Briefly: the next big downswing appears to be already underway. It might take several weeks before it's completely over.

Welcome to this week's Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

Before discussing the technical point of view, we’d like to say a few words about the situation on the labor market.

First, let’s examine the facts. As the chart below shows, total nonfarm payrolls in November 2020, rose by just 245,000, following much larger gains of 711,000 in October. What is important here is that the U.S. economy added significantly fewer jobs than expected – economists surveyed by Bloomberg forecasted 466,000 additions. Moreover, the civilian labor force participation rate decreased from 61.7 in October to 61.5 in November.

On the positive side, the unemployment rate edged down from 6.9 to 6.7 percent, as the chart above shows. Although the rate is down by 8.0 percentage points from April’s high of 14.7 percent, it’s still 3.2 percentage points higher than it was before the pandemic started. And the nonfarm employment in November was below its February level by 9.8 million, or 6.5 percent, so there is still a long way ahead to a full recovery in the labor market. Actually, the weakening rate of improvement is a signal that the labor market will struggle during the winter wave of the epidemic. As the chart below shows, the daily new cases of COVID-19 in the U.S. are still above 200,000.

You see, at such high levels of infection, the labor market’s rebound will slow down further in December. Many people are not looking for a job because of the coronavirus, and strengthened lockdown measures have limited the ability to find a job for those who don’t fear the pathogen.

Although there might not be a double-dip recession, a lot of time will pass before the economy will fully recover. As the chart below shows, the initial claims have stayed at an elevated level of 700,000-800,000 (more than three times higher than just before the pandemic) since October.

What does it all mean for the yellow metal? Well, gold’s initial reaction to a weak employment situation report was rather modest. As the chart below shows, the price of the shiny metal increased from $1,832 to $1,843 on Friday (December 4). However, the weak economy should support gold prices.

Moreover, the slowdown in the labor market increases the odds for the fiscal stimulus deal. Indeed, Congress should feel more pressure to act in providing the new package, especially considering that at the end of the year, a few unemployment benefit programs will expire, thereby aggravating the income situation of many Americans. The fresh fiscal aid can be agreed upon by the current White House and Congress, but even if not – don’t worry, dovish Janet Yellen, nominated as Treasury Secretary, is ready to act generously and to promote a strong fiscal response.

The disappointing nonfarm payrolls can also prompt the Fed to further strengthen its accommodative stance in the coming months to sail the U.S. economy through the pandemic storm until the vaccines will come to the rescue.

The increased chances of more cheap money from the U.S. central bank and Treasury should support the price of the yellow metal. They boosted the equities on Friday, that’s for sure. It seems that we are observing the return of “the worse, the better” in the financial markets. According to this logic, bad news is positive for Wall Street, as it increases the odds of more liquidity coming into the markets. Therefore, there is a risk that the improved risk sentiment will create downward pressure on the price of gold.

However, gold could also benefit from additional aid in the long run, as monetary and fiscal stimuli would add to both the Fed’s balance sheet and the fiscal deficits. Increased money supply and the public debt should benefit the shiny metal, as a more dovish central bank and Treasury imply lower real interest rates for longer, with a higher risk of inflation and debt crisis.

All in all, there are multiple fundamental reasons why gold is likely to soar in the upcoming years. However, even the most profound bull markets can’t move up in a straight line, and some corrections will likely take place. After the big rallies, we will probably witness significant corrections, and in the case of the precious metals market, one is long overdue.

Much like in March, it seems that the evident economic decline might trigger a sell-off.

At this point, we would like to quote what we wrote about the aspects of the virus scare and how the market reacts to them. In short, gold (and other markets) reacted when people started to strongly consider the pandemic's economic implications, a topic that was ubiquitous in the media.

Undoubtedly, the most important factor for gold will be the economic implications of the second COVID-19 wave. How do we know that? Because we compared what people were searching for (online) with how the gold prices were shaped. There's a lot more data available on https://searchingcovid19.com/, but we'll focus on the chart that shows us exactly when people were getting interested in each aspect of the pandemic, and we'll compare that to gold.

We aligned both charts with regard to time. The chart on the bottom is from Stockcharts.com and it features gold's continuous futures contract. The gold price (and the USD Index value) really started to move once people got particularly interested in the economic impact of the pandemic and in the government's response.

In the recent days (and weeks) the news is dominated by other issues. Once people start considering the economic implications of the second wave of this coronavirus, the prices would be likely to move.

The news coming from the Fed is positive for gold in the long run, but in the short term, they continue to indicate risk for the economy. This risk is likely to translate into lower stock values and initially gold is likely to slide given the above - just like it did in March.

All in all, gold is likely to rally far in the long run, but in the short run it’s vulnerable to a sizable decline, when the economic implications of the pandemic’s continuation become obvious to investors.

Stocks Weigh In

Stocks are testing their previous highs. Will this test be successful? Growing COVID-19 cases and an increasing number of hospitalizations suggest that this will not be the case.

Please note that back in 2018 stocks moved above their previous high before sliding. The fact that they moved above their previous highs is therefore not as bullish as it first appears.

Moreover, please note that back in early September, stocks topped at the vertex of the triangle created by the rising red and blue lines. The blue line is based on the 2020 bottom and the June bottom. The analogous line, based on the 2020 bottom and the September bottom also creates a triangle with the rising red line, and this triangle had a vertex last week.

Does this mean that the top is definitely in? No, but it makes it quite likely that stocks are about to turn lower.

Still, that’s not the most important factor at this time, as a decline in stocks is not required for the PMs to decline.

After all, back in 2016, stocks rallied right after the U.S. presidential elections, while PMs declined.

Keeping the analogy to the U.S. presidential election years in mind, please note that gold tends to decline in these years shortly after (or before) Thanksgiving.

Gold’s Performance around Thanksgiving

Thanksgiving is on the fourth Thursday of each November, which means that the holiday always falls between November 22 and 28. What’s usually happening to the price of gold before and after this period? Let’s check gold’s seasonality for Q4.

During this period, gold is usually just before forming a short-term top and starting the biggest decline within the final quarter of the year.

Please note that the accuracy measure as to when the top is likely to be is relatively low, but soars right before gold’s plunge. This means that while it’s not that clear when gold is likely to top, it’s quite probable that we are going to see some kind of important top regardless of when exactly that takes place. Could it be slightly ahead of Thanksgiving? Yes. Could it be slightly after it? That’s possible as well.

But this year is not like other years, and I don’t mean the pandemic. This year, particularly this November, is special because of the U.S. presidential elections. Therefore, instead of taking into account the average of the previous periods around all recent Thanksgivings, one should focus on the Thanksgivings which were concurrent with presidential elections.

Gold and Thanksgiving during the Presidential Election Years

Let’s examine the last four cases, when gold was already after the 1999-2000 bottom and within its secular bull market.

Starting with the most recent case:

Back in 2016, the decline simply continued after Thanksgiving, and gold bottomed in the second half of December.

Four years earlier, in 2012, gold topped right after Thanksgiving and – just like in 2016 – it bottomed in the second half of December.

In 2008, gold topped right before Thanksgiving and it bottomed in the first half of December.

Finally, in 2004, gold topped shortly after Thanksgiving, and it formed an initial bottom in the first half of December. However, it then declined once again, further reaching bottom in January and February 2005 (two separate bottoms).

Consequently, Thanksgiving during the U.S. presidential election year had a bearish follow-up for gold in practically all four cases. Sometimes it was a bit early and at other times a bit late, but overall, it seems that one should be prepared for declines in the yellow metal during the final days of November and early part of December.

Regardless of the above, please note that in all four cases there was a very short-term move higher immediately following Thanksgiving. Even in 2008, there was a slight uptick higher for one day. What does it mean? It further emphasizes that the current move higher in gold is likely just a temporary, counter-trend bounce.

Moreover, let’s keep in mind that the situation continues to be excessive on the forex market.

The USD Index broke below its previous 2020 lows and this breakdown was confirmed. However, since the recent low was 90.47, it seems that the target for the bottom – the 90 level – is at hand. Therefore, the implications for gold as not as bullish as they might seem at the first sight.

Why would the bottom in the USD Index form at about 90? Because this would be yet another way in which the history could rhyme. In case of the USD Index, we have more of a 1:1 repeat of what we already saw a few years earlier.

Namely, it appears that the USD Index is repeating its 2017 – 2018 decline to some extent. The starting points of the declines (horizontal red line) as well as the final high of the biggest correction are quite similar. The difference is that the recent correction was smaller than it was in 2017.

Since back in 2018, the USDX’s bottom was at about 1.618 Fibonacci extension of the size of the correction, we could expect something similar to happen this time. Applying the above to the current situation would give us the proximity of the 90 level as the downside target.

“So, shouldn’t gold soar in this case?” – would be a valid question to ask.

Well, if the early 2018 pattern was being repeated, then let’s check what happened to precious metals and gold stocks at that time.

In short, they moved just a little higher after the USDX’s breakdown. I marked the moment when the U.S. currency broke below its previous (2017) bottom with a vertical line, so that you can easily see what gold, silver, and GDX (proxy for mining stocks) were doing at that time. They were just before a major top. The bearish action that followed in the short term was particularly visible in the case of the miners.

Consequently, even if the USD Index is to decline further from here, then the implications are not particularly bullish for the precious metals market.

In fact, as the USD Index shows more weakness, gold might simply manage to rally back to its September lows ($1,851 in intraday terms, $1,866 in terms of the daily closing prices, or somewhere between them) and then slide once again. This would be in perfect tune with what happened in early 2018, and also what I discussed previously.

Before moving to the precious metals market, I would like to emphasize two more things about the USD Index.

First, the USD Index is after a long-term, more-than-confirmed breakout. This means that the long-term trend for the U.S. currency is up.

Second, the amount of capital that was shorting the USD Index was excessive even before the most recent decline. This means that the USD Index is not likely to keep declining for much longer.

Starting with the first point, you can clearly see the breakout on the below long-term chart.

Taking into account USDX’s lengthy breakout, its several breakout verifications, and the 5-year consolidation, it seems that the USD Index is ready to rally much higher – perhaps to approximately to the 120 level.

Please note that the consolidation that preceded the previous rally to 120 that took place between 1997 and 2000 happened when the USD index was trading at relatively similar price levels – approximately between 90 and 105.

The additional bullish factor is the presence of excessive bearishness on the futures market.

The above chart shows the netted version of the positions included in the Commitment of Traders report. Please note how the lows in the blue line correspond to major medium-term bottoms in the USD Index. We once again find ourselves in this situation.

On the fundamental front, please keep in mind that for the currency markets it’s not important how “things are going in the U.S.”, but how they are doing relative to the rest of the world, and most importantly, relative to the Eurozone and Japan (currency exchange rates against the euro and the yen have the biggest weights in the USD Index, which is ultimately a weighted average of currency exchange rates). Are things about to get much worse in the U.S. compared to them? No. In risking oversimplification, let’s say that while things are bad pretty much all around the world, they might actually get calmer in the U.S. as the post-presidential election turmoil subsides.

Overall, it seems likely that we’ll see higher USD Index values in the following months and weeks (not necessarily days, though), which is likely to have a bearish impact on the precious metals prices, at least in the first few weeks.

This is particularly the case if we take into account that recently, the Gold Miners Bullish Percent Index ($BPGDM) showed the highest possible overbought reading.

The excessive bullishness was present at the 2016 top as well and it didn’t cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing had caused the $BPGDM to move up once again for a few days. It then declined once again. We saw something similar also in the middle of this year. In this case, the move up took the index once again to the 100 level, while in 2016 this wasn’t the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline.

Based on the decline from above 350 to below 280, we know that a significant decline is definitely taking place. But has it already run its course?

Let’s consider two similar cases when gold miners declined significantly after the $BPGDM was very high: the 2016 decline and early-2020 decline.

In both cases, the HUI Index continued to decline until it moved slightly below its 61.8% Fibonacci retracement level. This means that if the history is to repeat itself, we shouldn’t expect any major turnaround until the gold miners decline to 220 - 230 or so. Depending on how things are developing in gold, the above might or might not be the final bottom, though.

Please note that the HUI already declined below its 2016 high. This breakdown is yet another bearish sign.

Please note that back in 2016 (after the top), and in March 2020, the buying opportunity didn’t present itself until the $BPGDM was below 10. Currently, it’s above 30, so it seems that miners are likely to move even lower.

On December 1, I wrote the following about the likely upside target for the mining stocks during the recent correction:

How high could miners go? Perhaps only to the previous lows and by moving to them, they could verify them as resistance. The previous – October – low is at $36.01 in intraday terms and at $36.52 in terms of the daily closing prices. No matter which level we take, it’s not significantly above the pre-market price of $35.76, thus it seems that adjusting the trading position in order to limit the exposure for the relatively small part of the correction is not a good idea from the risk to reward perspective – one might miss the sharp drop that follows. Please note how sharp the mid-November decline was initially.

That’s exactly what happened – the GDX ETF rallied to $36.14 and then it started moving back down. Is the corrective upswing over? This is quite likely, however, I wouldn’t rule out another move higher, if the USD Index declines to, or slightly below, the 90 level. Still, such a move higher in the miners is not likely to be anything significant.

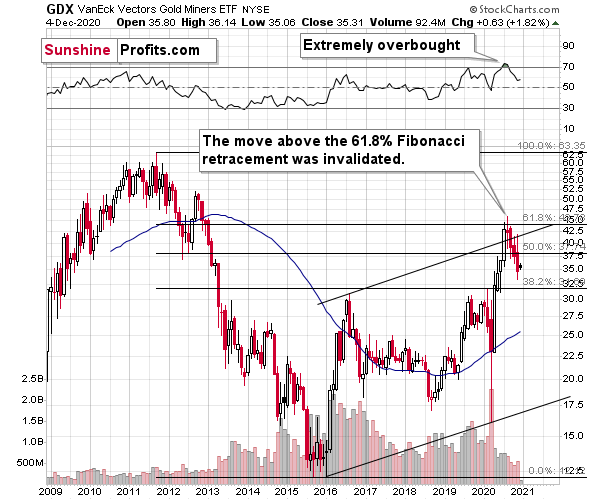

Also, let’s not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracement based on the 2011 – 2016 decline.

When GDX approached its 38.2% Fibonacci retracement, it declined sharply – it was right after the 2016 top. Are we seeing the 2020 top right now? This is quite possible – PMs are likely to decline after the sharp upswing, and since there is just more than one month left before the year ends, it might be the case that they move north of the recent highs only in 2021.

Either way, miners’ inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign.

The same goes for miners’ inability to stay above the rising support line – the line that’s parallel to the line based on the 2016 and 2020 lows.

Let’s proceed to metals themselves.

I previously wrote that gold could bounce to the September lows and that’s exactly what seems to have happened. After moving slightly above $1,850, gold futures turned south. This means that the breakdown below these levels was verified and further declines are now more likely.

Naturally, if the USD Index declines once more, it’s quite likely that gold would test the September low again.

Before moving further, I would like to quote my previous comments that explain why I expect gold to bottom at least at the $1,700 level.

One of the reasons is the 61.8% Fibonacci retracement based on the recent 2020 rally, and the other is the 1.618 extension of the initial decline. However, there are also more long-term-oriented indications that gold is about to move to $1,700 or lower.

(…) gold recently failed to move above its previous long-term (2011) high. Since history tends to repeat itself, it’s only natural to expect gold to behave as it did during its previous attempt to break above its major long-term high.

And the only similar case is from late 1978 when gold rallied above the previous 1974 high. Let’s take a look at the chart below for details (courtesy of chartsrus.com)

As you can see above, in late 1978, gold declined severely right after it moved above the late-1974 high. This time, gold invalidated the breakout, which makes the subsequent decline more likely. And how far did gold decline back in 1978? It declined by about $50, which is about 20% of the starting price. If gold was to drop 20% from its 2020 high, it would slide from $2,089 to about $1,671.

This is in perfect tune with what we described previously as the downside target while describing gold’s long-term charts:

The chart above shows exactly why the $1,700 level is even more likely to trigger a rebound in gold, at the very minimum.

The $1,700 level is additionally confirmed by the 38.2% Fibonacci retracement based on the entire 2015 – 2020 rally.

There’s also a good possibility that gold could decline to the $1,500 - $1,600 area or so (50% - 61.8% Fibonacci retracements and the price level to which gold declined initially in 2011), but based on the size of the recent upswing, we no longer think that this scenario is the most likely one.

The odd thing about the above chart is that I copied the most recent movement in gold and pasted it above gold’s 2011 – 2013 performance. But – admit it – at first glance, it was clear to you that both price moves were very similar.

And that’s exactly my point. The history tends to rhyme and that’s one of the foundations of the technical analysis in general. Retracements, indicators, cycles, and other techniques are used based on this very foundation – they are just different ways to approach the recurring nature of events.

However, every now and then, the history repeats itself to a much greater degree than is normally the case. In extremely rare cases, we get a direct 1:1 similarity, but in some (still rare, but not as extremely rare) cases we get a similarity where the price is moving proportionately to how it moved previously. That’s called a market’s self-similarity or the fractal nature of the markets. But after taking a brief look at the chart, you probably instinctively knew that since the price moves are so similar this time, then the follow-up action is also likely to be quite similar.

In other words, if something looks like a duck, and quacks like a duck, it’s probably a duck. And it’s likely to do what ducks do.

What did gold do back in 2013 at the end of the self-similar pattern? Saying that it declined is true, but it doesn’t give the full picture - just like saying that the U.S. public debt is not small. Back then, gold truly plunged. And before it plunged, it moved lower in a rather steady manner, with periodic corrections. That’s exactly what we see right now.

Please note that the above chart shows gold’s very long-term turning points (vertical lines) and we see that gold topped a bit after it (not much off given their long-term nature). Based on how gold performed after previous long-term turning points (marked with purple, dashed lines), it seems that a decline to even $1,600 would not be out of ordinary.

Finally, please note the strong sell signal from the MACD indicator in the bottom part of the chart. The only other time when this indicator flashed a sell signal while being so overbought was at the 2011 top. The second most-similar case is the 2008 top.

The above-mentioned self-similarity covers the analogy to the 2011 top, but what about the 2008 performance?

If we take a look at how big the final 2008 decline was, we notice that if gold repeated it (percentage-wise), it would decline to about $1,450. Interestingly, this would mean that gold would move to the 61.8% Fibonacci retracement level based on the entire 2015 – 2020 rally. This is so interesting, because that’s the Fibonacci retracement level that (approximately) ended the 2013 decline.

History tends to rhyme, so perhaps gold is going to decline even more than the simple analogy to the previous turning points indicates. For now, this is relatively unclear, and my target area for gold’s final bottom is quite broad.

While gold broke below its September low and now verified its breakout, silver just moved to its own September low and then bounced back. After moving higher, silver seems to have topped right below its 38.2% Fibonacci retracement based on the August – September decline. What does this imply? Not much, actually – it means that the white metal is continuing to trade sideways after breaking below the rising, medium-term support line in mid-September.

Silver shrugged off the rally in the general stock market and the decline in the USD Index – it could have rallied on any of the above, and instead it just kept consolidating.

Consequently, silver seems to be preparing for a bigger mover lower.

Silver’s downside target is relatively unclear, but the implications coming from silver’s long-term chart are definitely bearish for the next several weeks due to the size of the volume that accompanied the recent monthly rally.

If you look at the monthly silver volume levels, it seems likely that the next sizable downswing has already begun. The previous substantial monthly volume in silver accompanied the 2011 top. The analogy doesn’t get more bearish than this. Ok, it would, if there were multiple key tops confirmed by huge monthly volume. But the 2011 top was so significant that other tops are not comparable, except for the most recent one. Thus, the implications are bearish.

Moreover, please keep in mind that while gold moved to new highs, silver – despite its powerful short-term upswing – didn’t manage to correct more than half of its 2011 – 2020 decline.

In fact, silver has already invalidated its move above the lowest of the classic Fibonacci retracement levels (38.2%), which is not something that characterizes extraordinarily strong markets.

Silver is likely to move well above its 2011 highs, but it’s unlikely to do it without another sizable downswing first.

We are witnessing something similar in the HUI Index as well. The latter corrected half of its 2011 – 2016 decline and nothing more, while gold moved well above its 2011 high.

All in all, it was mostly gold that was making the major gains earlier this year – not the entire precious metals sector.

Please note that the HUI Index is declining at a pace that’s very much in tune with how it declined in 1999-2000 and 2012-2013.

So, how do we determine whether we see the buying opportunity or not?

We will view the price target levels as guidelines, and the same goes for the Gold Miners Bullish Percent Index (below 10), but the final confirmation will likely be something else. Something that we already saw in March when gold bottomed.

We will be on a special lookout for gold’s strength against the ongoing USDX rally. At many vital bottoms in gold, that’s exactly what happened, including what the March bottom.

The link between gold and the USD Index is strongly negative in the medium-term, but given gold’s extraordinary weakness despite the USD’s decline, the short-term correlation actually turned slightly positive recently. This is not the bullish sign we’ve been looking for. This is its opposite.

Since gold, silver, and mining stocks have been strongly negatively correlated with the USD Index in the medium term (250-day column), it seems likely that they will be negatively affected by the upcoming sizable USDX upswing.

…Until we see the day where gold reverses or soars despite the U.S. currency’s rally.

If that happens with gold at about $1,700, we’ll have a very good chance that this was the final bottom. If it doesn’t happen at that time, or gold continues to slide despite USD’s pause or decline, we’ll know that gold has further to fall.

Naturally we’ll keep you – our subscribers – informed.

To move forward, how does the GDX downside target compare to gold’s downside target? If, at the same time, gold moves to about $1,700 and miners are already after a ridiculously big drop (to $31-$32 in the GDX ETF, or lower), the binding profit-take exit price of your GDX ETF will become $32.02 (those with higher risk tolerance might lower it to $31.15 or so, but moving it lower seems just too risky).

At this time, the final GDX target (the one that would correspond to gold at $1,500 or so) is still unclear. The $17 - $23 area seems probable, especially if the general stock market slides once again. It’s too early to say with any significant level of certainty. Gold is providing us with a clearer final target, so that’s what we’ll focus on. And most importantly – we’ll focus on gold’s performance relative to the USD Index.

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think it has already begun.

During the final part of the slide (which could end within the next 1-5 weeks or so), I expect silver to decline more than miners. That would align with how the markets initially reacted to the Covid-19 threat.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is incredibly positive in the long run, which does not make the short-term decline improbable. Markets can and will get ahead of themselves and decline afterward – sometimes very profoundly – before continuing with their upward climb.

The plan is to exit the current short positions in miners after they decline far and fast, but at the same time, silver drops just “significantly” (we expect this to happen in 0 – 3 weeks). In other words, the decline in silver should be severe, but the decline in the miners should look “ridiculous”. That’s what we did in March when we bought practically right at the bottom. It is a soft, but simultaneously broad instruction, so additional confirmations are necessary.

I expect this confirmation to come from gold, reaching about $1,700 - $1,750. If – at the same time – gold moves to about $1,700 - $1,750 and miners are already after a ridiculously big drop (say, to $31 - $32 in the GDX ETF – or lower), we will probably exit the short positions in the miners and at the same time enter short positions in silver. However, it could also be the case that we’ll wait for a rebound before re-entering short position in silver – it’s too early to say at this time. It’s also possible that we’ll enter very quick long positions between those short positions.

The precious metals market's final bottom is likely to take shape when gold shows significant strength relative to the USD Index. It could take the form of a gold’s rally or a bullish reversal, despite the ongoing USD Index rally.

Summary

Summing up, the next big move lower in the precious metals market is definitely underway and it seems that it will take another 1-5 weeks (likely in the second half of December) before the decline ends. It seems that the part of the slide in gold that takes place below $1,700 is going to see a silver catching up with the decline in gold and miners. Last week’s upswing seems to be a relatively normal bounce within a bigger decline.

Please note that even Warren Buffett is limiting his exposure to gold.

Despite the recent decline in it, it seems that the USD Index is going to move higher in the following months and weeks, causing gold to decline. At some point gold is likely to stop responding to dollar’s bearish indications, and based on the above analysis, it seems that we might expect this to take place in December.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it was not already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,700 or lower), we expect the precious metals to rally significantly. The final decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager