Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Welcome to this week's Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

Let’s start with a brief summary of the previous year. Gold ended 2020 at $1,891, partially thanks to the monetary policy easing. In 2021, the Fed may not trigger a comparable rally in gold, but it should offer gold prices some support.

Figure 1

I know that about 24 percent does not look impressive compared to Bitcoin, which gained more than 260 percent in 2020, but it’s still a great achievement relative to other assets or gold in the past. Not to mention the fact that gold’s price level looks more sustainable, while the recent parabolic rises in cryptocurrencies suggest a price bubble.

Figure 2 – (Source: https://coinmarketcap.com)

Figure 3 – (Source: https://coinmarketcap.com)

Please note that the last time cryptos soared this fast, was in December 2017 and in January 2018, which further confirms the similarity present in the USD Index chart.

One of the reasons behind gold’s rally was the easy monetary policy adopted by the Fed (and other central banks) in a response to the pandemic and related economic crisis. In a way, the Fed reintroduced the quantitative easing first implemented in the aftermath of the Great Recession. So, gold’s bullish move shouldn’t be surprising.

However, there are also some important differences in the monetary policy that followed the global financial crisis and the coronavirus epidemic. First, when Lehman Brothers went bankrupt, the Fed went big. But when COVID-19 infections spread widely through America, the Fed went not only big, but also fast!

Just look at the chart below. As you can see, it took just about two months for the U.S. central bank to slash the federal funds rate to zero in the spring of 2020, while it took over a year during the Great Recession.

Figure 4

Moreover, from February to November, i.e., in just nine months, the Fed expanded its balance sheet by about $3 trillion, while a decade ago, such an increase took over six years!

What does the difference in the Fed’s stance imply for gold prices in 2021? Well, on the one hand, because the Fed acted aggressively, there is less room for further monetary policy easing. In the aftermath of the Great Recession, the Fed gradually fired from increasingly powerful weaponry, announcing new rounds of asset purchases from 2007 to 2013, while in a response to the coronavirus, the Fed has fired a bazooka at the outset. This decreases the odds for further monetary policy easing, pushing market expectations towards normalization. You see, when you are at the bottom, the only possible move is up.

This is my biggest worry for the gold market in 2021: that monetary policy has already become so dovish, that now it can only become hawkish – at least on a relative basis. The real interest rates are so low that – given the prospects of economic recovery on the horizon – they could go only up, especially if inflation does not increase.

On the other hand, inflation could really rise in 2021. Additionally, the fact that the Fed went both big and fast means that the U.S. central bank became more dovish than in the past, which should be positive for the yellow metal. Moreover, a decade ago the central banks at least pretended that they would like to tighten their stance and normalize monetary policy. They even said that the quantitative easing would be reversed, and the Fed’s balance sheet would return to its pre-recession level.

Now, any illusions have dissipated. The central banks will buy assets for years to come, if not indefinitely, and there will be no taper tantrum. The eventual exit from the current easy monetary stance will be ultra-slow and gentle. The Fed has a clear dovish bias, so the interest rates may go down further – after all, given the debt trap, the central banks could be forced to cap the bond yields, which should support the price of gold.

Therefore, in 2020, the Fed no longer only intervened on a large scale as it did a decade ago, but it also acted quickly. The change of strategy from go big to go big and fast can be positive for the price of gold, but only when the market participants do not believe that the Fed is out of ammunition and only when they do not expect the normalization of interest rates.

All in all, there are multiple fundamental reasons why gold is likely to soar in the upcoming years. However, even the most profound bull markets can’t move up in a straight line, and some corrections will likely take place. After the big rallies, we will probably witness significant corrections, and in the case of the precious metals market, one is long overdue.

To clarify, the significant correction in the precious metals market is already underway, but it seems that it’s not over yet, and it’s probably before its biggest and most important part.

Triggers for the decline in the precious metals market are not necessary – the market might collapse on its own or as a result of some lone random trigger that normally wouldn’t cause any major action. However, a trigger would speed things up. The less likely trigger might come from the general stock market – after all, it fell sharply together in the first half of this year.

S&P 500 (SPX) Signals

Despite setting another record on Thursday (Dec. 31) and ending 2020 with a 16.3% annual gain, the S&P 500 remains technically and fundamentally impaired. During the Santa Clause rally, the SPX sneaked above its triangle-vertex-based reversal point. However, the damage occurred on extremely low volume.

If you analyze the chart below, weak end-of-year volume tends to precede short-term pullbacks. Over the last five years (when two-week volume plunged before the end of a year), the SPX topped soon after.

Figure 5 – S&P 500 Index

In addition, investors who booked gains in 2020 will likely become sellers in January of 2021. Because U.S. investors file their taxes by April 15 of each year, selling in January (as opposed to December) allows them to delay their taxes owed by a year (as opposed to paying this April). Thus, investors are incentivized to wait until after the New Year to sell their winners.

The bottom line? An SPX top is within sight. And when the house of cards comes crashing down, the unwinding of excessive leverage (which I’ve been highlighting for some time) means a significant drawdown is likely to occur.

Fundamentally, I’ve also been warning about alarming valuations.

If you look at the chart below, you can see that 11 of 15 valuation metrics either equal or exceed the dot-com bubble (For further context, the data was compiled in late November; and with the SPX closing the year above 3,750, current valuations are even more extreme.)

Figure 6

But why are investors throwing caution to the wind?

Well, when Jerome Powell, Chairman of the U.S. Federal Reserve, says that P/E multiples are “not as relevant” in a world of low interest rates, market participants are happy to take their cue. However, because bad investors only think of ways to make money (and good investors think of ways to not lose money), history hasn’t been kind to those who shun fundamentals.

Please see the chart below:

Figure 7

To explain, I wrote on Dec. 29:

The blue line (from left to right) represents the S&P 500’s price movement over the last ~50 years; showing a strong correlation, the orange line represents net-income earned by the index’s constituents during the same time periods.

Analyzing the relationship, their movements are nearly identical. And the logic makes sense: Stock prices should trend higher (and lower) with earnings.

However, the dot-com bubble decided those rules no longer applied.

Notice the large gap between the 1997 and 2003 labels?

Well, when unprofitable tech companies convinced investors that clicks were greater than cash, valuations exploded beyond reason. But like other historical parabolas, gravity eventually took hold and the S&P 500 plunged by more than 50%.

Now look at the current gap:

In history, there has never been a larger divergence between valuations and fundamentals (net-income). And while pundits continue to suggest that “this time is different,” the chart suggests otherwise. Notice how the two lines eventually reconnect? If history repeats, there are two possible outcomes:

- Stock prices decline substantially to reflect the drop in net-income.

- Net-income rises sharply and catches up with stock prices.

And which outcome is most likely?

Well, given where we are in the business cycle, the latter seems nearly impossible.

Remember though: A decline in stocks is not required for the PMs to decline. However, a break in the former could easily trigger a sell-off in the latter. And as history has shown, silver and the miners will be the hardest hit.

Goodbye 2020, Welcome 2021

With a December to remember likely to become a January to forget, gold could be heading towards a New Years’ hangover. Not necessarily in the first days of the year, though.

On Dec. 31, I wrote:

As 2020 quickly draws to a close and the champagne corks pop, precious metals investors have January 2021 on their mind and how gold will fare just after the New Year. Let’s take a quick look at what the previous years tell us.

In a nutshell, gold didn’t just “soar” in previous Januaries, but rather reversed at the end of the year and then moved in the opposite direction in January – canceling the December moves. “New year – new me” sounds cliché, but that’s what gold has actually been adhering to instead of simply soaring.

Let’s take a look at gold’s very long-term chart for details.

Figure 8 - Gold Continuous Contract Overview, GOLD and Moving Average Convergence Divergence Chart (MACD) Comparison

The above chart covers the past 40 years. The green vertical lines represent cases when (approximately) the turn of the year was a great buying opportunity. The red lines represent cases when (approximately) the turn of the year was a great selling opportunity.

There were 25 cases when gold visibly reversed close to the end of the year or the beginning of the new year – so that’s what happens in most cases.

In 13 of the cases, those were buying opportunities.

In 12 of the cases, those were selling opportunities.

Since the number of turning points is not divisible, the 13-12 breakdown is the closest that it can get to 50/50.

So, while it’s true that in most past cases, the turn of the year was positive for gold, it’s also true that the gold price forecast for January 2021 is not necessarily going to be bullish. The context is important, since:

- Gold has been rallying in December 2020

- Gold tends to reverse at the turn of the year

The implications of the 0 becoming a 1 at the end of the date are actually bearish for the yellow metal.

Moreover, please take a look at the lower part of the above chart. It features the MACD indicator based on the monthly gold prices. There were very few cases when this indicator moved up significantly and then clearly declined. This happened only four times in the previous four decades. Once in the late 1980s, once in early 2008, once in 2011, and once recently. In all previous cases, it heralded months of declines.

This does not bode well for the price of the yellow metal at all, especially considering that it recently invalidated its breakout above the 2011 high.

The USD Index (USDX)

Breaking hearts as the USD Index falls in and out of love, the greenback continues to leave bulls at the altar, which is likely to have important implications for the gold market in the following weeks. Dressed to impress, investors lined the cathedral aisles as the USDX looked ready to commit to the 90-level.

But as cold feet turned into a dash for the exit, 2020 ended without a celebration.

However, as we enter 2021 and net-short futures positions (non-commercial traders) remain at their highest level since 2006, the slightest shift in sentiment could have wedding bells ringing again.

Please see below:

Figure 9 – Net-short Futures Positions

If you analyze the second red box (on the right side), you can see that the 2018 top in net-short futures positions ended with a violent short-covering rally, which propelled the USDX nearly 11% higher from trough to peak.

Figure 10 – U.S. Dollar Index

In this week’s early trading, the USDX moved lower, almost back to the 2020 lows. This was disappointing to anyone hoping that the December 31 rally was the beginning of a sharp rally, somewhat similar to what we saw in early September. In reality, the Dec. 31 rally and today’s decline don’t change much. It is not the immediate-term that is particularly important right now, but the medium and long-term pictures. The indications coming from them are much more decisive, and more important.

And while the USDX remains indecisive right now, its price action still follows a familiar playbook: In 2018, the USDX dipped below the 1.618 Fibonacci extension level before circling back with a vengeance (The initial bottom occurred in early 2018, with the final bottom not far behind.) Moreover, the 2018 USDX bottom also marked the 2018 top in gold, silver and the gold miners (depicted in the below).

Figure 11 – USD Index Futures Contract (ICE), USD, GOLD, GDX, and SPX Comparison

Also reprising its former role, the USDX’s RSI (Relative Strength Index) mirrors the double-bottom seen in 2017-2018 (the green arrows at the top-left of the chart). As the initial pattern emerged (with the RSI below 30 in 2017), it preceded a significant rally, with the USDX’s RSI surging to nearly 70. And just like the chorus from your favorite song, the pattern repeated in 2018 with nearly identical results.

Today, it’s more of the same.

If you look at the pattern at the top-right of the chart (the green arrows), the only difference is time. And in time, the USDX’s likely ascension will put significant pressure on gold, silver and the gold miners. In addition, the precious metals’ underperformance relative to the USDX further implies that a drawdown is the path of least resistance.

Moreover, let’s keep in mind the similarity in cryptocurrencies – we now have a parabolic upswing, just like what we saw in early 2018. The history does seem to be rhyming, and this doesn’t bode well for the stock market (there are some individual opportunities, e.g. Matthew Levy, CFA managed to reap great gains in the Taiwanese ETF – it gained over twice as much as the S&P since Dec. 3), as well as the precious metals market.

It appears that the USD Index is repeating its 2017 – 2018 decline to some extent. The starting points of the declines (horizontal red line) as well as the final high of the biggest correction are quite similar. The difference is that the recent correction was smaller than it was in 2017.

Since back in 2018, the USDX’s bottom was at about 1.618 Fibonacci extension of the size of the correction, we could expect something similar to happen this time. Applying the above to the current situation would give us the proximity of the 90 level as the downside target.

“So, shouldn’t gold soar in this case?” – would be a valid question to ask.

Well, if the early 2018 pattern was being repeated, then let’s check what happened to precious metals and gold stocks at that time.

In short, they moved just a little higher after the USDX’s breakdown. I marked the moment when the U.S. currency broke below its previous (2017) bottom with a vertical line, so that you can easily see what gold, silver, and GDX (proxy for mining stocks) were doing at that time. They were just before a major top. The bearish action that followed in the short term was particularly visible in the case of the miners.

Consequently, even if the USD Index is to decline further from here, then the implications are not particularly bullish for the precious metals market.

To summarize, gold’s recent strength is underpinned by a dormant U.S. dollar. But with the greenback more unloved than the villain in a superhero movie, it won’t take much to change the narrative. Furthermore, with net-short futures positions going from excessive to extreme, the game of musical chairs is likely to end with the shorts capitulating and the USDX moving higher. The implications may be unclear for the next few days, but they are bearish for the next few weeks to months.

And as we flip the calendar, I expect a similar pattern to emerge.

Why so?

First, the USD Index is after a long-term, more-than-confirmed breakout. This means that the long-term trend for the U.S. currency is up.

Second, the amount of capital that was shorting the USD Index was excessive even before the most recent decline. This means that the USD Index is not likely to keep declining for much longer.

In addition, the 2018 analogue signals that SPX’s days are also numbered (If you analyze the chart above, you can see that the USDX bottom coincided with the SPX top.)

On Dec. 22, I also highlighted the misguided narrative plaguing the U.S. dollar. In short:

With liquidity spigots on full blast around the world, the U.S. isn’t the only region expanding its money supply (And remember, currencies trade on a relative basis.) In fact, the European Central Bank (ECB) has more assets on its balance sheet than the U.S. Federal Reserve (FED).

And after another update, the ECB’s spending spree has hit nearly €7.015 trillion (As a point of reference, the Dec. 22 ECB chart was relative to the FED, so both balance sheets were presented in U.S. dollars. The chart below depicts the ECB’s balance sheet in euros).

Figure 12 - European Central Bank (ECB) Balance Sheet (2007-2020)

But the real story?

Well, the ECB’s total assets now equal 69% of Eurozone GDP – nearly double the FED’s 35%. Furthermore, the rally in EUR/USD (remember EUR/USD accounts for nearly 58% of the movement in the USDX) is occurring just as Europe’s largest economies – Germany, France, Italy and Spain – are rolling over.

Figure 13 – Alternative Economic Indicators in 2020 for Germany, France, Italy, and Spain

To explain, alternative economic indicators are high-frequency data like credit card spending, indoor dining traffic, travel activity and location information. The bottom line is that once European fundamentals catch up to EUR/USD, the forex market could provide the PMs and mining stocks with a substantial bearish push in the coming weeks – or even days.

As further evidence of a potential uprising, please see the USDX’s long-term breakout in 2015:

Figure 14 – USD Index Futures Contract (ICE)

The duration of the move, the multiple breakouts, and the five-year consolidation signals a move higher for the USDX. This remains the path of least resistance (perhaps to the ~120 level).

Please note that the consolidation that preceded the previous rally to 120 that took place between 1997 and 2000 happened when the USD index was trading at relatively similar price levels – approximately between 90 and 105.

A second major factor is extreme USDX bearishness within the futures market. A contrarian indicator, net-short USDX futures positions remain excessively high.

Figure 15 – Commitment of Traders Report

The above chart shows the netted version of the positions included in the Commitment of Traders report. Please note how the lows in the blue line correspond to major medium-term bottoms in the USD Index. We once again find ourselves in this situation.

On the fundamental front, please keep in mind that for the currency markets it’s not important how “things are going in the U.S.”, but how they are doing relative to the rest of the world, and most importantly, relative to the Eurozone and Japan (currency exchange rates against the euro and the yen have the biggest weights in the USD Index, which is ultimately a weighted average of currency exchange rates). Are things about to get much worse in the U.S. compared to them? No. In risking oversimplification, let’s say that while things are bad pretty much all around the world, they might actually get calmer in the U.S. as the post-presidential election turmoil subsides.

Please note that the current – broad – lows in the values of the net positions of the non-commercial traders (broad bottom in the blue line) is similar to only one case from the past – the 2017-2018 bottom. This further confirms the validity of the analogy to 2018 that I made earlier, based on the similarity in price patterns.

In summary, there are a variety of bullish catalysts supporting a higher USDX:

- Technicals show a bottom is forming (or may have already formed).

- Fundamentals show the ‘lower USDX story’ is much more semblance than substance.

- One-sided futures positing signals that a short-covering rally could be imminent (which results in traders buying the U.S. dollar, thus propelling the USDX higher).

Sentiment Indicators

After last week’s trade, the Gold Miners Bullish Percent Index ($BPGDM) still remains above 40 and sits more than 30 points above the 2016 and 2020 lows.

On Dec. 14, I wrote:

Back in 2016 (after the top), and in March 2020, the buying opportunity didn’t present itself until the $BPGDM was below 10.

Thus, with sentiment still caught in no-man’s land, it will take a lot more negativity for gold to find a bottom.

Figure 16 - Gold Miners Bullish Percent Index ($BPGDM) and NYSE Arca Gold BUGS Index (HUI) Comparison

The excessive bullishness was present at the 2016 top as well and it didn’t cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing had caused the $BPGDM to move up once again for a few days. It then declined once again. We saw something similar also in the middle of this year. In this case, the move up took the index once again to the 100 level, while in 2016 this wasn’t the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline.

Based on the decline from above 350 to below 280, we know that a significant decline is definitely taking place. But has it already run its course?

Let’s consider two similar cases when gold miners declined significantly after the $BPGDM was very high: the 2016 decline and early-2020 decline.

In both cases, the HUI Index continued to decline until it moved slightly below its 61.8% Fibonacci retracement level. This means that if the history is to repeat itself, we shouldn’t expect any major turnaround until the gold miners decline to 220 - 230 or so. Depending on how things are developing in gold, the above might or might not be the final bottom, though.

Please note that the HUI already declined below its 2016 high. This breakdown is yet another bearish sign.

Gold Miners (GDX)

Still recovering from last week’s tug-of-war (with the GDX ending the week $0.01 lower), the bulls’ muscle continues to shrink. And after failing to recapture the GDX’s 50-day moving average (yet again), their inner Thomas H. Palmer keeps telling them to “try, try, try again.”

But given the underperformance relative to silver and gold, hope may be all the bulls have left.

Figure 17 - VanEck Vectors Gold Miners ETF (GDX), GDX and Slow Stochastic Oscillator Chart Comparison – 2020

Last week, I mentioned that the GDX is staring up at a glass ceiling that just won’t break (a potential top with the next move lower likely to unfold in the coming weeks – perhaps days).

Why so?

Well, two weeks ago, the price action was analogous to the GDX’s behavior in October (as December rallies continued to fizzle and the moves mirrored the topping pattern seen in October).

Last but not least (in fact, it’s the most important indication that keeps on flashing the very bearish signals), the GDX’s underperformance relative to gold hasn’t dissipated. I wrote previously:

While gold corrected about 61.8% of its November decline, gold miners declined only half thereof. In other words, they underperformed gold, which is bearish.

We can see this underperformance also in case of today’s pre-market trading.

Gold futures soared in today’s pre-market trading to levels above $1,930, which is about midway between gold’s November high and its December high, while at the same time we see the following price action in the GDX ETF on the London Stock Exchange.

Figure 18 – GDX ETF on London Stock Exchange (July – Dec 2020)

The GDX moved only slightly above its December high. Once again, the miners are underperforming gold.

The GDX ETF moved to its 50-day moving average – the level that kept its rallies in check since early October. Can miners move above it? Sure, they did that in early November, but is it likely that such a move would be confirmed or followed by more significant strength? Absolutely not. Let’s keep in mind two things:

- Back in early November, the GDX moved above the 50-day MA, when gold did the same thing, so if the GDX wanted to rally above this MA, it “should have” done so yesterday. It was too weak to do it.

- The early-November move above the 50-day MA was invalidated in just 2 days.

Moreover, please note that the performance of the GDX ETF from late-November to now looks like an ABC correction. This is not a bearish sign on its own, but it fits other indications described today and this week in general. It increases the chance that the top is already in or very, very close.

Another important development was the spike in volume during Thursday’s (Dec. 17) upswing. It resulted in the largest number of GDX shares traded since the November 6 top (on days when GDX is positive), and we all know what happened to GDX after November 6 (As a point of reference, the four other highest volume days since the November 6 top coincided with declines of 6.13%, 2.74%, 3.40% and 4.29%).

As for price targets, my Dec. 1 comments remain up to date:

How high could miners go? Perhaps only to the previous lows and by moving to them, they could verify them as resistance. The previous – October – low is at $36.01 in intraday terms and at $36.52 in terms of the daily closing prices. No matter which level we take, it’s not significantly above the pre-market price of $35.76, thus it seems that adjusting the trading position in order to limit the exposure for the relatively small part of the correction is not a good idea from the risk to reward perspective – one might miss the sharp drop that follows. Please note how sharp the mid-November decline was initially.

That’s almost exactly what happened – the GDX ETF rallied to $36.92 in intraday terms, and to $36.50 in terms of the daily closing prices. The breakdown was verified in terms of the daily closing prices, which is more important than what happened in intraday terms.

Consequently, the outlook is bearish as it seems that miners are ready for another move lower. There’s still a chance that the precious metals sector would move higher based on a possible short-term decline in the USD Index, but this chance is slim, especially given today’s pre-market decline in both the USD Index and gold.

The next downside target for the GDX ETF is the February top in terms of the closing prices – $31.05.

Also, let’s not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracement based on the 2011 – 2016 decline.

Figure 19 - GDX VanEck Vectors Gold Miners ETF (2009 – 2020)

When GDX approached its 38.2% Fibonacci retracement, it declined sharply – it was right after the 2016 top. Are we seeing the 2020 top right now? This is quite possible – PMs are likely to decline after the sharp upswing, and since there is just more than one month left before the year ends, it might be the case that they move north of the recent highs only in 2021.

Either way, miners’ inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign.

The same goes for miners’ inability to stay above the rising support line – the line that’s parallel to the line based on the 2016 and 2020 lows.

Gold

Outperforming the GDX (which declined by $0.01), gold rallied by roughly $12 last week.

And at the risk of sounding like a broken record, the divergent behavior should be ringing alarm bells. For starters, the GDX always outperforms the yellow metal during bull markets. Second, gold couldn’t recapture its December highs, even as the USDX took out its December lows).

So just like the sun – which appears brightest before it sets – gold is unlikely to hold its 50-day MA. Furthermore, gold’s RSI (at ~59) is currently declining from a similar level that preceded the yellow metal’s plunge in November (the line shown at the very top of the chart). To be clear – the RSI declined from slightly above 60 back in November, so if the similarity is to be perfect, gold will have to move somewhat higher and decline thereafter.

Figure 20 - Gold Continuous Contract Overview and Slow Stochastic Oscillator Chart Comparison

In addition, rising real yields could be the canary in the coal mine.

On Dec. 28, I elaborated on the potential effect:

When real yields are negative (meaning the expected inflation rate is greater than the nominal interest rate), it’s bullish for gold, because the yellow metal offers a higher potential return than owning government bonds. Conversely, when real yields are positive (or become less negative), the opposite occurs.

Putting in a double bottom at – 1.08% on August 6 and August 31, the U.S. 10-Year real yield currently sits at – 1.01% (1 basis point below last week).

However, despite real interest rates inching lower, nominal interest rates (the yields listed on various government bonds) could be a sleeping giant.

Please see the chart below:

Figure 21 - Interest Rates and U.S. Recessions

Notice the shaded gray bars from top to bottom? They represent historical U.S. recessions. And to make a relative assessment, the blue line is the average interest rate on U.S. Treasuries (various maturities) during the same time periods.

If you analyze the last U.S. recession (the 2008 housing crisis, represented by the shaded gray bar near Jan-10), you’ll notice that the average U.S. Treasury yield peaked at more than 200 basis points (2.00%). In contrast, during the current economic malaise, the average U.S. Treasury yield hasn’t eclipsed (roughly) 75 basis points (0.75%).

The key takeaway?

If the average U.S. Treasury yield repeats its historical pattern, then nominal interest rates have plenty of room to move higher. And following right along, they will lift real yields in the process (unless the expected inflation rate swells, which is unlikely). The potential development is extremely bearish for gold, because it decreases gold’s attractiveness relative to government bonds. So, while pundits keep reiterating that “this time is different,” history suggests otherwise.

Copper-gold is another important piece of the puzzle:

Tilting the scale between risk-on and risk-off, the copper-gold ratio increases when investors are bullish on economic growth and decreases when investors are bearish on economic growth.

Please see below:

Figure 22 – Copper-Gold Ratio

Right now, copper-gold is trading nearly 1 standard deviation below its historical average, implying a ~18% chance of moving lower and an ~82% chance of moving higher when using standard normal probabilities (Z-Score of – 0.90). In other words, based on the reversion to its mean.

More importantly though, copper-gold is highly correlated with U.S. Treasury yields: When the ratio increases (copper is outperforming), higher interest rates tend to follow. Conversely, when the ratio decreases (gold is outperforming), lower interest rates tend to follow.

Notice the blue and gold lines moving in similar directions – especially since 2010?

Figure 23 - Copper-Gold Ratio and U.S. Recessions

The bottom line is that copper-gold might have the same effect as the steepening yield curve (one might be indicating the other and result in turn be followed by lower gold prices). If it reverts back to its historical average (by moving higher), gold will likely face significant selling pressure.

*Still, based on what we explained in the opening part of the Dec. 21 analysis, the situation with real interest rates is a big “if”.

Figure 24 - COMEX Gold Futures

As I mentioned previously, gold soared well above its December highs in today’s (Jan. 4) pre-market trading, while gold miners moved to the analogous level without breaking above it in a meaningful way.

Doesn’t it seem familiar? We already saw something very similar last year.

Figure 25 - COMEX Gold Futures, Silver Futures and NYSE Arca Gold BUGS Index Comparison

Today’s breakout seems bullish, but let’s not forget that breakouts should be confirmed before being viewed as really bullish. If early 2021 rhymes with early 2020, gold could move even a bit higher before reversing. And that’s the key word for this week “reversing”. Silver’s triangle-vertex-based reversal is already here, and the one in gold is due tomorrow. This, plus the situation in gold’s RSI indicator points to a likely top forming shortly.

Before moving further, I want to reiterate my previous comments and explain why gold is likely to bottom at roughly $1,700:

One of the reasons is the 61.8% Fibonacci retracement based on the recent 2020 rally, and the other is the 1.618 extension of the initial decline. However, there are also more long-term-oriented indications that gold is about to move to $1,700 or lower.

(…) gold recently failed to move above its previous long-term (2011) high. Since history tends to repeat itself, it’s only natural to expect gold to behave as it did during its previous attempt to break above its major long-term high.

And the only similar case is from late 1978 when gold rallied above the previous 1974 high. Let’s take a look at the chart below for details (courtesy of chartsrus.com)

Figure 26 - Gold rallying in 1978, past its 1974 high

As you can see above, in late 1978, gold declined severely right after it moved above the late-1974 high. This time, gold invalidated the breakout, which makes the subsequent decline more likely. And how far did gold decline back in 1978? It declined by about $50, which is about 20% of the starting price. If gold was to drop 20% from its 2020 high, it would slide from $2,089 to about $1,671.

This is in perfect tune with what we described previously as the downside target while describing gold’s long-term charts:

Figure 27 - Relative Strength Index (RSI), GOLD, and Moving Average Convergence Divergence (MACD) Comparison

The chart above shows exactly why the $1,700 level is even more likely to trigger a rebound in gold, at the very minimum.

The $1,700 level is additionally confirmed by the 38.2% Fibonacci retracement based on the entire 2015 – 2020 rally.

There’s also a good possibility that gold could decline to the $1,500 - $1,600 area or so (50% - 61.8% Fibonacci retracements and the price level to which gold declined initially in 2011), but based on the size of the recent upswing, we no longer think that this scenario is the most likely one.

Figure 28 - RSI, GOLD, and MACD Comparison

The odd thing about the above chart is that I copied the most recent movement in gold and pasted it above gold’s 2011 – 2013 performance. But – admit it – at first glance, it was clear to you that both price moves were very similar.

And that’s exactly my point. The history tends to rhyme and that’s one of the foundations of the technical analysis in general. Retracements, indicators, cycles, and other techniques are used based on this very foundation – they are just different ways to approach the recurring nature of events.

However, every now and then, the history repeats itself to a much greater degree than is normally the case. In extremely rare cases, we get a direct 1:1 similarity, but in some (still rare, but not as extremely rare) cases we get a similarity where the price is moving proportionately to how it moved previously. That’s called a market’s self-similarity or the fractal nature of the markets. But after taking a brief look at the chart, you probably instinctively knew that since the price moves are so similar this time, then the follow-up action is also likely to be quite similar.

In other words, if something looks like a duck, and quacks like a duck, it’s probably a duck. And it’s likely to do what ducks do.

What did gold do back in 2013 at the end of the self-similar pattern? Saying that it declined is true, but it doesn’t give the full picture - just like saying that the U.S. public debt is not small. Back then, gold truly plunged. And before it plunged, it moved lower in a rather steady manner, with periodic corrections. That’s exactly what we see right now.

Please note that the above chart shows gold’s very long-term turning points (vertical lines) and we see that gold topped a bit after it (not much off given their long-term nature). Based on how gold performed after previous long-term turning points (marked with purple, dashed lines), it seems that a decline to even $1,600 would not be out of ordinary.

Finally, please note the strong sell signal from the MACD indicator in the bottom part of the chart. The only other time when this indicator flashed a sell signal while being so overbought was at the 2011 top. The second most-similar case is the 2008 top.

The above-mentioned self-similarity covers the analogy to the 2011 top, but what about the 2008 performance?

If we take a look at how big the final 2008 decline was, we notice that if gold repeated it (percentage-wise), it would decline to about $1,450. Interestingly, this would mean that gold would move to the 61.8% Fibonacci retracement level based on the entire 2015 – 2020 rally. This is so interesting, because that’s the Fibonacci retracement level that (approximately) ended the 2013 decline.

History tends to rhyme, so perhaps gold is going to decline even more than the simple analogy to the previous turning points indicates. For now, this is relatively unclear, and my target area for gold’s final bottom is quite broad.

Silver

Adding $0.50 to its weekly haul, silver’s latest heist could be its last.

Right now, the yellow metal is flirting with its triangle-vertex-based reversal point – signaling that a sentiment shift could be imminent. Furthermore, silver’s continued outperformance of gold and the gold miners is a classic indicator of a forthcoming decline.

Figure 29 - COMEX Silver Futures

So ... is it make-or-break time for silver?

Well, not necessarily. Over the short-term, the price action remains a coin flip.

With a lack of conviction among market participants, silver could plunge over the near-term or it could continue its consolidation. Either way, silver’s car is running out of gas and it could approach a dead end in the next few weeks. Or days. Or hours.

Please look at the chart above: notice how silver remains range-bound? Despite the violent swings in both directions, silver is still consolidating within a roughly four-month channel

And what does this imply?

Not much, actually – it means that the white metal is continuing to trade sideways after breaking below the rising, medium-term support line in mid-September.

What is most important here is that silver is holding up much better than gold and – in particular – mining stocks. If this was the early stage of a rally, miners would have been strong, and silver would have been weak or average. What we see confirms the validity of the bearish case for the next few weeks or months.

Figure 30 - COMEX Silver Futures

On an immediate-term basis, we see that silver moved very close to its intraday December high, visibly above its October highs and is not that far from its 2020 highs. Despite being slightly below the intraday December high, one can say that silver is outperforming gold.

For more insight, let’s analyze the relative performance of gold, silver and the gold miners, and compare how they’re impacted by the USDX and the SPX.

Dancing to the same beat, the precious metals all broke down in September after the USDX broke above resistance.

Please see below:

Figure 31 - GOLD, SILVER, HUI, USD, SPX, GLD Comparison

What happened since that time? The USD Index moved somewhat higher, but then ultimately moved to and stayed at new yearly lows. Gold, silver, and mining stocks should have rallied given the above. They have not.

Silver is more or less at the level just before it broke, gold is below it, and mining stocks are also below it – the most out of the entire trio.

So, it is not only the case that silver was strong and miners were weak in the last several days – it’s been the case over the past few months as well. The implications are bearish.

Also troubling is that the soaring stock market hasn’t shined its light upon silver. Contrasting the mantra that ‘a rising tide lifts all boats,’ equity market strength hasn’t triggered a sustainable rally in silver or the gold miners. And this “should have” been the case – both are more connected to stocks than gold is. Gold stocks because they are, well, stocks. Silver, due to multiple industrial uses.

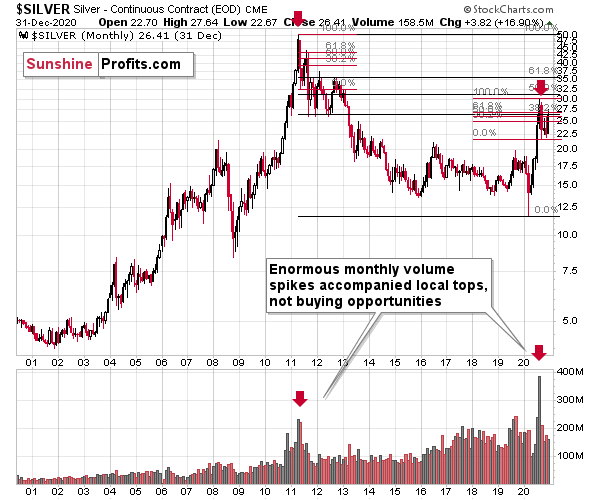

Additionally, the implications coming from silver’s long-term chart are also bearish for the next several weeks (perhaps even months) due to the size of the volume that accompanied the recent monthly rally.

Figure 32 - COMEX Silver Futures

If you look at the monthly silver volume levels, it seems likely that the next sizable downswing has already begun. The previous substantial monthly volume in silver accompanied the 2011 top. The analogy doesn’t get more bearish than this. Ok, it would, if there were multiple key tops confirmed by huge monthly volume. But the 2011 top was so significant that other tops are not comparable, except for the most recent one. Thus, the implications are bearish.

Moreover, please keep in mind that while gold moved to new highs, silver – despite its powerful short-term upswing – didn’t manage to correct more than half of its 2011 – 2020 decline.

In fact, silver has already invalidated its move above the lowest of the classic Fibonacci retracement levels (38.2%), which is not something that characterizes extraordinarily strong markets.

Just like in 2011, silver initially spiked on high volume, before rolling over and making a vertical move lower. Then it corrected slightly more than 61.8% of the preceding decline and then it truly plunged – much more than it had declined initially. We already saw the initial slide and the corrective upswing slightly above the 61.8% retracement. If the history is to rhyme (and this appears likely) then we can expect to see a sizable slide in the white metal in the next several weeks to months.

Based on the above chart, it seems that silver is likely to move well above its 2011 highs, but it’s unlikely to do it without another sizable downswing first.

We are witnessing something similar in the HUI Index as well. The latter corrected half of its 2011 – 2016 decline and nothing more, while gold moved well above its 2011 high.

Figure 33 - NYSE Arca Gold BUGS Index (HUI) and Slow Stochastic Oscillator Chart Comparison

All in all, it was mostly gold that was making the major gains earlier this year – not the entire precious metals sector.

Please note that the HUI Index is declining at a pace that’s very much in tune with how it declined in 1999-2000 and 2012-2013, which is a particularly bearish similarity.

To explain, focus on the green and purple dotted lines on the right side of the chart: In recent months, the HUI Index has been declining at a similar pace to the drawdown in 1999-2000. And despite what the bulls tell you, interim upswings were also apparent before the 1999-2000 drop.

Thus, the recent price action – even the short-term rallies - remains very bearish. And the HUI Index is likely to succumb to a similar fate over the next few weeks and months.

So, how do we determine whether we see the buying opportunity or not?

We will view the price target levels as guidelines, and the same goes for the Gold Miners Bullish Percent Index (below 10), but the final confirmation will likely be something else. Something that we already saw in March when gold bottomed.

We will be on a special lookout for gold’s strength against the ongoing USDX rally. At many vital bottoms in gold, that’s exactly what happened, including the March bottom.

As one would expect, the correlation between gold and the USDX is strongly negative over the medium-term (past year). However, after trading in similar directions for much of November, gold, silver and the HUI Index (relative to the USD) are now back to their usual divergences (10-day correlations of – 0.92, – 0.82 and – 0.78). Naturally, 10 trading days of data is not enough to say if the correlations are fully back to normal but given the stable movements over the last 20 days, a USDX rally is more likely to trigger a slide in the PMs and miners than it was last week.

Figure 34

Since gold, silver, and mining stocks have been strongly negatively correlated with the USD Index in the medium term, it seems likely that they will be negatively affected by the upcoming sizable USDX upswing.

…Until we see the day where gold reverses or soars despite the U.S. currency’s rally.

If that happens with gold at about $1,700, we’ll have a very good chance that this was the final bottom. If it doesn’t happen at that time, or gold continues to slide despite USD’s pause or decline, we’ll know that gold has further to fall.

Naturally we’ll keep you – our subscribers – informed.

To move forward, how does the GDX downside target compare to gold’s downside target? If, at the same time, gold moves to about $1,700 and miners are already after a ridiculously big drop (to $31-$32 in the GDX ETF, or lower), the binding profit-take exit price of your GDX ETF will become $32.02 (those with higher risk tolerance might lower it to $31.15 or so, but moving it lower seems just too risky).

At this time, the final GDX target (the one that would correspond to gold at $1,500 or so) is still unclear. The $17 - $23 area seems probable, especially if the general stock market slides once again. It’s too early to say with any significant level of certainty. Gold is providing us with a clearer final target, so that’s what we’ll focus on. And most importantly – we’ll focus on gold’s performance relative to the USD Index.

Overview of the Upcoming Decline

- As far as the current overview of the upcoming decline is concerned, I think it has already begun.

- During the final part of the slide (which could end within the next 1-10 weeks or so), I expect silver to decline more than miners. That would align with how the markets initially reacted to the COVID-19 threat.

- The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is incredibly positive in the long run, which does not make the short-term decline improbable. Markets can and will get ahead of themselves and decline afterward – sometimes very profoundly – before continuing with their upward climb.

- The plan is to exit the current short positions in miners after they decline far and fast, but at the same time, silver drops just “significantly” (we expect this to happen in 1 – 5 weeks ). In other words, the decline in silver should be severe, but the decline in the miners should look “ridiculous”. That’s what we did in March when we bought practically right at the bottom . It is a soft, but simultaneously broad instruction, so additional confirmations are necessary.

- I expect this confirmation to come from gold, reaching about $1,700 - $1,750 . If – at the same time – gold moves to about $1,700 - $1,750 and miners are already after a ridiculously big drop (say, to $31 - $32 in the GDX ETF – or lower), we will probably exit the short positions in the miners and at the same time enter short positions in silver. However, it could also be the case that we’ll wait for a rebound before re-entering short position in silver – it’s too early to say at this time. It’s also possible that we’ll enter very quick long positions between those short positions.

- The precious metals market's final bottom is likely to take shape when gold shows significant strength relative to the USD Index . It could take the form of a gold’s rally or a bullish reversal, despite the ongoing USD Index rally.

Summary

With 2021 looking like a case of Dr. Jekyll and Mr. Hyde, 2020’s ‘buy everything’ mentality has effectively masked the markets’ dark underbelly. But as the S&P 500’s alter-ego grows larger and larger – with fundamentals and technicals revealing what’s really beneath the veneer – the story is likely to have the same tragic ending.

And as the clock ticks toward the eventual climax, gold, silver and miners are likely to suffer a similar fate.

But how long until the story unfolds?

Well, the divergent price action signals that the next move lower in the precious metals market is already underway. It will likely take another 2-10 weeks to play out (or perhaps even longer), with gold falling to or below $1,700 and with a substantial decline in silver (downside target is unclear) and miners ($1,700 in gold is likely to correspond to about $31 in GDX).

Given gold’s and silver’s triangle-vertex-based reversal points (right about now), it seems that the days of this corrective upswing are numbered.

Despite a recent decline, it seems that the USD Index is going to move higher in the following months and weeks, in turn causing gold to decline. At some point gold is likely to stop responding to dollar’s bearish indications, and based on the above analysis, it seems that this is already taking place.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it was not already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,700 or lower), we expect the precious metals to rally significantly. The final decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager