Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Dear subscribers,

Friday’s Gold Investment Update got stuck in the pipes and we did not upload it properly. We also failed to double check, making it a double oversight on our part. Therefore, you and the rest of our cherished readers were not able to access this important publication. It’s a rare occurrence, but that’s not an excuse. On behalf of the editorial team, I offer you my sincere apologies for this mishap. You deserve better, and we’ll work on making sure that every publication is delivered on time and on schedule.

As a thank you for your understanding, we’re also including the full daily Gold and Silver Investment Update in your mailbox for the rest of the week.

Again, our kindest apologies.

Best regards,

Dominik Starosz

Managing Editor

Introduction

Welcome to the Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

Last Thursday’s session didn’t bring any changes to the market, so quite a few things that I wrote about Mar 3 are up-to-date. In this analysis, in addition to updating you on the situation in the short-term charts, I’d like to put the recent moves into a broader perspective. Let’s start with a market from precious metals’ surroundings – the crude oil market.

Quite a lot has happened in crude oil, and it tells us something important not only about gold, but also about mining stocks.

As you may have noticed, crude oil shot up recently in a spectacular manner. This seems normal, as it’s a market with rather inflexible supply and demand, so disruptions in supply or threats thereof can impact the price in a substantial way. With Russia as one of the biggest crude oil producers, its invasion of Ukraine, and a number of sanctions imposed on the attacking country (some of them involving oil directly), it’s natural that crude oil reacts in a certain manner. The concern-based rally in gold is also understandable.

However, the relationship between wars, concerns, and prices of assets is not as straightforward as “there’s a war, so gold and crude oil will go up.” In order to learn more about this relationship, let’s examine the most similar situation in recent history to the current one, when oil supplies were at stake.

The war that I’m mentioning is the one between Iraq and the U.S. that started almost 20 years ago. Let’s see what happened in gold, oil, and gold stocks at that time.

The most interesting thing is that when the war officially started, the above-mentioned markets were already after a decline. However, that’s not that odd, when one considers the fact that back then, the tensions were building for a long time, and it was relatively clear in advance that the U.S. attack was going to happen. This time, Russia claimed that it wouldn’t attack until the very last minute before the invasion.

The point here, however, is that the markets rallied while the uncertainty and concerns were building up, and then declined when the situation was known and “stable.” I don’t mean that “war” was seen as stable, but rather that the outcome and how it affected the markets was rather obvious.

The other point is the specific way in which all three markets reacted to the war and the timing thereof.

Gold stocks rallied initially, but then were not that eager to follow gold higher, but that’s something that’s universal in the final stages of most rallies in the precious metals market. What’s most interesting here is that there was a time when crude oil rallied substantially, while gold was already declining.

Let me emphasize that once again: gold topped first, and then it underperformed while crude oil continued to soar substantially.

Fast forward to the current situation. What has happened recently?

Gold had moved above $1,970 (crude oil had peaked at $100.54 at that time), and then it declined heavily. It was trying to move back to this intraday high, but it was not able to do so. On Friday, gold was trading at about $1,938, while crude oil was trading at about $108.

In other words, while gold declined by $30, crude oil rallied by about $14. That’s a repeat of what we saw in 2003!

What happened next in 2003? Gold declined, and the moment when crude oil started to visibly outperform gold was also the beginning of a big decline in gold stocks.

That makes perfect sense on the fundamental level too. Gold miners’ share prices depend on their profits (just like it’s the case with any other company). Crude oil at higher levels means higher costs for the miners (the machinery has to be fueled, the equipment has to be transported, etc.). When costs (crude oil could be viewed as a proxy for them) are rising faster than revenues (gold could be viewed as a proxy for them), miners’ profits appear to be in danger; and investors don’t like this kind of danger, so they sell shares. Of course, there are many more factors that need to be taken into account, but I just wanted to emphasize one way in which the above-mentioned technical phenomenon is justified. The above doesn’t apply to silver as it’s a commodity, but it does apply to silver stocks.

Back in 2004, gold stocks wiped out their entire war-concern-based rally, and the biggest part of the decline took just a bit more than a month. Let’s remember that back then, gold stocks were in a very strong medium- and long-term uptrend. Right now, mining stocks remain in a medium-term downtrend, so their decline could be bigger – they could give away their war-concern-based gains and then decline much more.

Mining stocks are not declining profoundly yet, but let’s keep in mind that history rhymes – it doesn’t repeat to the letter. As I emphasized previously today, back in 2003 and 2002, the tensions were building for a longer time, and it was relatively clear in advance that the U.S. attack was going to happen. This time, Russia claimed that it wouldn’t attack until the very last minute before the invasion. Consequently, the “we have to act now” is still likely to be present, and the dust hasn’t settled yet – everything appears to be unclear, and thus the markets are not returning to their previous trends. Yet.

However, as history shows, that is likely to happen. Either immediately, or shortly, as crude oil is already outperforming gold.

Technically, the GDX ETF confirmed its breakout above the declining medium-term resistance line, but with the RSI just below 70 and the stochastic at one of its highest levels in the recent past, it’s far from likely that a big rally would follow.

The declining resistance line is not the only one on the above chart. The 50% Fibonacci retracement is less than $0.50 above the Mar. 3 intraday high. Even if miners move higher on an intraday basis, the above would likely be stopped by the Fibonacci retracement. I previously wrote about the “pennies to the upside and dollars to the downside” situation, and the above chart continues to support it.

While the GDX ETF is close to its 50% retracement, the GDXJ – a proxy for junior mining stocks – is visibly below its 38.2% retracement. The junior miners continue to underperform senior miners - the sector selection for the current short position appears to have been correct.

Junior miners moved higher on very low volume, which indicates that everyone who wanted to buy based on the current events has already done so, and the price is ready to fall. That would be in tune not only with what happened during the U.S. invasion of Iraq, but also in perfect tune with what happened to mining stocks when Russia took over Crimea in 2014.

Let’s keep in mind that back then, GDXJ actually topped in mid-Feb 2014, and then it just moved back and forth until gold topped in mid-March 2014. OK, to be precise, the GDXJ’s intraday high in March was about 3% above its mid-Feb high, and it was then followed by an immediate decline.

At the same time, when GDXJ was moving back and forth, and then it popped up about 3% higher before sliding, gold was rallying.

Taking into account last week’s upswing, the GDXJ was 3.25% higher. This was in perfect tune with what we saw in 2014, right at the top.

Based on the above analogy, it seems like the worst time to be exiting short positions in junior mining stocks. Instead, it might be a perfect time to be entering or adding to them (if one doesn’t have the desired exposure yet).

The long-term HUI Index chart supports the bearish narrative in the medium term as well.

If you look at the areas marked with red circles (especially: now, 2012/2013, and 2008), you’ll notice that they are very similar. These are the sizable short-term rallies that we saw after / in the final parts of the broad head-and-shoulders patterns.

The moves were quite sizable – the 2012 rally was even bigger than the current one, even though there was no war in Europe at that time.

Based on how broad the pattern is and self-similarity present in gold, it seems that the analogy to what happened in 2012 is most important right now.

Looking at the moving averages, we see that the 50-week moving average (blue) and 200-week moving average (red) performed quite specifically in late 2012, and we see the same thing this year.

The distance between 50- and 200-week moving averages currently narrows, while the former declines. Back in 2012, the top formed when the HUI rallied above its 50-week moving average, which just happened once again.

Still, if the general stock market slides, and that appears likely for the following weeks and months, then we might have a decline that’s actually similar to what happened in 2008. Back then, gold stocks declined profoundly, and they have done so very quickly.

The dashed lines that start from the recent prices are copy-paste versions of the previous declines that started from the final medium-term tops. If the decline is as sharp and as big as what we saw in 2008, gold stocks would be likely to decline sharply, slightly below their 2016 low. If the decline is more moderate, then they could decline “only” to 120 - 140 or so. Either way, the implications are very, very, very bearish for the following weeks.

Speaking of gold’s analogy to 2011-2013, last week’s price performance in gold didn’t make my previous comments on it any less valid. In fact, the RSI based on gold’s weekly chart was above its 2021 high and just below 70 on Friday, which was even more in tune with what we saw in 2012 (at the top) than what we had seen previously.

The move higher in the MACD indicator (bottom of the above chart) is also noticeable, which is in tune with what we saw at the 2012 top.

Gold is trading close to its previous medium-term tops, which formed well below the initial top (2011, 2020) – the situation is extremely similar and the implications are very bearish. Even the moving averages (40- and 60-week ones) are trading close to each other, just like what we saw in late 2012. Back then, they marked the target for the very initial decline from the top.

If this part of history were to be repeated, we could see some sort of short-term rebound (nothing major, though) after gold declines to about $1,800. This would be in tune with the analogy to 2003 (the one that I started today’s analysis with), when gold gave back all the war-based premium.

This would likely have a devastating impact on the prices of mining stocks. The latter would also likely suffer when the general stock market slides, and it seems that we won’t have to wait too long for that either.

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so and… they failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium- and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in the mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not “logarithmic” scale. You probably still remember how significant and painful (if you were long that is) the decline at the beginning of 2020 was.

Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

What does it mean? It means that it is time when being out of the short position in mining stocks to get a few extra dollars from immediate-term trades might be risky. The possibility that the omicron variant of Covid makes vaccination ineffective is too big to be ignored as well. If that happens, we might see 2020 all over again – to some extent. In this environment, it looks like the situation is “pennies to the upside and dollars to the downside” for mining stocks. Perhaps tens of dollars to the downside… You have been warned.

Here's how the situation currently looks from the U.S. point of view. The chart below features the S&P 500 futures.

The key thing about the above chart is that what we’ve seen this year is the biggest decline since 2020, and the size of the recent slide is comparable to what we saw as the initial wave down in 2020. If these moves are analogous, the current rebound is normal – there was one in early 2020 too. This also means that a much bigger decline is likely in the cards in the coming weeks.

The thing that we see with regard to the short term is that stocks moved above their declining resistance line. However, this line was already “broken” in a similar way earlier this year. The fact is that this “breakout” actually resulted in its invalidation and another wave down.

If history is about to rhyme with regard to both short-term and the analogy to 2020, the next move lower might be much bigger.

This would be likely to have a very negative impact on the precious metals market, in particular on junior mining stocks (initially) and silver (a bit later).

Speaking of silver, the white metal is now trying to move above its late-2021 highs.

Despite the recent strength, it seems that silver might not be able to move above its late-2021 highs, and even if it does, to hold above this level for longer.

Remember the analogy to the early-2020 correction in stocks? While it’s not clearly visible on the above chart, it’s important to note that during this correction, silver was relatively weak – it didn’t rally as much as gold or mining stocks did. Well, we see the same thing right now. Silver is not performing that well, while gold moved decisively higher and senior miners (not juniors) moved above their late-2021 highs.

Just as in 2020, junior miners declined the most first, but silver caught up later, so we might get a similar opportunity in the coming months. I can’t promise any specific performance, but if we do, the gains on this short position will be truly legendary. If we don’t get it, they are likely to be “only enormous.”

All in all, despite the recent short-term war-based rally, silver is not that strong. It’s well below its early-2021 high, when everyone and their brother thought that silver is going to the moon immediately.

Silver’s long-term potential remains huge, but in the following months, the white metal is likely to decline.

With silver’s long-term cycle implying a surge above $75 (and even $100) over the next several years, the white metal’s secular uptrend remains intact. However, with an epic collapse likely to precede the forthcoming Renaissance, volatility presents us with ample opportunities.

Case in point: silver cycles last roughly two years and the turning points culminate with extreme volatility in both directions. Sometimes ferocious rallies follow, and other times the white metal falls off a cliff. In the here and now, with silver approaching the end of its current cycle, a supreme climax could be around the corner. Moreover, when we combine the myriad of technical and fundamental indicators signaling the same outcome, the white metal could get cut in half over the next few months.

Furthermore, with the white metal declining after reaching its long-term turning point, silver is mirroring its behavior from past cycles. And with the historical shifts ending with profound drawdowns, another major decline should commence in the coming months

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on “buy the rumor and sell the fact.” This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. Junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

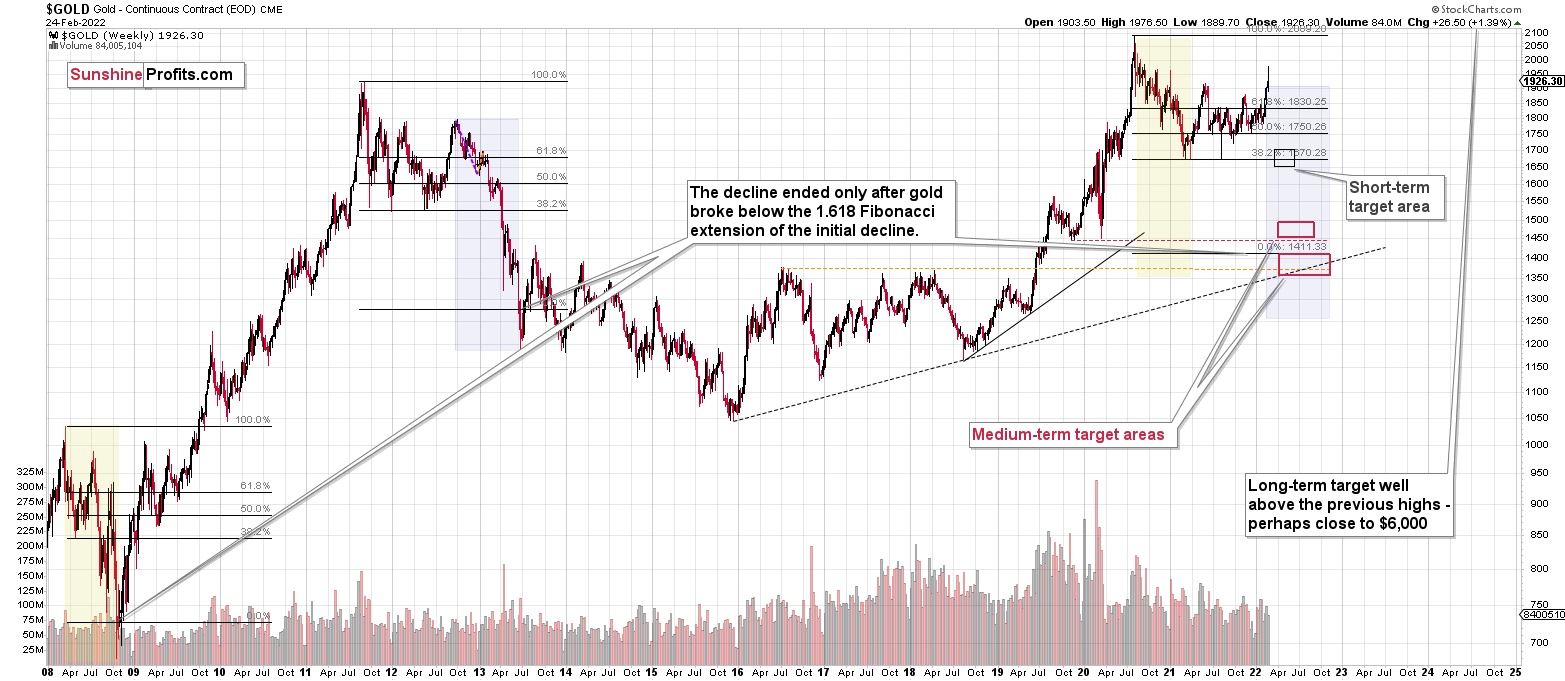

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, despite the recent rally in gold, the outlook for junior mining stocks remains exactly as I described previously.

Gold is up from its late-2021 low, just like how much it rallied in 2014 when Russia took over Crimea. When that happened, junior miners moved about 3% above their previous highs, and we saw something very similar in last week’s London trading of the GDXJ.

It looks like “peak uncertainty” and “peak gold” are already here or very, very close. It’s even more likely that the top in junior mining stocks is in, or about to be in.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on “buy the rumor and sell the fact”. This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. Junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

Consequently, I’m keeping my short position in the GDXJ intact. In fact, as it declined in value due to recent movement, and the outlook didn’t change (in fact, the downside potential is even bigger), I just added to my short position in the junior miners. Please note that it doesn’t mean the increase of the desired position size – it means making sure that the desired size of the position remains as I want it to be. If that’s not a clear confirmation of putting one’s money where one’s mouth is, then I don’t know what would be one.

Moreover, let’s keep in mind that there are triangle-vertex-based reversals in mid- and late-February, so even if we see more back-and-forth trading soon, it’s likely that the decline resumes later this month.

I continue to think that junior mining stocks are currently likely to decline the most out of all the parts of the precious metals sector.

From the medium-term point of view, the two key long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the coming months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief