likely have it right. Thus, if investors assume that the Fed won’t tighten, their bets will likely go bust in 2022.

In conclusion, the PMs rallied on Dec. 22, as an FDA approval of Pfizer’s coronavirus treatment pill helped uplift sentiment. However, the next several months will likely test their mettle. With the Fed hawked up and little stopping interest rate hikes in 2022, the pace of the current liquidity drain should surpass the precedent set in 2013/2014. As a result, more downside likely confronts the PMs over the medium term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: Dollar’s 2021 Rally – Over or Just Resting?

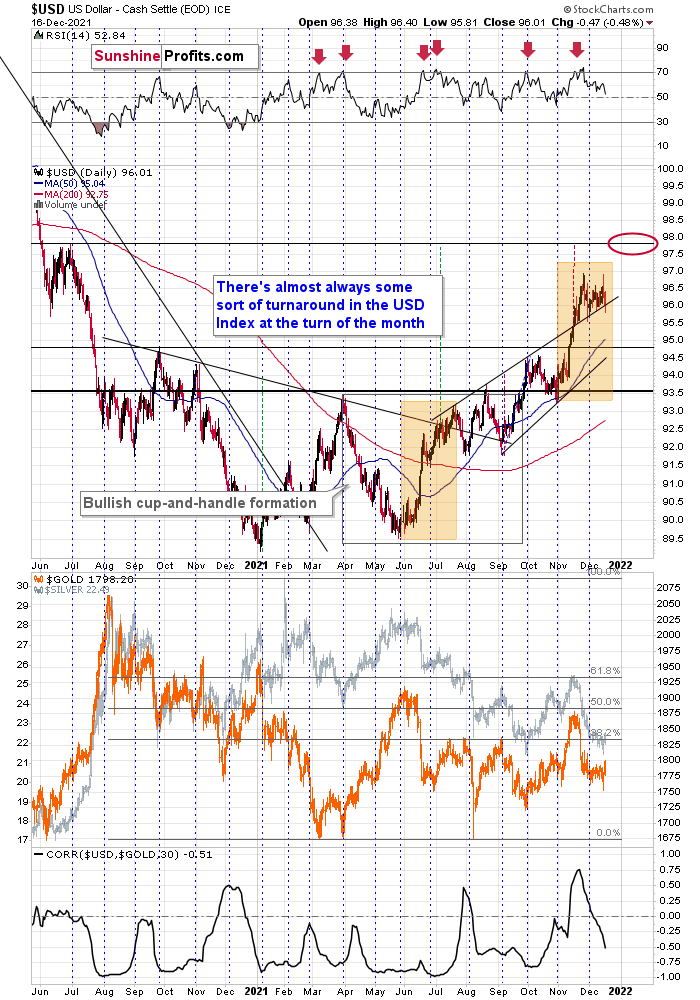

December 17, 2021, 5:04 AMWith the USD Index suffering a ‘sell the news’ event on Dec. 15, the FOMC’s hawkish Summary of Economic Projections wasn’t enough to uplift investors’ optimism. However, while the dollar day traders performed their usual disappearing act, the greenback’s fundamentals were bolstered by the FOMC’s median projection of three rate hikes in 2022.

What’s more, while the USD Index initially dipped below 96 and fell below its rising resistance line (which is now support) on Dec. 16, buyers stepped in, and the USD Index bounced.

For context, a short-term correction is possible. However, the important point is that the USD Index is likely on a medium-term path to ~98. And with gold, silver and mining stocks often moving inversely to the U.S. dollar, their optimism may disappear over the next few months.

Please see below:

For context, I warned that a consolidation was likely overdue by highlighting the USD Index’s overbought RSI (Relative Strength Index) readings with the red arrows above.

Conversely, the blue vertical dashed lines above demonstrate how the USD Index often bottoms near the end of each month, and rallies often follow. And while the current consolidation may need some more time to run its course, higher highs should materialize over the medium term.

To explain, after the USD Index recorded sharp rallies in June and July, consolidation phases unfolded before the uptrends continued. And while the secondary uprisings occurred at more moderate paces, the USD Index still managed to make new highs. As a result, ~98 should materialize during the winter months.

Furthermore, if the forecast proves prescient, the USD Index’s strength will likely usher gold back to its previous 2021 lows.

Adding to our confidence (don’t get me wrong, there are no certainties in any market; it’s just that the bullish narrative for the USDX is even more bullish in my view), the USD Index often sizzles in the summer sun and major USDX rallies often start during the middle of the year. Summertime spikes have been mainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011, 2014 and 2018 a retest of the lows (or close to them) occurred before the USD Index began its upward flights (which is exactly what’s happened this time around).

Furthermore, profound rallies (marked by the red vertical dashed lines below) followed in 2008, 2011 and 2014. With the current situation mirroring the latter, a small consolidation on the long-term chart is exactly what occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its 50-week moving average; an identical development occurred in 2014. More importantly, though, with bottoms in the precious metals market often occurring when gold trades in unison with the USD Index (after ceasing to respond to the USD’s rallies with declines), we’re still far away from that milestone in terms of both price and duration. Again, the recent move higher in the USD Index doesn’t necessarily apply in the case of the above rule, as it was not the strength of the USD but the weakness in the euro that has driven it.

Likewise, with the USD Index now approaching its long-term rising support line (which is now resistance), a rally above the upward sloping black line above would invalidate the prior breakdown and support a move back above 100.

Also, please note that the recent medium-term rally has been calmer than any major upswing witnessed over the last 20 years, where the USD Index’s RSI has hit 70. I marked the recent rally in the RSI with an orange rectangle, and I did the same with the second-least and third-least volatile of the medium-term upswings.

The sharp rallies in 2008 and 2014 were of much larger magnitudes. And in those historical analogies, the USD Index continued its surge for some time without suffering any material corrections.

As a result, the short-term outlook is more of a coin flip. However, the medium-term outlook remains profoundly bullish, and gold, silver, and mining stocks may resent the USD Index’s forthcoming uprising.

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or the ones of silver) here is likely not a good idea.

Continuing the theme, the eye in the sky doesn’t lie. And with the USDX’s long-term breakout clearly visible, the wind remains at the dollar’s back. Furthermore, dollar bears often miss the forest through the trees: with the USD Index’s long-term breakout gaining steam, the implications of the chart below are profound. And while very few analysts cite the material impact (when was the last time you saw the USDX chart starting in 1985 anywhere else?), the USD Index has been sending bullish signals for years.

Please see below:

The bottom line?

With my initial 2021 target of 94.5 already hit, the ~98 target is likely to be reached over the medium term (and perhaps quite soon), mind, though: we’re not bullish on the greenback because of the U.S.’ absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, gold, silver and mining stocks pulled rabbits out of their hats on Dec. 16. However, as 2021 has demonstrated, their daily tricks often lose their allure fairly quickly. Moreover, while it’s uncommon for magicians to reveal their secrets, the precious metals tip their hands time and time again. As a result, the USD Index’s daily weakness was likely a corrective downswing, while the precious metals daily strength was likely a corrective upswing. And with a reversal of fortunes likely to occur over the medium term, gold, silver and mining stocks may lose their magic touch.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: All’s Well That Ends Well, But Gold Is Far From Finished

December 10, 2021, 7:31 AMFundamentals are as strong as ever, but gold has to go some way down before it can resume its uptrend. Think of Moria from The Lord of the Rings.

While inflation has soared, the S&P 500 has soared, WTI has soared, and copper has soared, 2021 has been extremely unkind to the precious metals. Gold has declined by 6.25%, silver by 16.66% and the GDX ETF by 14.83% YTD – not to mention the GDXJ ETF (our short position), which is down by 24.91% (all as of the Dec. 9 close).

Moreover, investors often assume that material underperformance provides them with buying opportunities. I mean, why not position for a reversion to the mean? However, the harsh truth is that bearish technicals predicted these drawdowns well in advance. And while 2021 has been rough, the charts signal more downside in 2022.

To explain, while gold prices, silver prices, and mining stocks rallied hard in October, their price action was more of a trick than a treat. And with the trio becoming part of the bears’ Thanksgiving dinner in November, only Santa Clause can save them now.

However, while the S&P 500 had uplifted sentiment, the GDX ETF closed the Dec. 9 session one cent below its Dec. 3 close and the senior miners gave back all of their early-week stock-market-induced gains. As a result, investors aren’t showing much faith in the GDX ETF’s medium-term prospects.

Please see below:

As further evidence, the GDX ETF’s 4-hour chart is also sending ominous signals. For example, after running into its declining resistance line (the red dashed line on the right side of the chart below), the senior miners’ momentum fizzled, and a sharp decline followed.

For more context, I wrote the following on Dec. 7 and updated the analysis on Dec. 9:

After verifying the breakdown below its rising support line, the GDX moved lower, just as I expected it to. Now it’s after a breakdown below its previous (November) lows, and it seems to be verifying that breakdown just as it verified the breakdown below the rising support line in late November.

The black dashed line in the above chart shows the resistance provided by the previous lows. It wasn’t invalidated. At the same time, the GDX is well below its declining red resistance line, and even if it moves close to this line but then declines, it will not be viewed as something bullish.

What happened yesterday (Wednesday) and on Tuesday is exactly what I put in bold.

Gold miners moved to their declining red resistance lines and then they moved back down.

As far as the November lows are concerned, while it might not be 100% clear based on the above chart, it is the case that the lowest daily close in November was $31.53, and yesterday, the GDX ETF closed the day at $31.49. As the daily closes are more important than the mid-session candlestick closes, I don’t view the breakdown below the November lows as invalidated.

Showcasing similar weakness, the GDXJ ETF also reversed sharply after slightly breaking above its declining resistance line (the black dashed line on the right side of the chart below). The invalidation of the breakout served as a strong sell sign, and it’s no wonder that junior miners declined by almost 3% yesterday.

Moreover, investors rejected the junior miners’ attempt to rally back above their November lows. As a result, whether big or small, the gold miners have struggled mightily.

Please see below:

To that point, with more negativity likely to commence in the coming weeks and months, I wrote on Dec. 2 that the selling pressure may persist until the GDXJ ETF reaches its September lows:

One of the previous situations that’s similar to the current one is what we saw right before the mid-year top. I marked mid-year declines (from the start to the first more visible correction) in both charts: GDX and GDXJ with orange rectangles. If the history repeats itself, both proxies for mining stocks could move back to their previous 2021 lows before correcting.

Please see below:

Finally, while I’ve been warning for months that the GDXJ/GDX ratio was destined for devaluation, the ratio has fallen precipitously in 2021. Interestingly, the ratio is still moving lower, its RSI was previously overbought, and similar periods of excessive optimism have preceded major drawdowns (marked with the black vertical dashed lines below).

For example, the ratio showcased a similar overbought reading in early 2020 – right before the S&P 500 plunged. On top of that, the ratio is still near its mid-to-late 2020 lows and its mid-2021 lows. As a result, the GDXJ ETF will likely underperform the GDX ETF over the next few months. It’s likely to underperform silver in the near term as well.

Furthermore, a drop below 1 in the ratio isn’t beyond the realms of possibility. In fact, it’s actually quite likely – that’s what happened in 2020 as well, and that’s why I’m shorting the GDXJ ETF.

For context, I believe that gold, silver, and the GDX ETF are all ripe for sharp re-ratings over the medium term. However, it’s my belief that the GDXJ ETF offers the best risk-reward ratio due to its propensity to materially underperform during bear markets. As a result, shorting junior miners remains the most prudent strategy, in my opinion.

In conclusion, while the seasons have changed, gold, silver, and mining stocks’ downtrends have remained the same. With a cold winter likely to culminate with new lows, the precious metals should embark on a tumultuous journey over the medium term. However, as Shakespeare told us: all's well that ends well. And with gold, silver and mining stocks poised to soar in the years to come, the bulls should have the last laugh over the long term. In the meantime, patience is prudent, as sharp drawdowns will likely materialize before the precious metals resume their secular uptrends.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Investment Update: US Dollar Still Has the Green Light

December 6, 2021, 9:54 AMThe dollar looks poised for another rally, to gold’s dismay. So, what’s the price target for the greenback over the winter months?

While the consensus across the financial markets (especially at the beginning of the year) was that the U.S. dollar was destined for devaluation, I warned that the greenback would rise from the ashes. And with gold, silver, and mining stocks often moving inversely to the U.S. dollar, the latter’s ascent helped make the precious metals one of the worst-performing asset classes in 2021.

Moreover, after more dollar doubters emerged in October – and the precious metals rallied hard – the USD Index eventually cut through 94, 95, and then 96 like a knife through butter. And with the precious metals reversing sharply once again, I expect another rally to push the USD Index to ~98 over the medium term. Perhaps quite soon. And the implications for the precious metals sector, are bearish.

On top of that, while overbought conditions elicited a short-term pullback, end-of-month turnarounds and / or rallies are commonplace for the greenback.

For context, I warned that a consolidation was likely overdue by highlighting the USD Index’s overbought RSI (Relative Strength Index) readings with the red arrows above.

Conversely, the blue vertical dashed lines above demonstrate how the USD Index often bottoms near the end of each month, and rallies often follow. And while the current consolidation may need some more time to run its course, higher highs should materialize over the medium term.

To explain, after the USD Index recorded sharp rallies in June and July, consolidation phases unfolded before the uptrends continued. And while the secondary uprisings occurred at more moderate paces, the USD Index still managed to make new highs. As a result, ~98 should materialize during the winter months.

Furthermore, if the forecast proves prescient, the USD Index’s strength will likely usher gold back to its previous 2021 lows.

Adding to our confidence (don’t get me wrong, there are no certainties in any market; it’s just that the bullish narrative for the USDX is even more bullish in my view), the USD Index often sizzles in the summer sun and major USDX rallies often start during the middle of the year. Summertime spikes have been mainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011, 2014 and 2018 a retest of the lows (or close to them) occurred before the USD Index began its upward flights (which is exactly what’s happened this time around).

Furthermore, profound rallies (marked by the red vertical dashed lines below) followed in 2008, 2011 and 2014. With the current situation mirroring the latter, a small consolidation on the long-term chart is exactly what occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its 50-week moving average; an identical development occurred in 2014. More importantly, though, with bottoms in the precious metals market often occurring when gold trades in unison with the USD Index (after ceasing to respond to the USD’s rallies with declines), we’re still far away from that milestone in terms of both price and duration. Again, the recent move higher in the USD Index doesn’t necessarily apply in the case of the above rule, as it was not the strength of the USD but weakness in the euro that has driven it.

Likewise, with the USD Index now approaching its long-term rising support line (which is now resistance), a rally above the upward sloping black line below would invalidate the prior breakdown and support a move back above 100.

Also, please note that the recent medium-term rally has been calmer than any major upswing witnessed over the last 20 years, where the USD Index’s RSI has hit 70. I marked the recent rally in the RSI with an orange rectangle and I did the same with the second-least and third-least volatile of the medium-term upswings.

The sharp rallies in 2008 and 2014 were of much larger magnitudes. And in those historical analogies, the USD Index continued its surge for some time without suffering any material corrections.

As a result, the short-term outlook is more of a coin flip. However, the medium-term outlook remains profoundly bullish, and gold, silver, and mining stocks may resent the USD Index’s forthcoming uprising.

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or the ones of silver) here is likely not a good idea.

Continuing the theme, the eye in the sky doesn’t lie. And with the USDX’s long-term breakout clearly visible, the wind remains at the dollar’s back. Furthermore, dollar bears often miss the forest through the trees: with the USD Index’s long-term breakout gaining steam, the implications of the chart below are profound. And while very few analysts cite the material impact (when was the last time you saw the USDX chart starting in 1985 anywhere else?), the USD Index has been sending bullish signals for years.

Please see below:

The bottom line?

With my initial 2021 target of 94.5 already hit, the ~98 target is likely to be reached over the medium term (and perhaps quite soon), mind, though: we’re not bullish on the greenback because of the U.S.’ absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, gold, silver, and mining stocks have reversed sharply in recent weeks. And though the trio tried to ignore the USD Index’s recent uprising, I wrote on Jul. 23 that the time-tested relationship of ‘U.S. dollar up, PMs down’ will likely be a major storyline during the Autumn months. To that point, with the theme likely to continue over the medium term, lower lows should confront gold, silver, and mining stocks over the next few months.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM