Business activity in the Eurozone hit a 13-month low in February. What does it imply for the gold market?

Is Eurozone Recovery Over?

According to Markit, business activity in the Eurozone grew at the slowest rate since January 2015. The flash Markit Eurozone PMI fell from 53.6 in January to 52.7 in February. It was the second consecutive month of slowdown in the rate of output expansion. The weakness is more visible in manufacturing than in services – manufacturing output showed the smallest increase since December 2014. The slowdown was driven mainly by a contraction in France and very weak rise in German manufacturing output. To make matters worse, the outlook for growth in March is negative, as new orders declined for the third month in a row. The decline in German business sentiment on Tuesday intensified concerns about Europe’s economic engine. The Ifo business climate index fell from 107.3 last month to 105.7 in February, marking its third consecutive decrease. The slowdown in global demand has finally reached the Eurozone.

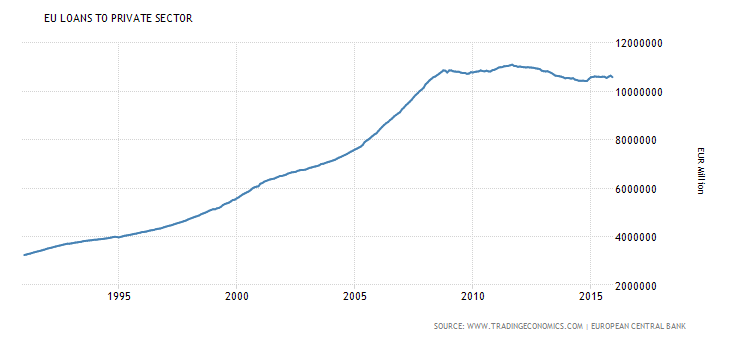

Moreover, deflationary pressures intensified. Average prices charged by companies for their goods and services declined at the steepest rate in a year. Average input costs fell marginally, but manufacturing prices plunged, dropping the most since July 2009. So much for the effectiveness of the ECB’s quantitative easing and Draghi’s actions fighting deflation. The recovery in the Eurozone is over. The Organization for Economic Cooperation and Development cut its forecasts for the euro region last week. The OECD cut its 2016 Eurozone GDP forecast by 0.4 percentage points from the last estimate in November, to 1.4 percent. Actually, it is debatable whether there was a genuine recovery at all. The GDP in the Eurozone has only just returned to its pre-crisis peak of early 2008. The biggest problem of the Eurozone is that European officials failed to clean up the banks and to restructure the banking system after the financial crisis of 2007-2008. Contrary, the relatively robust recovery in the U.S. is a result of a quick (although partial) restructuring of the American banking system. In consequence, the banking system in Europe is in awful condition with many non-performing loans on its balance sheets. Bad debts in zombie-banks partially explain the stagnant amount of loans to the private economy (see the chart below) and the recent declines (by more than 20 percent) in equity prices of banks in 2016.

Chart 1: Loan to private sector in the Eurozone from 1991 to 2016.

The End of Eurozone Recovery and Gold

The end of the Eurozone recovery should be negative for gold, as weak PMI data may prompt ECB to apply a more aggressive stimulus in March. In a speech to the European Parliament given last week, Mario Draghi said that the ECB will not hesitate to act if the recent financial and economic developments entail downward risks to price stability. Surely, the recent ECB’s actions did not help the Eurozone, therefore there is no reason to believe that more quantitative easing or deeper negative interest rates will help, but central bankers are desperate and hardly learn from mistakes. If the ECB unleashes further quantitative easing, the U.S. dollar will gain against euro. The greenback’s strengthening should exert some downward pressure on the price of gold. Moreover, the end of the recovery in the Eurozone would probably mean further divergence in economic growth in the U.S. and the Eurozone. That divergence could then translate into deeper divergence in major central banks’ monetary policies, which would depress the price of gold. On the other hand, the ECB could also introduce deeper negative interest rates. Gold was recently main beneficiary of worries about NIRP, therefore such a move could boost some safe-haven demand for the shiny metal.

Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview