Yesterday we wrote that although U.S. existing home sales rose in March, the real-estate market was far from full recovery after the last bubble burst. Indeed, on the same day negative data on new home sales was published. What does it mean for the economy and the gold market?

Sales of new single-family homes tumbled 11.4 percent to an annual rate of 481,000 in March, according to government data released on Thursday. It is the biggest drop since July 2013, when sales pulled back from a seven-year high reached in the prior month. An economists survey by Bloomberg forecast a level of 518,000, thus the report on new home sales in March is a next piece of data below expectations. Indeed, the Bloomberg's U.S. Economic Surprise Index, which measures data relative to the economists’ projections, has fallen to -0.783, a level seen only during the Great Recession.

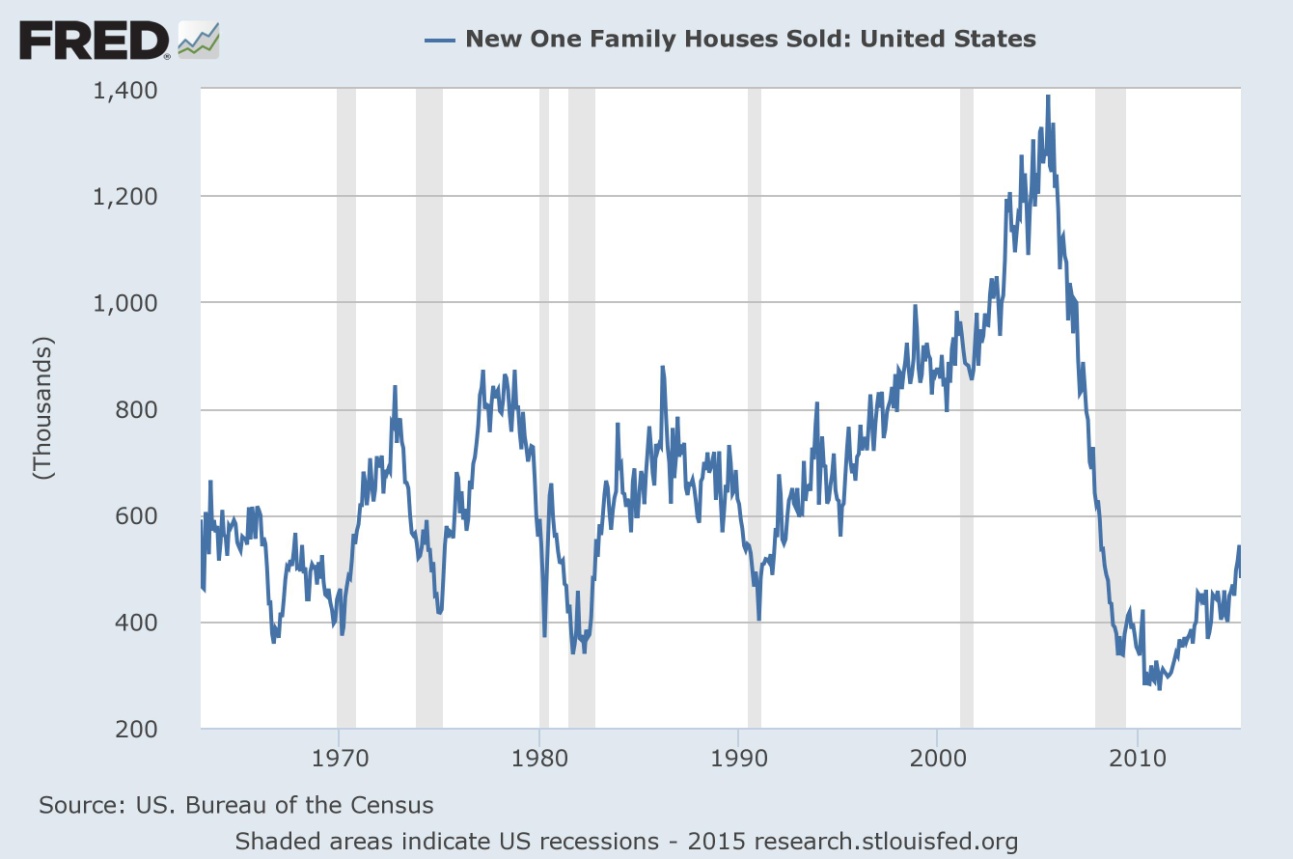

On an annual basis, new home sales actually increased over 19 percent, however sales still remain almost 40 percent below the long-term trend (see the chart below).

Figure 1: U.S. new home sales from January 1963 to March 2015

We have to note that sales of new homes represent only about 10 percent of the housing market and data in the monthly Commerce report are based on small samples with a margin of error around 15 percent. This is why numbers are revised frequently, and the measure is less reliable than existing home sales.

As we pointed out yesterday, the rise in existing home sales in March does not mean that the U.S. real estate market is very healthy. This is because the headline number for March is misleading when it is put into the context of a long-term trend. We would like to add one point to our yesterday’s analysis. The first time buyer segment has been declining and it represents 30 percent of March home sales, compared with a long-term trend of 40-50 percent. It is important because the first-time buyers are the most import fundamental segment of the market. The relative lack of such buying naturally depresses buy and sell activity by move-up buyers and explains why the housing market has not yet recovered (historically, the rebound in housing came much faster after recessions). Therefore, the whole market is supported mainly by vacation home sales by the upper income classes which benefited most from the current stock boom.

Summing up, recent data on March new home sales was negative and confirmed our yesterday’s opinion that the housing market is far from a full recovery. The quality of this data is not the best; however, there are no doubts that current sales are much below the long-term trend. The simultaneous rise in existing home sales and decrease in new home sales may indicate that economic conditions are slowing down and people prefer buying cheaper, used homes. Therefore, the March new home sales report, which calls into question the outlook for the U.S. economy, is positive news for the gold market, since gold can be considered as a bet against the U.S. dollar and it behaves relatively good during economic slowdowns.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview