According to the U.S. Department of Labor, the core Consumer Price Index (CPI) rose by 0.3 percent in January. Does it mean that inflation is rising, which would bring us closer to the next Fed hike? How can this data affect the gold market?

CPI Flat, Core CPI Rises

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in January, following a 0.1 percent decline in December. The core CPI, which excludes energy and food, rose 0.3 percent, following 0.2 percent increase in December. It means that decline in the energy index was offset by an increase in core items, mainly housing expenses and medical care costs.

What is perhaps the most important is that the CPI jumped 1.4 percent on an annual basis, a surge from 0.7 percent a month ago. That’s the fastest pace since late 2014. Moreover, the core CPI increased 2.2 percent over the last 12 months, a modest rise from 2.1 percent in December. That’s the biggest increase since the summer of 2012.

Is the Inflationary Pressure Building?

The January data led some analysts to claim that although inflation is still quite low, the inflationary pressure is beginning to build, which may be a game changer for the FOMC, increasing the chances for a Fed hike in March.

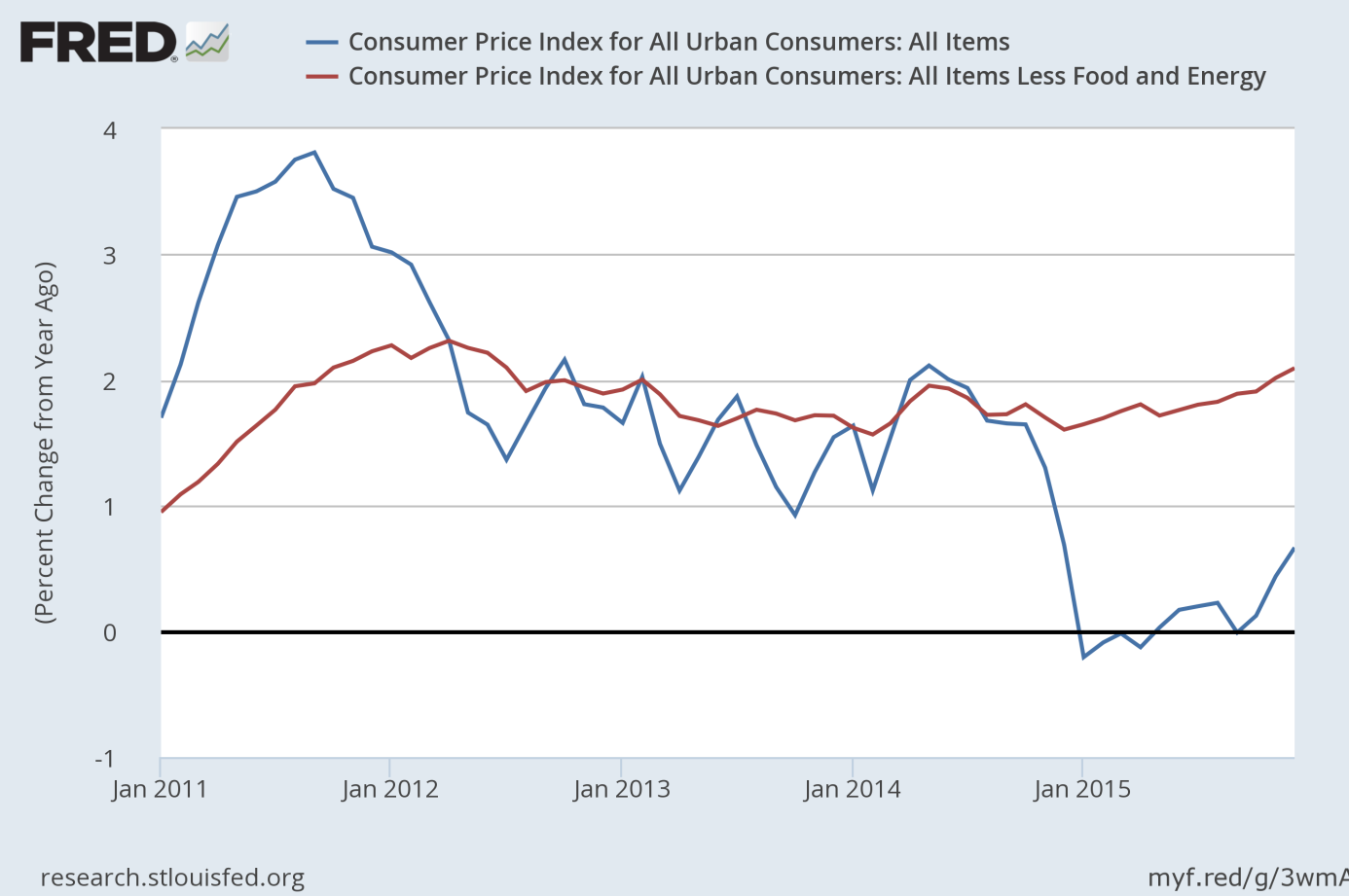

Undoubtedly, as the chart below shows, both indices have been rising over the last year on an annual basis.

Chart 1: CPI and core CPI (percent change from year ago) from January 2011 to January 2016.

So far, markets do not believe that inflation will rise significantly or sufficiently to change the Fed’s stance. Yields fell after the CPI data was released, and market-based inflation expectations are still very low, which indicates that investors discount deflationary pressures rather than inflationary ones. Gold ignored the rise in inflation and traded sideways on Friday. And interestingly, the odds for a March hike plunged from 14.9 to 2.1 percent on Friday, according to CME FedWatch. Fed funds future contracts suggest that markets expect no hikes in 2016. Perhaps investors know that the Fed’s preferred gauge of inflation is the PCE Price Index, which has been much softer than the CPI. In December, inflation measured by the former increased 0.6 percent on annual basis and 1.4 percent when measured by the core PCE Price Index.

However, investors should not forget that the PCE Price Index assigns much less weight to rents and housing and much more to health care. That is important, because health care-related indices have driven the recent acceleration in the core CPI. Therefore, the January PCE Price Index, which is scheduled to be released this week, could be a signal that inflation is accelerating. If inflation accelerates, investors could adjust their expectations of inflation and the pace of Fed’s tightening cycle, since the most recent Fed minutes noted that a number of FOMC members wanted to see inflation rise before next hikes.

Moreover, the Producer Price Index rose 0.1 percent in January, a much stronger reading than the 0.2 percent decline in December and the 0.2 percent decline expected by economists (although it declined 0.2 percent for the 12 months ended in January). The core PPI, which excludes energy, food and trade prices, increased 0.2 percent and 0.6 percent on an annual basis.

Conclusions

The bottom line is that the core CPI unexpectedly increased in January and the CPI is accelerating on an annual basis. We believe that it is too early to draw serious conclusions about the inflation outlook. The data on inflation is quite volatile, while there is still a deflationary pressure from China around the corner. So far, markets do not expect a rise in inflation. However, the increase in the PCE Price Index and especially further increases in February may be a strong signal of accelerating inflation. It could be positive for the gold, if it were be a perfect inflation hedge. But the gold trade is now about the Fed’s actions, therefore the rise in inflation may be negative for the price of gold, as it could convince the doves among the FOMC members to further hike in 2016.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview