Gold is trading at high levels versus many other assets. What does it mean for the gold market?

Platinum to Gold Ratio

There is an old joke about two economists who meet on the street. One asks, “How’s your wife doing?” The other responds, “Relative to what?” The same is with gold. The gold may seem to be cheap or expensive, depending on what we compare it with. When we express the price of gold in U.S. dollars and compare it with the last boom, it looks relatively cheap (but it does not mean that it cannot fall). However, relative to other commodities, gold seems to be expensive.

For example, in February platinum traded at the biggest discount to gold in nearly two years. Historically, platinum costs about 30 percent more than gold, but now it is traded at about 24 percent less than gold. Does it mean that the gold is overvalued? Not necessarily. We might as well say that gold is priced correctly, but the price of platinum is simply too low. Generally speaking, investors have to be always very careful when comparing gold to other assets. Gold is primarily a financial asset, while platinum, although also being a precious metal, is mainly an industrial commodity. Therefore, comparing a financial asset to an industrial commodity is like comparing apples to oranges. Various factors affect both metals, so there is nothing surprising that the relative ratio is changing. Investors should not take the historical relationship as sacred. Gold may look expensive relative to platinum, but its safe-haven properties are much greater than platinum’s. Therefore, the global slowdown lowers the industrial demand for platinum, but increases the safe-haven demand for gold. Thus, the low platinum to gold ratio may simply reflect concerns about the Eurozone. Another European turmoil could hurt demand from the European car sector (which accounts for about 20 percent of annual platinum consumption), but would make gold more attractive as a safe-haven.

Gold to Oil Ratio

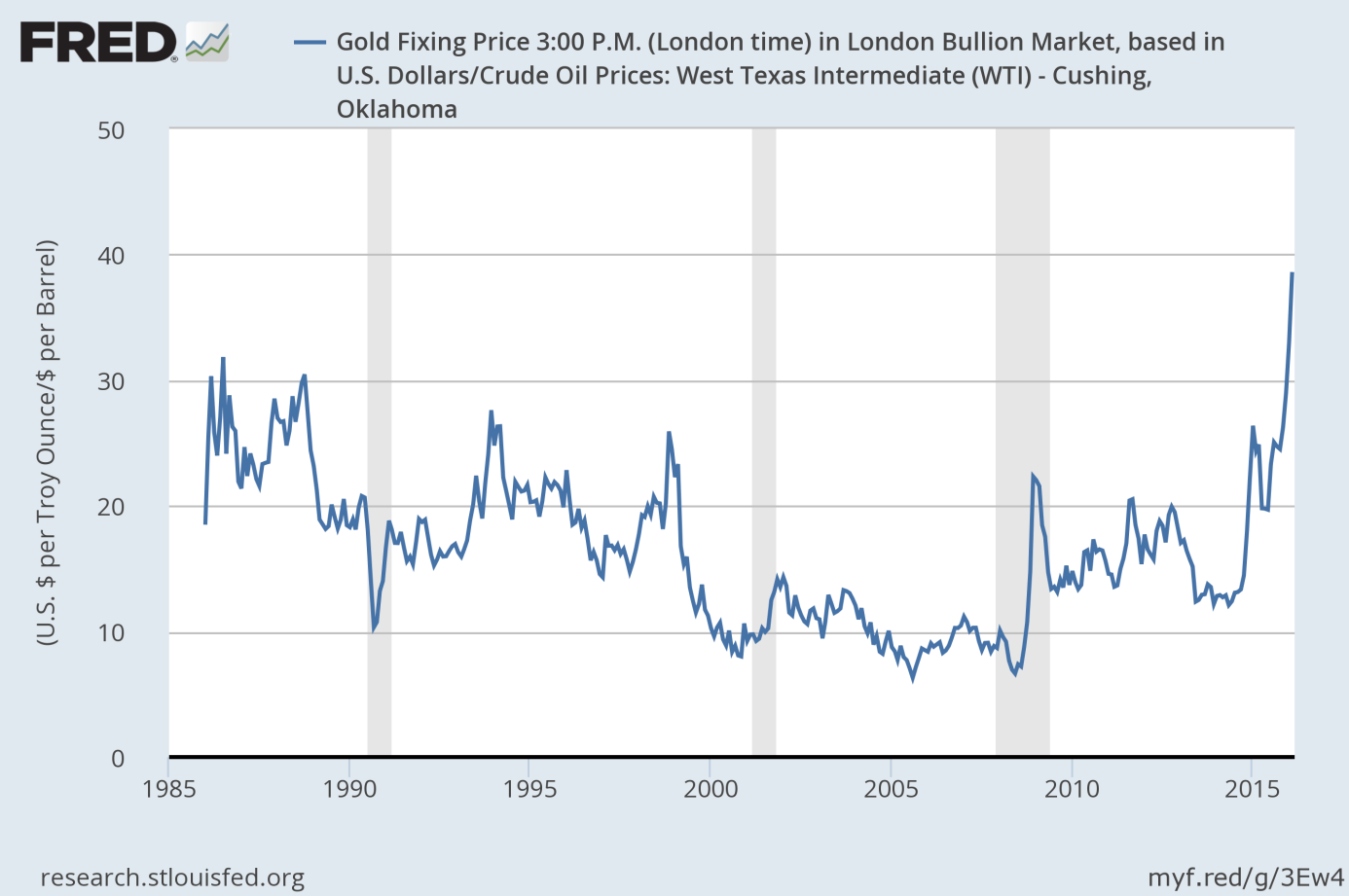

Similarly, the number of barrels of oil that an ounce of gold can buy has never been higher. The chart below shows that the ratio of gold to oil hit a multi-year high in February.

Chart 1: The ratio of gold to oil from 1985 to February 22, 2016.

What does it mean? Well, we can say that the price of gold is too expensive, but we might as well say that oil is simply too cheap. However, the ratio may also reflect the new conditions (oversupply) in the oil market and the change in the investors’ risk appetite. Oil prices have plummeted far enough to change the investors’ risk perception. As the decline in the price of oil signals a global slowdown and may spread contagion to U.S. junk bonds, banks or equity markets, investors have turned to gold – an ultimate safe-haven asset. Actually, the ratio of gold to oil prices usually spikes during financial crises, like the Latin American debt crisis in the 1980s, Asian and Russian crises in 1997-1998, the outbreak of the Great Recession in 2008, or the European debt crisis in 2011. This clearly shows that gold is not merely a commodity, but also a monetary asset, which reacts to different factors than oil.

Conclusions

To sum up, gold hit high levels compared with other commodities, such as platinum or oil. Logically, it either implies that the price of gold is overvalued, or that the prices of industrial commodities are too cheap (or that the current global slowdown affected distinct assets differently). We do not rule out that the price of gold may decline in the short term. However, for us, the recent rise in the yellow metal reflects a justified (at the moment) worry about the weakness of the global economy and the central banks’ inability to counteract it. Usually, the rise of the gold to oil ratio signals some economic turbulences. What awaits us this time?

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview