Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite USD Index’s continuous strength will likely be the signal that confirms that the bottom is in.

Welcome to this week's Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

To begin, I want to highlight the fundamental variables that are likely to affect the precious metals in the coming weeks

First up, we have the copper/U.S. 10-Year Treasury yield ratio.

On Feb. 2, I warned that the U.S. 10-Year Treasury yield’s outperformance signaled further downside for gold.

I wrote:

If the copper/gold ratio is a reliable indicator of future U.S. interest rates, then the copper/U.S. 10-Year Treasury yield ratio should be a reliable indicator of future gold prices.

Please see below:

Figure 1

To explain the chart above, the red line depicts the price of gold over the last ~21 years, while the green line depicts the copper/U.S. 10-Year Treasury yield ratio. As you can see, the two have a tight relationship: when the copper/U.S. 10-Year Treasury yield ratio is rising (meaning that copper prices are rising at a faster pace than the U.S. 10-Year Treasury yield), it usually results in higher gold prices. Conversely, when the copper/U.S. 10-Year Treasury yield ratio is falling (meaning that the U.S. 10-Year Treasury yield is rising at a faster pace than copper prices), it usually results in lower gold prices.

If you focus on the right side of the chart, you can see that the copper/U.S. 10-Year Treasury yield ratio (the green line) has made a vertical move lower. Falling from a high of nearly 5.5, the ratio is now below 3.5. And moving in lockstep, gold peaked at roughly the same time.

The key takeaway?

With gold already tracking the copper/U.S. 10-Year Treasury yield ratio lower, the magnitude of the latter’s decline implies further downside for gold. In addition, the U.S. 10-Year Treasury yield remains technically sound, with higher highs and higher lows signaling that a continuation of August’s uptrend remains the path of least resistance.

Figure 2

Fast forward to Feb. 5.

Despite silver’s short squeeze providing a one-day distraction, the narrative continues to play out. The U.S. 10-Year Treasury yield has increased by 8.3% over the last four trading days and Friday’s (Feb. 5) close was the highest since Mar. 18. In addition, the August uptrend continues to accelerate.

Please see below:

Figure 3

Moving in lockstep, the copper/U.S. 10-Year Treasury yield ratio’s 6.6% weekly decline coincided with a 2.0% weekly decline in gold.

Please see below:

Figure 4

Furthermore, with the copper/U.S. 10-Year Treasury yield ratio approaching the three handle (the scale on the right side of the chart), gold’s decline likely isn’t over. If you analyze the right side of the chart, you can see that gold’s vertical move higher in 2020 coincided with a vertical spike in the copper/U.S. 10-Year Treasury yield ratio. Thus, if the ratio reverts back to its historical average, gold has plenty of room to fall.

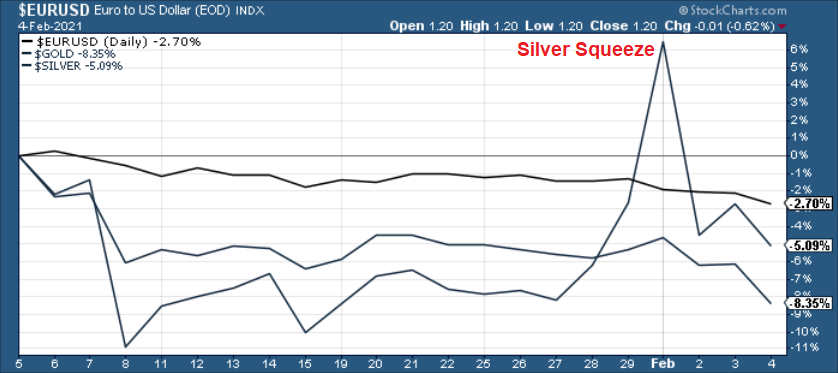

As a second source of potential trouble, the EUR/USD remains destined for devaluation. And given the PMs strong correlation with the currency pair, a profound decline could weigh heavily on their performance.

On Feb. 4, I wrote:

For weeks, I’ve been warning that the Eurozone economy and the EUR/USD were on a collision course. And with Europe’s fundamental underperformance accelerating at a drastic pace, we may have just had impact.

On Feb. 4, the EUR/USD hit its lowest level since Nov. 30.

Please see below:

Figure 5

Along for the ride, the EUR/USD’s pain has not been the PMs gain. Because of their strong correlation, it’s no surprise that the euro’s downfall is making waves across the precious metals’ market.

Figure 6

Foretelling the decline, I warned that the EUR/GBP was about to crack. And given the EUR/USD’s strong correlation with the EUR/GBP, the latter’s collapse was an early warning sign.

Please see below:

Figure 7

More importantly though, a break in the EUR/GBP could be an early warning sign of a forthcoming break in the EUR/USD.

Figure 8

If you analyze the chart above, ~20 years of history shows that the EUR/GBP and the EUR/USD tend to follow in each other’s footsteps. As a result, if the EUR/GBP retests its April low (the next support level), the EUR/USD is likely to tag along for the ride (which implies a move back to ~1.08).

And living up to its billing, the EUR/GBP is racing toward its April low.

Please see below:

Figure 9

And if the April low breaks, it could be lights out for the EUR/USD. Already, the currency pair has broken below its long-term declining resistance line. And if the technical damage continues and the EUR/USD breaks below the 1.16/1.17 level, its long-term support (roughly 1.05) is well within the range of its April low (roughly 1.08).

Figure 10

And despite taking a breather on Feb. 5 and bouncing off of oversold conditions – after the EUR/USD’s RSI (Relative Strength Index) fell below 31 – the overall downtrend remains in place.

As further evidence, I wrote:

To make the fundamental case for a lower EUR/USD, the U.S. Treasury revealed on Feb. 1 that it plans to borrow $274 billion in the first-quarter of 2021. In stark contrast to its November estimate of $1.127 trillion, the massive 76% reduction (the red box below) is the result of stimulus gridlock in Washington.

Figure 11 - Source: The U.S. Department of the Treasury

To explain, the U.S. Treasury raises money by selling bonds to the general public. And to keep interest rates low, the FED purchases these bonds on the secondary market. The two claim that they don’t collaborate, however, the end result is always the same: the more bonds the Treasury issues, the more purchases that the FED has to make to keep interest rates low. Conversely, the less bonds the Treasury issues, the less purchases that the FED has to make to keep interest rates low.

More importantly though, the U.S. Treasury’s new-found fiscal accountability is extremely bullish for the U.S. dollar. With the European Central Bank’s (ECB) printing press working 24/7, the FED/ECB ratio has already declined by 0.26% week-over-week. And now, with the U.S. Treasury reducing its Q1 borrowing, the ratio should continue its descension.

Please see below:

Figure 12

The red line above depicts the movement of the EUR/USD, while the green line above depicts the FED/ECB ratio. As you can see, when the green line rises (FED is outprinting the ECB), the EUR/USD also tends to rise. Conversely, when the green line falls (the ECB is outprinting the FED), the EUR/USD tends to fall.

As it stands today, the FED/ECB ratio has declined by 0.26% week-over-week and is down by nearly 18% since June. And if you analyze the right side of the chart, you can see that the EUR/USD is starting to notice. As the FED/ECB ratio tracks lower, the EUR/USD is starting to roll over. And if history is any indication, the EUR/USD has plenty of catching up to do.

Third on the docket, a drawdown of U.S. equities will likely cast a shadow over the precious metals’ market. Right now, fund managers’ cash positions are at an all-time low, while speculative behavior is at an all-time high. Case in point: frantic buying of technology companies regardless of valuation has pushed the NASDAQ 100/S&P 500 ratio beyond the high set during the dot-com bubble.

Please see below:

Figure 13

To explain, the green line above depicts the performance of the NASDAQ 100 relative to the S&P 500. When the green line is rising, it means that the NASDAQ 100 is outperforming. Conversely, when the green line is falling, it means that the S&P 500 is outperforming. As you can see, 2000 is no longer the main course.

Equally troubling, a significant drawdown of the NASDAQ 100 inflicts plenty of pain on the PMs. If you exclude silver’s one-day outlier, the metals – especially the miners – aren’t immune to equity market stress.

Please see below:

Figure 14

In conclusion, the above fundamental and cross-asset implications are extremely important to monitor over the coming weeks. Remember, the PMs don’t operate in a vacuum. As a result, the behavior of these assets are early indicators of the PMs next move.

Looking long-term, there are plenty of fundamental reasons why gold is likely to soar in the coming years. However, even the most profound bull markets don’t move up in a straight line, and corrections are inevitable.

As it relates to the precious metals, a significant correction (medium-term downtrend) is already underway. However, the pain is not over, and a severe climax likely awaits.

For context, potential triggers are not always noticeable, and the PMs may collapse on their own or as a result of some random trigger that normally wouldn’t cause any major action. However, a trigger will speed things up and that’s where the S&P 500 comes in:

S&P 500 (SPX) Signals

Continuing to defy gravity, the S&P 500 is still running hot. However, the double-top in the S&P 500’s RSI implies that it’s a matter of when, not if, a profound drawdown occurs.

Since 2018, each time the S&P 500’s RSI approached (or exceeded) 70, it preceded a significant decline. Moreover, the previous week’s GameStop fiasco ushered the S&P 500 below its dashed rising support line, and in the process, did plenty of technical damage.

Please see below:

Figure 15 - S&P 500 Index

In addition, the unrelenting strength of crude oil (WTI) and the resurgence of Bitcoin signals that the speculative frenzy has resumed on Wall Street. And while timing is always difficult, once the rubber meets the road, the drawdown will likely be fast and furious.

As evidence, the S&P 500’s price-to-sales (P/S) ratio just hit another all-time high on Feb. 4. Up from a previous high of 2.85x, the multiple now sits at 2.90x. And knowing that what goes up must come down, a reversion to the mean will be extremely unkind to the bubble buyers.

Please see below:

Figure 16 - Source: Bloomberg/ Liz Ann Sonders

As such, the S&P 500’s pedal to the metal mentality is likely to end with a crash. And given their moderate-to-strong correlations, the PMs will likely be a casualty of this derailment. But keep in mind: due to the U.S. Federal Reserve’s excessive intervention, the S&P 500 has essentially become a government-sponsored entity. Thus, equities’ puzzle piece remains less reliable than the fundamental variables that I outlined above.

As well, a decline in stocks is not required for the PMs to decline. However, a break in the former could easily trigger a sell-off in the latter, and as history has shown, silver and the miners will be the hardest hit.

Goodbye 2020, Welcome 2021

With the MACD indicator showing a screaming sell signal, the 2011 analogue is already upon us. Only a shade below the 2011 high, today’s MACD indicator has delivered its second-highest reading in the last 40 years.

More importantly though, if you analyze the chart below (the red arrows at the bottom), the last four times the black line cut through the red line from above, a significant drawdown occurred.

Figure 17 - Gold Continuous Contract Overview, GOLD and Moving Average Convergence Divergence Chart (MACD) Comparison

Also ominous is that the magnitude of the drawdowns in price tend to coincide with the magnitude of the preceding upswings in MACD. And with today’s reading only surpassed by 2011, a climactic move to the $1,250/$1,450 range isn’t out of the question for gold. The above is based on how low gold had previously declined after similarly important sell signal from the MACD

Now, the month is not over yet, so one might say that it’s too early to consider the sell signal that’s based on monthly closing prices, but it seems that given the level that the MACD had previously reached and the shape of the top in the black line, it makes the situation so similar to 2011/2012 that the sell signal itself is just a cherry on the bearish analytical cake.

Considering the reliability of the MACD indicator as a sell signal for major declines, the reading also implies that gold’s downtrend could last longer and be more severe than originally thought. As a result, $1,500 remains the most likely outcome, with $1,250 still in the cards.

For more context on the potential move, on Dec. 31, I wrote:

As 2020 quickly draws to a close and the champagne corks pop, precious metals investors have January 2021 on their mind and how gold will fare just after the New Year. Let’s take a quick look at what the previous years tell us.

In a nutshell, gold didn’t just “soar” in previous Januaries, but rather reversed at the end of the year and then moved in the opposite direction in January – canceling the December moves. “New year – new me” sounds cliché, but that’s what gold has actually been adhering to instead of simply soaring.

The above chart covers the past 40 years. The green vertical lines represent cases when (approximately) the turn of the year was a great buying opportunity. The red lines represent cases when (approximately) the turn of the year was a great selling opportunity.

There were 25 cases when gold visibly reversed close to the end of the year or the beginning of the new year – so that’s what happens in most cases.

In 13 of the cases, those were buying opportunities.

In 12 of the cases, those were selling opportunities.

Since the number of turning points is not divisible, the 13-12 breakdown is the closest that it can get to 50/50.

So, while it’s true that in most past cases, the turn of the year was positive for gold, it’s also true that the gold price forecast for January 2021 is not necessarily going to be bullish. The context is important, since:

- Gold has been rallying in December 2020

- Gold tends to reverse at the turn of the year

The implications of the 0 becoming a 1 at the end of the date are actually bearish for the yellow metal.

Moreover, please take a look at the lower part of the above chart. It features the MACD indicator based on the monthly gold prices. There were very few cases when this indicator moved up significantly and then clearly declined. This happened only four times in the previous four decades. Once in the late 1980s, once in early 2008, once in 2011, and once recently. In all previous cases, it heralded months of declines.

This does not bode well for the price of the yellow metal at all, especially considering that it recently invalidated its breakout above the 2011 high.

The USD Index (USDX)

Sending shockwaves across the precious metals’ market, the USD Index has gotten its swagger back. And as the greenback struts with new-found confidence, the PMs are starting to notice.

Please see below:

Figure 18

Over the last month, the greenback has been steadily rising while the PMs have been underwater. On Jan. 25, I warned that the USD Index was likely to hit ~91.30. And despite not holding, the USDX hit an intraday high of 91.61 on Feb. 5. More importantly though, and because moves don’t occur in a straight line, the bearish divergence is poised to continue.

Why so?

Because if you analyze the chart below, you can see that the USD Index has broken above its declining resistance line, while gold has broken below its rising support line. Even more telling, the respective breakout and breakdown were confirmed by both assets delivering three consecutive daily closes (and weekly close) above and below their key trendlines.

Please see below:

Figure 19

Again, because assets don’t move in a straight line, it’s plausible that the USD Index retests its declining resistance line, while gold retests its rising support line. If this occurs, the USDX is likely to decline to the 90.6 range, while gold will receive a short-term boost. Remember though: the outcome does not change their medium-term trends and the above confirmations signal that the USDX is heading north and gold is heading south.

As for the USDX’s invigorated RSI, I wrote on Jan. 18:

Increasing the likelihood of a sustained bounce, the USDX’s RSI (Relative Strength Index) mirrors the double-bottom pattern seen in 2017-2018 (the green arrows on the below chart). As the initial pattern emerged (with the RSI below 30 in 2017), it preceded a significant rally, with the USDX’s RSI surging to nearly 70. And just like the chorus from your favorite song, the pattern repeated in 2018 with nearly identical results.

And today? Well, the choir is gearing up for its third act.

If you look at the pattern at the top-right of the chart below (Figure 10 - the green arrows), the USDX’s RSI bounced off identical oversold levels and is now trading north of 50.

Figure 20

To help explain the 2017-2018 analogue, I wrote previously:

It appears that the USD Index is repeating its 2017 – 2018 decline to some extent. The starting points of the declines (horizontal red line) as well as the final high of the biggest correction are quite similar. The difference is that the recent correction was smaller than it was in 2017.

And how did gold, silver and the miners react?

In short, they moved just a little higher after the USDX’s breakdown. I marked the moment when the U.S. currency broke below its previous (2017) bottom with a vertical line, so that you can easily see what gold, silver, and GDX (proxy for mining stocks) were doing at that time. They were just before a major top. The bearish action that followed in the short term was particularly visible in the case of the miners.

Also supporting the historical analogue, the USD Index’s current breakout above its 50-day moving average is exactly what added gasoline to the USDX’s 2018 fire. And after the 2018 breakout, the USDX surged back to its previous high. Today, that level is roughly 94.5.

For more context, I wrote on Feb. 4:

The U.S. currency just confirmed two important breakouts:

- Breakout above the neck level of the inverse head-and-shoulders pattern

- Breakout above the declining medium-term resistance line based on the March 2020 and November 2020 highs.

The above is important also due to another – even more critical – reason.

Based on the remarkable similarity to early 2018 (also in bitcoin and dogecoin, and most likely also in stocks to some extent), the breakout above the declining resistance line (and the 50-day moving average) is likely to mark the start of a big, sharp upswing.

Back in 2018, the rally continued until the USD Index moved to its previous medium-term high. Afterwards, it started to move in a more moderate manner.

If the history rhymes once again (the similarity has been uncanny in the previous months), then the next temporary stop for the USD Index is a bit below 95, as that’s when the USDX topped in September 2020. Precisely, that was 94.80, so to be conservative, we can say that the next particularly significant resistance for the USD Index is at about 94.5.

Regarding other catalysts, there are plenty that are vying to ignite the USDX’s flame:

First, the USD Index is after a long-term, more-than-confirmed breakout. This means that the long-term trend for the U.S. dollar is up.

Figure 21

Second, the amount of capital shorting the greenback remains at an all-time high. As a result, the slightest shift in sentiment could lead to a violent short-covering rally.

Figure 22

Third, if the speculative frenzy unwinds and fireworks erupt across U.S. equities, the USDX’s strong negative correlation with the S&P 500 could propel the greenback back to its March highs. And following a short-term consolidation, the USDX is likely to exceed those previous highs.

Figure 23

And rounding out the Four Horsemen of the Apocalypse?

Bitcoin

Surfing a wave of unprecedented liquidity, Bitcoin belongs on the Mount Rushmore of speculative assets. But while HODLers claim that they’ll never sell, the cryptocurrency – despite having its own merits – seems to be somewhat of a high-beta tracker of the S&P 500.

Please see below:

Figure 24

As such, if the S&P 500 fulfils its 12 Steps to Sobriety (or vice versa) a return to ‘normal’ will coincide with significantly lower prices. As a result, a re-emergence of the ‘fear’ phase below should add even more fuel to the USDX’s fire.

Figure 25

Circling back to the FED/ECB ratio, relative outprinting by the ECB remains of critical importance.

Figure 26

I wrote previously:

The top in the FED/ECB total assets ratio preceded the slide in the EUR/USD less than a decade ago and it seems to be preceding the next slide as well. If the USD Index was to repeat its 2014-2015 rally from the recent lows, it would rally to 114. This level is much more realistic than most market participants would agree on.

The bottom line?

As the ECB injects more and more liquidity to support the floundering Eurozone economy, the FED/ECB ratio should continue its trek lower. And with the EUR/USD just starting to notice, the currency pair still has plenty of catching up to do.

To expand on the one-sided futures positioning, we’re already seeing some capitulation from the speculative dollar bears. And as the initial flurries turn into a snowstorm, a race to cover their shorts will be felt across every corner of the financial markets. To explain, notice the extreme divergence between the users of U.S. dollars (the dark blue line below) and the dollar speculators (the light blue line below)?

Figure 27 - Commitment of Traders Report

Right now, commercial traders (the dark blue line) and non-commercial traders (the light blue line) have differing opinions on the future direction of the U.S. dollar. Again, commercial traders are businesses that use U.S. dollars on a day-to-day basis, while non-commercial traders are speculators (hedge funds, prop traders).

On a more granular level, we’re also witnessing the same activity within the EUR/USD.

I wrote on Jan. 12:

Figure 28

The light blue bars (Figure 27) represent the net-positioning of non-commercial futures traders (speculators), while the dark blue line is the movement of EUR/USD. Please focus on the red circle at the top-right of the chart: right now, bullish futures bets on EUR/USD are at their highest level since before the financial crisis.

More importantly, notice how one-sided positioning (in both directions) often leads to a sharp reversal?

If you analyze the 2009 to 2011 period, you can see that the EUR/USD plunged almost immediately after speculative futures positioning approached (or hit) the 30-level (using the vertical scale on the right side of the chart). And with today’s positioning already exceeding 30 (the red circle), there is plenty of room for the EUR/USD to move lower.

The key takeaway?

Knowing the difference between commercial traders and speculators is extremely important. Case in point: when speculators bet against commercial traders – with respect to gold and silver futures – the former were forced to cover their shorts at substantial losses.

On Jan. 6, I wrote:

Since Jun. 15, the two parties have drawn opposite lines in the sand. While speculators increased their long positions, producers took the other side of the trade. And despite the yellow metal leaping above $2,000 soon after (mainly momentum driven), gold topped less than two months later and fell by 15.4% before reaching a bottom on Nov. 30 (intraday peak to trough).

Regarding silver, the results are identical. However, producers’ timing was much more prescient.

Since Aug. 17, producers and speculators have traded in opposite directions. In September, with speculators still buying, the white metal rallied to an intraday high of $29.24 (on Sept. 1). However, in just over three weeks, silver plunged by 25.4% before bottoming on Sep. 24.

The bottom line?

Commercial traders (producers) study the market more intently than speculators. And because they have more to lose than just the trigger of a stop-loss, producers are usually on the right side of the trade.

Sentiment Indicators

Despite last week’s pump and dump, the Gold Miners Bullish Percent Index ($BPGDM) didn’t flinch. However, it still remains more than 30 points above its 2016 and 2020 lows.

On Dec. 14, I wrote:

Back in 2016 (after the top), and in March 2020, the buying opportunity didn’t present itself until the $BPGDM was below 10.

Thus, with sentiment still elevated, it will take a lot more negativity for gold to find a bottom.

Figure 29 - Gold Miners Bullish Percent Index ($BPGDM) and NYSE Arca Gold BUGS Index (HUI) Comparison

For further context, I wrote previously:

The excessive bullishness was present at the 2016 top as well and it didn’t cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing had caused the $BPGDM to move up once again for a few days. It then declined once again. We saw something similar also in the middle of this year. In this case, the move up took the index once again to the 100 level, while in 2016 this wasn’t the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline.

Based on the decline from above 350 to below 280, we know that a significant decline is definitely taking place. But has it already run its course?

Let’s consider two similar cases when gold miners declined significantly after the $BPGDM was very high: the 2016 decline and early-2020 decline.

In both cases, the HUI Index continued to decline until it moved slightly below its 61.8% Fibonacci retracement level. This means that if the history is to repeat itself, we shouldn’t expect any major turnaround until the gold miners decline to 220 - 230 or so. Depending on how things are developing in gold, the above might or might not be the final bottom, though.

Please note that the HUI already declined below its 2016 high. This breakdown is yet another bearish sign.

The Gold Miners

Just barely eking out a weekly gain, the GDX ETF took steps toward invalidating its head and shoulders pattern. However, because the previous invalidation didn’t trigger a substantial rally, a decline below the neckline ($31) still remains a very likely follow-up for the following weeks.

As further evidence, the Feb. 5 weakness in the USD Index was likely a very-short-term event. As a result, a continuation of the greenback’s upswing will only exacerbate the GDX ETF’s prior breakdown. As the story plays out, it could result in a decline to the $23 to $24 range.

Please see below:

Figure 30 - VanEck Vectors Gold Miners ETF (GDX), GDX and Slow Stochastic Oscillator Chart Comparison – 2020

To explain, I wrote on Feb 5:

The most recent move higher only made the similarity of this shoulder portion of the bearish head-and-shoulders pattern to the left shoulder (figure 2 - both marked with green) bigger. This means that when the GDX breaks below the neck level of the pattern in a decisive way, the implications are likely to be extremely bearish for the next several weeks or months.

Due to the uncanny similarity between the two green rectangles, I decided to check what happens if this mirror-similarity continues. I used purple, dashed lines for that. There were two important short-term price swings in April 2020 – one shows the size of the correction and one is a near-vertical move higher.

Copying these price moves (purple lines) to the current situation, we get a scenario in which GDX (mining stocks) moves to about $31 and then comes back up to about $34. This would be in perfect tune with what I wrote previously. After breaking below the head-and-shoulders pattern, gold miners would then be likely to verify this breakdown by moving back up to the neck level of the pattern. Then, we would likely see another powerful slide – perhaps to at least $24.

Moving on to the junior gold miners, the GDXJ ETF is following a similar script.

I wrote previously:

Poised to re-test the ~$42.50 range, the GDXJ ETF (just like it’s big brother, the GDX) put in three adjacent tops in 2019/2020 and put in a similar bottom in June of 2020 right at the 50% Fibonacci retracement level. However, with $42.50 a key support level, a corrective upswing is likely to occur following the steep decline.

Like its big brother, the GDXJ ETF is also forming a similar head and shoulders pattern. If you analyze the dotted line below (the upward sloping line that currently intersects with the $50-level), the GDXJ ETF’s pattern is playing out on an angle.

However, with the right shoulder nearly complete, we could be approaching a make-or-break point. And given the size of the head relative to the neckline, a breach of $47.50 could trigger a slide to ~$33.00.

Figure 31

Keep in mind though, $42.50 is the first shoe to drop. And because a re-test could deliver a short-term bounce, the longer-term downtrend trend will take time to play out. However, once the curtain call is upon us, gold, silver and the miners will likely take their finals bows at significantly lower levels.

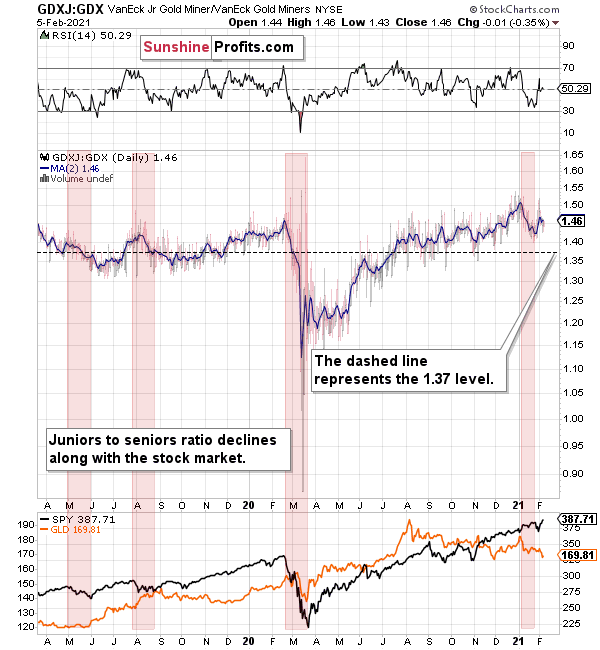

In addition, and while the performance is unfolding, the GDXJ ETF is likely to underperform the GDX ETF over the next few weeks (i.e., decline more than GDX on a relative basis).

Please see below:

Figure 32

To expand on the potential move, I wrote on Jan. 18:

The above chart depicts the ratio of the GDX ETF’s price relative to the GDXJ ETF’s price (the dark blue line above). When the line is rising, it means that the GDXJ ETF is outperforming the GDX ETF. Conversely, when the line is falling, it means that the GDX ETF is outperforming the GDXJ ETF. If you analyze the right-half, you can see that the GDXJ ETF has massively outperformed since late May.

However, once the calendar turned (to 2021), the ratio has made a vertical move lower. Thus, if both ETFs reach their 50% Fibonacci retracement levels ($42.50 and $31 respectively), the ratio above should drop from 1.43 to 1.37. As a result, the GDXJ ETF will incur a swifter drawdown. Given the pace at which the ratio has been declining so far this year, the above is easily achievable – the pace of decline would simply have to continue.

Also supporting the underperformance, the GDXJ ETF’s high-beta nature (and stronger correlation with the S&P 500) means that as the SPX falls, more damage is being done to the GDXJ ETF. Please note how closely linked the declines were in case of the GDXJ/GDX ratio and the general stock market (black line in the lower part of the chart). This also explains why the juniors to seniors ratio moved higher since the March bottom.

Thus, if the S&P 500 hits a wall (like I mentioned above), the GDXJ/GDX ratio should continue its free fall.

Further supporting the thesis, it’s important to remember that the GDX ETF invalidated its previous breakout above the 61.8% Fibonacci retracement level (based on the 2011 to 2016 decline).

Please see below:

Figure 33 - GDX VanEck Vectors Gold Miners ETF (2009 – 2020)

To explain, I wrote previously:

When GDX approached its 38.2% Fibonacci retracement, it declined sharply – it was right after the 2016 top. And miners’ inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign. The same goes for miners’ inability to stay above the rising support line – the line that’s parallel to the line based on the 2016 and 2020 lows.

Supporting the fundamental data that I presented at the outset, rampant NASDAQ speculation could eventually drop the guillotine on the gold miners. Back in 2000, when the dot-com bubble burst, the NASDAQ lost nearly 80% of its value, while the gold miners lost more than 50% of their value.

Please see below:

Figure 34

To explain, I wrote previously:

Right now, the two long-term channels above (the solid blue and red dashed lines) show that the NASDAQ is trading well above both historical trends.

Back in 1998, the NASDAQ’s last hurrah occurred after the index declined to its 200-day moving average (which was also slightly above the upper border of the rising trend channel marked with red dashed lines).

And what happened in the first-half of 2020? Well, we saw an identical formation.

The similarity between these two periods is also evident if one looks at the MACD indicator. There has been no other, even remotely similar, situation where this indicator would soar so high.

Furthermore, and because the devil is in the details, the gold miners’ 1999 top actually preceded the 2000 NASDAQ bubble bursting. It’s clear that miners (the XAU Index serves as a proxy) are on the left side of the dashed vertical line, while the tech stock top is on its right side. However, it’s important to note that it was stocks’ slide that exacerbated miners’ decline. Right now, the mining stocks are already declining, and the tech stocks continue to rally. Two decades ago, tech stocks topped about 6 months after miners. This might spoil the party of the tech stock bulls, but miners topped about 6 months ago…

Also supporting the 2000 analogue, today’s volume trends are eerily similar. If you analyze the red arrows on the chart above, you can see that the abnormal spike in the MACD indicator coincided with an abnormal spike in volume. Thus, mounting pressure implies a cataclysmic reversal could be forthcoming.

Interestingly, two decades ago, miners bottomed more or less when the NASDAQ declined to its previous lows, created by the very first slide. We have yet to see the “first slide” this time. But, if the history continues to repeat itself and tech stocks decline sharply and then correct some of the decline, when they finally move lower once again, we might see THE bottom in the mining stocks. Of course, betting on the above scenario based on the XAU-NASDAQ link alone would not be reasonable, but if other factors also confirm this indication, this could really take place.

Either way, the above does a great job at illustrating the kind of link between the general stock market and the precious metals market that I expect to see also this time. PMs and miners declined during the first part of the stocks’ (here: tech stocks) decline, but then they bottomed and rallied despite the continuation of stocks’ freefall.

Gold

Suffering its second-largest weekly decline since Nov. 29, gold continues to underperform in 2021.

Please see below:

Figure 35

Unable to recover after touching its triangle-vertex-based reversal point (which I warned about previously), the yellow metal is facing an ever-growing wall of worry. On Friday (Feb. 5), gold mustered a short-term relief rally. However, on Feb. 4, I predicted as much.

I wrote:

Given the proximity of the triangle-vertex-based reversal, I wouldn’t rule out a quick comeback.

But living on borrowed time, Friday’s bounce is unlikely to last. As early as today, gold is likely to resume its downtrend. Mirroring what we saw at the beginning of the New Year, gold’s triangle-vertex-based reversal point remains a reliable indicator of trend exhaustion. As a result, even if gold’s top is formed later in the week, the yellow metal’s days are still numbered.

Please see below:

Figure 36 - Gold Continuous Contract Overview and Slow Stochastic Oscillator Chart Comparison

All in all, $1,700 remains the initial target, while $1,500 to even ~$1,250 are still possiblilties under the right curcumstances.

To explain the rationale, I wrote previously:

Back in November, gold’s second decline (second half of the month) was a bit bigger than the initial (first half of the month) slide that was much sharper. The January performance is very similar so far, with the difference being that this month, the initial decline that we saw in the early part of the month was bigger.

This means that if the shape of the price moves continues to be similar, the next short-term move lower could be bigger than what we saw so far in January and bigger than the decline that we saw in the second half of November. This is yet another factor that points to the proximity of $1,700 as the next downside target.

Before moving on, I want to reiterate my previous comments and explain why $1,700 remains the first stop:

One of the reasons is the 61.8% Fibonacci retracement based on the recent 2020 rally, and the other is the 1.618 extension of the initial decline. However, there are also more long-term-oriented indications that gold is about to move to $1,700 or lower.

(…) gold recently failed to move above its previous long-term (2011) high. Since history tends to repeat itself, it’s only natural to expect gold to behave as it did during its previous attempt to break above its major long-term high.

And the only similar case is from late 1978 when gold rallied above the previous 1974 high. Let’s take a look at the chart below for details (courtesy of chartsrus.com)

Figure 37 - Gold rallying in 1978, past its 1974 high

As you can see above, in late 1978, gold declined severely right after it moved above the late-1974 high. This time, gold invalidated the breakout, which makes the subsequent decline more likely. And how far did gold decline back in 1978? It declined by about $50, which is about 20% of the starting price. If gold was to drop 20% from its 2020 high, it would slide from $2,089 to about $1,671.

This is in perfect tune with what we described previously as the downside target while describing gold’s long-term charts:

Figure 38 - Relative Strength Index (RSI), GOLD, and Moving Average Convergence Divergence (MACD) Comparison

The chart above shows exactly why the $1,700 level is even more likely to trigger a rebound in gold, at the very minimum.

The $1,700 level is additionally confirmed by the 38.2% Fibonacci retracement based on the entire 2015 – 2020 rally.

There’s also a good possibility that gold could decline to the $1,500 - $1,600 area or so (50% - 61.8% Fibonacci retracements and the price level to which gold declined initially in 2011). In fact, based on the most recent developments in gold and the USDX (how low the latter fell without a rally in the former), it seems that $1,500 is more likely to be the final bottom than $1,700. The $1,700 level is likely to be a bottom – yes – but an interim one only.

Before looking at the chart below (which is very similar to the chart above, but indicates different RSI, volume, etc.), please note the – rather obvious – fact: gold failed to break above its 2011 highs. Invalidations of breakouts are sell signals, and it’s tough to imagine a more profound breakout that could have failed. Thus, the implications are extremely bearish for the next several weeks and/or months.

Figure 39 - RSI, GOLD, and MACD Comparison

The odd thing about the above chart is that I copied the most recent movement in gold and pasted it above gold’s 2011 – 2013 performance. But – admit it – at first glance, it was clear to you that both price moves were very similar.

And that’s exactly my point. The history tends to rhyme and that’s one of the foundations of the technical analysis in general. Retracements, indicators, cycles, and other techniques are used based on this very foundation – they are just different ways to approach the recurring nature of events.

However, every now and then, the history repeats itself to a much greater degree than is normally the case. In extremely rare cases, we get a direct 1:1 similarity, but in some (still rare, but not as extremely rare) cases we get a similarity where the price is moving proportionately to how it moved previously. That’s called a market’s self-similarity or the fractal nature of the markets. But after taking a brief look at the chart, you probably instinctively knew that since the price moves are so similar this time, then the follow-up action is also likely to be quite similar.

In other words, if something looks like a duck, and quacks like a duck, it’s probably a duck. And it’s likely to do what ducks do.

What did gold do back in 2013 at the end of the self-similar pattern? Saying that it declined is true, but it doesn’t give the full picture - just like saying that the U.S. public debt is not small. Back then, gold truly plunged. And before it plunged, it moved lower in a rather steady manner, with periodic corrections. That’s exactly what we see right now.

Please note that the above chart shows gold’s very long-term turning points (vertical lines) and we see that gold topped a bit after it (not much off given their long-term nature). Based on how gold performed after previous long-term turning points (marked with purple, dashed lines), it seems that a decline to even $1,600 would not be out of ordinary.

Finally, please note the strong sell signal from the MACD indicator in the bottom part of the chart. The only other time when this indicator flashed a sell signal while being so overbought was at the 2011 top. The second most-similar case is the 2008 top.

The above-mentioned self-similarity covers the analogy to the 2011 top, but what about the 2008 performance?

If we take a look at how big the final 2008 decline was, we notice that if gold repeated it (percentage-wise), it would decline to about $1,450. Interestingly, this would mean that gold would move to the 61.8% Fibonacci retracement level based on the entire 2015 – 2020 rally. This is so interesting, because that’s the Fibonacci retracement level that (approximately) ended the 2013 decline.

History tends to rhyme, so perhaps gold is going to decline even more than the simple analogy to the previous turning points indicates. For now, this is relatively unclear, and my target area for gold’s final bottom is quite broad.

Silver

As the precious metals’ version of moral hazard, silver tipped over the flowerpot, and left gold to clean up the mess. After silver’s short squeeze mania ended in tears on Feb. 2, the white metal gave back 97% of its squeeze-induced gains. Conversely, bearing the brunt of the market’s wrath, gold gave back 237% of the momentum-induced gains.

Please see below:

Figure 40

As a result, silver is doing what it normally does near market tops: outperforming among comments regarding silver shortage.

Positioning itself for an epic blow-off top, silver’s Feb. 1 surge ended in less than 24 hours. In addition, silver is approaching two triangle-vertex-based reversal points – which could come to a head by the end of February or early March. However, given the two set ups, they could be signaling one climactic reversal or two separate reversals of differing magnitudes. As it stands today, it’s still too early to tell.

Figure 41 - COMEX Silver Futures

However, supporting the argument of a single blow-off top, I mentioned last week that the iShares Silver Trust ETF (SLV) took in nearly $1 billion in daily inflows on Jan. 29. For context, that was nearly double the previous record.

Please see below:

Figure 42 - Source: Bloomberg/Eric Balchunas

But because too much of a good thing can often be bad, the frantic buying mirrored an ominous period in SLV’s history.

Please see below:

Figure 43 - COMEX Silver Futures

If you analyze the volume spikes at the bottom of the chart, 2021 and 2011 are a splitting image. To explain, in 2011, an initial abnormal spike in volume was followed by a second parabolic surge. However, not long after, silver’s bear market began.

SLV-volume-wise, there's only one similar situation from the past - the 2011 top. This is a very bearish analogy as higher prices of the white metal were not seen since that time, but the analogy gets even more bearish. The reason is the "initial warning" volume spike in this ETF. It took place a few months before SLV formed its final top, and we saw the same thing also a few months ago, when silver formed its initial 2020 top.

The history may not repeat itself to the letter, but it tends to be quite similar. And the more two situations are alike, the more likely it is for the follow-up action to be similar as well. And in this case, the implications for the silver price forecast are clearly bearish.

Based on the above chart, it seems that silver is likely to move well above its 2011 highs, but it’s unlikely to do it without another sizable downswing first.

In conclusion, if silver meets its maker, the white metal is likely to lead gold and the miners to slaughter. Moreover, silver is well known for its false breakouts and its relative strength is often a precursor to substantial declines. As a result, last week’s short squeeze was much more semblance than substance. In contrast, once the metals rebase and trade at more appropriate levels, an attractive buying opportunity will emerge.

For more insight, let’s look at the relative performance of gold, silver and the gold miners, and compare how they’re impacted by the USDX and the SPX. If you analyze the chart below, you can see that the precious metals all broke down in September, after the USDX broke above resistance.

Figure 44

To explain, I wrote on Jan. 18:

Like traffic lights flashing red, notice how the HUI Index (proxy for gold stocks) is trading well below its early 2020 highs? In stark contrast, gold remains moderately above its early 2020 highs, while silver is significantly above its early 2020 highs. The misaligned performance – with silver outperforming and gold miners underperforming – puts a bow on this bearish package.

The bottom line?

It is not only the case that silver was strong and miners were weak in the last several days – it’s been the case over the past several months as well. The implications are bearish.

Also troubling is that the stock market that’s soaring in the medium term, hasn’t shined its light upon the PM market. Contrasting the mantra that ‘a rising tide lifts all boats,’ equity market strength hasn’t triggered a sustainable rally in silver or the gold miners. And this “should have” been the case – both are more connected to stocks than gold is. Gold stocks because they are, well, stocks. Silver, due to multiple industrial uses

All in all, based on what we saw in silver recently, it doesn’t seem that we’re likely to see much higher precious metals prices without seeing a major decline first.

As another potential warning sign, silver is also showing an interesting pattern when analyzing its inverse price action. Nearly identical to the inverted formation that emerged from 2006 to 2009, today’s chart looks eerily similar to its predecessor.

Figure 45 - COMEX Silver Futures

I wrote previously:

While it’s more of a wild card, the above pattern shows that silver’s 2020 top plots nearly identical to the inverse of the 2006-2009 performance. I copied the 2006 – 2009 performance right below the regular price movement and I inverted it, and I also copied this inverted pattern to the last few years.

The similarity is quite significant. And whenever a given pattern has been repeated, the odds are that it could also repeat in the not-too-distant future. Of course, there is no guarantee for that, but once the same market has reacted in a certain way to a specific greed/fear combination, it can just as well do it again. And these similarity-based techniques work quite often. So, while it’s not strong enough to be viewed as a price-path-discovery technique on its own, it should make one consider some scenarios more closely. In particular, this means that the declines in the prices of silver, gold, and mining stocks could be bigger and take longer than it seems based on other charts and techniques.

The above is in tune with the implications of the sell signal from the MACD indicator on the monthly gold chart.

The only thing that comes to my mind, which could – realistically – trigger such a prolonged decline would be a major drop in the general stock market. Given what I wrote above, the latter is quite possible, so I’ll be on the lookout for confirmations and invalidations of this scenario.

If history rhymes, silver could be in for a profound decline over the next few months (beyond my initial target). Moreover, the development would increase the duration of a precious metals’ bear market (also beyond my initial forecast).

After all, gold did invalidate its long-term breakout above the 2011 highs and the way gold reacted to a small upswing in the USD Index was truly profound…

Moving on to the HUI Index, it’s also flashing red in a very bright way.

I wrote on Feb. 5:

The three of the biggest declines in the mining stocks (I’m using the HUI Index as a proxy here), all started with broad, multi-month head-and-shoulders patterns. And now we’re seeing this pattern all over again.

Figure 46 - NYSE Arca Gold BUGS Index (HUI) and Slow Stochastic Oscillator Chart Comparison

The above picture should make it clear why I was putting “at least” in bold, when describing the targets based on the head-and-shoulders patterns.

In all three cases, the size of the decline exceeded the size of the head of the pattern. This means that the $24 target on the GDX ETF chart is likely conservative.

Can we see gold stocks as low as we saw them last year? Yes.

Can we see gold stocks even lower than at their 2020 lows? Again, yes.

Of course, it’s far from being a sure bet, but the above chart shows that it’s not irrational to expect these kind of price levels before the final bottom is reached.

The dashed lines starting at the 2020 top are copies of sizes of the declines that started from the right shoulder of the previous patterns. If things develop as they did in 2000 and 2012-2013, gold stocks are likely to bottom close to their 2020 high. However, if they develop like in 2008 (which might be the case, given the extremely high participation of the investment public in the stock market and other markets), gold stocks could re-test (or break slightly below) their 2016 low.

I know, I know, this seems too unreal to be true… But wasn’t the same said about silver moving below its 2015 bottom in 2020? And yet, it happened.

Keep in mind though: a move of this magnitude most likely requires equities to participate. In 2008 and 2020, the above near-vertical drawdowns in the HUI Index coincided with significant drawdowns of the S&P 500. However, with the words ‘all-time high’ becoming commonplace across U.S. equities, the likelihood of a three-peat remains relatively high.

As the story unfolds, how will we know when a bottom has formed?

We view the price target levels as guidelines and the same goes for the Gold Miners Bullish Percent Index (below 10), but the final confirmation will likely be something else. Something that we already saw in March when gold bottomed.

We will be on a special lookout for gold’s strength against the ongoing USDX rally. At many vital bottoms in gold, that’s exactly what happened, including the March bottom.

Moving on to cross-asset correlations, gold and the USDX have been strongly negative over the medium-term (past year). And despite trading in similar directions for much of November, gold and the HUI Index (relative to the USD) are now back to their usual divergences (30-trading-day correlations of – 0.81 and – 0.78). Conversely, silver’s squeeze scrambled its 30-day correlation, increasing the reading to – 0.08. However, the long-term (250-day) coefficient remains intact at – 0.92. The key takeaway? Despite the one-day anomaly, a USD Index rally should continue to pressure the PMs in case of bigger, medium-term moves.

Amid last week’s chaos, gold, silver and the HUI Index’s 30-day correlations with the S&P 500 also turned moderately negative (correlations of – 0.50, – 0.20 and – 0.41). However, for a more reliable assessment, it’s prudent to follow the 250-day correlations. And because the PMs demonstrate a moderate-to-strong correlation with the S&P 500 over the medium-term (roughly one year) a plunge in equities will likely send shockwaves across the precious metals’ market, even if they don’t impact PMs’ and miners’ prices in the very short term.

Figure 47

Since gold, silver, and mining stocks have been strongly negatively correlated with the USD Index in the medium term, it seems likely that they will be negatively affected by the upcoming sizable USDX upswing.

…Until we see the day where gold reverses or soars despite the U.S. currency’s rally.

If that happens with gold at about $1,700, we’ll have a very good chance that this was the final bottom. If it doesn’t happen at that time, or gold continues to slide despite USD’s pause or decline, we’ll know that gold has further to fall.

Naturally we’ll keep you – our subscribers – informed.

To move forward, how does the GDX downside target compare to gold’s downside target? If, at the same time, gold moves to about $1,700 and miners are already after a ridiculously big drop (to $31-$32 in the GDX ETF, or lower), the binding profit-take exit price of your GDX ETF will become $32.02 (those with higher risk tolerance might lower it to $31.15 or so, but moving it lower seems just too risky).

At this time, the final GDX target (the one that would correspond to gold at $1,500 or so) is still unclear. The $17 - $23 area seems probable, especially if the general stock market slides once again. It’s too early to say with any significant level of certainty. Gold is providing us with a clearer final target, so that’s what we’ll focus on. And most importantly – we’ll focus on gold’s performance relative to the USD Index.

Overview of the Upcoming Part of the Decline

- I expect the initial bottom to form with gold falling to roughly $1,700, and I expect the GDX ETF to decline to about $31 - $32 at that time. I then plan to exit the short positions in the miners and I will consider long positions in the miners at that time – in order to benefit from the likely rebound.

I expect the above-mentioned decline to take another 1 – 7 weeks to materialize and I expect the rebound to take place during 1-3 weeks.

- After the rebound (perhaps to $33 - $34 in the GDX), I plan to get back in with the short position in the mining stocks.

- Then, after miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-4 weeks to materialize). I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,500 and the entire decline (from above $1,700 to about $1,500) would be likely to take place within 1-10 weeks and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments in my view. This might happen with gold close to $1,500, but it’s too early to say with certainty at this time.

Consequently, the entire decline could take between 3 and 20 weeks, while the initial part of the decline (to $1,700 in gold) is likely to take between 1 and 7 weeks.

If gold declines even below $1,500 (say, to ~$1250 or so), then it could take another 10 weeks or so for it to bottom, but this is not what I view as a very likely outcome.

The above is based on the information available today and it might change in the following days/weeks.

Summary

To summarize, the PMs short-term downswing has likely just begun, as miners broke below the neck level of their almost-yearly head-and-shoulders formation. We saw a small invalidation, but we don’t trust its bullish implications – we just saw something similar that failed to ignite a lasting rally and the USD’s decline seems to be a normal, post-breakout pullback.

In addition, because we’re likely entering the “winter” part of the Kondratiev cycle, the outlook for the precious metals’ sector remains particularly bearish during the very first part of the cycle, when cash is king.

Silver’s strength seems bullish at first sight, but taking a closer look at this move, and comparing it with previous cases (when silver got so much attention) and with miners’ weakness, provides us with bearish implications for the medium term.

The confirmed breakout in the USD Index is yet another confirmation of the bearish outlook for the precious metals market.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it was not already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief