On Wednesday, President Trump revealed his tax reform plan. What does it mean for the gold market?

Yesterday, Trump revealed a new version of his “once in a generation” tax reform proposal, entitled “United Framework for Fixing Our Broken Tax Code”. He also gave a speech in Indiana about the tax reform, saying that it is a “once in generation” opportunity, which would cut taxes for the middle class and make the tax code simpler and more fair for everyday Americans:

This is a revolutionary change, and the biggest winners will be the everyday American workers as jobs start pouring into our country, as companies start competing for American labor, and as wages start going up at levels that you haven't seen in many years. (…) The framework I’ve just described represents a once-in-a-generation opportunity to reduce taxes, rebuild our economy, and restore America's competitive edge. Finally.

The proposal calls for lower personal and corporate tax rates. The framework shrinks the current seven tax brackets of personal tax into three – 12%, 25% and 35% - and doubles the standard deduction. Moreover, it imposes a one-time, low tax rate on repatriated assets from overseas. When it comes to the corporate taxes, it reduces the rate to 20 percent, which is important change, since it is the first time Trump has publicly withdrawn from campaign promise of a 15-percent corporate tax rate.

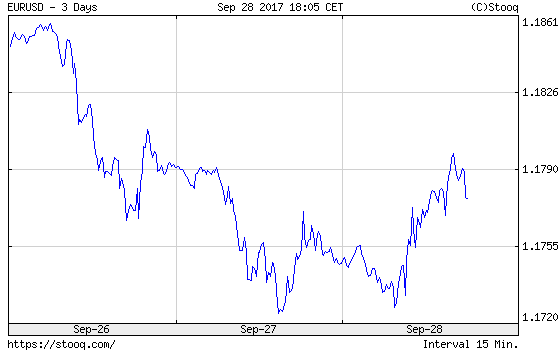

However, despite that change, the tax cuts do not pay for themselves and there are no details how these tax cuts are supposed to be paid for. Therefore, if implemented, they would grow the debt. Hence, the long-term impact of tax reform on the gold market may be actually positive, as it could raise worries about the public debt trajectory. Financial markets reacted enthusiastically to the proposal. As one can see in the chart below, the U.S. dollar appreciated against the euro, while the price of gold declined.

Chart 1: EUR/USD exchange rate from September 26 to September 28, 2017.

Chart 2: Gold prices from September 26 to September 28, 2017

However, we believe that the enthusiasm will be temporary and when investors will digest the plan they could feel disappointment. The plan still lacks details and tax cuts do not pay for themselves. And it would be difficult to pass it, as Democrats already opposed the proposal due to concerns about deficit and inequality.

Summing up, president Trump announced another version of his tax reform. It is definitely an improvement, but it is still raw and fiscally unsound. It could boost equity prices, but there will be definitely a struggle to pass it in Congress. The U.S. dollar strengthened yesterday, but we do not expect a sustained rally on tax reform – investors already lost their faith in quick implementation of Trump’s economic agenda, which is positive for the gold market.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview