On Friday, two important U.S. economic reports were released. What do they imply for the gold market?

Retail Sales Rise, but Slower Than Expected

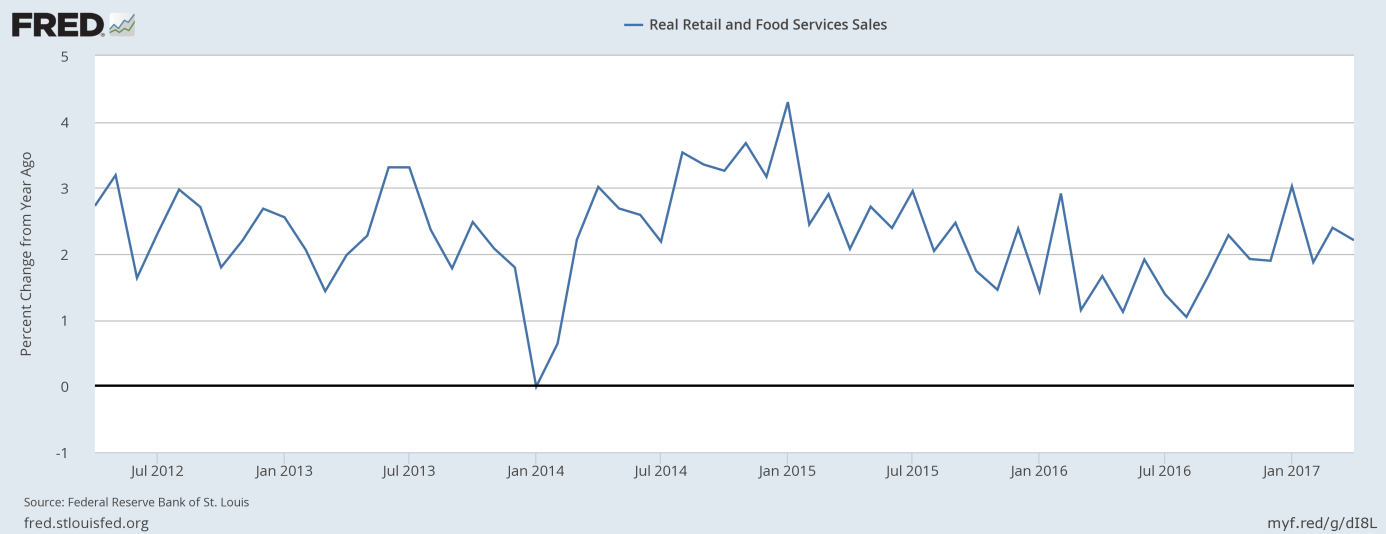

Retail sales jumped 0.4 percent in April, following a 0.1 percent rise in March (after an upward revision from a 0.2 percent drop). It means a rebound which could revive hopes for higher economic growth in the second quarter of 2017. However, retail sales fell short of expectations of 0.6 percent growth. The Atlanta Fed’s GDPNow model forecasts of real GDP growth in the first quarter of 2017 remained unchanged at 3.6 percent after the publication of the retail sales report. Importantly, excluding both vehicles and gasoline, retail sales rose only 0.3 percent, also below expectations. As one can see in the chart below, the annual growth rate in real retail sales declined slightly, but remained in a sideways trend. The weakness was partially caused by the 5.2 percent decline in sales at department stores, as consumers shifted to online retail sales.

Chart 1: Real retail sales year-over-year from April 2012 to April 2017.

Inflation Rebounds from March, but Slows Downs Y-o-Y

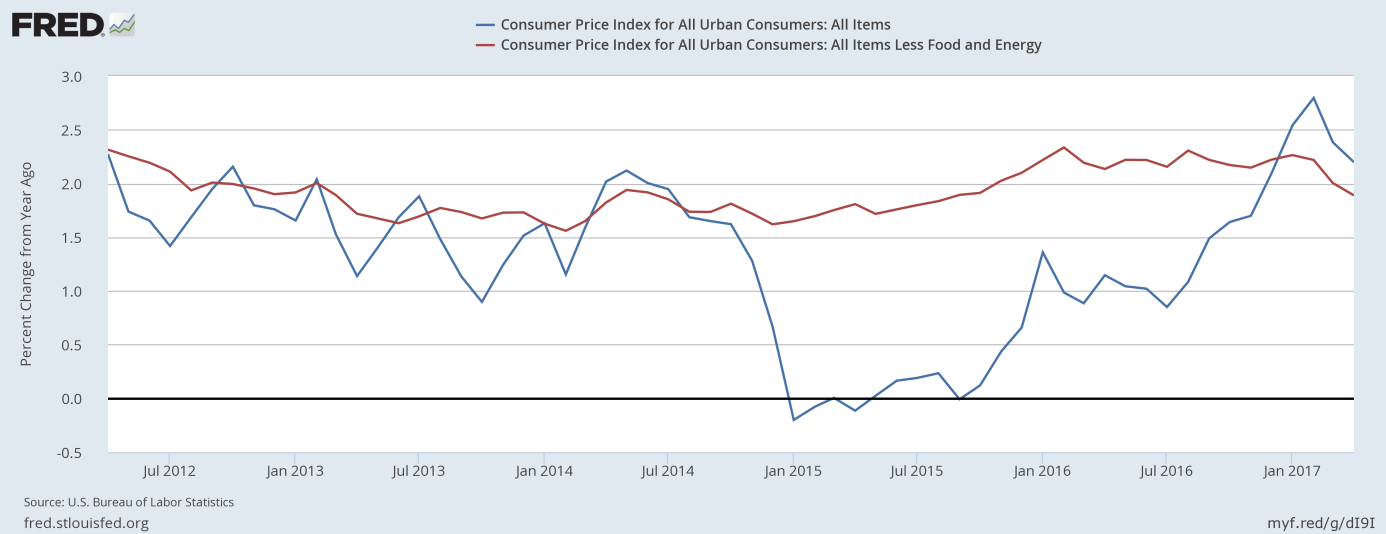

Second, consumer prices increased 0.2 percent in April, in line with expectations. The rise followed a 0.3 percent decline in March. The core CPI, which excludes the volatile energy and food categories, rose 0.1 percent. On an annual basis, the overall CPI slowed to 2.2 percent, while the core CPI jumped only 1.9 percent over the last 12 months. As one can see in the chart below, inflationary pressures softened further in April.

Chart 2: CPI (blue line) and core CPI (red line) year-over-year from April 2012 to April 2017.

The weak inflation report – despite the monthly rebound – should undermine the optimistic narrative about Trumponomics and reflation (we wrote about it on Friday) and could strengthen the dovish camp at the Fed. However, the data is not weak enough to push the U.S. central bank from the track to raise interest rates this year. Nevertheless, the market odds of a June hike decreased from 83.1 percent to 73.8 percent after the release of Friday’s economic reports.

Retail Sales, Inflation, and Gold

The price of gold saw a modest rise on Friday after the publication of reports about retail sales and inflation. The soft data triggered some doubts whether the Fed would raise interest rates in June. In consequence, the yellow metal gained about 4 dollars, rising from about $1,228 to almost $1,232 on Friday’s morning, as the chart below shows.

Chart 3: Gold prices over the last three days.

Conclusions

The bottom line is that the Friday’s U.S. economic reports were disappointing. Retail sales rebounded, but were weaker than expected. Consumer prices rose on a monthly basis, but inflationary pressured softened on an annual basis. The weakness in the data hurt the U.S. dollar and the hawkish expectations for the actions of the U.S. central bank. Hence, the price of gold rose initially.

However, there is still a lot of time before the June FOMC meeting. We believe that these reports – although weaker-than-expected – do not radically change the outlook for the Fed’s actions and the gold market. Actually, lower inflation raises real interest rates, which is bad for the yellow metal. Hence, gold is likely to remain under downward pressure due to a looming June hike, especially with the biggest geopolitical concerns behind us (however, the price of gold rose a bit today in the Asian market due to North Korea’s latest missile launch and a global computer ransomware attack). But if history is any guide, the yellow metal would experience a relief rally in the aftermath of the actual Fed hike. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview