The Fed now sees faster GDP growth, higher inflation, and no interest rate hikes until 2023. This new outlook is fundamentally positive for the gold market.

On Wednesday (Mar. 17), the FOMC published its newest statement on monetary policy. A statement that was little changed. The main modification being that the U.S. central bank has noticed that indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak. The Fed also pointed out that inflation continues to run below two percent. So, the statement itself is mixed, as the emphasis on the improvement in economic indicators is rather hawkish, while explicitly mentioning the fact that inflation remains below the Fed’s target is rather dovish.

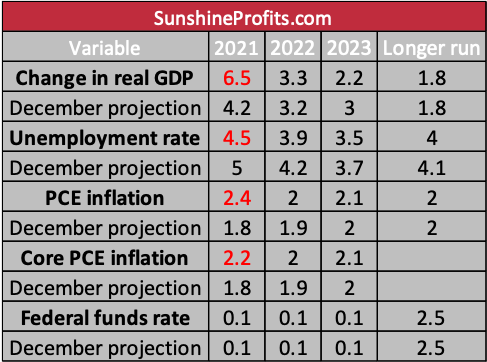

Importantly, the FOMC also issued yesterday its fresh economic projections. They can have quite the impact on the precious metals market, as the Fed forecasts a lower unemployment rate, higher GDP growth and higher inflation, as the table below shows.

The biggest updates in economic projections pertain to this year. In particular, the FOMC expects that the GDP will soar 6.5 percent in 2021, compared to a 4.2 percent rise expected in December. That’s a huge change! Meanwhile, the unemployment rate is forecasted to decrease to 4.5 percent instead of the 5 percent expected in the previous projections. So, it seems that the FOMC has incorporated the latest U.S. fiscal stimulus into its dot plot, assuming that Biden’s fiscal program will significantly boost the GDP growth, while reducing the unemployment rate. I remain skeptical whether we will see such a reduction in the unemployment rate, given the generous government support, which could potentially decrease the motivation to work, but time will tell.

What is really interesting of note is that the Fed has also updated its inflation outlook. The FOMC members now believe that the PCE inflation will jump to 2.4 percent this year, compared to just 1.8 percent seen in December. Importantly, U.S. central bankers expect that the core PCE inflation will also rise faster, although slower than the overall index, reaching 2.2 percent in 2021, versus the 1.8 percent projected previously.

Implications for Gold

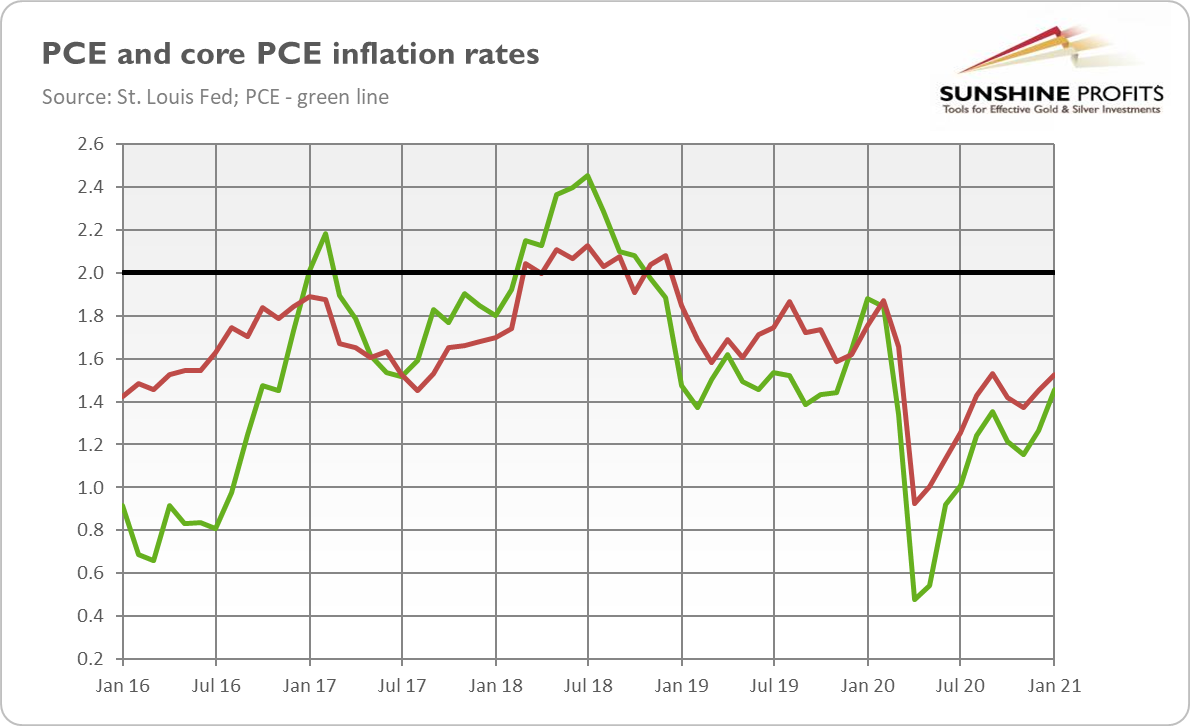

What does this all mean for gold prices? Well, the updated economic projections are good news for the yellow metal, at least from the fundamental point of view. This is because the Fed officials have officially acknowledged that inflation will jump this year. And not just “jump” – it will soar above the Fed’s two-percent target! Whoa, if this happened, it would be the first time since late 2018, as the chart below shows!

The U.S. central bank has also admitted that Biden’s plan – which clearly has the biggest impact on the updates in economic projections – will not only stimulate some growth, but it will also entail some inflation. This implies that the Fed expects households and companies will not save all the additional money they will get, but will rather start to spend, lifting both the GDP and consumer prices.

And what is of particular importance is that despite all these upward revisions in the expected pace of economic growth and inflation, the FOMC members haven’t changed the projected path of the federal funds rate. It means that the Fed is not going to react to the jump in inflation and tighten its monetary policy. So, the U.S. central bank will stay behind the curve, allowing for further reductions in the real interest rates. It goes without saying that higher inflation and lower real interest rates would be positive factors for gold prices.

However, although the price of gold soared on Wednesday (Mar. 17) above $1,750, it erased much of these gains yesterday (Mar. 18) and continues to suffer today. Why? Well, what is crucial is not merely the Fed’s signals, but whether investors trust them. And it seems that the markets doubt whether the U.S. central banks will not hike interest rates until 2023, especially considering that the rise in inflation is expected by many to be only temporary and that the number of hawkish FOMC members who see the hikes next year as appropriate has increased from one to four.

So, these fears of sooner-than-expected rate hikes, or the next taper tantrum, together with the still present risk of further rises in the bond yields, may still exert some downward pressure on the gold prices. But from the fundamental point of view, the recent FOMC projections, and Powell’s press conference (which I will cover next week), have been generally more dovish than expected and, thus, positive for the gold. Time will tell whether this event will be sufficient to alter the current bearish trend.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.