Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Dear subscribers,

Friday’s Gold Investment Update got stuck in the pipes and we did not upload it properly. We also failed to double check, making it a double oversight on our part. Therefore, you and the rest of our cherished readers were not able to access this important publication. It’s a rare occurrence, but that’s not an excuse. On behalf of the editorial team, I offer you my sincere apologies for this mishap. You deserve better, and we’ll work on making sure that every publication is delivered on time and on schedule.

As a thank you for your understanding, we’re also including the full daily Gold and Silver Investment Update in your mailbox for the rest of the week.

Again,

our kindest apologies.

Best regards,

Dominik

Starosz

Managing Editor

Introduction

Welcome to the Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

So much for gold’s move above $2,000. Congratulations on avoiding the mania – it was not easy. The volume readings show that many people were caught up in the “inevitable rally” in gold. You, however, kept focused on what’s most important in the medium term, and over this time frame, this approach is likely to prove most beneficial.

As gold tried to rally to new all-time highs, I sent out an intraday Gold & Silver Trading Alert, and in it, I emphasized the likely temporary nature of this move. I wrote the following:

Yes, the situation in Ukraine is critical.

However, the two key drivers of gold price continue to point to lower gold prices, and at the same time we know that geopolitical-event-based rallies don’t last and very likely to be reversed.

These two key drivers are:

- real interest rates

- the USD Index

The USD Index is already soaring, and real interest rates are likely to increase as the nominal interest rates are about to increase – and given the recent rally in prices they might increase more than most investors expect them to.

Consequently, while – given today’s rally – it might seem like there’s no stopping gold, silver, and mining stocks, please keep the above in mind. This rally is likely to be reversed, and when it reverses, junior gold miners are likely to decline in an epic manner. And lead to epic profits in case of those, who were able not to follow the mania during the parabolic upswing.

The above remains up-to-date.

Let’s check what changed on the charts based on yesterday’s profound decline.

When I wrote yesterday’s analysis, gold was trading at about $2,020, and I wrote that, given the last few days’ volatility, it could be below $2,000 in a few hours. That’s exactly what happened next.

Taking a step back, please note that the previous breakouts above $2,000 were all invalidated sooner rather than later.

Gold tried to break above $2,000 several times:

- twice in August 2020;

- twice in September 2020 (once moving above it, once moving just near this level);

- once in November 2020 (moving near this level);

- once in January 2021 (moving near this level);

- once in February 2022 (moving near this level).

These attempts failed in each of the 7 cases mentioned above.

Yesterday, gold failed its eighth attempt. History rhymed, as it often does. Let’s keep in mind the specific similarity to the 2020 top that I described yesterday:

Gold topped at a similar price to its 2020 top, while the sharpest part of the rally started at about $1,800 (just like in 2020), and the entire rally started in the middle of the year at about $1,670.

In fact, even the moment where gold traded on huge volume for the first time during those rallies is similar. I marked that with blue dotted lines. We saw huge volume more or less in the middle of the final (sharpest) part of the upswing. The history tends to rhyme, and since it seems that the tensions have finally peaked (as I wrote in the opening part of today’s analysis) the same is quite likely for the gold price.

Gold’s big-volume reversal on Tuesday added to the decline’s credibility, making its continuation likely.

The dramatic sell signal was even clearer in the case of mining stocks; and yesterday’s invalidations of breakouts are just as telling.

Yesterday, I commented on miners’ reversal in the following way:

While the junior miners (GDXJ ETF) closed higher yesterday, they were up only slightly. At one point of the session, the GDXJ was up from its previous close by 5.74%. However, it ended only 0.86% higher. Therefore, almost the entire daily rally in junior miners was invalidated.

Yesterday’s session was therefore a profound daily reversal – in candlestick pattern terms, it was a “shooting star reversal”. These patterns should be confirmed by high volume, and yesterday’s volume in the GDXJ was the highest volume not only this year, but it was actually highest volume that we’ve seen in this ETF since mid-2020. The top is most likely in.

If I didn’t have my short position in the GDXJ ETF that’s already significant (and in tune with how significant I want it to be), I would have entered or added to this position now.

(Of course, the above is not an investment advice, nor am I saying that should increase your position, but that’s exactly what my opinion is at the moment based on what we just saw.)

The above bearish signal turned into an extremely bearish one because of GDXJ’s invalidations of previous (small, but still) breakouts. Junior miners just closed visibly below their:

- 38.2% Fibonacci retracement level;

- declining (blue) resistance line;

- late-2021 top.

Invalidations of breakouts are bearish as they show that a given market’s strength was not real and that sellers were able to overwhelm the buyers.

While mining stocks underperformed gold in a rather extreme manner on Tuesday, silver outperformed it on the same day. This was a bearish indication, and indeed, it was followed by lower prices.

On Tuesday, the GDXJ ETF was up by less than 1%, gold was up by 2.37%, and silver was up by 4.57%. Silver’s outperformance and miners’ underperformance is what we tend to see right at the tops. That’s exactly what it was – a top. Silver declined profoundly, and the attempt to break above its 61.8% Fibonacci retracement level will soon be just a distant (in terms of price) memory.

On a medium-term basis, silver was simply weak relative to gold, but we saw short-term outperformance. In short, that was and continues to be bearish.

How high could silver go before declining? Given all that I wrote above, I think that silver’s top is already in. However, if it isn’t, I don’t think it would manage to move above $30.

All in all, it seems that due to the technical resistance in gold and mining stocks, the sizable – but likely temporary (like other geopolitical-event-based ones) – rally is likely to be reversed shortly. Then, as the situation in the general stock market deteriorates, junior miners will likely plunge in a spectacular manner.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Pendulum

While bad news and escalation headlines have uplifted the PMs in recent weeks, the pendulum swung to the other side on Mar. 9. For example, Ukraine’s Deputy Chief of Staff, Ihor Zhovkva, told Bloomberg on Mar. 9: “we are ready for a diplomatic solution.”

Moreover, the United Arab Emirates (UAE) ambassador to Washington, Yousef Al Otaiba, said on Mar. 9 that they “will be encouraging OPEC to consider higher [oil] production levels.”

“The UAE has been a reliable and responsible supplier of energy to global markets for more than 50 years and believes that stability in energy markets is critical to the global economy.” Likewise, Iraq’s Oil Minister Ihsan Abdul-Jabbar Ismail added: “if OPEC+ requires it, we can increase output.”

The sliver of good news pushed investors out of safe-haven assets and into risk assets. While the daily news remains volatile and the pendulum could swing back to negative once again, gold’s decline on Mar. 9 highlights what should occur over the medium term.

To explain, I wrote on Mar. 8:

With commodities running wild amid the Russia-Ukraine conflict, the S&P GSCI has become the new FAANG. And with gold, silver and mining stocks riding the momentum higher, profound pain should confront the PMs when the all-time outperformance reverses.

Please see below:

To explain, the chart above tracks the monthly performance of the S&P GSCI, while the blue line above tracks the index’s 20-month moving average, and the purple line on the bottom half of the chart tracks the index’s monthly RSI.

Now, if the month ended on Mar. 7, the S&P GSCI would record the third-highest monthly RSI of all time. For context, the only periods with higher monthly readings were May and June 2008.

Furthermore, if you analyze the right side of the chart, you can see that the S&P GSCI is now 58% above its 20-month MA, and this is the largest outperformance on record.

To that point, if you focus your attention on the long-term bull market from 2002 until roughly 2006, the S&P GSCI remained closely connected to its 20-month MA. Moreover, even during the vertical ascent from 2006 to 2008, peak intra-month outperformance of the 20-month MA was 56%. And today, if we use the current intra-month high, the outperformance is 64%. As a result, the S&P GSCI has never been more disconnected, and the PMs have been material beneficiaries.

In addition, even though the global financial crisis (GFC) helped accelerate the sharp drop in the S&P GSCI in 2008 and the economic fundamentals are different now, please note the connection between the S&P GSCI and its 20-month MA. As you can see, reconnections are inevitable, and they often occur within 12 to 24 months. Furthermore, the S&P GSCI began its current outperformance in January 2021, so we’re roughly 14 months into the recent splurge. But investors seem to think that the S&P GSCI is the new FAANG and will never fall.

To provide another update, the S&P GSCI declined by 9.31% on Mar. 9. Moreover, while volatility should persist until a formal resolution materializes. The important point is that the negativity that confronted the S&P GSCI and the PMs on Mar. 9 still has a long way to run.

For context, the S&P GSCI contains 24 commodities from all sectors: six energy products, five industrial metals, eight agricultural products, three livestock products, and two precious metals. However, energy accounts for roughly 54% of the index’s movement.

Please see below:

To explain, despite the more than 9% daily decline, the S&P GSCI is still nowhere near its 20-month MA. As a result, there is still plenty of room for further downside. Moreover, if the U.S. increases shale production, the U.S. makes progress in its talks with Venezuela, OPEC+ decides to pump more oil, or the Russia-Ukraine conflict reaches a peaceful resolution, the potential outcomes are negative for the entire commodity complex.

Likewise, while the near-term is extremely unpredictable, please note that plenty of bad news is already priced in. As such, less bad is good, and unless WW3 breaks out, the potential for more market-moving geopolitical headlines should start to decline.

As further evidence, before the Mar. 9 drawdown, the Bloomberg Commodity Spot Index recorded a five-day percentage increase of 14.2% – a new all-time high.

Please see below:

To explain, the blue line above tracks the Bloomberg Commodity Spot Index’s five-day rate of change. If you analyze the right side of the chart, you can see that the recent splurge was the largest in more than 60 years. As a result, while I noted how overbought commodities are in this environment, it’s another indicator of how significant the reversion will be if (once) it unfolds.

To that point, the amount of fear in the financial markets is already palpable. For example, Goldman Sachs’ Risk Appetite Indicator (RIA) is near two standard deviations below its 14-year average.

Please see below:

To explain, the dark blue line above tracks Goldman Sachs’ RIA. If you analyze the right side of the chart, you can see that demand for risk assets has declined materially. When investors run from risk assets, they rotate into safe havens like the PMs. As a result, a reversion to the mean should inflict plenty of pain on gold, silver, and mining stocks.

Likewise, Credit Suisse’s U.S. Credit Risk Appetite (CRA) Indicator is at panic levels. For context, the metric quantifies investors’ demand, or lack thereof, for U.S. investment-grade corporate bonds.

Please see below:

To explain, the black line above tracks Credit Suisse’s CRA. If you analyze the right side of the chart, you can see that panic has already surpassed the levels witnessed during the coronavirus crisis in 2020. As a result, profound fear and unprecedented buying of commodities have combined to uplift the PMs. However, if (when) these developments reverse, the PMs should suffer mightily.

Continuing the theme, with the S&P 500 shifting from depressed to euphoric on a seemingly hourly basis, the rally on Mar. 9 did little to offset the “Extreme Fear” reading present on CNN’s Fear & Greed Index.

Please see below:

Moreover, after the index sank to 12 on Mar. 8, investors’ fear hit its highest level since the COVID-19 crisis unfolded.

If that wasn’t enough, only 8% of the S&P 500’s consumer discretionary constituents are trading above their 200-day moving average (as of Mar. 8). For context, this is also the lowest level since the coronavirus crash.

Please see below:

As a result, the Russia-Ukraine conflict has freaked out investors. When geopolitical panic unfolds, they pile into safe havens like the PMs. Moreover, with the algorithms increasing the intensity of the moves, the buying pressure that materialized in the PMs and the S&P GSCI can be just as powerful on the downside. Thus, unless one expects extreme fear and extreme panic to become even more extreme, the systematic (quant/algorithmic) bid underwriting the PMs’ rallies will likely evaporate over the medium term.

Finally, I’ve long warned that the U.S. economy remains on solid footing. For context, I noted on Mar. 9 that while the S&P 500 has been under pressure in 2022, Citigroup’s Economic Surprise Index has not. I wrote:

To explain, the blue line above tracks the S&P 500, while the orange line above tracks Citigroup’s Economic Surprise Index. For context, a surprise occurs when an economic data point outperforms economists’ consensus estimate.

If you analyze the right side of the chart, you can see that the orange line bottomed in January and has been moving higher ever since. As a result, the U.S. economy remains in a healthy position, and as long as this is the case, it keeps the pressure on the Fed to raise interest rates at its next several monetary policy meetings.

To that point, with another example of outperformance witnessed on Mar. 9, U.S. job openings came in at 11.263 million versus 10.925 million expected. Moreover, it would be a new all-time high if December’s data wasn’t revised higher by 523,000 to 11.448 million. However, any way that you slice it, there are plenty of employment opportunities in the U.S, and with the Fed’s dual mandate comprised of steady inflation and maximum employment, the strong data supports more rate hikes in the coming months.  Source: U.S. Bureau of Labor Statistics (BLS)

Source: U.S. Bureau of Labor Statistics (BLS)

The bottom line? While fear and panic have been the PMs’ best friends in recent weeks, the slight semblance of calm on Mar. 9 had the opposite effect. Since uncertain events have uncertain futures, the headline risk from the Russia-Ukraine conflict has cooled. Moreover, if an optimistic outcome materializes and peace prevails, the best-case scenario from a human perspective is the worst-case scenario for the PMs. However, even if that’s wishful thinking, the level of panic in the financial markets should still dissipate over the medium term.

In conclusion, the PMs declined on Mar. 9, as good news is bad news for gold, silver, and mining stocks. Moreover, with countries showing signs of wanting to intervene and avoid a larger crisis, successful efforts could accelerate the pace of the PMs’ likely declines. However, even if the short term proves more difficult, the medium-term fundamentals remain unchanged: the Fed should raise interest rates several times in the coming months, and the PMs will likely feel this pain when the Russia-Ukraine conflict no longer dominates the headlines.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

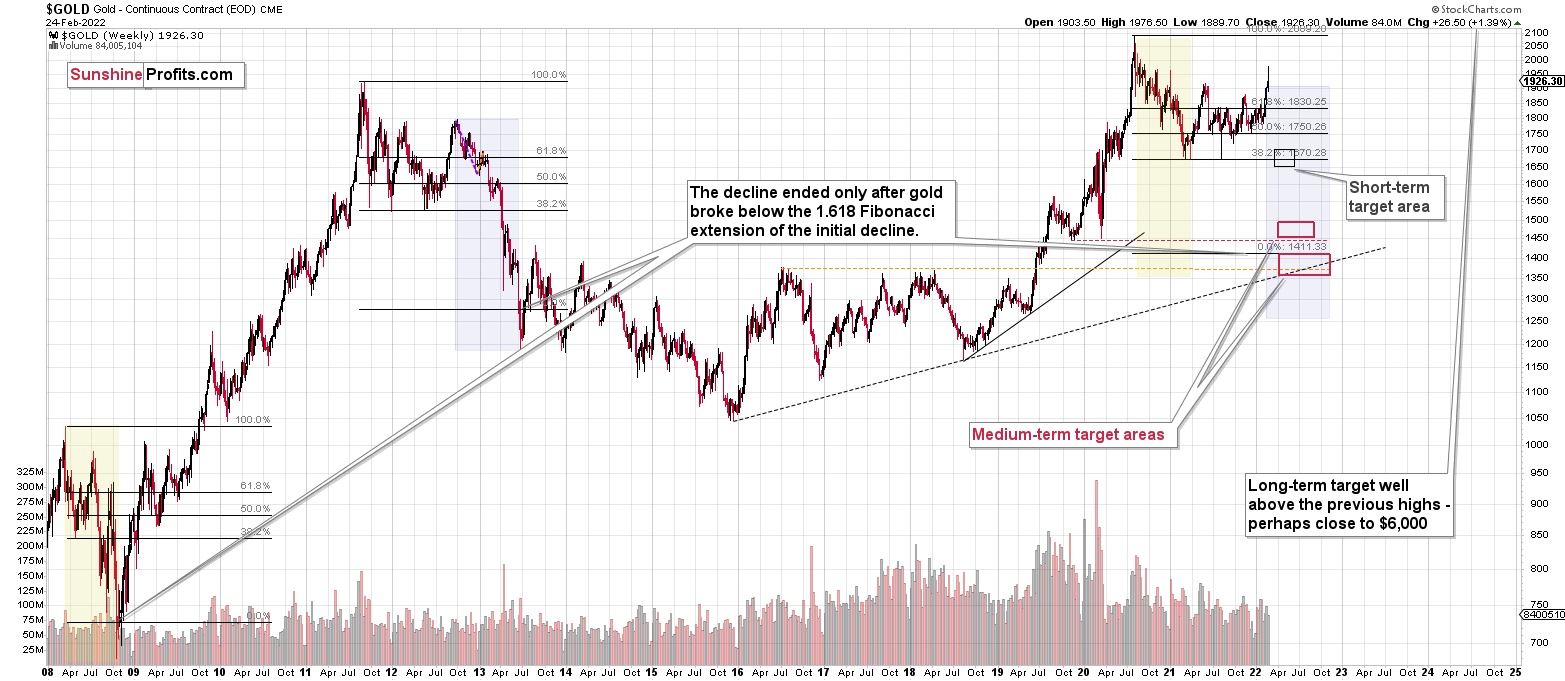

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, despite the recent rally in gold, the outlook for junior mining stocks remains exactly as I described previously.

Crude oil’s extreme outperformance, the stock market’s weakness, and critical medium-term resistance levels reached by gold (all-time high!) and junior mining stocks, all indicate that the tops are at hand or have just formed. The huge-volume reversals in gold and (especially) mining stocks along with silver’s short-term outperformance, all point to lower precious metals prices in the following days/weeks. It seems that the top is in.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on “buy the rumor and sell the fact.” This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. Junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

From the medium-term point of view, the two key long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from short positions are going to become truly epic in the coming months.

After the sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more in the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief