The price of gold has been rising recently despite some positive headlines on the U.S. economy. What does it mean for the gold market?

Upward GDP Revision

Real GDP growth for the fourth quarter was revised upward from 0.7 to 1.0 percent on an annual basis in the second reading. It implies an important slowdown, because real GDP increased 2.0 percent annually in the third quarter. Markets had expected a downward revision to 0.4 percent. Therefore, the second estimate should be bearish for the gold market. However, the devil is in the details. Actually, the upward revision reflects mainly an unwanted build-up of inventories (while personal consumption declined from 2.2 to 2.0 percent). It means that companies got stuck with more unsold goods than they had expected. Instead of substantial and needed inventory liquidation we witnessed only a modest inventory decline. It implies that inventory liquidation will be postponed and will subtract from GDP growth in the first quarter of 2016. Indeed, the Atlanta Fed GDPNow Estimate for the first quarter of 2016 declined 0.4 percentage points to 2.1 percent after the publication of the second estimate of Q4 2015 GDP data. Welcome to the magical world of national accounts where an upward revision is negative news. Since the outlook for GDP growth in the first quarter of 2016 is much more important than the revision of past numbers, it should now be clear why the price of gold did not decline after the upward GDP revision.

Personal Income, Consumer Spending and PCE Inflation

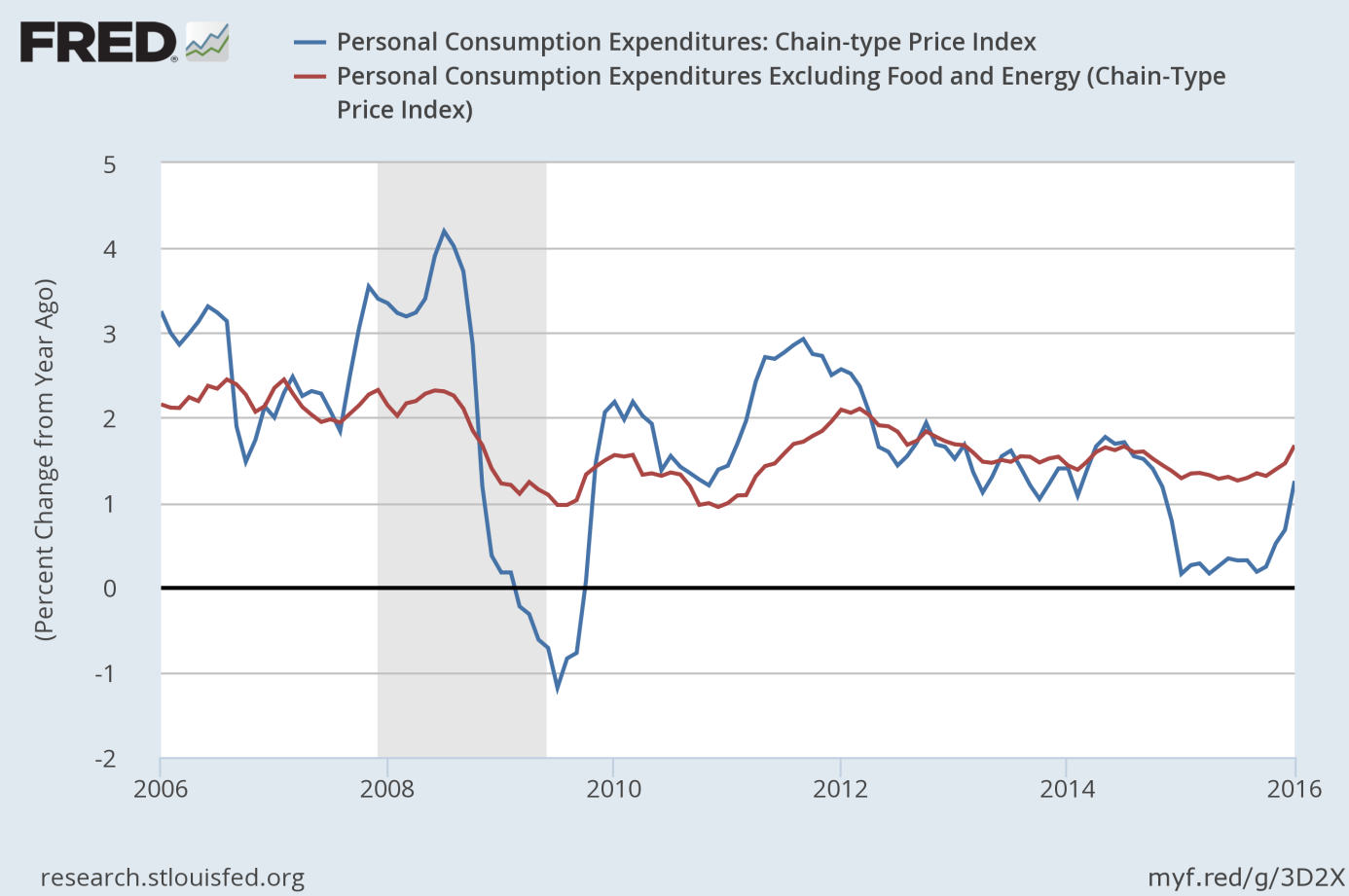

Personal consumption expenditures and income both rose 0.5 percent in January, more than in the previous month and more than expected. The PCE Price Index increased 0.1 percent in January on a monthly basis (in contrast to a decrease of 0.1 percent in December), while core inflation rose 0.3 percent (compared with an increase of 0.1 percent in December). On an annual basis, the overall inflation rate jumped 1.3 percent, while the core PCE Price Index increased 1.7 percent, the biggest year-over-year since the end of 2012. As the chart below shows, both indices have been rising since October 2015.

Chart 1: PCE Price Index (blue line) and core PCE Price Index (red line) as percent change from year ago from January 2006 to January 2016.

We believe that it is too early to draw serious conclusions about the inflation outlook. Markets still do not believe that inflation will rise significantly or sufficiently to change the Fed’s stance, however, everything may change if February data confirms the upward trend. If inflation accelerates next month, the Fed would be free to raise interest rates in March (if it really wants to do it, of course). The second hike should be negative for the yellow metal, since it could restore some confidence in the Fed and the U.S. economy and diminish the safe-haven demand for gold.

Conclusions

Last week, we saw some positive U.S. economic news headlines. GDP growth in Q4 2015 was revised upwardly, but only because the weakness will be carried over to 2016. Personal expenditures and income rose in January, as well as PCE inflation. However, gold shrugged these headlines off. The reason may be that there remains a heightened risk of an economic downturn, reflected by a slowdown in business investment or weakening PMI data. It seems that there is an emerging belief among investors that even the U.S. economy is no longer bullet-proof, especially when we take into account the most controversial presidential election campaign in years.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview