tools spotlight

-

Gold Looks Beyond the Recovery

July 24, 2020, 6:16 AMThe coronavirus recession was shockingly big and swift, but also very short. The global economy has probably started to grow again in May, which was welcomed by the stock market investors. They perceive the crisis as an accident at work or completely external shock. However, the unpleasant truth is that even without the global epidemic, major economic would probably have entered recession. As we wrote earlier, Germany, Italy and Japan were already in recessions or in flirt with the recession before the pandemic. The American economy was in better shape, but the yield curve inverted and the real US GDP has been slowing down in 2019 compared to 2018, as the chart below shows.

It means that even if the economy recovers relatively quickly, it does not have to flourish and grow at a satisfactory pace. After all, when you start with the very low base, the reported numbers will always look rosy.

But the real question is what will happen when the economy will shake off from the coronavirus infection and the Great Lockdown. We bet that the economy will slow down relative to the pre-pandemic rate of growth because of the subdued demand, reduced labor supply, weak trade growth, and reconfiguration of the supply chains. Importantly, the world's merchandise trade volume, which normally rises significantly faster that the rate of the increase in GDP, last year declined by 0.1 percent. Such decreases are very rare, two others accompanied the deep recession of 1982 and the Great Recession of 2009. And this year may be even worse, as the world merchandise trade could plummet between 13 and 32 percent this year, because of the coronavirus.

Moreover, the collapse of the supply chains during the pandemic is likely to cause the return of protectionism and an increase in trade barriers. The supply chains will probably become shorter to increase their resilience, but also more expensive. What is here important is that given that globalism was deflationary, so its retreat should be inflationary, at least relatively, which is good news for gold, considered to be an inflation hedge.

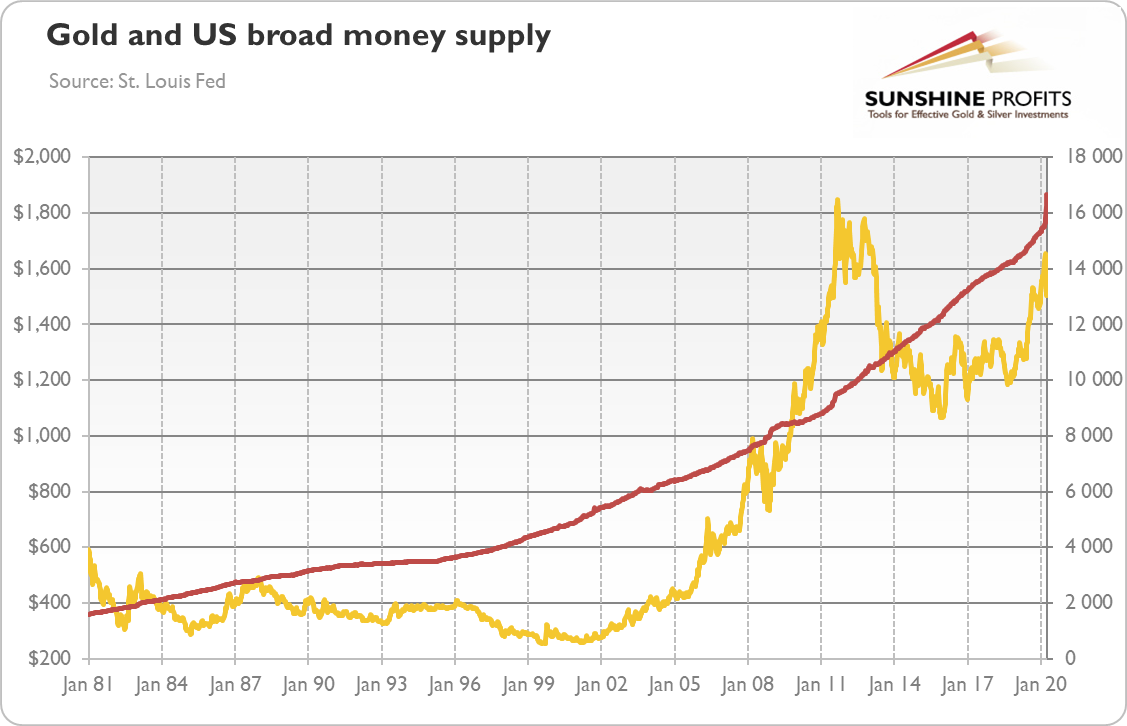

The subdued pace of economic growth should also be supportive for the gold prices. Importantly, it won't be the only positive developments that the pandemic triggered. Another will be the monetary U-turn. The normalization of monetary policy ended in 2019, even before the global epidemic. So it completely failed. And now, in the aftermath of the coronavirus recession, it is off the table for years, as the quantitative easing is the new normal. The monetary U-turn has a few significant implications. First of all, it means the expansion of the Fed's balance sheet and the broad money supply, as the chart below shows. It could at some point hit the confidence in the monetary system based on fiat currencies and the US dollar. The fact that "money printer goes brrr" (as the popular memes picture it) makes also the inflationary or stagflationary scenario more probable.

Moreover, the monetary about-face and the Zero Interest Rate Policy created the environment of negative real interest rates, which should also be supportive for the gold prices. Additionally, the ultra dovish Fed significantly reduced the divergence in the monetary policies and in interest rates between the areas of the US dollar and the euro (or Japanese yen), which should weaken the greenback, while supporting the gold prices.

What is crucial is that the very dovish monetary policy has been accompanied by a similarly expansive fiscal policy. The Congressional Budget Office estimates that the American budget deficit will be $3.7 trillion in the fiscal year of 2020, or 17.9 percent of GDP in 2020, compared with "only" 4.6 percent in 2019, while the federal debt is projected to be 101 percent, versus 79 percent in 2019, a huge increase. The ballooning public debt undermines the independence of the central banks (as it makes the normalization of the monetary policy more difficult), increases the odds of falling into the debt trap, and lowers the resilience of the global economic system.

If this all sounds bullish for gold prices to you, you are right. The stock market investors look beyond the valley of recession, but the precious metals investors should adopt even more long-term orientation and look beyond the nearest quarters. The legacy of the coronavirus crisis will be subdued economic growth, ultra-easy monetary and fiscal policies, and negative real interest rates. These factors are likely to support the gold prices, although there will be both ups and down on the way.

Thank you for reading today's free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold During Coronavirus Recession and Beyond

July 17, 2020, 9:56 AMIt's official now! On June 8, the Business Cycle Dating Committee of the National Bureau of Economic Research stated that economic activity in the United States had peaked in February 2020 (and in Q4 2019, when it comes to the peak in quarterly economic activity), marking the start of a recession. The peak also designates the end of the expansion that began in June 2009 and lasted 128 months, the longest in the history of business cycles dating back to 1854.

How did gold behave during the last U.S. economic expansion? Let's look at the chart below. As one can see, a lot happened in the gold market during 2009-2020 period. Initially, the yellow metal rallied until 2011, doubling its price from about $900 to $1,900 in September 2011.

Then, gold lost almost half of its value in five years, bottoming out at about $1,000 in December 2015. For a couple of years, gold could not break the resistance at about $1,380 and was trading sideways. However, in 2019 we finally saw a strong bullish run, with gold rallying above $1,400 in June and even $1,500 in August.

What can we learn from the past gold's behavior? The first lesson is that gold can rally during economic expansion, not only during recessions or economic crises. This is great news for the yellow metal, as it implies that the recovery from the coronavirus recession won't necessarily end the gold's bull market.

The second insight is that gold performed the best at the beginning and at the end of the expansion. It makes sense, as the last phase of expansion is already shaky and everyone worries about the recession. Indeed, in 2019, when gold entered the bull market, the U.S. economy has slowed down, while the yield curve has inverted and many market participants have already started to expect the recession.

And the initial phase of the expansion is also rather fragile and still full of uncertainty. To a large extent, the recovery in the aftermath of the Lehman Brothers' bankruptcy was driven by the easy unconventional monetary policy (quantitative easing and the ZIRP) and expansionary fiscal policy with rising federal debt. In other words, the rebound was created but not without the costs. The recovery was spurred by easy monetary and fiscal policies with significant side effects that gold reacted to.

The fact that the initial phase of 2009-2020 expansion was very positive for the gold bulls is another great news for them. It implies that the rebound from the 2020 recession not only does not have to be bad for the gold prices, but it can actually push them higher. This is why the Goldman Sachs has recently raised its 12-month forecast for gold to $2,000 - the lower interest rates and inflation worries tend to support the gold prices in this stage of economic recovery. Moreover, just as in 2008-2009, recession was constrained by the very aggressive, easy monetary policy and the ballooning of the fiscal deficit. So far, nobody worries about the negative real interest rates and high indebtedness, but they will one day.

And the unfolding recovery may be slower than many people expect and weaker than in the past. You see, in the aftermath of the Great Recession, there was a rapid rebound of global value chains, which was a major driver of productivity growth. But now we have still broken supply relationships and decline in world's trade volume, so the recovery might be sluggish and the trend of the GDP growth may not return to the pre-pandemic trajectory.

In other words, investors could focus too much on the upcoming recovery. Yes, the GDP growth in the third quarter may be spectacular (the CBO expects a rebound of 5.4 percent), but the truth is that the GDP will still be below the pre-pandemic level. What is important is what will happen after the third quarter. Many analysts expect that the U.S. economy will return to normal growth, if not on its own, then aided by monetary and fiscal stimulus. However, given high household debt and corporate debt and reduced demand for many non-essential goods and services, these hopes might be delusional. People can differentiate between "needs" and "wants" and they reduce spending on travels and eating out. They will repay the debts and save more. Some businesses will not reopen and many people will not re-enter the labor market or find a new job quickly (especially that companies learnt during pandemic to do more with fewer people). Moreover, although the U.S. dollar reaffirmed its status as the safe-haven currency, the post-pandemic pile of public debt combined with Trump's nationalistic approach could weaken the greenback.

Hence, although gold may struggle a bit during the third quarter, which could be full of spectacularly positive economic news, it could appreciate later during the initial phase of a new economic expansion.

Thank you for reading today's free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Gold Amid Epidemiological and Economical Update

July 10, 2020, 5:15 AMSometimes when we observe people on the streets, when we see crowded restaurants and pubs, it seems like the pandemic has ended. But is the global epidemic really over? Not at all. Please look at the chart below. As one can see, the daily number of confirmed cases of COVID-19 in the world is still in an upward trend.

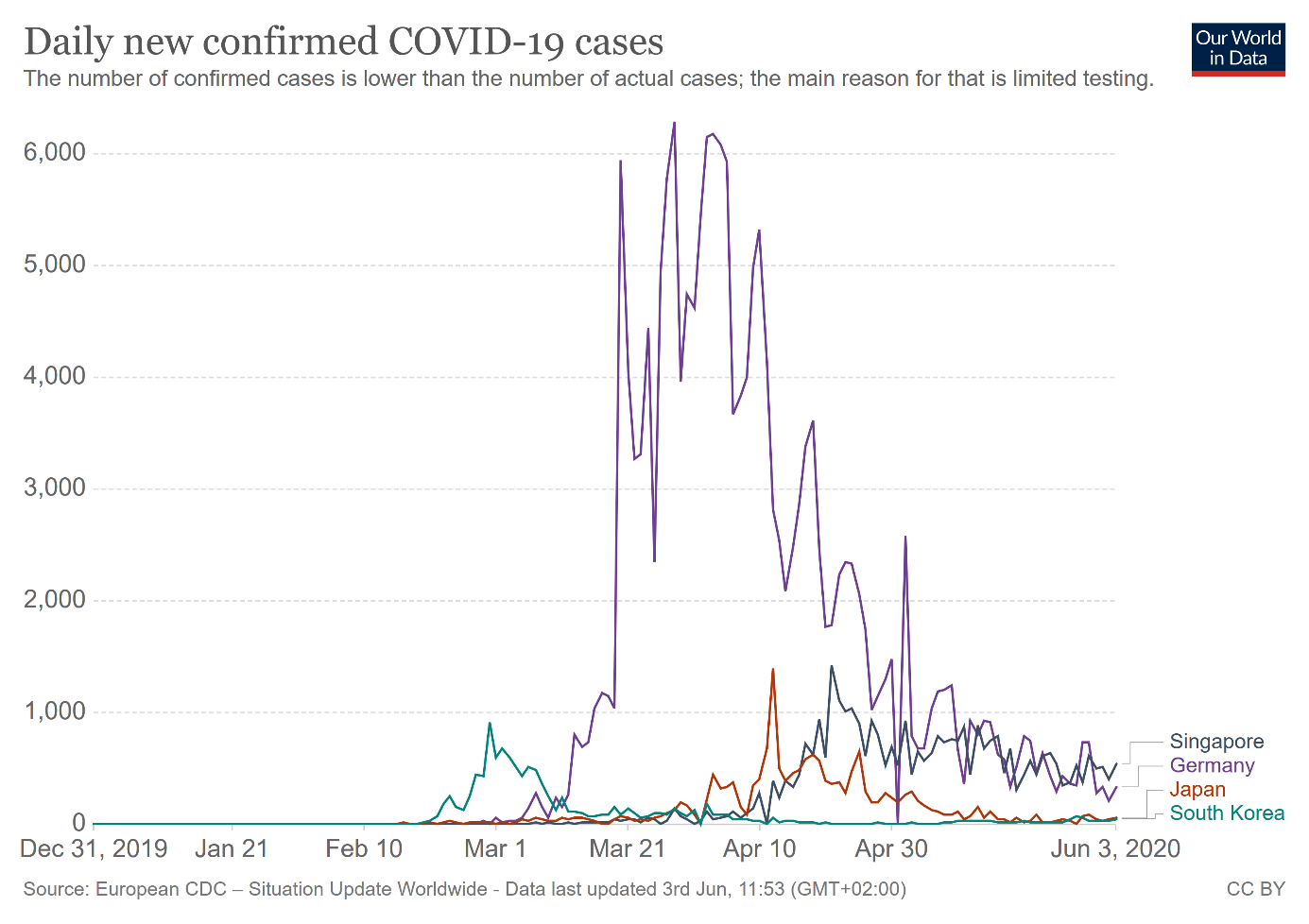

However, in the developed countries the number of daily new cases has declined and stabilized at very low levels, as one can see in the chart below. So, although the pandemic is not over, it has been contained in the West. And remember that global capital markets focus on developments in major economies and financial centers, which are precisely rich countries.

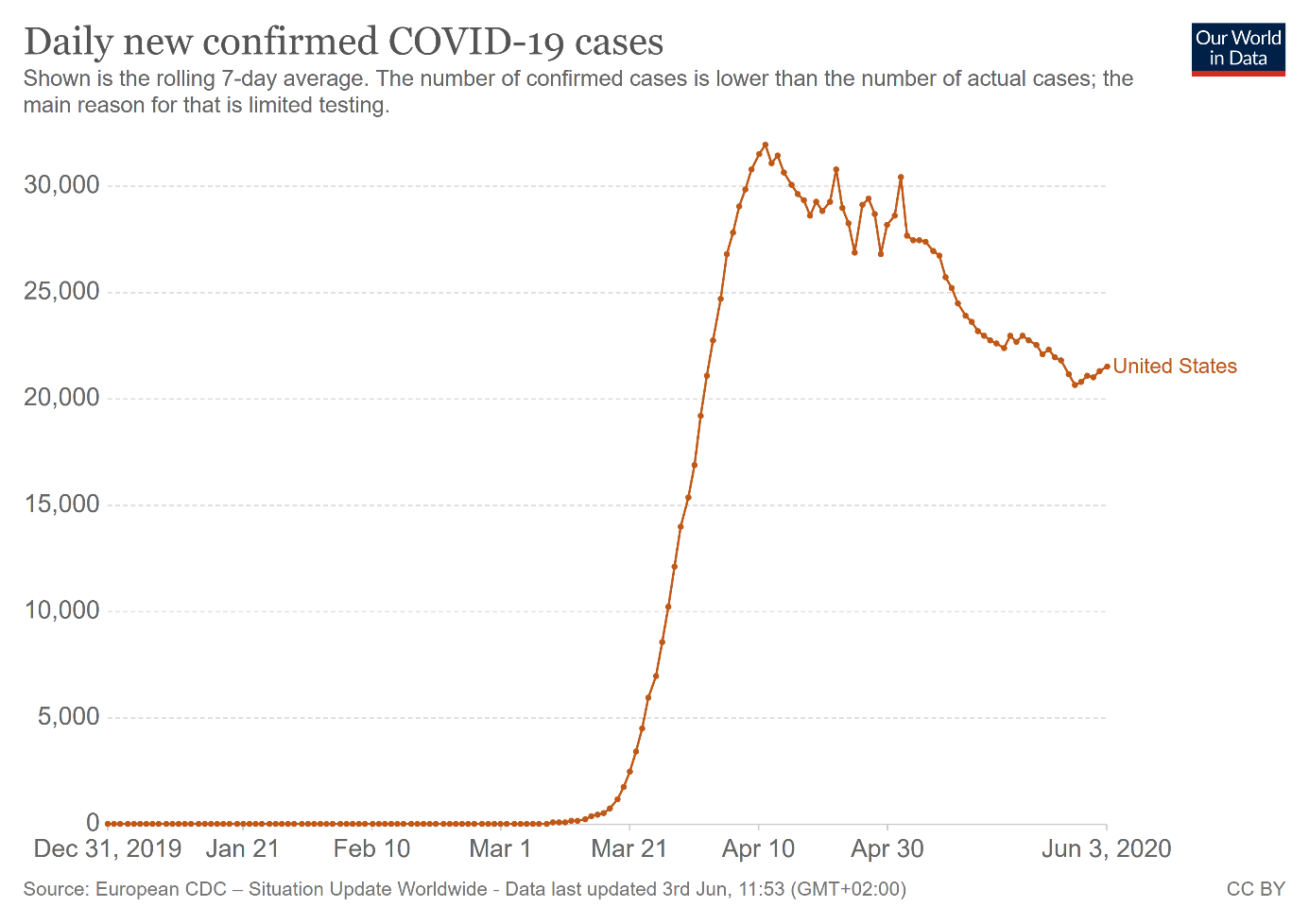

The only possible exception is the U.S., where the number of new cases has also peaked, but it stabilized at not so low level, as the chart below shows. Actually, the number of new cases is at level from the turn of March and April - and it has been even rising recently.

However, people's reaction is different. So, although the pandemic is not over, the fear is over. At the beginning of the epidemic, people panicked (rightly or not), but after two months in quarantine, they got used to the new epidemiological situation. After all, the virus has not mutated (so far), the healthcare systems have not collapsed (luckily and partially thanks to the adopted containment measures), the mortality rates have not surged, and the world has not ended. People quickly adapted to new circumstances and they learnt how to live with the coronavirus threat.

This is very important as markets are driven not by facts and the number of daily new cases of Covid-19, but by people's emotions and reactions to these facts and to the epidemiological threat. And now it seems that many people stopped to fret about the coronavirus.

Rightly or not. We mean here that there are some important arguments for not worrying and be optimistic about the epidemic. The worst is probably behind us and we are now better prepared to handle the pandemic (the shortages of equipment have been remedied). Moreover, in June, the scientists at Oxford University in the United Kingdom reported that the dexamethasone could be the first drug able to save the lives of Covid-19 patients (however, the study results were presented only in press release without any scientific paper).

On the other hand, the threat of the resurgence of the coronavirus is real. Many American states noted a record number of new cases (or new hospitalizations) of coronavirus in June, and Florida could be the next epicenter of the pandemic.

Meanwhile, on the other side of the Pacific, China faces the new coronavirus outbreak in Beijing. In consequence, several communities in the Chinese capital are back on lockdown. The surge in new cases in Beijing, and in other Asian cities (like Tokyo) or American states, is a clear warning to the U.S. and other Western countries: the second wave is possible.

This is, of course, positive for the gold market, as the risk of resurgence of the coronavirus and the reintroduction of the economic lockdowns supports the safe-haven demand for gold and its prices. However, investors should remember that the number of new cases within the second waves are so far limited. The autumn wave could be worse, but the situation is not out of control yet (and wearing masks can help reduce the size of a possible second wave of infection). And the key issue is that even the second wave will not trigger rally in the gold market, unless it spurs fear in the marketplace and it diminishes confidence in the US economy.

So far, the market is not worried about a large outbreak in the fall. It seems that investors believe that there will by the fall enough testing, contact tracing, drugs and R&D on vaccines. And that we will not shut down economies as deeply as we did in spring, if there is the second major outbreak in fall. This time the market might be right - however, at the beginning of the year, Mr. Market was clearly too optimistic, so correction in the risky asset markets is possible at some point this year.

Luckily, the bullish perspective for gold does not depend solely on the second wave. After all, the price of gold has not collapsed amid the optimism about the end of epidemic and economic revival. The key is what the Fed has recently said: it would take nearly two years to fully recover from the coronavirus recession. The subdued economic growth, the dovish U.S. central bank and ultra low real interest rates should support the gold prices (unless they surge suddenly).

Thank you for reading today's free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

High Premiums in Physical Gold Market: Scam or Supply Crisis?

June 26, 2020, 8:45 AMDuring the coronavirus crisis many people couldn't find physical gold, as there was a bullion shortage at dealerships. And these lucky individuals who managed to obtain bullion had to pay high premiums. We invite you to read our today's article about the high premiums in physical gold market during the pandemic and find out whether they were indicated scam or supply crisis.

Gold is expected to serve as a safe-haven asset. But during the coronavirus crisis many people couldn't find physical gold, as there was a bullion shortage at dealerships. And these lucky individuals who managed to obtain bullion had to pay high premiums. What a safe haven that people can't find? And does not the price divergence between physical and paper gold show the price manipulation in the latter market? Let's analyze what really happened in the bullion market during the coronavirus crisis.

First of all, gold was perceived as a safe haven - and this is why it was in such high demand. Since the dawn of civilization, people turn to gold to protect their savings when they are worried about the future. The yellow metal was demonetized in 1971 when President Nixon closed the gold window, ending the gold standard, but gold never lost its position as a store of value. It should not be surprising, as gold was used as money for thousands of years and it has no counterparty risk.

However, that high demand did not meet with sufficiently increased supply. You see, the coronavirus crisis is both the negative demand and supply shock. Many supply chains were broken. The quarantine, labor absenteeism, travel limitations and other measures undertaken to prevent the spread of the coronavirus disrupted the normal, smooth functioning of the economic engine. And it applies to the mints and refiners which simply could not work at full capacity. The bullion coin you see in the retail store is a highly sophisticated product which had to be earlier minted, refined and transported, which can be logistically challenging even in normal times, but it became really difficult during the Great Lockdown.

This is the reason behind the supply shortage and high premiums. They do not necessarily prove manipulation in the paper gold market. Rather, refineries and mints stopped operating or capped production because of the collapse in global travel and shutdowns of local economies. Remember that three important gold retailers - Valcambi, Pamp and Argor-Heraeus - are all based in the Swiss region of Ticino, near the border with Italy, that was quickly shut down at the beginning of the current pandemic.

Investors should remember two things here. First, there is always a certain premium on retail gold, as bullion dealers live on these premiums. One cannot have "spot gold", so if somebody wants to own physical gold, he or she has to pay premium. After all, small and beautiful bullion coins or bars add some value and there are costs involved in producing them. Yes, during the coronavirus crisis these premiums soared, sometimes to 10-15 percent or even more over spot prices. But the havoc was unique: exploding demand and disrupted production and distribution chain at the same time.

Second, the markets are not homogenous, but heterogeneous - they are many segments on each market. Just as there is no single labor markets, but many labor markets (one for IT specialists, another for waiters, etc.), there is no single gold market. So, prices in these markets may differ, which is pretty normal (you don't expect that the salary of IT specialists will be equal to waiters' pay, do you?). After all, the LBMA Gold Price is a snapshot of gold prices quoted by traders in the London OTC spot market for wholesale transactions (and spot price might be even something else, as it is derived from the futures prices quoted in Comex), while the price offered by bullion dealers is the market price of physical bullion in retail trade.

Hence, there might be plenty of gold in a big trading hub like London, as there might be more sellers in the institutional market during the asset selloffs. And big fish typically use large bars of 400 ounces. The big ETFs and central banks do not buy gold at local bullion shops - they buy large gold bars by the truckload. This is why the size of different products is an important reason for the price discrepancy. Such large gold bars are beyond the reach of regular people, who prefer kilobars, one ounce bars and coins, or even smaller products. So they have to pay premium for the possibility to get gold products suitable for their shallow pockets.

Summing up, the bullion shortage and high premiums in the retail market do not prove manipulation in the gold market. They result from the market segmentation and supply disruption together with the explosion in demand for retail gold. But these shortages and high premiums do not have to impact the gold spot price, which is shaped in different segment of the gold market and by different factors. This is why London gold prices could go down during the stock market selloff, as the chart below shows, simultaneously with gold shortages in the retail market.

Chart 1: Gold prices (London P.M. Fix) from January 2 to June 1, 2020

To be clear, it doesn't mean that the price of gold will not go up. We actually consider gold's fundamentals to be bullish. But if gold prices appreciate, they will not do it because of the bullion boom in the retail market, which is a small fraction of the whole gold market, but because of stronger fundamentals and better sentiment among bigger players.

If you enjoyed the above analysis and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the June Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

-

Gold During Covid-19 Pandemic and Beyond

June 26, 2020, 5:01 AMWhat a crazy six months! Let's look at the chart below. As you can see, over the first half of the year, gold gained more than 16 percent, rising from $1,515 at the end of December 2019 to $1,762 at the end of June 2020.

The beginning of the year was, as usual, positive for the gold prices. However, gold did not rally in January as it did in just like in the previous years. Instead, it shot up in February amid mounting worries about the COVID-19 pandemic. After a short correction at the end of the month, probably due to the initial stock market crash, the price of gold jumped to $1,684 at the beginning of March, in the aftermath of the emergency FOMC meeting, when the Fed cut the federal funds rate by 50 basis points.

Then, when the most acute part of the global stock market happened and investors were selling everything to raise cash, the price of gold plunged below $1,500, bottoming out on March 19. But the rapid spread of the coronavirus, radically accommodative response of the Fed (including slashing interest rates to almost zero) and the implementation of economic lockdowns pushed gold prices to above $1,740 in mid-April (for the first time since late 2012). There was a sideways trend in the gold market with a yellow metal trading between $1,680 and $1,750 until the end of June, when the price of gold jumped above the ceiling.

How can we judge the gold's performance during the first half of the year and the global epidemic in particular? Well, on the one hand, gold bulls might be a bit disappointed. After all, one could expect that the most impactful pandemic since the Spanish flu of 1918, together with the unprecedented stock market crash, the deepest recession since the Great Depression, and the reintroduction of the ZIRP and quantitative easing would push gold prices much higher. The gain of 16 percent is great, but in the first half of 2016 gold gained even more.

On the other hand, gold performed much better than many other assets. Although its price declined in March, the drop was relatively mild compared to the stock market crash (see the chart below) or the collapse in oil prices. Gold is actually one of the biggest beneficiary of the coronavirus crisis, confirming its role as a safe-haven asset and portfolio diversifier.

We have to also remember about three important features of the recent crisis, which limited gains in the gold market. First, there was a fire sale to get cash - and during panic no assets are really safe. In the aftermath of the Lehman Brothers' bankruptcy, the price of gold also declined initially. Moreover, in March 2020, the U.S. dollar appreciated significantly, which put downward pressure on the gold prices, as the chart below shows.

Second, the coronavirus recession was very deep, but also very short. It means that investors started quickly to expect a bottom and the following rebound, which weakened the safe-haven demand for gold. In other words, the coronavirus crisis was more like a natural disaster rather than financial crisis or recession triggered by fundamental factors (although the global economy slowed down even before the pandemic and the U.S. repo crisis showed that the American financial system is quite fragile).

Third, the Fed's response was quick and very aggressive, much more radical than in the aftermath of the Great Recession. The U.S. central bank's decisive actions and implementation of many liquidity measures and unconventional monetary policies (as well as Treasury and Congress' actions) managed to quickly restore confidence in the marketplace, spurring the appetite for risky assets rather than safe havens.

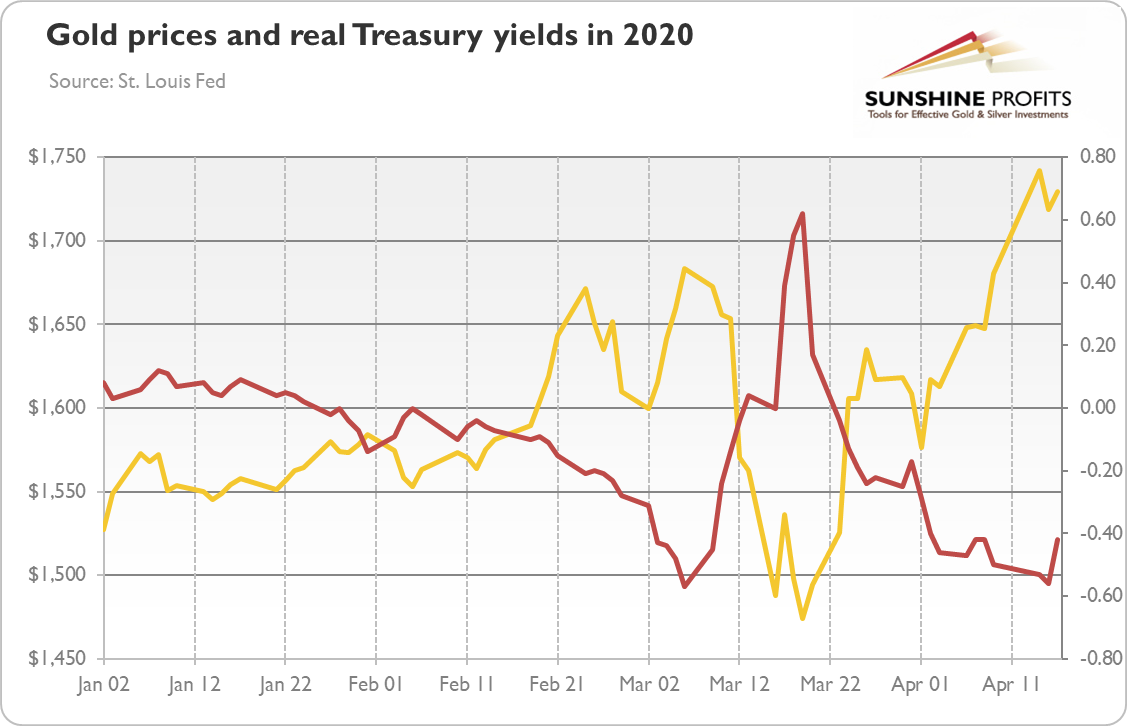

OK. But what's next for the gold market? Well, the key to this question might lie in the chart below. As one can see, there has been a strong negative correlation between the gold prices and real interest rates. In March, the panic was so great that investors were selling even Treasuries, which pushed the bond yields higher, and send the price of the yellow metal down.

Now, the real interest rates are at very low, negative level, which should support the gold prices. The record low was -0.87 percent, so there is still some potential for going negative, especially given the ultra dovish Fed's monetary policy.

However, with yields at such low level, there might be limited room for further downward move. So, unless we see a high inflation (or a significant second wave of coronavirus infections, or a softening of the greenback, for example, because of the sovereign debt crisis), we won't expect a significant rally in gold prices (or there might be ups and downs on the way). Actually, if the real interest rates rebound somewhat, the yellow metal may struggle.

Thank you for reading today's free analysis. If you enjoyed it, and would you like to know more about the links between the economic outlook, the current (past?) crisis and the gold market, we invite you to read the June Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.

-

Will the Second Wave Trigger Rally in Gold?

June 19, 2020, 5:47 AMThe initial health crisis seems to be under control in many countries, including the US. The situation is stabilizing and the governments are easing quarantine restrictions. And, importantly, the number of daily confirmed deaths in the US has peaked in April and has been declining since then, as the chart below shows.

Chart 1: The number of daily confirmed cases in the United States (as a rolling 7-day average) from December 2019 to June 2020.

However, this is not the end of the epidemic. Many epidemiologist warn now against the second wave of infections, especially if people stop distancing socially too quickly. For example, Dr. Zhong Nashan, a leading Chinese epidemiologist, has recently said that a lack of immunity among Chinese residents could be a cause for concern in spurring another wave of infections. Are these warnings sensible and what do they imply for the gold market?

Nobody knows for sure. On one hand, as people put themselves into quarantine long before the governments mandated them to do, they are likely to socially distance even after the Great Unlock. Thus, the second wave may never arrive. Instead, we will have one but prolonged wave with steady influx of new infections.

On the other hand, for the pandemic to disappear, we need herd immunity, so more than half of the population (at least half, as we could need even 70 percent) would have to be immune either from a prior infection of from a vaccine. And we have bad news here. The vaccine will not arrive in the very near future, while we are still a long way from developing the herd immunity. According to the recent Spanish study, only five per cent of Spain's population has been infected, so far. In the US, even in the hardest-hit communities like the New York state, only 14 percent of residents have been infected at some point by the coronavirus. These results are really frightening, as they show that the disastrous outcomes in Spain or New York are not even close to the worst-case scenario.

It means that either societies will distance socially until the vaccine arrives, which could be difficult due to the economical and psychological constraints, or the second wave is inevitable.

History also suggests that the second wave is possible. After all, historians have counted eighteen waves of the bubonic plague of Justinian, although over more than two hundred years, stretching from 541 to 750. More recently, the Spanish flu attacked in three waves (in some areas even in four waves), partially because the authorities eased the restrictions too early. Please remember that the second wave of the 1918 pandemic was much more deadly than the first one.

And, when it comes to the coronavirus, all countries that seemingly contained the virus - Germany, Japan, Singapore, and South Korea - were hit by the second wave, although a not very large one, as the chart below shows, but these countries were adequately prepared to combat COVID-19 from the very beginning.

Chart 2: Daily confirmed Covid-19 cases in Germany (purple line), Japan (blue line), Singapore (grey line) and South Korea (red line).

What would the second wave mean for the gold prices? Well, assuming a similar impact as in the first wave, the price of gold should go up, but not before plunging. Given that the yellow metal appreciated around 8 percent since the stock market crash on February 20, 2020, gold price could ultimately (after a not inevitable from the fundamental point of view, but certainly a possible - decline) reach almost $1,900, assuming another 8-percent upward move.

However, the second wave does not have to bring similar effects as the first wave. As people have become accustomed to the epidemic, its impact may be weaker. The second wave may be also partially already priced into gold. And just as the simple SIR models of the epidemic turned out to be too gloomy, the second wave may be less deadly than many epidemiologists fear. Such a scenario would be less favorable for gold and we could see some correction then, although the fundamental outlook should remain bullish.

On the other hand, given the level of complacency in the US stock market and still common hopes for the V-shaped recovery, the second wave of infections might be like a cold bucket of water poured onto heated investors' heads. Such a scenario seems to be more positive for the gold market, although initially the price of gold could drop together with the stock market.

Which scenario is more probable? I wish I knew! But generally people react the most to new, unknown threats, so they should react less vividly in the future to coronavirus-related risks, especially that the authorities should be better prepared. Remember quantitative easing? The first round was very supportive for the gold prices, while the last one not so much. Similarly, the subsequent rounds of infections could have less and less impact on the financial markets. However, some people are already fed up with the epidemic and hope that life is getting back to normal. The second wave could crash these hopes, especially if it is worse than the first one, as was the case with the Spanish flu.

Anyway, one thing is certain, life is not likely to be completely "normal" for a significant time, perhaps until a vaccine is widely distributed. And gold prefers such abnormal, exceptional times more than boring business as usual!

If you enjoyed the above analysis and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the June Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

-

What Does The Great Disconnect Imply for Gold?

June 15, 2020, 6:47 AMIt seems that global stock markets have disconnected from the fundamental reality. They have been rising since the end of March despite the collapsing economies and soaring unemployment. Why? And what does it imply for the gold prices?

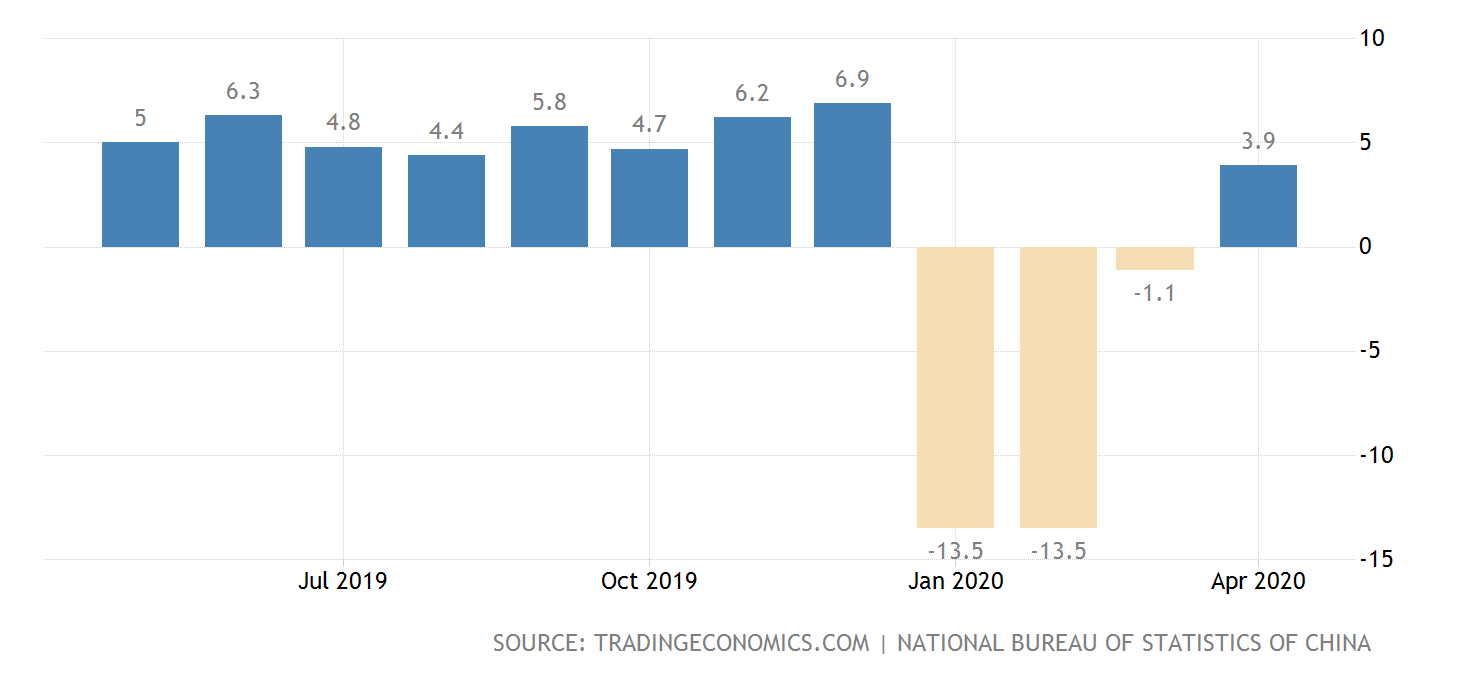

Let's start with the brief review of the economic reality, focusing on China, as the country offers a preview of what is likely to happen in the West a bit later. In April, the industrial production grew 3.9 percent year-over-year, following the 1.1 percent decline in March, as the chart below shows. This is very good news for China's economy. However, it might be too early to trump the full recovery. As a reminder, the industrial production in December 2019, before the outbreak of the pandemic, rose 6.9 percent.

Chart 1: Industrial production in China from April 2019 to April 2020.

And the domestic demand remains very weak: the retail sales in China dropped 7.5 percent in April from a year earlier. Moreover, investment fell 10.3 percent in the January-April period on an annual basis, a modest improvement from the 16.1 percent drop posted in the first three months of the year, but still a negative growth below expectations.

The official unemployment rate reached 6 percent, up from 5.9 percent in March and just shy of February's record of 6.2 percent. Of course, the true unemployment rate is likely twice as much as the official rate does not include people in rural communities and migrant workers. And remember that the global economy is expected to contract 3 percent in 2020, so this decline will negatively hit China, which is the world's factory.

And there are also significant downside risks on the way to full normalization, with the risk of the second wave of the coronavirus and resulting reemergence of lockdowns being the most important threat for the steady economic recovery. Actually, this is actually materializing right now. According to the Bloomberg News, more than 100 million people in China's northeast region, Jilin province, are once again under lockdown restrictions after new cases of COVID-19 have recently emerged.

The situation might be even worse, as the Financial Times' China Economic Activity Index in mid-May was still below 80, where 100 is level seen on January 1, 2020. Many of its subindices, such as coal consumption, air pollution, container freight or box office numbers, remain subdued.

The conclusion is clear: China - and Western countries as well - can forget about the V-shaped recovery, as we have long ago warned. Instead, we could see a U-shaped recovery, which is deeper and more prolonged, or even a L-shaped recovery, which is even slower, although it might be too pessimistic a forecast. Or, there might be actually a mix of V, U, and L: in some industries the recovery will be quicker, while in certain industries - think airlines - it will be slower. Another possibility is that the recovery will look like W, i.e., there will be a rebound in one or two quarters, followed by another dip because of the second wave of epidemic.

The W-shaped recovery seems to be the most positive scenario for the gold market, as the second wave of injections would imply renewed worries and shaky economy. The slow recovery - U-shaped or L-shaped - will be better for the yellow metal than V-shaped, but they would not have to cause a rally in gold. After all, in the aftermath of the Great Recession, the recovery was very sluggish, but gold entered the bear market in 2011.

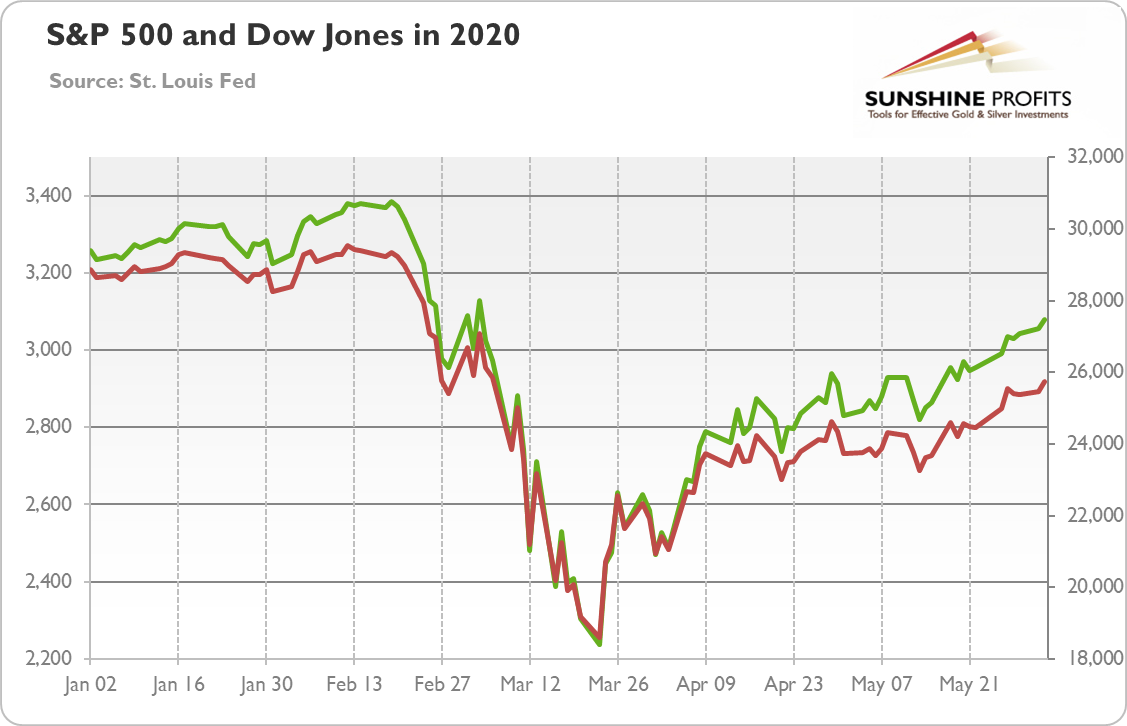

However, the performance of the global equity markets suggests that investors are rather optimistic about the future, at least this is the popular interpretation. Despite rising COVID-19 infections and deaths and the Great Lockdown, despite the collapsing economy and skyrocketing unemployment, the S&P 500 Index has been rising since March 23, as the chart below shows. We know that the stock market is not the real economy and that stock markets are forward-looking and do not want to fight the Fed, but the disconnect is troubling. After all, Mr. Market is not always correct - for example, it overlooked the risk of Covid-19 pandemic.

Chart 2: S&P 500 Index (green line, left axis) and Dow Jones (red line, right axis) from January 2 to June 2, 2020.

But the rising S&P 500 Index does not have indicate strong recovery on the horizon. This is because the rebound in the S&P 500 was driven by selected few companies, i.e., Microsoft, Apple, Amazon, Alphabet, and Facebook - the relative winners during the Great Lockdown that forced people to shift into the online world. Moreover, the behavior of cyclical commodities and bond yields suggest rather weak recovery.

What does it mean? Well, the fundamental outlook does not bode well for equity markets. Given the expected decline in the GDP, the earnings per share for companies listed on the S&P 500 will likely fall by 10-20 percent versus expectations from the beginning of 2020. So, the stock market capitalization from end of May of about 3,000 implies the P/E is higher than before the pandemic! Maybe we should believe more in the collective wisdom of the crowds, but today's equity valuations appear to be at odds with the fundamental reality. The selected few companies will not drive the broad market forever.

We do not say that the stock market crash is imminent, but rather that at least a correction might happen, which could be positive for the gold prices, although the initial downward move could pull the yellow metal down. In other words, investing in the stock market seems to be risky right now given that the V-shaped recovery is unlikely and given elevated equity valuations, so adding gold, which is good portfolio's diversifier, to the portfolio might be a smart move.

If you enjoyed the above analysis and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the June Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

-

Will Great Unlock Push Gold Prices Down?

June 5, 2020, 7:34 AMAs Great Lockdown was positive for the gold prices, the Great Unlock will be bad, right? We invite you to read our today's article about the Great Unlock and find out whether it really must be negative for the gold prices.

It's all government's fault, right? After all, the Great Lockdown was introduced by the federal and state governments introduced, wasn't? Well, not quite.

Before I will explain why, let me clear one thing up: I'm a liberty lover and I'm skeptical about the government regulations. And the economic shutdown was obviously untenable - the only reason to shut down the economy was to buy some time to prepare the healthcare system for better handling of the epidemic. So, it's good that the Great Lockdown is ending.

However, the truth is that the economic shutdown was only partially triggered by the government. While in part it was caused by the bottom-up actions of millions of people who were afraid for their health. Indeed, the data shows that many residents essentially began imposing a lockdown on themselves before their government did. For example, the electricity usage indicates that people became homebodies well before they were required to do so. Similarly, the NBER working paper written by Felipe L. Rojas and others writes:

most of the economic disruption was driven by the health shock itself. Put differently, it appears that the labor market slowdown was due primarily to a nationwide response to evolving epidemiological conditions and that individual state policies and own epidemiologic situations have had a comparatively modest effect.

Many employers sent their employees home long before any official measures. Many workers reduced their labor supply, while many consumers reduced their shopping activity long before any national or state restrictions. Americans and other nations did not need their governments to tell them to stay home, they all saw what was happening in Italy. People are not stupid, and they are not like sheep who meekly await the orders of their governmental shepherd. So as Jonathan Key noticed in his excellent Quillette story:

much of the lockdown effect was imposed not by top-down fiat, but through millions of small decisions made every day by civic groups, employers, unions, trade associations, school boards and, most importantly, ordinary people.

OK, but why are we writing about this? Well, just as many people blame the governments for the economic shutdown, they also hope that the end of the Great Lockdown will quickly revive economic growth. Unfortunately, these hopes are unfounded. The government decrees do not work as a sort of magic wand that first knocked the economy to its knees but now it will bring it to life.

What does it mean? There will be no V-shaped recovery. Just deal with it. People are afraid - rightly or not - of the new coronavirus. Yes, the mortality rate is not high, but it is several times higher than in case of influenza. And even if it kills only a small percentage of infected people, it can cause serious long-term health complications such as lung scarring, heart damage, lower testosterone level in men, and neurological and mental health effects.

So, it should not be surprising that customers won't rush to shopping malls, cinemas and restaurants after the Great Unlock. The uncertainty and fear will remain for some time, perhaps even until the arrival of an effective treatment or a vaccine. As a consequence, many shops and restaurants will not reopen after the strict shutdown ends. As a reminder, the restaurant industry itself accounts for about 16 million US jobs.

And some changes in the labor market will also have permanent effects. As Victoria Gregory and others in another NBER working paper show, the pandemic will "have long-lasting negative effects on unemployment. This is so because the lockdown disproportionately disrupts the employment of workers who need years to find stable jobs." The conclusion is clear: the economy will not quickly return to the pre-pandemic state and trajectory.

What does it mean for the gold market? The lack of V-shaped recovery is good news for gold. The persistent uncertainty and fear should support the safe-haven demand for gold. The weaker than expected recovery will cause the Fed and Treasury to maintain their dovish monetary and fiscal policies, which should also be positive for the yellow metal. To be clear, we do not claim that gold prices will necessarily rally like crazy. Rather, we argue that the Great Unlock does not have to be very negative for the yellow prices, because it will not be a reverse of the Great Lockdown, and the return to normalcy will be only gradual.

Chart 1: Gold prices (London P.M. Fix) from January 2 to June 1, 2020

Indeed, as the chart above shows, the easing of government regulations did not send gold prices down. Actually, gold moved further north in May. And the fundamental outlook for gold - which includes low real interest rates, elevated uncertainty, dovish Fed and mammoth fiscal deficits - should remain positive.

If you enjoyed the above analysis and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the June Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

-

Gold Performance During the Great Unlock

June 5, 2020, 5:38 AMLast month, we analyzed the Great Lockdown. As the first wave of infections has been contained, the governments are easing the restrictions. So, in this edition of the Market Overview, we assess the Great Unlock. First of all, we analyze how the gradual reopening of economies will affect the gold prices. We argue that the Great Unlock will not be as great as it sounds, so the price of gold does not have to go down.

Second, we examine how the second wave of the coronavirus - which is now the biggest threat and in some countries it is already present - could affect gold prices. The issue is not simple, as gold could on one hand gain less than during the first wave as people would be better prepared for the epidemic but on the other hand, it could benefit even more amid extinguished hopes for the quick recovery.

Third, we study the Great Disconnect between the fundamental reality and the global stock market, drawing implications for the gold market. The S&P 500 Index has been rallying since late March, despite the soaring unemployment rate to levels not seen since the Great Depression. Isn't it strange?

Last but not least, we analyze the recent shortages of bullion and high premiums in the retail gold market, investigating what happened and what does it mean for the gold market. In particular, we examine whether the divergence between physical and paper gold resulted from the manipulation and whether it signals the bull market.

We hope that you are healthy and in a good financial position. During the pandemic, the most important job is to survive. But it's not the only task: another is to protect health and capital. We are here to help you in these turbulent times: read our Gold Market Overview and find out what the current crisis implies for the gold market!

-

Will the Fed Trigger Inflation This Time, Boosting Gold?

May 29, 2020, 6:21 AMDuring Great Recession, many people feared that the Fed's quantitative easing would trigger high inflation, or even hyperinflation. As we know, it didn't happen. Why? Well, the main reason is that the Fed created money - that's true - but in the form of bank reserves. And this is a very specific medium of exchange that does not enter the real economy like cash, but stays within the interbank market. You see, bank reserves are a special kind of money used only between commercial banks and central bank and between commercial banks themselves. So, larger supply of reserves does not therefore automatically translate into higher prices.

This can happen only if these additional reserves motivate commercial banks to expand their lending. Investors should remember that in the contemporary banking model based on the fractional reserve banking, the bank deposits account for the majority of the money supply. And when the bank deposits are created? They are created whenever banks grant loans.

As the chart below shows, the growth rate of credit supply was falling during Great Recession, reaching even negative values for some time. Why? For two reasons. First, American households have deleveraged, i.e., they decided to pay back the debts they had, so they were not interested in taking new loans. Second, as the name suggests, the global financial crisis was, well, financial crisis to a large extent. It means that banks were severely hit and they were left with a lot of toxic assets. So, banks themselves were not interested in granting new loans, rather they cleaned their balance sheets. Please also remember that the supervisors tightened the bank capital requirements in the aftermath of the Lehman Brothers' collapse.

Chart 1: US bank credit (annual % change) from January 2007 to December 2010.

However, this crisis is different. The Fed and other central banks did not only introduce quantitative easing, but they also implemented other programs which can turn out to be more inflationary. For example, the US central bank will lend, under the Term Asset-Backed Securities Loan Facility, to holders of certain AAA-rated securities backed by newly and recently originated consumer and small business loans. Moreover, the new Main Street Lending Program set by the Fed in April works like this: commercial banks grant loans to small and medium companies employing up to 10,000 workers or with revenues of less than $2.5 billion, and then they retain 5 percent of the loan on their balance sheets but sell the remaining 95 percent of the loans to the Main Street facility created by the Fed.

All these programs aim to support the flow of credit to employers, consumers, and businesses, encouraging commercial banks to grant new loans to companies that have suffered as a result of the economic lockdown. Moreover, the financial sector has not been hit initially by the coronavirus crisis, while the supervisors eased reserve and capital requirements for banks. The demand for loans from entrepreneurs is also vivid. All this means that the pace of growth of credit and money supply may be higher than during the Great Recession. Indeed, as the chart below shows, they accelerated in March and April.

Chart 2: The annual % change of the US bank credit (green line) and M2 money supply (red line) from January 2019 to April 2020.

Summing up, the unconventional monetary policy implemented in the aftermath of the Great Recession did not spur inflation. However, this time may be different. To be clear, we are not saying that we will see hyperinflation in the US. That's still very unlikely. What we mean is that the commercial banks are - so far - significantly more eager to grant new loans. So, the resulting increase in money supply should create higher inflation after some time, if other factors remain unchanged.

In other words, this crisis is more likely to result in stagflation than the Great Recession, especially as economy faces disruptions in the supply chains. Indeed, please take a look at inflation expectations derived from the 5-year inflation-adjusted Treasuries displayed in the chart below - as you can see, the market does not expect deflation now, as it did in the aftermath of the previous economic crisis.

Chart 3: US 5-year breakeven inflation rate from January 2007 to April 2020

Given that gold is considered to be an inflation hedge, the higher odds of inflation are fundamentally positive for the gold prices. It does not mean that disinflation or deflation would be negative for the yellow metal, as it could shine nevertheless during the crisis of any kind, but increased chances for stagflation should be an additional factor that could encourage more investors to buy gold.

Thank you for reading today's free analysis. If you enjoyed it, and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the May Gold Market Overview report. Please note that in addition to the above-mentioned free fundamental gold reports, and we provide premium daily Gold & Silver Trading Alerts with clear buy and sell signals. We provide these premium analyses also on a weekly basis in the form of Gold Investment Updates. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits. -

Implications for Gold – 2007-9 Great Recession vs. 2020 Coronavirus Crisis

May 25, 2020, 7:13 AMIf you thought that the Great Recession was a disaster, you might want to change your mind soon, as the coronavirus crisis is much broader and deeper. In today's article, we'll compare the Global Financial Crisis from 2007-2008 with the current crisis. Let's find out what it implies for the gold market.

When the economic crisis hits, the first instinct is to analyze the previous catastrophes to learn what to expect from and how to handle the current calamity. So, not surprisingly, many analysts have already pointed to the 2008 global financial crisis (GFC) as the most relevant example. However, is really the current coronavirus recession similar to the Great Recession? Let's compare these two big crises and draw investment conclusions for the gold market!

First of all, in terms of scale and pace of the decline, the current crisis is much broader and deeper. It hits practically the whole globe, not only advanced countries, and it affects all offline sectors, not just the financial sector and construction. And in just four weeks, 22 million of Americans made claims for the unemployment benefit. For comparison, during the Great Recession, 37 million unemployment claims were filed. But the Great Recession started in December 2007 and ended in June 2009, so it lasted one year and half. When it comes to output, the cumulative decline in the real GDP amounted to 4 percent during the Great Recession. Meanwhile, just two months of mitigation measures are estimated by some economists to shrink the real US GDP by 10 percent. Even the overly optimistic IMF expects that the US economy will shrink 5.9 percent this year.

Hence, the severity of the current crisis will be larger than the impact of the Great Recession. After all, it should not be surprising. The current crisis is not a normal economic crisis, but an economic lockdown, during which most people cannot work at full potential. It means that the current crisis is not a mere liquidity crisis, but a profit crisis - entrepreneurs cannot generate revenues, while they still have to bear some costs. Importantly, without profits, companies will lack funds for investments. It all suggests that the effect on the gold prices should be larger, especially since the response of the Fed has also been much more swift and aggressive.

Of course, there is one caveat, i.e., the duration of the crisis. The Great Recession lasted 18 months. But nobody knows how long the current crisis will take. If it is deep but short, the overall damage may not be as severe compared to the protracted depression. In such a scenario, the positive impact on the gold price might be limited, especially that investors are forward-looking and they can see across the valley. After all, the lockdown will be probably loosened in the coming weeks. However, it remains to be seen whether the crisis will be short. Although some measures may be lifted, we think that some social distancing will stay in place and the economy will not return to full capacity. And the Fed will not normalize its monetary policy in general and its interest rates in particular for a longer period of time, which should support the gold prices.

The nature of the coronavirus crisis is also different that the nature of the Great Recession. The latter is widely believed to be the financial shock that took a severe toll on the real economy. That's not exactly the truth, as the financial sector got into trouble because of the housing bubble, i.e., the misallocation of resources within the real economy. But we could say that the initial hit was felt by the housing sector, then financial sector, and then the overall real economy because of the credit crunch. In other words, the banks which were engaged in subprime lending were severely hit, so they constrained lending for households and companies.

In contrast, the coronavirus crisis originated because of the health crisis and the response to it. Radical containment efforts produced a huge shock to the real economy, hurting mainly businesses and their workers. The financial sector has not been hit initially, although it may feel the negative effects in the second-round of effects. Why is this difference important? For two reasons.

First, it shows that the central banks are helpless against this crisis. Assuming that in 2008 we faced liquidity crises, the Fed could inject liquidity and alleviate the primary source of the problems. But now the Fed addresses only the a secondary financial repercussions, but it cannot deal with the primary shock to the real economy. This is something the gold bulls should rejoice.

Second, as banks remain relatively unaffected by the initial shock, they are able to expand credit. Hence, the bank credit and broad money supply can grow faster than during the GFC. Actually, as the chart below shows, they do grow faster than during the Great Recession. As one can see, both measures have started to expand above 10 percent year-over-year, much faster than in the aftermath of the financial crisis of 2008.

Chart 1: The annual % change of the US bank credit (green line) and M2 money supply (red line) from January 2007 to April 2020.

It means that stagflation is more likely now than during the Great Recession. Please note that we don't claim that it will trigger stagflation for sure - after all, the negative demand shock is severe, while the high corporate debt may limit the demand for credit. However, as the majority of the money supply is created by commercial banks, the fact that this is not primarily a banking crisis, as it was during the Great Recession or during the Great Depression (when banks went under and we had deflation), increases the chances of stagflation (the expected spike in the public debt also increases odds of its monetization and the resulting inflation later in the future).

Moreover, the current crisis is not only the negative demand shock (as the GFC is believed to be), but also the negative supply shock, which creates some inflationary pressure. No need to say that stagflation seems to be a better scenario for gold prices than the case of low inflation or even deflation (although gold can shine even during such circumstances, as it showed in the aftermath of the Lehman Brothers' collapse).

To sum up, generals always fight the last war, while the economist and central bankers always fight the last recession. However, the coronavirus crisis is different from the global financial crisis. So, central banks' response may not help much. The former crisis is already worse than the latter. And because it results from negative supply shock as well as negative demand shock, while banks smoothly expand credit (so far), the current crisis could be more inflationary than the Great Recession. This is, of course, good news for gold, which is considered to be an inflation hedge.

If you enjoyed the above analysis and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the May Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

-

Will Gold Shine Under the Great Lockdown?

May 15, 2020, 7:24 AMThe recession that started in 1929 is called the Great Depression. The global financial crisis that originated in 2007 is named the Great Recession. The current coronavirus crisis can be called the Great Lockdown. As we all already know, the protection measures implemented to contain the coronavirus are severely impacting economic activity. However, the severity of the economic calamity is still uncertain. The initial shock was deep - all economic data, including the jobless claims, retail sales or industrial production - suggests that the downturn will be worse than during the Great Recession.

Now, we got an "official" confirmation. In its newest World Economic Outlook Report, the IMF projects that the global economy will contract sharply by 3 percent this year, preceded by 2.9 percent growth in 2019. The US economy is expected to plunge 5.9 percent, compared to 2.3 percent growth in 2019. It means that the global and the US economies are likely to experience their worst recessions since the Great Depression, dwarfing the output loss during the global financial crisis from a decade ago.

OK, we already know that this year will be pretty ugly. But what about the next year - will we see a sharp rebound? Well, in the IMF's baseline scenario, which assumes that the pandemic fades in the second half of 2020 and containment efforts would be gradually unwound, the global economy is projected to grow by 5.8 percent next year, while the US economy is expected to expand by 4.7 percent in 2021. And China's economy is forecasted to rise 1.2 in 2020, accelerating to 9.2 percent in 2021, as the chart below shows.

Chart 1: Actual and projected real GDP growth for China (blue line), the US (red line) and the global economy (green line) from 2007 to 2021.

This looks great. But if something seems too good to be true, it probably is. To be sure, there are many reasons for optimism. In some countries, the number of new cases has come down. And the unprecedented pace of work on treatments and vaccines also promises hope. However, the IMF's base scenario assumes basically the V-shaped recovery, which is not likely to happen.

Surely, the normalization of economic activity will take place from very low levels, but the social distancing will not disappear until the vaccine arrives. We have to remember that when the containment efforts are lifted and people start moving more freely, the virus could again spread rapidly. As long the society does not have herd immunity, the economy will not simply return to normal, pre-pandemic life. And if history of previous deep downturns is any guide, the reduced investment, employment and commercial bankruptcies will leave long-term scars on the economy.

Moreover, the IMF's baseline scenario assumes no widespread company bankruptcies, extended unemployment or system-wide financial strains. It assumes no sovereign debt crisis, although the Great Lockdown is projected to boost the fiscal deficit among advanced countries from 3 percent in 2019 to 10.7 percent of GDP in 2020, and general government debt from 105.2 in 2019 to 122.4 percent of GDP in 2020. But it remains to be seen, whether the policy actions will prevent all these threats.

Last but not least, the IMF's projections are always too optimistic - even the Fund itself admits that "even after the severe downgrade to global growth, risks to the outlook are on the downside." Indeed, in the worst case scenario, which assumes a protracted pandemic and longer containment effort in 2020 as well as a recurrence in 2021, the IMF projects that the global economy will not grow 5.8 percent in 2021, but decline 2.2 percent!

The case of China is illustrative here. The country's GDP shrank 6.8 percent in the first quarter of 2020, the first such decline since at least 1992 when quarterly GDP series started. What is important, is that although economic activity improved in March and April compared to January and February, it remained weak. The unemployment rate remains high, the exports are subdued because of the global recession, while the retail sales data shows that consumption is in slow recovery. All this means that China is far from returning to pre-crisis normal - although the second quarter will be better than the first one, the rebound will be more gradual than previously hoped. All this confirms our thesis that opening America will take more time while the recovery will be weaker than most think.

What does it all mean for the gold market? Well, the lack of swift rebound means that the recession will be longer, while the recovery slower. That's actually great news for gold, which shines the most during economic crises. The stronger the economic calamity, the higher the chances of second-rounds repercussions for the financial system, and the larger scars on the economy and investors' psyche. In a post-pandemic world, risk aversion could be larger than before the epidemic, which should be positive for safe-haven assets such as gold.

If you enjoyed the above analysis and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the May Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

-

Coronapocalypse and Gold - How High Is Too High for the Yellow Metal?

May 8, 2020, 8:01 AM$2,000, $5,000 or even the Jim Rickard's $50,000 as the next target for gold. How realistic are these figures - could we see the yellow metal at $5,000 or even higher amid the coronavirus crisis? We invite you thus to read our today's article and find out how high gold prices can go in this downturn.

The first quarter of 2020 was clearly positive for the gold market, as the chart below shows. The yellow metal gained 6.2 percent from December 30, 2019 to March 31, 2020, moving from $1,515 to $1,609. In April, the bullion went up even further to $1,693, increasing gains to 11.7 percent in 2020 (as of April 17).

Chart 1: Gold prices (London PM Fix, in $) in 2020.

The obvious reason for this bullishmove was the COVID-19 pandemic and the resulting shutdown of the global economy. As a result of the coronavirus shock, most of the major drivers of the gold prices improved. In particular, the real interest rates, as measured by yields on the 10-year inflation-indexed Treasuries, dropped, plunging into negative territory. As one can see in the chart below, gold prices behaved like a mirror image of the real government bond yields.

Chart 2: Gold prices (yellow line, left axis, London PM Fix, in $) and real interest rates (red line, right axis, in %, yields on 10-year inflation-indexed Treasuries) in 2020.

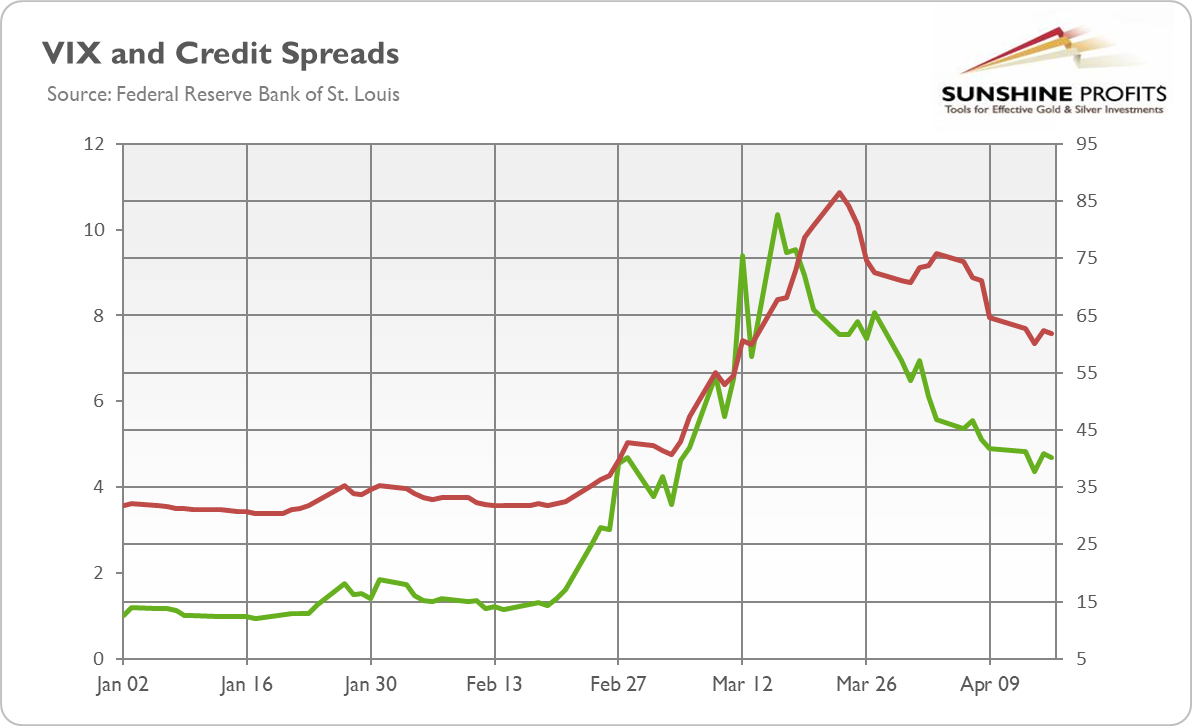

Moreover, the risk premium also surged, which supported safe-haven assets such as gold. As the chart below shows, credit spreads greatly widened, while the CBOE Volatility Index skyrocketed.

Chart 3: CBOE Volatility Index (green line, right axis, index) and ICE BofAML Option-Adjusted Spreads (red line, left axis, %) from January 2 to April 16, 2020

Some people complain that gold's performance has been rather shy given the depth of the negative economic shock. Well, it's true that gold has not rallied so far, but achieving almost 12-percent gain when almost all assets plunged makes gold one of the best performing asset in 2020, if not the best.

Gold prices did not soar further because of two factors. First, just as in the immediate aftermath of the Lehman Brothers' collapse, investors started to liquidate gold holdings in order to raise cash. But when the dust settles and the sell-off inevitably ends, the yellow metal will have a cleared path upward.

Second, the US dollar appreciated amid the coronavirus crisis, as the chart below shows. The greenback is also seen as the safe haven during crashes, so investors switched their funds from all over the world and put them into the US-dollar denominated assets. Given the strong negative correlation between the greenback and gold, the appreciation of the dollar exerted downward pressure on the gold prices. However, gold and greenback can both appreciate during the financial crises, as it was the case in early 2009. Importantly, the surge in the US fiscal deficit and public debt may weaken the dollar in the longer run.

OK, we know what happened, but what's next for the gold market? Will the price of gold quickly rally to $5,000 or more, as some analysts claim? No. It's true that the Fed's balance sheet is going to balloon, and the money supply will soar, but there is no correlation between the money supply and gold prices. As you can see in the chart below, the broad money supply has been rising since the 1970s (the data series we got unfortunately starts only in the 1980s), when Nixon closed the gold window, but the price of gold has not - instead, the yellow metal experienced bull and bear cycle.

Chart 4: Gold price (yellow line, left axis, London PM Fix, in $) and the US M2 money stock (red line, right axis, in billions of $) from January 1981 to March 2020

The ratio between the fiat money supply and gold's supply is no simple formula for gold's fair value. You see, the claims that the soaring money supply could push gold prices to a dozen or even tens of thousands dollars are based on the assumption that the global economy will return to the gold standard (then, the price of gold would have to indeed increase to "replace" the value of all demonetized paper money), which is highly unlikely, no matter whether we sympathize with the idea (we do) or not.

Let's move now to the aftermath of the Great Recession. The price of gold increased 244 percent, from $775 on September 15, 2008 to $1,895 on September 5, 2011. So, if history replays itself, the price of gold could increase to about $4,140. However, it was not a quick rally, it took three years for gold to reach the peak. And history never repeats itself, but only rhymes: remember that it always easier to rise when you start from lower levels.

Does it mean that we are bearish on gold? Not at all. Of course, there is a risk for gold outlook that the pandemic will be quickly contained and the economic growth will swiftly rebound. However, we think that the V-shaped recovery is unlikely. Social distancing will not disappear in one day. You see, the pandemic is not confined in time and space like a hurricane or a terrorist attack. The coronavirus will linger through the year (or even longer, according to Michael Osterholm, an infectious-disease epidemiologist at the University of Minnesota). The problem is that people still do not understand that this epidemic is not a matter of just weeks.

And there are significant downside risks for the economy, which - if they materialize - could push gold prices even further up. In particular, there might be a feedback loop in the financial system that could culminate in a systemic financial crisis. We believe that many analysts underestimate the possibility of further repercussions, hoping for a quick rebound. Remember 2007? Economists believed then that the problems would be limited to the subprime mortgage market and wouldn't affect the whole economy. Yeah, right.

However, even if the quick recovery happens, the low interest rates, dovish central banks and high debt will stay with us, which would support the gold prices. Thus fundamentally, the coronavirus crisis is very positive for the gold prices, and the outlook for the yellow metal in 2020 has clearly improved compared to a few months ago.

If you enjoyed the above analysis and would you like to know more about the links between the coronavirus crisis and the gold market, we invite you to read the May Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

-

Gold Performance During the Great Lockdown

May 1, 2020, 6:34 AMWe've never experienced anything like this. There was the Great Depression and the Great Recession. Now, we have the Great Lockdown, which bans much of economic activity. Well, the shutdown of economy really shut downs the economy.

In this edition of the Market Overview, we assess the scale of the Great Lockdown, based on the newest economic reports. The IMF expects that the global economy will contract 3 percent this year, but we argue that the IMF's estimate might be too optimistic.

We also compare the current coronavirus crisis with the global financial crisis from a decade ago. We have good news for the gold bulls: the today's downturn is much deeper than the Great Recession. And it may turn out to be more inflationary later in the future, if the current trends in the bank credit and money supply continue.

We also examine the Fed's unconventional monetary policy implemented in the aftermath of the pandemic outbreak. Although the quantitative easing does not have to be inflationary and it was not in the aftermath of the Great Recession, this time is different. In the short run, we expect disinflation, but we think that the risk of inflation later in the future is higher than a decade ago.

Last but not least, we analyze how gold performed during the first quarter of 2020 and later in April. Although gold prices did not skyrocket, the yellow metal was one of the best performing assets during the pandemic, if not the best one. We do not merely examine the past - we also present the fundamental perspective for gold prices later this year! In particular, we address the question how far the gold price can go up, taking on some popular myths.

So, stay home and protect your health. But also protect your capital. We are here to help you in these challenging and risky times: read our Gold Market Overview and find out what the current crisis implies for the gold market!

-

Financial Antivirus Stimulus Packages and Gold