On Sunday, Italy registered a huge jump in new cases of the COVID-19, the stock market plunged, while the oil market crashed. Tuesday morning, and Italy is on lockdown. Meanwhile, gold jumped above $1,700. What's next for the yellow metal?

Gold Jumps Above $1,700

Last week, I wrote that:

from the fundamental point of view, the environment of fear, ultra low interest rates, weak equity markets and elevated stock market volatility should be positive for the yellow metal (...) the good news is that the markets expect further Fed's interest rate cuts on the way - it lays the foundation for future gains in the gold market.

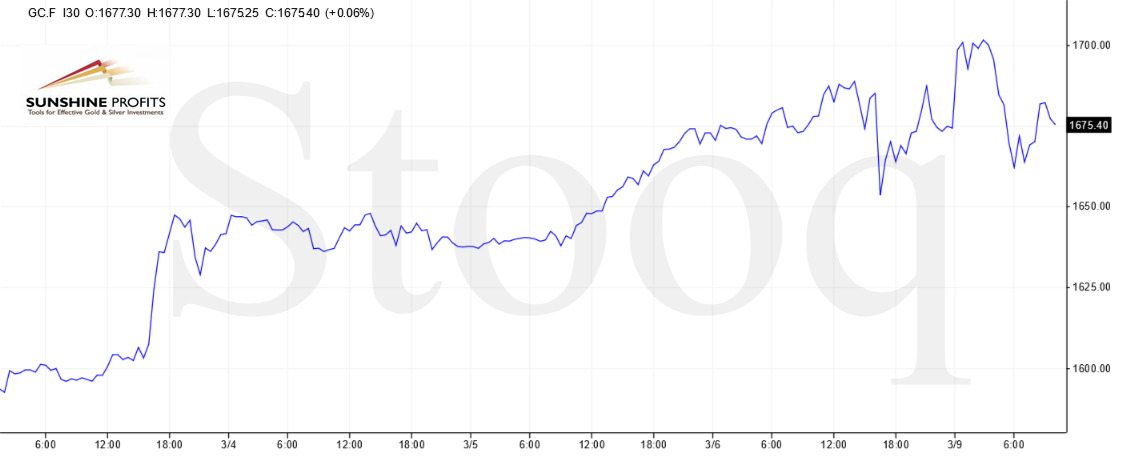

And indeed, we did not have to wait long for more gains. On Sunday, gold jumped briefly above $1,700, reaching another psychologically important level, as the chart below shows. The yellow metal made it to this price point for the first time since late 2012.

Chart 1: Gold future prices from March 3 to March 9, 2020.

Yes, you guessed, gold went further north amid the growing spread of the COVID-19. Data reported to the World Health Organization by March 8 shows 105,586 confirmed cases in the world, of which 24,427 originated outside China. Actually, over 100 countries have now reported laboratory-confirmed cases of the new coronavirus.

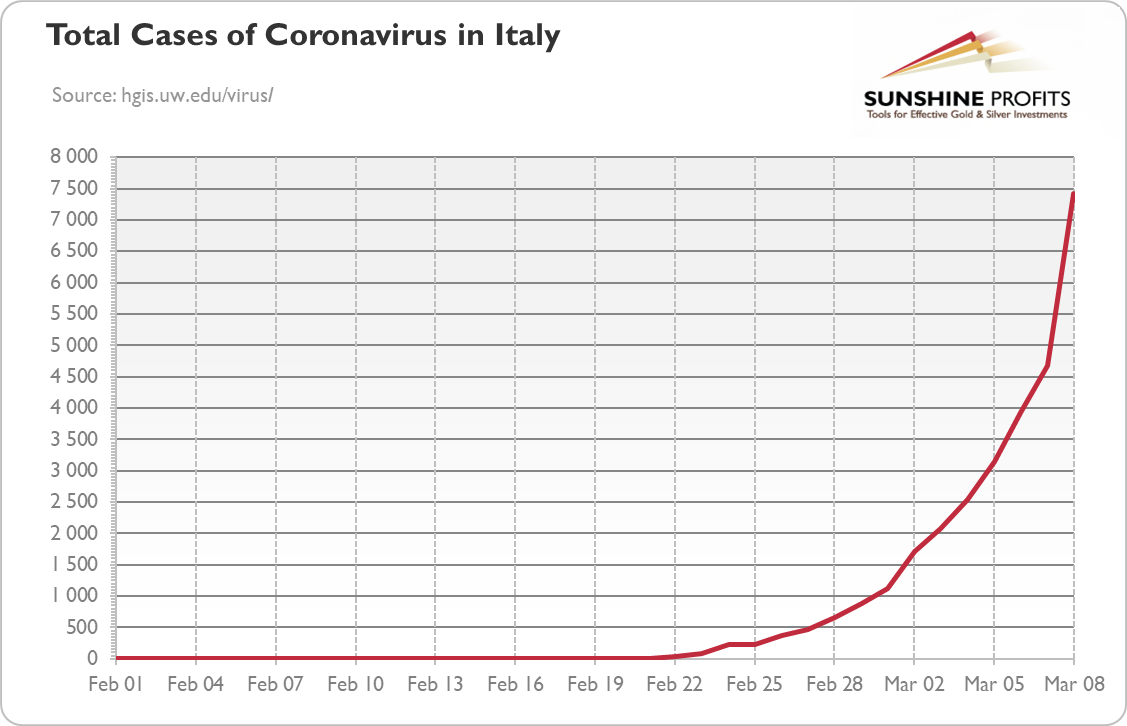

What is really disturbing is that Italy reported a huge jump in total cases and deaths from the COVID-19 on Sunday, a surge from 4680 and 197 to, respectively, 7424 and 366, as one can see in the chart below. The jump in figures comes as the Italy's government introduced a quarantine of 16 million Italians in the Lombardy region and 14 provinces and announced the closure of schools, gyms, museums, ski resorts, nightclubs and other venues across the whole country. In the US, more than 500 people have been confirmed to have the virus and more than 20 of them have already died.

Chart 2: Total number of confirmed cases of COVID-19 in Italy from February to March 2020.

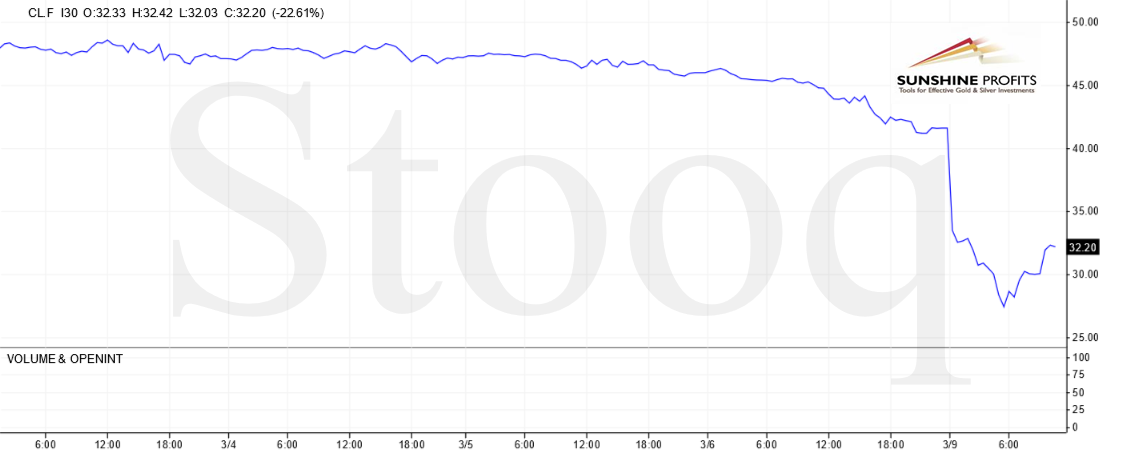

The spread of the COVID-19 increased the risk of a full-blown world pandemic and global recession. The expected economic slowdown slashed the demand for oil. To make matters worse, the OPEC and Russia did not agree on production cuts. Instead, the Saudi Arabia slashed its April official selling price and announced plans to raise production in a bid to retake market share. As a consequence, the WTI oil price plunged below $30, or 34 percent in the biggest crash since 1991, as the chart below shows.

Chart 3: WTI oil price from March 3 to March 9, 2020.

Moreover, the stock market plunged again. The futures on S&P 500 went down 4.5 percent on Sunday evening in North America, and closed 7.5% lower (that's over 225 points down). It's not surprising that investors are fleeing equity and oil markets and increasing their safe-haven demand for gold.

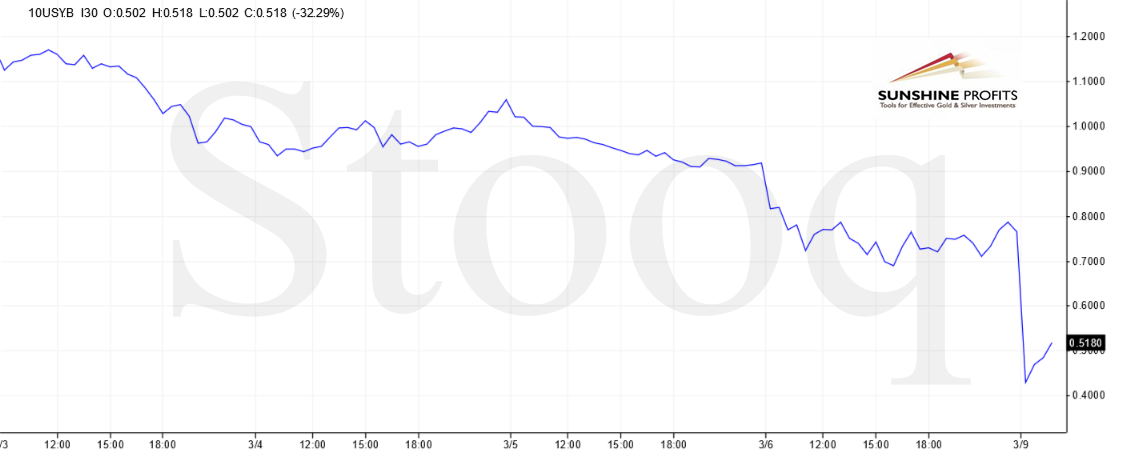

Another positive factor for the gold prices is the collapse in the bond yields. The 10-year interest rates have plunged below 50 basis points on Sunday. As a reminder, in December 2019, the yield was slightly below 2 percent. It means a huge change. The bond market action implies that investors are expecting recession and the Fed's accommodative response. It would be hard to imagine better conditions for gold to shine.

Chart 4: US 10-year Bond Yields from March 3 to March 9, 2020.

Implications for Gold

What does it all mean for the gold market? Well, I am of the opinion that the prospects for gold are positive. We have not yet reached the full-on panic. The epidemiological peak is still ahead of us. With Italy rolling out a massive quarantine, the fears over the COVID-19 impact on the supply chains and the global economy will intensify. Moreover, the biggest headwind to the gold market, i.e. strong US dollar, has been removed. As the Fed's interest rates cut worked to soften the greenback, gold can now benefit from both the safe-haven demand and the weak US dollar.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.