The U.S. economy added 211,000 jobs in April. What does it mean for the gold market?

Job Gains Strong in April

Total nonfarm payroll employment increased 211,000 in April, following a disappointing increase of 79,000 in March, according to the U.S. Bureau of Labor Statistics. Analysts had expected 185,000 jobs created. Thus, the actual number was above expectations. However, employment gains in February and March combined were 6,000 lower than previously reported. It means that job gains in the last three months have averaged 174,000, similarly to the level seen in the previous month. The job gains were broad-based, with the biggest increases in leisure and hospitality (+55,000), in education and health services (+41,000), and in professional and business services (+39,000). Information cut 7,000 jobs, while employment in utilities was practically unchanged.

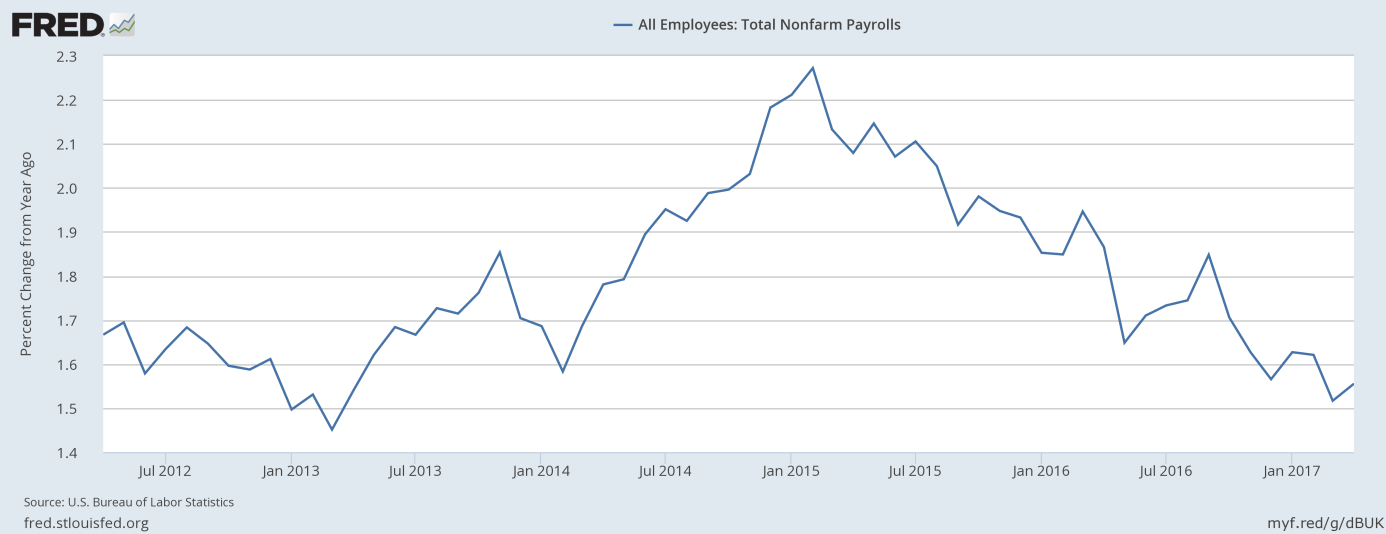

Hence, job gains were strong in April after a weak March, but the annual job growth rate remains in a downward trend, as the chart below shows. Anyway, the recent job gains may strengthen the hawkish camp at the U.S. central bank and give the Fed reason to stay on track to raise interest rates this year.

Chart 1: Total nonfarm payrolls (percent change from year ago) over the last five years.

Other Labor Market Indicators

Other labor market indicators were also positive, on balance. The unemployment rate dropped from 4.5 percent to 4.4 percent, marking a new post-recession low. The labor force participation rate declined from 63 to 62.9, while the employment-population rate increased from 60 to 60.2 percent. However, it is up by 0.5 percentage point since December 2016. The average wage in the private sector increased 7 cents to $26.14. It means that the hourly pay jumped 2.5 percent over the year. That increase is not very impressive, but a gradual wage increase and declining unemployment rate are likely to be welcomed by the Fed.

Payrolls, Fed and Gold

We believe that the April report is bearish for gold. It shows that the hiring rebounded, which revives hopes that the second quarter will be better than the first one. The employment report is the long-awaited piece of positive ‘hard data’. The strong job gains also keep the U.S. central bank on course to lift interest rates later this year. Indeed, the market odds of a June hike increased from 75 percent to 83.1 percent after the publication of the report. There is still one more employment report before the June meeting – unless hiring collapses in May, we should see a hawkish move next month.

The price of gold declined initially after the publication of the report. However, as one can see in the chart below, the reaction was limited. One of the reasons behind the market’s muted reaction could be the sluggish wage growth, despite a tight labor market, which suggests that a breakout in inflation is unlikely.

Chart 2: New York price of gold on Friday, May 5, 2017.

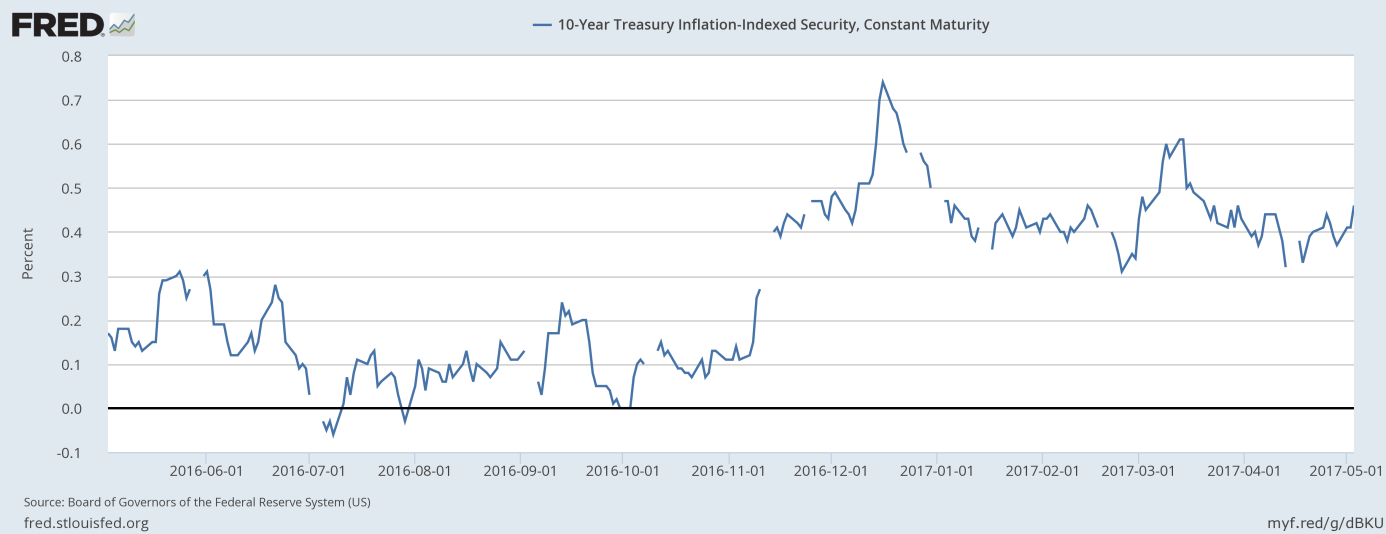

Another explanation could be the impact of the French presidential election held yesterday – investors awaited the outcome and did not sell gold, despite strong job gains. Indeed, the U.S. dollar weakened significantly against the euro on Friday, ahead of the second round of France's presidential election. However, investors should be aware of the “sell the rumor, buy the fact strategy”. The greenback may rebound after the election, which should be negative for the yellow metal. What is important is that the event risk from the French election is finally over, so macroeconomic factors should now exert a stronger influence on gold prices. And they do not look encouraging. Real interest rates have been rising recently as the chart below shows. Stay tuned!

Chart 3: U.S. real interest rates over the last year.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview