The U.S. economy added 261,000 jobs in October. What does it mean for the gold market?

Rebound after Weak September

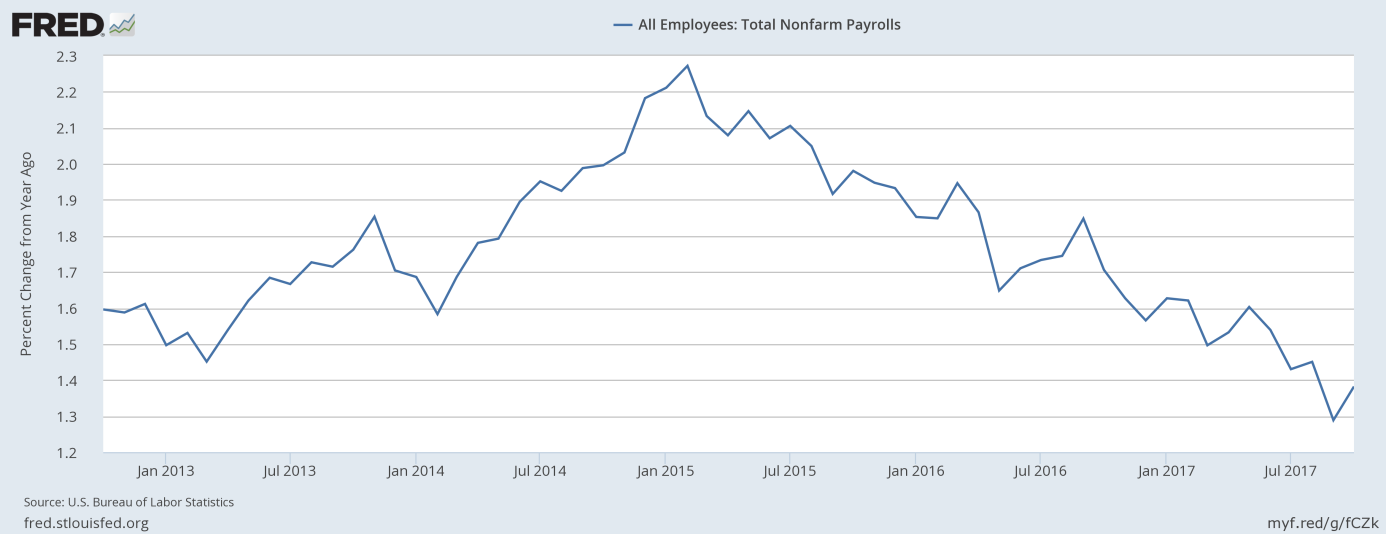

Total nonfarm payroll employment increased 261,000 in October. The rise followed an increase of 18,000 in September (after an upward revision), according to the U.S. Bureau of Labor Statistics. The rebound is positive news for the U.S. labor market. Moreover, employment gains in August and September combined were 90,000 higher than previously reported. It means that job gains in the last three months have averaged 162,000. Employment gains were widespread again, but employment in food services and drinking places increased sharply (+89,000), mostly offsetting a decline in September that largely reflected the impact of Hurricanes Irma and Harvey. However, analysts had expected 325,000 jobs to be created. Thus, the actual number significantly disappointed expectations. And the annual job growth rate remains in a downward trend, as the chart below shows.

Chart 1: Total nonfarm payrolls (change, thousands of persons) over the last five years.

Other Labor Market Indicators

Other labor market indicators were mixed. The labor force participation rate decreased from 63.1 to 62.9 percent, while the employment-population rate rose from 60.4 to 60.2 percent. Moreover, the average hourly earnings for all employees on private nonfarm payrolls declined by 1 cent. It means that wage inflation is still absent in the U.S.

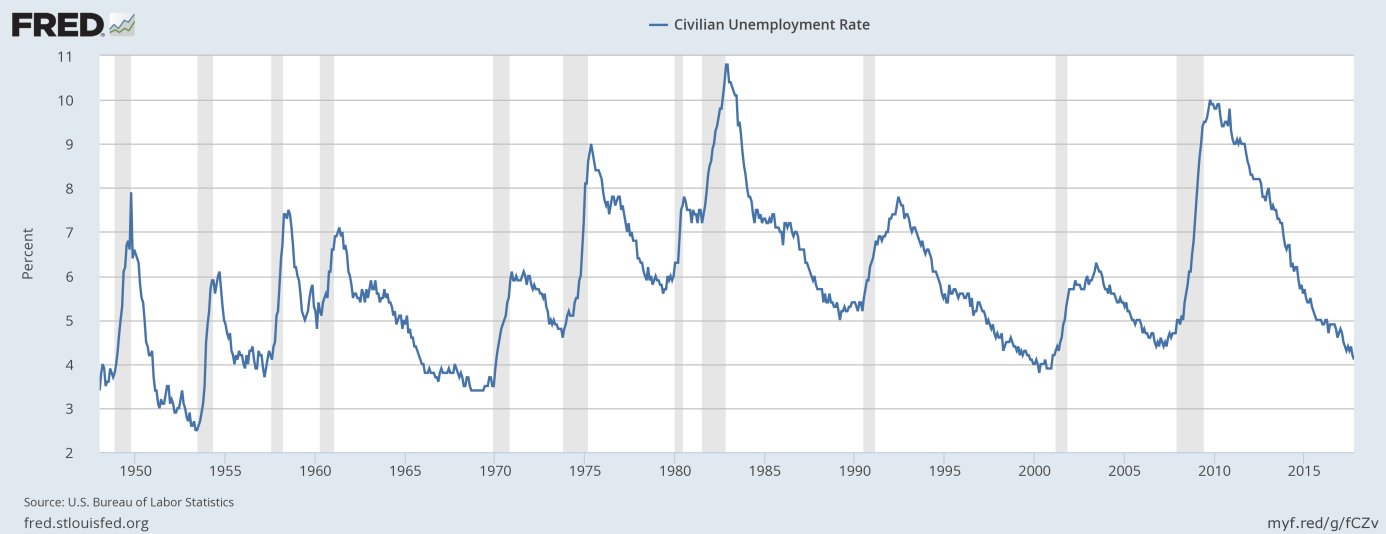

On the other hand, the unemployment rate fell further from 4.2 percent to 4.1 percent, hitting another multi-year low, as the chart below shows. The drop in the unemployment rate confirms the view that the U.S. labor market remains tight.

Chart 2: Unemployment rate over the last 10 years.

Payrolls, Fed and Gold

The U.S. nonfarm payrolls rebounded in October, but the number was a negative surprise for the markets. After the initial rise, the price of gold declined on Friday, as one can see in the chart below.

Chart 3: Gold prices from October 4 to October 6.

It appears that after traders digested the report, they decided that it was not so negative after all, despite falling short of expectations. The upward revisions to August and September could help to create positive sentiment. Moreover, the publication confirms expectations of a rate hike in December, as the report should not push the Fed off the track to normalize its monetary policy. Actually, after the report was released, JP Morgan Chase & Co raised its forecast for the number of Fed hikes next year from three to four as the October data reinforced the view of a tightening labor market.

Hence, such expectations made the U.S. dollar rally. Meanwhile, the price of the yellow metal declined. It seems that gold will stay under downward pressure in the near future due to hawkish expectations about the Fed’s monetary policy. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview