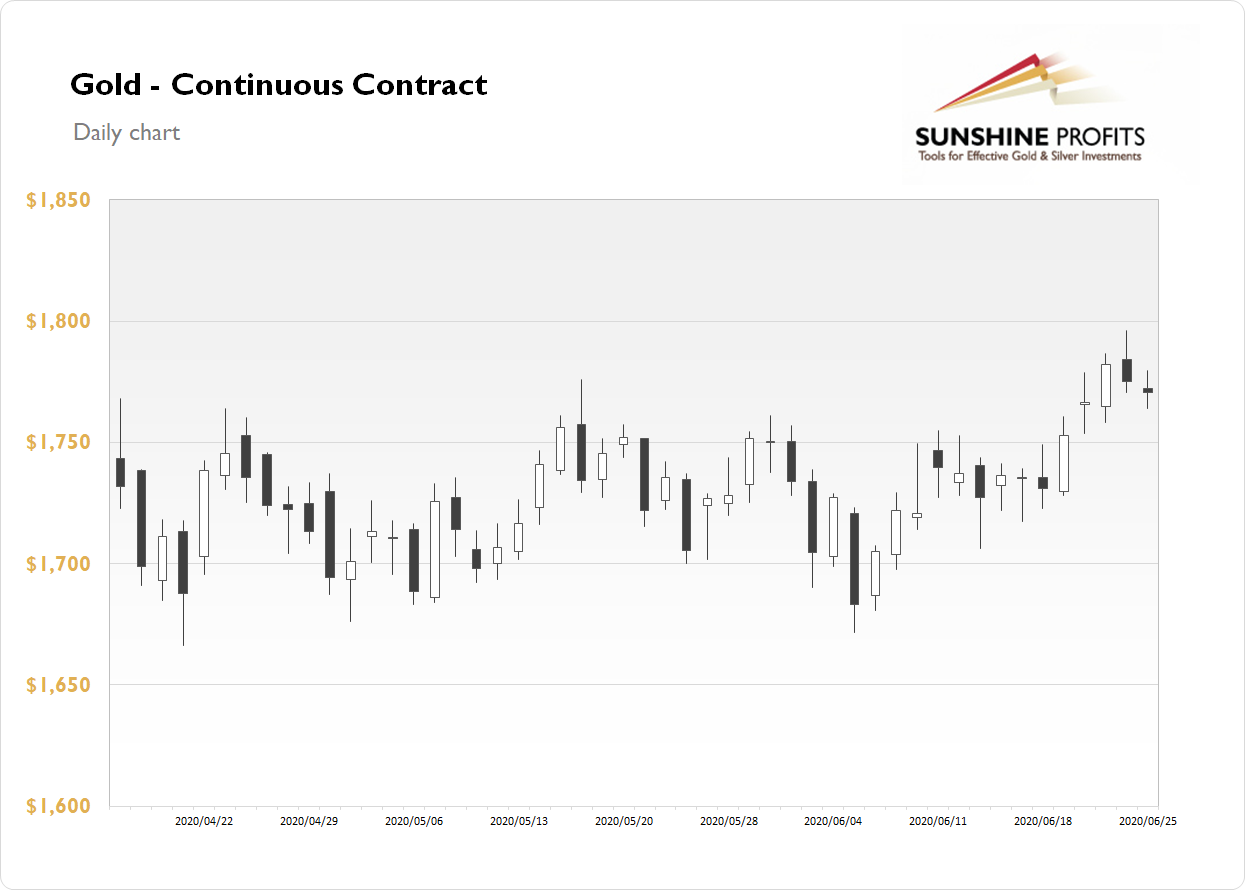

The gold futures contract lost 0.25% on Thursday, as it retraced some of the recent advance. The market got very close to $1,800 mark on Wednesday but then it has reversed lower. The recent economic data releases didn't bring any new surprises for the financial markets. However, gold broke above its local highs, as we can see on the daily chart:

Gold is unchanged this morning, as it is continues to fluctuate along Wednesday's and yesterday's closing prices. What about the other precious metals? Silver gained 1.27% on Thursday and today it is 0.3% higher. Platinum lost 0.24% and today it is trading 0.3% lower. Palladium lost 2.30% yesterday and today it is up 0.8%. So precious metals extend their short-term consolidation today.

Financial markets are waiting for today's U.S. economic data releases. We will get the Personal Spending/ Personal Income numbers along with Core PCE Price Index at 8:30:0 a.m. Then the Revised UoM Consumer Sentiment number will be released at 10:00 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for today:

Friday, June 26

- 8:30 a.m. U.S. - Personal Spending m/m, Personal Income m/m, Core PCE Price Index m/m

- 10:00 a.m. U.S. - Revised UoM Consumer Sentiment, Revised UoM Inflation Expectations

Thank you for reading today's quick gold news guide. If you enjoyed it, we invite you to read also our other gold market analyses. This includes our free Fundamental Gold Reports as well as premium Gold & Silver Trading Alerts with clear buy and sell signals and weekly premium Gold Investment Updates. If you're not ready to subscribe to our premium services, a great way to check them out (also the premium services - free for 7 days!), is to sign up for our no-obligation free gold newsletter. We'll only ask to whom (just the first name) and to what e-mail address we should be sending our analyses. Sign up today.

Paul Rejczak

Stock Selection Strategist

Sunshine Profits: Analysis. Care. Profits.