U.S. consumer spending jumped 0.1 percent in May. What does it mean for the gold market?

Consumers Barely Increase Spending

Personal consumption expenditures increased 0.1 percent in May, following a 0.4 percent rise in April. The rise is soft, but in line with expectations. To some extent, the weak number reflected low energy prices, not low demand – however, spending on durables dropped 0.3 percent.

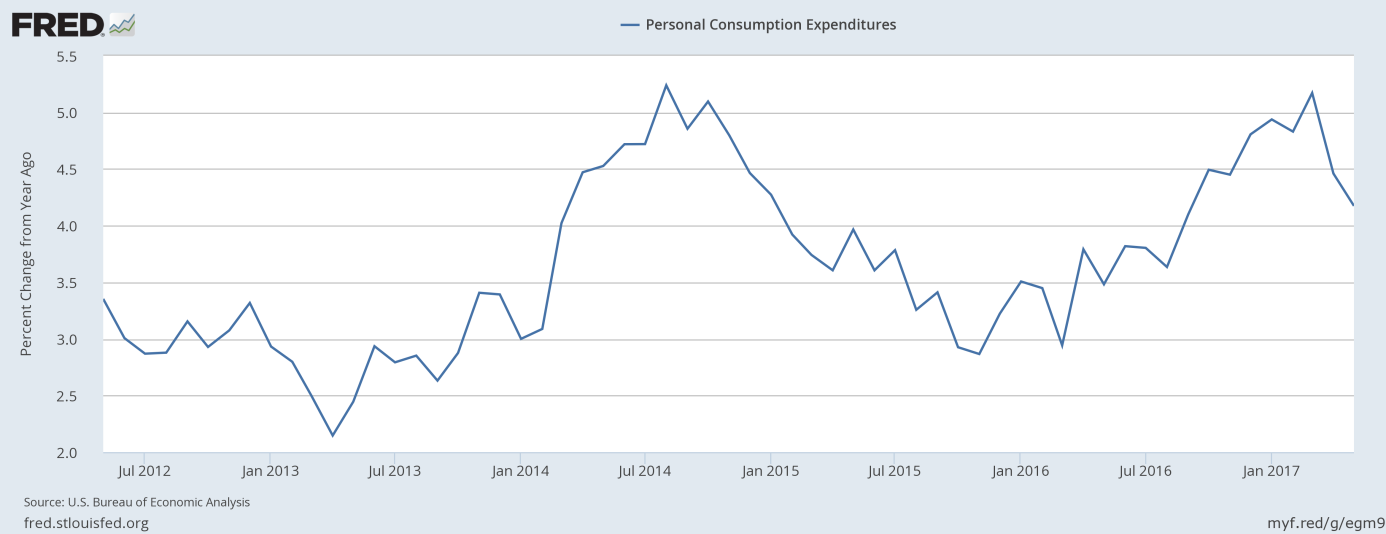

On an annual basis, consumer spending rose 4.2 percent, which means that the pace of personal consumption expenditures growth decreased further, continuing its downward trend since March 2017, as one can see in the chart below.

Chart 1: Personal consumption expenditures from 2012 to 2017 (as percent change from year ago).

As a reminder, consumer spending was disappointing in the first quarter, so everyone is looking for a rebound in Q2. Soft personal outlays in May put this in question, however, the GDPNow model still forecasts 2.7 percent real GDP growth in the second quarter of 2017.

Personal Incomes Rise

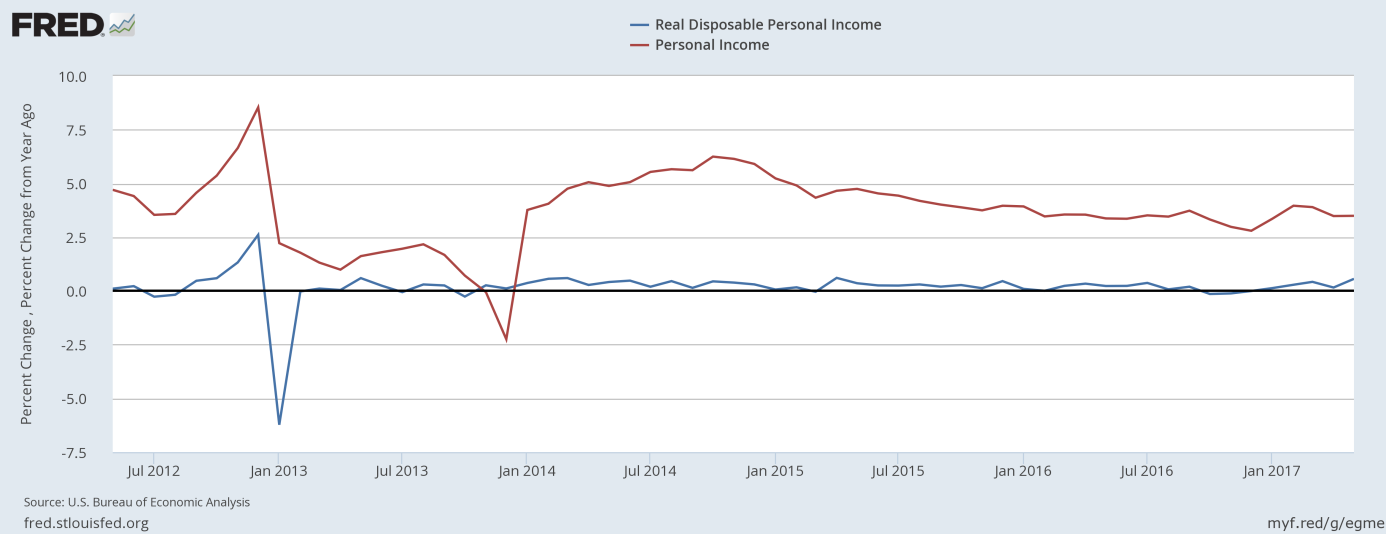

The income side of the report was definitely better, as personal income jumped 0.4 percent in May, following a 0.3 percent increase in the previous month. The rise in income was slightly above the expectations. However, the wages and salaries component barely changed (it rose just 0.1 percent), which should strengthen the dovish camp at the Fed, if doves are still there. On an annual basis, nominal personal incomes remain solid, while real disposable incomes accelerated, as the chart below shows.

Chart 2: Nominal personal income (red line) and real disposable personal income (blue line) over the last 5 years (as percent change from year ago).

Inflation Softens Further

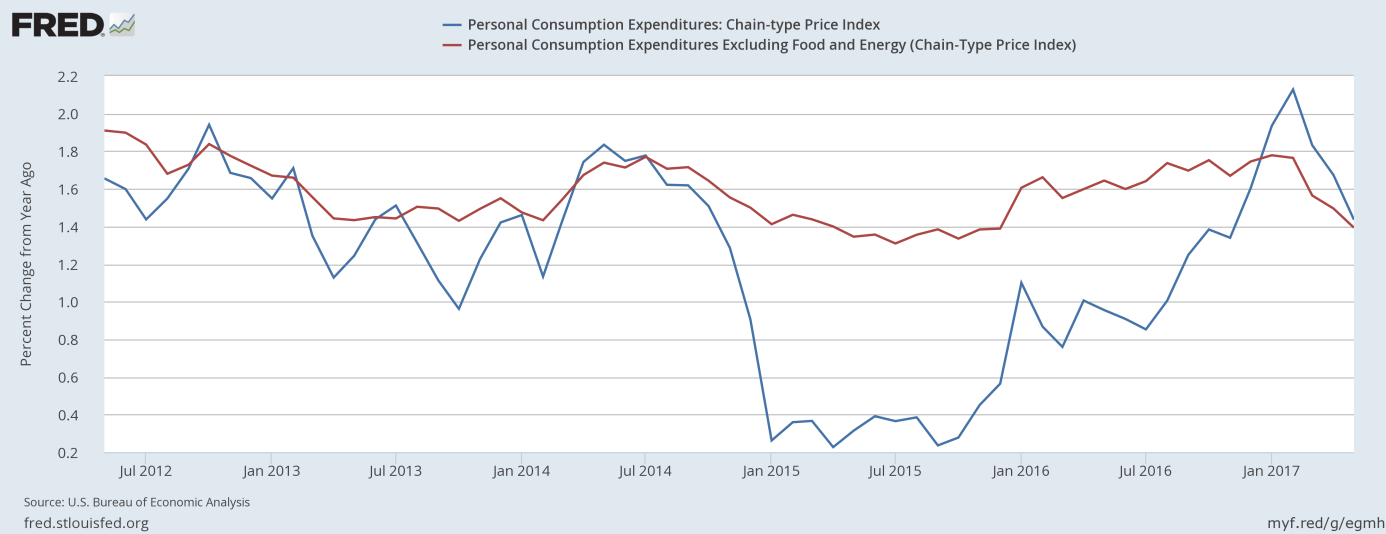

The PCE price index declined 0.1 percent, while its core version increased 0.1 percent in May, after a 0.2-percent and 0.1-percent rise in the previous month, respectively. On an annual basis, both indices jumped 1.4 percent. It means that inflation retreated even further from its five-year peak hit in February, as one can see in the chart below.

Chart 3: PCE Price Index (blue line) and Core PCE Price Index (red line) from 2012 to 2017 (as percent change from year ago).

The slowdown in inflation is actually not a bad thing for households, as it boosted real disposable income by 0.6 percent in May, the biggest gain since the end of 2012. However, the weakened inflationary pressure could theoretically ease some pressure on the FOMC members to tighten monetary policy. We wrote “theoretically”, because the Fed has evidently stopped to be data dependent since the U.S. presidential election. Hence, the U.S. central bank is still likely to increase interest rates once more and start unwinding its balance sheet this year.

Conclusions

The take-home message is that the May personal income and outlays were not impressive, as American consumers barely increased spending, while inflation weakened further. However, the income side was solid. And since the numbers were generally in line with expectations, so they should not affect the gold market significantly.

It seems that the price of gold is more dependent now on the rising expectations of global monetary policy tightening after hawkish comments from the ECB and other central banks last week. Although a weak U.S. dollar (due to the bets that the Fed is likely to stop being the only hawk in town in the near future) should support gold prices, the shift in central bank monetary policy expectations could be a headwind for the precious metals market. Indeed, signals from major central banks that the era of easy money may be coming to a close pushed real interest rates higher, which sent the price of gold south. In June, the yellow metal suffered its first monthly loss this year. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview