The orders for durable U.S. goods rose by 4 percent in March, however the core orders dropped by 0.5 percent. What does it mean for the U.S. economy and the gold market?

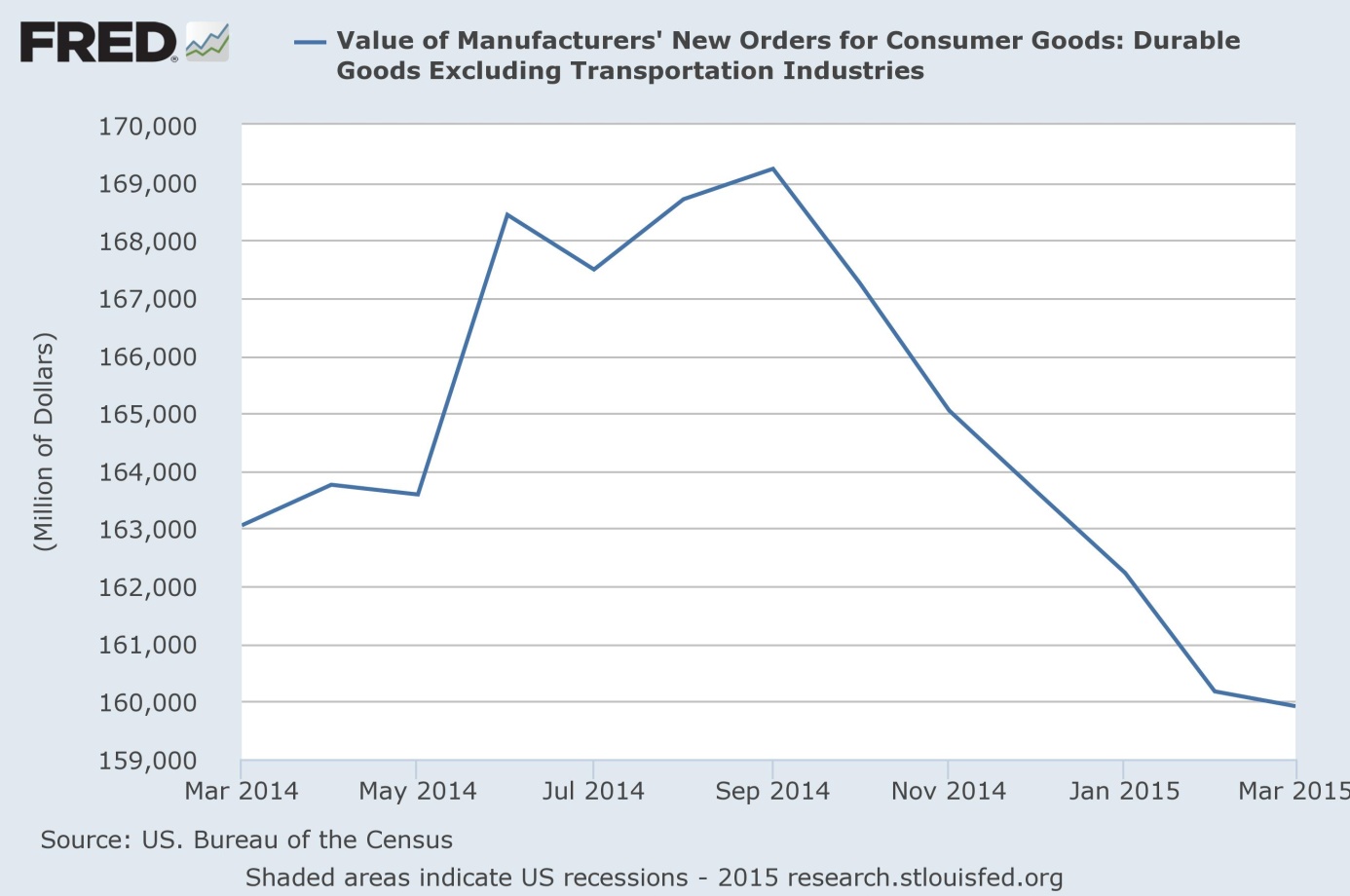

The rise in durable goods orders came surprisingly since the Bloomberg Consensus was for a 0.5 percent increase. Although the headline number looks very healthy, the reality behind it is much gloomier. Why? The so-called core orders, which exclude aircrafts and defense goods, unexpectedly fell by 0.5 percent, the sixth monthly decline in a row, while the durable goods excluding transportations, which is the Fed’s main concern, dropped by 0.2 percent (see the chart below).

Figure 1: The value of new orders for durable goods excluding transportation from 2014 to 2015

Economists were projecting a 0.3 percent gain, as economy should have rebounded after the harsh winter. That was the expectation; however it is not weather that caused this downward trend, but appreciation of the U.S. dollar and the rollover in capex in the oil sector (however, the major cutbacks in the energy sector have yet to show up). In consequence, the increase in the headline number was driven almost entirely by volatile transportation (civilian aircrafts order surged 31 percent, while defense aircrafts surged 113 percent) and higher demand for autos, commercial jets and military hardware.

Moreover, February’s reading (orders for durable goods excluding transportation) has been revising significantly lower to -1.3 percent instead of 0.4 percent. The data is very pessimistic, since the last time core orders were declining for six months in a row was a 2008 year, and when core order declined for five consecutive months in 2012, the Fed launched the third round of quantitative easing.

Summing up, the March report on U.S. durable goods orders are another pessimistic data on the U.S. economy, which signals the economic slowdown (the data on durable goods is a leading indicator). This is good news for the gold market, as it may postpone the Fed’s decision about the interest rates hike. Indeed, the gold prices rose to the highest levels of the session on Wednesday, after the March report was published.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview